Truth has to be repeated constantly, because Error also is being preached all the time, and not just by a few, but by the multitude. In the Press and Encyclopaedias, in Schools and Universities, everywhere Error holds sway, feeling happy and comfortable in the knowledge of having Majority on its side. -Goethe

One of the most bizarre ironies which can be observed from the mainstream is the selective use of market signals for analysis.

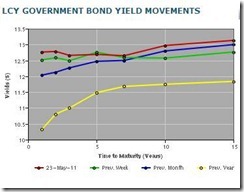

A conventional mantra is that because actions in the bond markets have been benign, therefore experts say that inflation risks have not been apparent. Others argue that actions in the bond markets signal deflation instead of inflation.

On the one hand, these mainstream experts and their acolytes don’t trust the markets. They see markets as inherently unstable thus always opine for some form of government intervention. They believe that through mathematical equations, governments can simply adjust economic conditions similar to a thermostat of an air conditioner.

On the other hand, in justifying the selective use of market prices for government intervention, they specifically see bond markets as conveying the actual state of affairs of the credit markets. In other words, they see the bond markets as being “efficiently” priced.

The Policy of Permanent Quasi Booms

It is pretty much naive to suggest that bond markets accurately represent price signals that exhibits the actual time preferential balance of savings and loans.

First of all bond markets operate under government’s guiding dogma meant to promote the permanence of quasi boom.

From John Maynard Keynes,

The right remedy for the trade cycle is not to be found in abolishing booms and thus keeping us permanently in a semi-slump; but in abolishing slumps and thus keeping us permanently in a quasi-boom.

Hence by actively intervening in the marketplace by forcing down interest rates implies that bond markets have already been significantly distorted which has led to serial boom bust cycles.

Further proof of the Fed’s Zero Bound interest rate policy from a Federal Reserve Paper authored by Ben Bernake, Vincent Reinhart and Brian Sack

Central banks usually implement monetary policy by setting the short-term nominal interest rate, such as the federal funds rate in the United States. However, the success over the years in reducing inflation and, consequently, the average level of nominal interest rates has increased the likelihood that the nominal policy interest rate may become constrained by the zero lower bound on interest rates. When that happens, a central bank can no longer stimulate aggregate demand by further interest-rate reductions and must rely instead on “non-standard” policy alternatives...

In this paper, we apply the tools of modern empirical finance to the recent experiences of the United States and Japan to provide evidence on the potential effectiveness of various nonstandard policies. Following Bernanke and Reinhart (2004), we group these policy alternatives into three classes: (1) using communications policies to shape public expectations about the future course of interest rates; (2) increasing the size of the central bank’s balance sheet, or “quantitative easing”; and (3) changing the composition of the central bank’s balance sheet through, for example, the targeted purchases of long-term bonds as a means of reducing the long-term interest rate. We describe how these policies might work and discuss relevant existing evidence.

This paper was done in 2004. Apparently the Bernanke led US Federal Reserve has put this study into action.

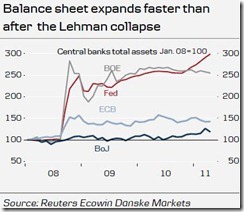

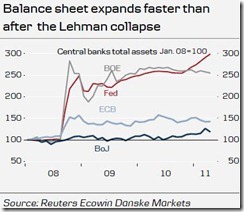

This means that aside from Zero bound interest rate policies; activist policymaking today includes the expansion of the balance sheet of the US Federal Reserve.

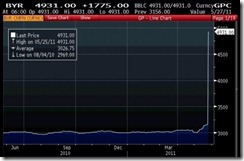

And this operating precept appears to have been exported to the US major trading partners.

Chart from Danske Bank

Financial Repression As A Driving Force

Second, seen from the distribution of ownership of Federal securities or US treasuries, 80% appear to be owned by governments.

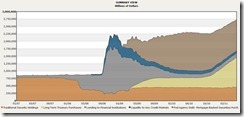

The chart from Wikipedia shows of the expanding share of Federal Reserve and intragovernmental holdings, along with foreign governments which accounted for 28% in 2008. And this chart was prior to the activation of the Quantitative Easing programs.

