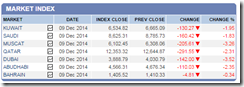

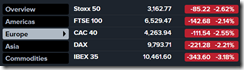

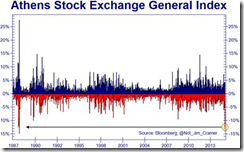

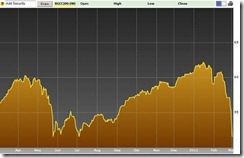

Greek stocks are now down 13% - the biggest single-day drop since (drum roll please) the crash of 1987... led by total carnage in Greek banks (down 15-25% on the day). Greek bond yields exploded, 3YR +183bps to a new post-bailout high at 8.32% (and inverted to 10Y).

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, December 10, 2014

Bloody Tuesday: GCC, European Stocks Battered; Greek Stocks Collapse 13%!

Monday, December 01, 2014

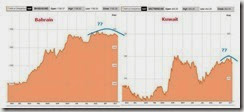

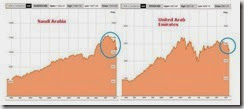

Wow. Saudi, UAE, Kuwait, GCC Stocks Just Crashed! Malaysian Financial Markets Under Pressure

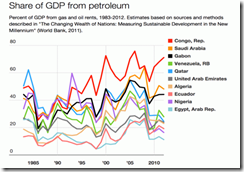

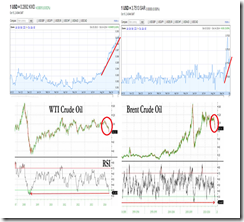

Friday, as OPEC the deadlock persisted, oil prices crashed! West Texas Crude collapsed 10.18% and Europe’s Brent dived 9.77%! Friday’s meltdown compounded on the losses of oil prices for the week, specifically at 13.98% and 12.95% respectively!Oil producing Norway’s all share index missed the region’s risk ON boat and instead got walloped by 7.13% this week.GCC states, whose markets were closed during oil collapse, have already been drubbed due to prior oil price weakness. For the week, Saudi’s Tadawul plummeted 3.75%, UAE’s DFM sank 1.5%, Qatar’s Qatar Exchange plunged 3.72%, and Oman’s Muscat fell 2%.

Friday, November 28, 2014

Crashing Oil Prices: OPEC Deadlock, Shale Bubble, Global Liquidity and Philippine OFWs

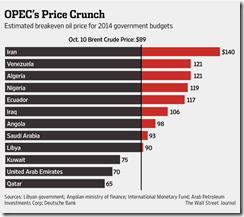

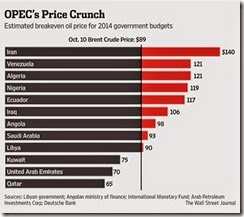

Saudi Arabia blocked calls on Thursday from poorer members of the OPEC oil exporter group for production cuts to arrest a slide in global prices, sending benchmark crude plunging to a fresh four-year low.Brent oil fell more than $6 to $71.25 a barrel after OPEC ministers meeting in Vienna left the group's output ceiling unchanged despite huge global oversupply, marking a major shift away from its long-standing policy of defending prices.This outcome set the stage for a battle for market share between OPEC and non-OPEC countries, as a boom in U.S. shale oil production and weaker economic growth in China and Europe have already sent crude prices down by about a third since June.

Again the problem seems to be why prices are at current levels?

Employment in the oil and gas sector has grown more than 72 percent to 212,200 in the last decade as technology such as horizontal drilling and hydraulic fracturing have made it possible to reach fossil fuels that were previously too expensive to extract. In order to fund the rapid growth, exploration and production companies have borrowed heavily. The energy sector accounts for 17.4 percent of the high-yield bond market, up from 12 percent in 2002, according to Citi Research.

Based on recent stress tests of subprime borrowers in the energy sector in the US produced by Deutsche Bank, should the price of US crude fall by a further 20pc to $60 per barrel, it could result in up to a 30pc default rate among B and CCC rated high-yield US borrowers in the industry. West Texas Intermediate crude is currently trading at multi-year lows of around $75 per barrel, down from $107 per barrel in June.

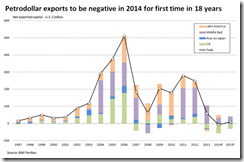

As Reuters reports, for the first time in almost two decades, energy-exporting countries are set to pull their "petrodollars" out of world markets this year, citing a study by BNP Paribas (more details below). Basically, the Petrodollar, long serving as the US leverage to encourage and facilitate USD recycling, and a steady reinvestment in US-denominated assets by the Oil exporting nations, and thus a means to steadily increase the nominal price of all USD-priced assets, just drove itself into irrelevance.A consequence of this year's dramatic drop in oil prices, the shift is likely to cause global market liquidity to fall, the study showed.This decline follows years of windfalls for oil exporters such as Russia, Angola, Saudi Arabia and Nigeria. Much of that money found its way into financial markets, helping to boost asset prices and keep the cost of borrowing down, through so-called petrodollar recycling.But no more: "this year the oil producers will effectively import capital amounting to $7.6 billion. By comparison, they exported $60 billion in 2013 and $248 billion in 2012, according to the following graphic based on BNP Paribas calculations."In short, the Petrodollar may not have died per se, at least not yet since the USD is still holding on to the reserve currency title if only for just a little longer, but it has managed to price itself into irrelevance, which from a USD-recycling standpoint, is essentially the same thing.According to BNP, Petrodollar recycling peaked at $511 billion in 2006, or just about the time crude prices were preparing to go to $200, per Goldman Sachs. It is also the time when capital markets hit all time highs, only without the artificial crutches of every single central bank propping up the S&P ponzi house of cards on a daily basis. What happened after is known to all..."At its peak, about $500 billion a year was being recycled back into financial markets. This will be the first year in a long time that energy exporters will be sucking capital out," said David Spegel, global head of emerging market sovereign and corporate Research at BNP.Spegel acknowledged that the net withdrawal was small. But he added: "What is interesting is they are draining rather than providing capital that is moving global liquidity. If oil prices fall further in coming years, energy producers will need more capital even if just to repay bonds."In other words, oil exporters are now pulling liquidity out of financial markets rather than putting money in. That could result in higher borrowing costs for governments, companies, and ultimately, consumers as money becomes scarcer.

