There are numerous virtues and vices that account for the rise and fall of societies. Near the top of the list are the two opposites, humility and pride. . . . Pride sprouts and grows from ignorance and self-blindness. Those with a haughty spirit foolishly believe they know the most, whereas they know the least-Leonard E. Read

In this issue:

Clash of the Titans: Phisix 7,700 in the Face of a Steep Flattening of the Bond Yield Curve!

-Philippine Bonds: The Flattening Dynamic Intensifies!

-What a Continuing Steep Yield Curve Flattening Means: Clue—Not A Boom!

-Phisix 7,700: Casino Stocks CRASH Anew!

-Phisix 7,700: Surging Store Vacancies at Many Shopping Malls!

-Record Stock Market and the Smoking Risk Debate Analogy

-How to Lose $ Billions in 2 Years

Clash of the Titans: Phisix 7,700 in the Face of a Steep Flattening of the Bond Yield Curve!

Record upon record.

Philippine equity markets carved a fresh record on the same routine: manic bidding of overpriced securities punctuated by serial marking the close or index management.

Yet it is the foundation or the health of the stock markets that determines the sustainability of its actions and accompanying the tradeoff between risk and returns for investors.

And it is not just the Philippines but record or milestone high stocks have been occurring worldwide, mostly in US, Europe, Asia despite mounting uncertainties in the economic, financial and even the geopolitical sphere.

Yet the 2008 bear market provided me several insights;

-Bear markets can happen even with little or minor fundamental impairments. This has been the case for Philippine equities where corporate and from statistical economy has hardly been affected by the Lehman episode. Yet the Philippine stocks endured a crash predicated on a contagion from a global liquidity crunch.

-Bear markets happen when fundamentals deteriorate as with the US and Europe’s experience.

-If bear markets have precipitated by global factors, there will be no decoupling.

So risk factors should be identified from external and domestic origins.

And this week’s record Phisix comes with deepening domestic fundamental divergences.

In this issue I highlight three: Intensifying flattening of the domestic yield curve, crashing casino stocks and ballooning incidences of store vacancies at shopping malls.

Philippine Bonds: The Flattening Dynamic Intensifies!

One of the common rationalizations of today’s record stocks has been that negative real rates have eviscerated risks on stocks and debt. The idea is that rising stocks and ballooning debt are free lunches for as long as rates remain zero bound or at negative in real terms.

I have already explained here using elementary logic why even at zero bound, debt financed spending is no free lunch[1].

Yet the present developments in the domestic bond markets reinforce the dismantling of the myth that negative rates are a free lunch to debt.

The significance of the yield curve as explained by a professor at the University of Rhode Island in a presentation (bold mine): “(1) Related to inflation and growth expectations (2) Affected by monetary policy (3) A real-time economic forecast by the bond market.”[2]

The presentation further deals with the different slopes of the yield curve.

On the one hand, “an upward-sloping Yield Curve is a forecast of economic growth to occur (or continue) in the future - the steeper is an upward-sloping curve, the more growth and/or inflation is expected in the future.”

On the other hand, the opposite, “It should be fairly obvious that when the Yield Curve flattens, banks become less profitable, as NIM falls, and if the Yield Curve becomes inverted (longer-term rates below short-term rates), bank profits disappear and financial stocks begin to underperform”. NIMs are the bank’s net interest margins.

The reason I used a presentation from a school lecture is to demonstrate on the importance of the signals from the yield curve from a basic level.

Now the flattening dynamic as seen from the financial mainstream.

From About.com[3]: (bold mine) However, economic slowdowns generally have a dampening effect on inflation. This tends to reduce the risk, and therefore interest rates, on long-term debt. The net effect is a flattening, or actual inversion, of the yield curve, with short-term loans growing more expensive and long-term loans growing cheaper, driven largely by investor expectations of a rocky road in the near future.

The above applies to the US where bonds (long term government debt) are seen as “risk free”. In emerging markets, flattening of the yield curve have usually been about short term yields rising faster than the long term equivalent.

The flattening of the yield curve thus represents a transition towards an inversion.

Last December, I wrote about the Philippine bond selloff. A die hard zealot of this phony boom countered that this has merely been an aberration. Such sentiment, which has been representative of the consensus, shows that nothing wrong can ever happen today.