Adding up the local and state government and state and local government (pensions) the share of government ownership rises above 80%.

The private sector (profit oriented segment) only holds a paltry (less than 20% share) in contrast to (politically motivated) governmental ownership.

In short, who or which entities will do the selling?

While it is true that like the stock markets, prices are set on the margins, there is another factor which attempts to protect treasury ownership from a panic: regulations on the banking system via the BASEL III accord.

According to this Bloomberg article, (bold emphasis mine)

Lenders have an added incentive to buy Treasuries after the Basel Committee on Banking Supervision proposed rules on Oct. 4 that banks increase available capital and improve their measurement and control lending risk.

Banks will have less than five years to comply with the so- called Basel III rules for minimum tier-1 capital ratios and until Jan. 1, 2019, to meet the capital buffer requirements. The Treasury Borrowing Advisory Committee forecast in February that banks may have as much as $1.6 trillion in demand for Treasuries in the next five years based on the evolving rules.

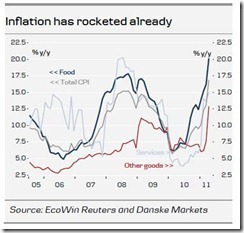

So new regulations will essentially force the private (banking) sectors to buy and own Federal securities, despite of the environment of higher commodity prices, which have been signaling inflation.

Thus the only marked threat of a potential selloff will likely emanate from politically motivated foreign governments.

The key question is what would motivate them to do so? A selloff would only devastate the value of their stash of US dollar reserve holdings.

And to reiterate, even if some foreign entities, like China seems reluctant to acquire US federal securities, the Fed appears to have an open checkbook—which may only be constrained by an explosion of inflation.

The chart from the Cleveland Federal Reserve shows the Fed as huge buyers of US long term treasury and Fed agency debt (yellow) and Mortgage backed Securities (brown)

Hence, anyone who argues from the standpoint of market prices without considering these variables either have been misdiagnosing real events or deluding themselves.

Yet all these constitute what Carmen Reinhart and Kenneth Rogoff calls as “Financial Repression” [This Time Is Different (p. 143)] (bold emphasis mine)

Under financial repression, banks are vehicles that allow governments to squeeze more indirect tax revenue from citizens by monopolizing the entire savings and payment system. Governments force local residents to save in banks by giving them few, if any, other options. They then stuff debt into the banks via reserve requirements and other devices. This allows the government to finance a part of its debt at a very low interest rate; financial repression thus constitutes a form of taxation. Citizens put money into banks because there are few other safe places for their savings. Governments, in turn, pass regulations and restrictions to force the banks to relend the money to fund public debt. Of course, in cases in which the banks are run by the government, the central government simply directs the banks to make loans on it.

Governments frequently can and do make the financial repression tax even larger by maintaining interest rate caps while creating inflation.

These are Harvard guys. But their observations square with the Austrian school’s position of the enmeshed clandestine relationship between central banks, the banking system and the government.

According to Murray N. Rothbard,

The Central Bank has always had two major roles: (1) to help finance the government's deficit; and (2) to cartelize the private commercial banks in the country, so as to help remove the two great market limits on their expansion of credit, on their propensity to counterfeit: a possible loss of confidence leading to bank runs; and the loss of reserves should any one bank expand its own credit. For cartels on the market, even if they are to each firm's advantage, are very difficult to sustain unless government enforces the cartel. In the area of fractional-reserve banking, the Central Bank can assist cartelization by removing or alleviating these two basic free-market limits on banks' inflationary expansion credit.

This means that bond markets almost everywhere operate under the same dynamics. That’s until they became unsustainable (such as in Greece).

Bottom line:

Bond markets reflect more on the effects of government policies rather than market price based distributions.

The bond markets have been so distorted by a myriad of deeply embedded government interventions such that they cannot be used as dependable standalone indicators in analyzing the marketplace or the economy.