Wednesday, October 15, 2014

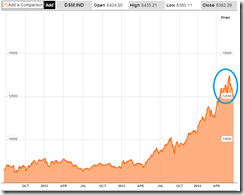

Will a Collapse in Oil Prices Burst the Middle East Bubble?

As a final note on markets, the US dollar index has been firming of late. Since July 1, the US dollar index has been up by 5%!The basket of the US dollar index consist of the euro (57.6%), the Japanese yen (13.6%),British pound (11.9%), the Canadian loonie (9.1%), the Swedish Krona (4.2%) and the Swiss franc (3.6%).Their individual charts reveal that the US dollar has been rising broadly and sharply against every single currency in the basket during the past 3 months.This may have been due to a combination of myriad complex factors: ECB’s QE, expectations for the Bank of Japan to further ease, Scotland’s coming independence referendum, or expectations for the US Federal Reserve to raise rates in 1H 2015 (this has led to a sudden surge in yields of US treasuries last week), escalating Russian-US proxy war in Ukraine and now in Syria (as US Obama has authorized airstrikes against anti-Assad rebels associated with ISIS, but who knows if US will bomb both the Syrian government and the rebels?) more signs of a China slowdown and more.Yet a rising US dollar has usually been associated with de-risking or a risk OFF environment. Last June 2013’s taper tantrum incident should serve an example.

Saturday, June 21, 2014

Has the Middle East Stock Market Bubble been Popped?

Thursday, March 03, 2011

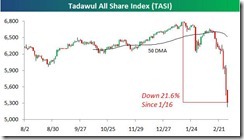

Middle East Stock Market Meltdown: Likely Driven By (Political Economic) Insider Selling

I wouldn’t deny that the meltdown in Saudi stocks, which had been down for 21% for 13 consecutive days have been politically driven. This applies to most bourses in the region too.

But before my explanation let’s go to some expert opinion or mainstream reporting.

According to Bespoke Invest (also the source of the chart above) [emphasis added]

Back in late January, the TASI saw a one-day decline of over 6% on 1/29 when tensions began to escalate in Egypt. When things settled down in Cairo, the TASI rebounded back above its 50-day moving average, but it then began to roll over again when tensions moved to Libya. Watching the charts must be a popular past time in Saudi Arabia, because once the index broke below its January lows, the bottom literally fell out of the index. With the March 11th Day of Rage coming up in Saudi Arabia next week, are traders in this market anticipating a replay of Egypt or Libya?

The Wall Street Journal adds, (emphasis added)

Large scale instability in North Africa and protests in neighboring countries [Bahrain, Oman, Yemen] have culminated in a significant selloff as investors are growing increasingly concerned that protests and subsequent instability could ultimately reach the Saudi market," said an analyst at Riyadh-based NCB Capital. "We firmly believe that fears of instability reaching the Saudi market are overdone, despite reports of calls for demonstrations in the coming days."

Saudi Arabia recently introduced a number of nonpolitical changes, estimated to cost around $36 billion, but there have still been signs of domestic discontent since Tunisia's popular uprising in January.

While foreign investors continued to cut their equities exposure to the region, the selling was mainly retail-driven—exacerbated by margin calls and redemptions at local Saudi funds, traders said.

The reason I’m not gonna deny this politically instigated collapse as a valid driver is that the declines have been far stretched or extended than the counterparts in non-MENA emerging market bourses. This implies something more than meets the eye.

I might add that, aside from foreign investors, importantly, I suspect that the insiders (meaning those economic and political agents whose stakes had been built around the current regimes over the years) could have been liquidating their stakes in fear, that in the event these People Power revolts become successful, the new administrations would resort to the sequestration or a freeze on their assets to appease the incensed populace or as indemnity for their political misconduct.

This has already happened to former Egypt President Hosni Mubarak, whose assets have been frozen by the Egyptian government, while other foreign banks as the Swiss appear to be headed for the same route as seen with its scrutiny of Tunisia’s deposed president Zine al-Abidine Ben Ali’s transactions.

So the likelihood would be for these embattled political economic agents to scramble and exit from conventional asset holdings, and subsequently, divert their assets outside of the region.

So yes, insider selling could likely be a crucial factor in the current market actions, while foreign selling and panicking retail investors have all combined to worsen these conditions.

The Bloomberg GCC 200 Index, a capitalization weighted index of the top 200 equities in the GCC region based on market capitalization and liquidity, reveals of the broad market declines of major Middle East stocks as the People Power movements ripple across the region.

And possibly gold and other commodities could signify as alternative ways to shelter the assets of these insiders.