Well, two months after the Moody’s upgrade, a month since the Philippine $ 2 billion of international bond issuance, the recent string of record breaking stocks, and the alleged 4Q 6.9% GDP, the flattening of the domestic yield spread have only deepened!

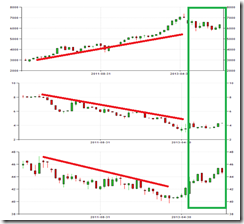

Flattening spreads has now pulled farther away from December levels (see right)!

Given that Philippine local currency bonds have been a tightly held market by both the banking sector and by the government, I have been expecting the cabal to massage the market as they may have done to the Phisix.

Last week there seem to have been an attempt. What resulted has been a deviation: some spreads appear to have widened (spiked) while others continued narrow. In short, a botched effort to manipulate the curve.

This week, activities in domestic bonds negated all the deviances from last week’s activities.

Now all spreads based on 10 and 20 year minus 6 months, 1 year and 2 year seem in unison. Flattening yields have been accelerating! And this has been led by rising yields of 3 and 6 months and the 1 year which have all returned to near December highs! Yields of 2 year treasury hardly budged during the soothing period from the Philippine government’s bond issuance.

As a side note, the international bond issuance gave a breathing spell to the country’s forex reserves as seen via the GIRs which marginally rebounded last January, and to the domestic currency the peso which thus far has been up .9% against the US dollar year to date. My guess is that this about to reverse.

Additionally the inversion of the yields of 4 relative to the 5 year have become wider (violet square shows the start of the inversion)!

The seeming intensifying flattening dynamic shows not only that “short-term loans growing more expensive”, but importantly a market induced tightening of the system’s liquidity!

Ironically, the current flattening dynamic has been one “anomaly” that has been continuing!

The flattening dynamic should also be an eye-opener, since there are only a few (concentrated) holders of Philippine treasuries, the implication is that recent developments has hardly been a revelation of dandy conditions, instead they signify as progressing entropy that has been camouflaged by record stocks and by statistical blandishments.

What a Continuing Steep Yield Curve Flattening Means: Clue—Not A Boom!

Some possible implications from a continuing yield flattening dynamic.

With spreads tumbling fast, the incentives to lend diminish.

This means domestic credit activities will decline. And because real formal economic growth has been financed by credit growth or real formal economic growth have become dependent on credit, what has been seen as “aggregate demand” by the mainstream will head south or growth in the real formal economy will stagger.

[Oh yes government statistics may continue to exhibit cosmetic strong G-R-O-W-T-H, but all these will reverse once real micro problems surface!]

Loan portfolios constitute about half or 50% of the banking system’s assets Php 11.159 trillion as of December based on BSP data. This implies that much of the earnings growth from the banking system has been derived from loans. Thus a slowdown in loan activities will eventually hurt bank earnings mostly through the loan channel.

Additionally, financial assets comprise about 20% of the banking system’s balance sheets. Since values of financial assets have mostly been a product of surging credit growth, reduced credit activities postulates to eventual pressures on the values of financial assets. Once financial assets reveal signs of strains, ancillary activities related to financial assets such as commissions or fees will also backtrack. Thus a slowdown in loan activities will also eventually hurt bank earnings through the financial assets channel.

And because of the previous torrid pace of the rate of growth of credit activities mostly from the banking system, “short-term loans growing more expensive” should imply a tightening of credit.

And such tightening extrapolates to likely increases in the incidences of Non-Performing Loans (NPLs) or expose on the deterioration of credit conditions in the banking system’s portfolio. The rise in NPLs will impact banking and financial system’s balance sheets. And this comes as loan conditions stagnate. Aggravating such conditions will be a downturn in other banking and finance activities anchored on sustained inflation of financial assets.

For banks, the flattening dynamic should eventually filter into general earnings conditions.

And for stocks, a concise way to say this is that a continuing yield flattening dynamic means that the fuel to the present record stocks has been draining fast.

So a slowdown in credit activities as consequence from a continuing flattening dynamic will be transmitted to economic, financial market and credit risk conditions.

BSP data on December’s bank credit activities has already been manifesting signs of this. Except for the hotel, the major sectors have posted a sharp slump in credit loan growth rates.

This explains the school lecture which I quoted above that “It should be fairly obvious that when the Yield Curve flattens, banks become less profitable, as NIM falls, and if the Yield Curve becomes inverted (longer-term rates below short-term rates), bank profits disappear and financial stocks begin to underperform”.

There are policy implications too.

The current flattening dynamic comes as the BSP has maintained its rates this week.

Lately in his spiel over the risk from global deflation, the BSP chief, Amando Tetangco Jr., has signaled the BSP’s willingness to respond to changes in conditions (exact words: We do not pre-commit to a set course of action) since they are “data-dependent” as noted last week. This has been a euphemism or a signal by which the BSP has opened the doors to ease or cut rates.

But the BSP seems hesitant to make this outright because of the potential perception from the public to project rate cuts with economic weakness ahead. Infringing on the G-R-O-W-T-H image is a taboo. It’s showbiz everywhere, from business to the economy to the BSP’s monetary policies, to politics and even to the government statistics.

So the BSP chief issued instead a trial balloon to see how the market responds. I bet that there will be more accounts of the deflation spin story coming as part of the conditioning of the marketplace.

Yet hasn’t it been a coincidence that intensifying flattening activities came in the light of BSP’s recent announcement to keep rates at present level? The domestic bond markets seem to be pressing on the BSP to ease!

Yet the current flattening dynamic only reveals that the time window of efficacy from BSP’s monetary actions and the government’s action has been thinning. Should the BSP accommodate the bond holders, like the January $2 billion international bond issuance, the easing’s anodyne effect will likely be a short term one.

Said differently, domestic balance sheets problems, as revealed by the flattening dynamic, have been growing fast enough that may be rendering BSP actions impotent. This phenomenon is known in the mainstream as “pushing on a string”.

The bottom line: Philippine bond markets have been signaling a vastly different story than record stocks.

The growing divergence between stocks and bonds is simply not sustainable. One of them will be proven wrong.

Also actions in the bond markets also shows that even at zero bound or negative real rates, debt is NO free lunch.

Oh by the way, on a very much related note, yields across the curve of Japanese government Bonds (JGB) have been on a rip! Could these signify as the bond market’s ongoing (one month) strike against the Bank of Japan (BoJ)? Will the BoJ accommodate the desire for more easing? Or will this herald an inflection point for BoJ’s subsidy to the Japanese government and their private sector allies?

Record or milestone high stocks in the face of imbalances at the edge!

Phisix 7,700: Casino Stocks CRASH Anew!

Actions in the bond markets reflect not only inflation and growth expectations, monetary policy, the term premium but also credit developments.

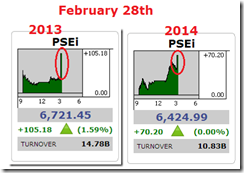

Before this some numbers on the Phisix.

This week’s record Phisix 7,700 comes with a weekly market breadth in favor of decliners whom dominated 3 days of trading days. Peso volume has been dwindling even when this has been padded by special block sales. Special block sales, mainly due to Metro Pacific’s Php 8.9 billion offering last Tuesday February 10, have accounted for 20% of total peso volume for the week. Even the wild trade churning has been moderating.

Market internals have been suggesting for a pause from the blistering run, but index managers would have none of this. As noted above, record stocks have been a result of last minute pumps on select popular heavy weights in two trading sessions last week.

Obviously the next attempt is 7,800. Since stocks can only rise, so the hysteric pumping and pushing.

But of course, since record Phisix has been about popular biggest market cap issues, there appear to be parts of the markets that have been meaningfully diverging.

Yes this week’s record Phisix has masked a crash. Monday, February 9th, the big three major casino stocks tailspinned!

Traveller’s International Hotel [PSE:RWM], operator of Resorts World, got smoked by 4.22%! Bloombery Resorts [PSE: BLOOM] operator of Solaire Casino tanked 11.64%! Melco Crown (Philippines) [PSE: MCP] operator of newly opened City of Dreams cratered 10.18%!

At the close of the week, Bloom was able to recover half of the day’s loss down by 4.97%, MCP hardly came back and closed deep in red or 9.44% while RWM closed the week down 4.37% reflecting a slight additional loss (see right window).

Year to date the losses has been massive: MCP has dived 27.98%, RWM bled 17.7% while Bloom shed 10.48%. The scale of losses runs opposite to the degree of gains by the popular issues. This can be seen by the ordeal of casino stocks during the last four months (see left).

One irony is that previous meltdown has been spearheaded by heavy foreign selling, but last Monday’s crash was basically about local investors. Have locals become aware of the growing risks from casinos or have they just been influenced by the momentum and movements in Macau or Singapore?

Yet unlike crashing Macau stocks which most likely will be an issue of earnings, losses from domestic casinos will not just be about earnings but about DEBT or credit risks. I have to admit, I haven’t looked at financial statements of Macau casinos so my presumption over the quandary upsetting Macau’s casinos may be inaccurate.

Yet if RWM’s 3Q 2014 financial statement should give us a clue, then the casino business haven’t been revealing the promises that have been meant to be.

On a quarterly basis, RWM’s gaming and non-gaming revenues grew by only 2.9%. On a year to date the same top line data has skidded by 14.2%. This means that 1H 2014 was a drag to RWM. Has RWM high rollers shifted to the competitors only to return in 3Q?

The admirable thing RWM did was to slash debt by a huge Php 4.2 billion! But despite this, the company still has an enormous pile of Php 13.5 billion in liabilities to reckon with.

RWM’s debt payment has been the biggest since Resorts World opened in 2009. The debt chart can be seen here. Why so? Have recent actions abroad prompted operator and owner to see things more conservatively? Or could they be sensing trouble ahead?

It’s a different story for RWM’s competitor Bloomberry which raised Php 11.4 billion in private placement deals via corporate notes reportedly for expansion. (news) (3Q 2014) Raising debt via corporate bonds effectively padded Bloom’s debt by 74%.

In late 2014, media gushed over the company’s Php 3.3 billion of net profit in 3Q which they most likely projected into the future. They forgot all about the Php 11.4 billion in debt.

Yet the recent casino selloff hasn’t been as dramatic with Bloom as compared to her peers. Why? Because grandiose plans and recent sales will shield her from the woes afflicting the competitors?

Meanwhile, MCP which operates on the recently opened City of Dreams has a debt of Php 14.690 billion based on 3Q 2014 FS.

As of the 3Q 2014, 3 major casinos have among them Php 57.22 billion of debt. This is a smidgen compared to San Miguel’s Php 461 billion!

Those high rollers from China should start streaming in soon. Otherwise there will be a small segment of domestic bettors from which the 3 majors will be competing intensely to serve.

This has been the current dilemma that has plagued Singapore’s two glitzy casinos; Las Vegas Sands’ Marina Bay Sands Resorts and Genting’s Resorts World Sentosa. The decline of Chinese gamblers has led Singapore’s two casinos to undercut each other to gain market share from a limited population of domestic gamblers. The result of which has been sizably prune profits which has been reflected on their respective share prices. Such fierce competition has even turned into acrimonious conflict waged over at media.

And the huge non-gaming capacity expansion by these companies will add to the inventories of the numerous malls and hotels sprouting all over the metropolis. Has the recent sellers of casino stocks realize that the plight of the casinos have been indirectly connected to the other sectors? Considering that the Philippine financial economy has been very shallow in terms of penetration level or participation by the population, how tightly linked are financiers and investors of casinos with that of the other property segments?

Going back to the flattening of the yield curve, has demand for short term debt by casino operators intended to fund operational financing gaps been contributing to influence “short-term loans growing more expensive”?

Phisix 7,700: Surging Store Vacancies at Many Shopping Malls!

It’s not a propensity of mine to make a claim without providing evidence.

Last week I gave a clue that one of the malls has shown vacancy rates that may have likely exceeded 10% of total retail space for lease.

A panoramic glimpse of the upscale Edsa Shangri-la mall from the elevator reveals immediately 13 vacancies. (left photo taken February 5, 2015, this may be subject to change).

If we add the former Tokyo Tokyo, this makes 14. But I heard that the prime Tokyo Tokyo space has been under negotiation.

The above photo accounts for just one of the many blocks of shop vacancies that seem to have suddenly emerged during the last quarter at the said mall.

Since the original mall has about 300 stores, the new mall, the East Wing, has about 160 stores, a 10% vacancy rate would imply 46. If my estimates are correct that number has been exceeded. But most of the vacancies can be found at the original mall.

Nota Bene: Life is dynamic so changes can happen as I write this. But I do not expect any sharp improvement.

Over the past two weeks I have been shopping mall hopping. And I discovered that this has not been a phenomenon exclusive to EDSA Shang. Many other malls have shown significant increases in vacancies, but not as much as the EDSA Shang. Even the most popular malls—where I didn’t expect to see one—surprised me.

Interestingly some vacancies have even occurred in high traffic areas! This defies the common perception that malls operates like public parks.

In the dotcom bubble, the misperception was that “eyeballs” (site traffic) can be monetized. This led to massive overvaluations. In today’s shopping mall equivalent, some believe that traffic equals sales. Yet current vacancies prove that this hasn’t been so. There are many factors that affecting sales, like competition, economic conditions, price, regulations, and more…

Based on my observation, the vacancy rates from the various malls I visited has ranged somewhere from 1.0% to over 3%. In absolute terms, these figures are small. But remember, coming from a base rate of almost full occupancy, the surge in vacancies appear to be significant. They are signs of trouble.

Of course it is more than just vacancies, the other consideration is the turnover rate. Many of the vacancies I saw have indicated new tenants and some have just opened.

As I wrote back in April 2013[4] (bold mine)

For shopping malls, the “periphery to the core” would start from the mall areas with the least traffic and from marginal malls or arcades.Surpluses amidst a boom which implies high rents, high cost of operations such as wages, electricity and other inputs prices, would place pressure on profits of retail tenants competing for consumers with limited purchasing capacity.Periphery to the core would mean initially fast turnover from retail tenants on stalls of lesser traffic areas and of marginal malls. Then the length of vacancy extends and the number of vacancy spreads.Leveraged malls and arcades thus will suffer from the same vicious cycle of cash flow problems and eventual insolvencies that will impair creditors and will spread to many sectors of the economy.

Remember changes always happen at the margins.

What has been truly stunning has been the near simultaneous closures by many stores over a very short window, particularly during December to January. There are even some February closings.

It can be easily deduced that stores sales have plummeted prior to and through the holiday season for many stores to have shut down!

Hasn’t 4Q GDP supposedly been a boom, given the headline numbers of 6.9%? Yet statistics seem to have departed from street activities.

Too give the government some credit, the 4Q 6.9% GDP report revealed of a collapse in retail GDP.

As I recently wrote, But surprise, the retail growth rates in 4Q 2014 plummeted from 6.1% in 3Q to 4.1% 4Q or by 2%! In percentage terms that would be tantamount to a 33% decline—a crash!

Such astounding collapse in retail GDP seem to have been manifested in the surge of shop vacancies at the various shopping malls. Yet you got to wonder how the government came up with the HFCE numbers (in the expenditure segment of the GDP) which doesn’t seem to square with retail activities (industry segment of the GDP). Or how can a collapse in retail GDP translate to a “growth” in HFCE or household final spending?

Yet the collapse in 4Q retail GDP shares the same period where CPI posted negative month on month in November and December (yes m-o-m CPI has become positive January), the substantial drop in growth rates of OFW personal remittances last November, contracting month on month liquidity during November and December and a slowdown in BSP credit activities as shown above.

Of course the surge in store vacancies at many shopping malls backed by a slump in 4Q retail GDP has been a symptom of a disease. The underlying disease of which has been the malinvestments caused by financial repression (negative real rates or zero bound) policies

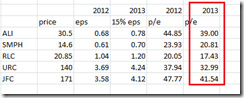

Based on the chart I have shown last week. Let me reiterate the numbers

Based on current prices, the statistical GDP grew by 70.2% over the past 6 years. Annualized this would be about 9.3% (again this is current prices, the 6.9% 4Q GDP are 2000 prices). Household final demand or consumer spending represents about 70% of the expenditure side GDP. For the same period, consumer spending grew by 73.43% or by 9.61% yearly.

Now look at the growth rate of the trade industry. For the same period, trade GDP grew by 105.1% or by 12.77% a year.

So what does the above numbers say? Household spending growth has been at 9.61% annualized, while trade GDP grew at 12.77%. The numbers tell us that the supply side has been growing 33% (12.77%/9.61%) more or faster than consumer spending!

This data doesn’t show income growth which is the ultimate source of growth.

So what happens when the supply grows faster than consumers? Well common sense or economics 101 tell us that the Philippine economy will have more supply or EXCESS CAPACITY.

That’s the secret of the Philippine boom all captured in a single chart.

But here is more: If you add the BSP component, it shows how the overbuilding has been financed by leverage or 177% loan growth to the retail industry or 18.5% a year.

In terms of credit intensity or growth rate of GDP/Bank loan, every 1% growth by the retail industry has been financed by 1.68% growth in banking loans (177/105).

So we have not just been seeing excess capacity we are looking at excess capacity financed by debt!

Now excess capacity financed by an inundation of leverage has been manifesting itself on the yield spreads of local currency sovereign bonds.

The flattening yield dynamics now has served as a natural barrier to aggregate demand based policies founded on credit expansion.

Yet underneath the flattening curve dynamics I greatly suspect developing balance sheet problems.

And those constrained balance sheets will slow capex that leads to lower income growth. And lower income growth will filter into consumer demand that will get reflected on higher turnover rates and store vacancies at the shopping mall.

This is an example of the asymmetric linkages in a complex economy.

Of course, no trend goes in a straight line. There will be bounces.

Nevertheless, unless income growth grows faster than supply side growth, expect that vacancies to become a new trend.

Realize that overcapacity in shopping malls has brought about a “dead mall” spiral in the US or ghost shopping malls in China.

Are you aware that the world’s largest mall (based on gross leasable area), China’s New South Mall has a vacancy rate of NINETY NINE percent since it opened in 2005???!!! From Wikipedia.org: Total spaces: 2350, Unoccupied: 2303.

Meanwhile, one of the largest ghost city of China in Ordos, Inner Mongolia includes “a series of doom-struck towers, grey office buildings, flats and shopping malls – and most of them are completely empty”, according to Gizmodo.

What does the consensus think the Philippines is: Immune to the laws of economics?

Record Stock Market and the Smoking Risk Debate Analogy

Stocks at record levels—pillared by sheer pump and by index manipulation in the face of severe mispricing via overvaluation, total disregard of valuations and risks, harassed consumers from previous episode of inflation, the sustained and even acceleration in the flattening of the domestic yield curve, ballooning debt levels, emerging signs of overcapacity in several parts of the real economy, as well as developing external risks all over the world (which even the BSP chief recognizes)—doesn’t seem like a sustainable dynamic.

In the hat of an investor, while the markets may rise, the balance in the tradeoff between risk and returns seem to have been greatly tilted in favor of risks.

Thus positioning on popular or mainstream stocks in the face of great risks looks very much like a vice rather an investment.

So here is a fictional anecdote characterizing the outlook of the majority of the stock market participants as analogized in the context of “smoking risk” debate.

In an informal occasion, I stumble at an old friend who divulges that he consistently smokes two packs of cigarettes a day. So I mention to him that since studies reveal that smoking has an 86% chance of leading to lung cancer, he bears enormous risk of acquiring the disease if he continues to smoke at the current rate. My friend smiles and bids adieu.Two years after, at a gathering, the same friend and I share a roundtable with many other guests.And the following discussion ensues:My friend rationalizes: “Do you recall two years ago, you warned me of smoking? Look I’m alive and kickin’. I have NO lung cancer. And I feel absolutely great! So you are wrong. Because, I feel great, I have even DOUBLED DOWN. I now smoke four packs a day!!! Believe me, nothing bad will happen or will ever happen from smoking alone! But thanks for your concern.”The person seated beside my friend conforms and addresses me: “Like your friend, my friends and I have been smoking about two packs or even more a day for the past few years. And like him, nothing has happened. So those risk studies are a quack. Smoking does no harm. It’s all in the mind. The going gets good, so why then should we stop?...”Across the table, another person, who also acquiesces, argues from a different standpoint. In a stentorian tone he interjects: “…Besides everybody has been doing it. When everybody does it, this means that those opposed have only been a minority. And because they are a minority they are wrong, Vox populi, vox Dei! It’s not about studies or risks. It’s about what the majority thinks and believes! Since the majority has been having fun, then this can’t ever be wrong! But who cares about risks? As Tyler Durden at the Fight Club would say “Let the chips fall where they may”. There is no stopping the majority from having fun! Only fools will attempt to do so, but they do so in vain…”The persons seated next to the majoritarian jibes: “…and all opposition to the smoking should be censored!”An industry representative lubricates on the no smoking risk hysteria and provides ‘expert’ confirmation to the biases of the crowd: “You see smoking is fun. The more you smoke, the more the fun. Our company has studies that show health risks from smoking have been greatly overstated. For instance, the adrenalin rush from “surge” smoking reduces stress. This diminishes, if not offsets, the physical risk aspects from smoking. This means that health risks have all been an illusion peddled by alarmists to stop you from having fun. Media support us. Here, I show you the statistics...”The man from the industry also resorts to the appeal to the majority: “…And as testament, just look around.” Pointing to the early speakers…“These guys here…are all having fun!” Then looking at me he cavils, “But the non-smokers, I repeat, the non-smokers have been missing out!” Then he looks at the rest to punctuate his point, “Would you like to be a loser and miss out on the party of winners?”But he whispers to himself: “BUT if all of you should stop smoking, the greasing of my employer’s pocket stops, this means I’d lose my job!”Another person, a media personality, with proclivities toward a home bias adds a new dimension in support of the consensus: “The risk all comes down to the genetic makeup of the race. Our genes have stronger resistance to the hazards of intense smoking than the rest of the world. The error of those anti-smoking studies has been because they have lumped people as one or they have ignored the inherent structural ramparts built into our genes! Because of this, I smoke as much too! Since I began my intense smoking just a few years back, like them, I am also staying alive with no lung cancer! We are more immune but the others are at risk! So smoke on!”[As a side note: you can replace genetic/genes with territorial boundaries/borders to highlight the nationalist theme. For instance, “The risk all comes with the territorial borders.” —Benson]In response to the last comment, a former smoker turns recidivist along with a non-smoker, who suddenly transforms into a convert. They jointly profess: “Damned, look at the years I have missed from the fun of smoking! I have had it listening to these negative pronouncements. Because it did not happen to them, then nothing bad will also ever happen to me! So will anyone please give me a cigarette now?”Turning to the industry man, the proselytes ask, “And where do I buy reams of your cigarettes?”Also at the table, another guest who stopped smoking a few years back, dithers and mumbles to himself: “Oh how could I have been so dumb enough to have missed partying with them! I must have missed a world! But still, I sense something terribly wrong with way these people smoke. Or perhaps I have not been entirely persuaded by both camps. So I will just watch. But, if nothing happens to these smokers, then this will keep haunting me for staying on the fence!”Hearing the discussion, the serving waiter, a bystander, who turns out to be a straddler, adds to the discussion: “Ah, I’m mostly with the smokers. But…but, I fear that the risks hazards could also pack some truth. Anyway, to ensure that I get the best of both worlds, I smoke only one pack a day…sometimes…but rarely…two. Hopefully this may not qualify as risk! You see, doing so means that I possess a Monopoly ‘get out of jail free card’!

At the end of the day, all actions have time inconsistent consequences. Or said differently, the consequences will be different in the short term as against the long term. As with smoking, this is what record stocks will be all about. Yet the consensus has been seduced to popular talking points while ignoring the negative long term ramifications of their present actions.

How to Lose $ Billions in 2 Years

Finally since stocks are at record after record highs, I’m quite sure you’d hear at parties people raving and blustering, “I made blah & blah % in yada yada yada stocks”. That’s nice. This would be true if the returns have been realized and pocketed away. But if the holdings remain open then they are only paper profits. And if sold, where stocks have been plowed back to prices at current levels, and if a reversal occurs and current position be left hanging, paper profits will vanish.

It’s like winning in horse racing. After the excitement and self-gratification, the tendency is to plunk down the prize money back to the races over the coming days. At the end of a period, all the gains have been returned to the horse racing facility with additional losses or total losses exceeding gains by miles.

How do I know? I was once a jai-alai and horse racing aficionado until I learned of Austrian economics.

Yet if the stocks of companies positioned at by the market speculators go bankrupt, they become wallpapers. How do I know? My beloved Dad left me a legacy of mining stocks, which was the fad of their stock market glory days. They transformed into wallpapers. Unfortunately so had been my Dad’s dreams

If stock positions have been financed by leveraged, and the market reverses, not only will paper wealth vanish, losses will likely be amplified due to leverage.

How do you think Brazil’s former tycoon Eike Bastista’s $25-35 billion of paper wealth in 2012 became NEGATIVE $1.2 billion in 2015? Or what is the secret to lose $26.2 or $36.2 billion in a little over 2 years?

The answer: (speculative) G-R-O-W-T-H driven by G-R-E-E-D financed by D-E-B-T!

[1] See Phisix: BSP Panics, Raises BOTH Official and SDA Rates!!! September 15, 2014

[2] University of Rhode Island The Yield Curve, Stocks, and Interest Rates (Leonard Lardaro)

[3] About.com The Yield Curve

[4] See Phisix 7,000: Why Asia’s Rising Star is a Symptom of Mania April 29, 2014