The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Sunday, June 05, 2016

Why Blowoff Episodes Reveals That The Boom Is The Disease!

Sunday, May 08, 2016

Philippine Presidential Elections: My Expected Outcome, “None of the above” Wins!

Thursday, April 28, 2016

Quote of the Day: Enough is Enough. No Endorsement to State Plunder of People Through Elections

I realize that the suspense may become unbearable unless I make the following announcement, so here it is: I will not be endorsing any of the candidates seeking the Republican or Democratic Party nominations for president nor any of those seeking nomination by the minor parties. Indeed, I will not be endorsing the election itself. Finally, I will not be endorsing the continued existence of the nation-state over which these aspirants seek to preside. Enough is enough. I will not give my endorsement to politics as usual, a process by which competing parties seek to gain control the state's powers in order to plunder and bully the people at large for the sake of their principal supporters. Oh that all other people would join me in withdrawing their endorsement -- indeed, their acquiescence and blessings. Decent people ought to flee the whole diabolical process, leaving only the criminally inclined to go to war exclusively against one another without sacrificing the bodies, souls, and wealth of innocent parties.

Sunday, April 22, 2012

Will France’s Elections Signify as Death Warrant of the Euro?

France holds its elections today with 10 candidates in contention. Currently all the leading candidates appear to be rabid interventionists and inflationists who appeals to class warfare, protectionism, anti-immigration and nationalist platforms,

Writes the Wall Street Journal, (bold emphasis mine)

Nicolas Sarkozy, the center-right incumbent, is proposing to shrink the budget deficit by raising taxes in the name of "solidarity." On top of his already-passed hikes in corporate and personal income taxes, and his 4% surcharge on high incomes, Mr. Sarkozy also promises an "exit tax" on French citizens who move abroad, presumably to make up for the revenue that goes missing when all those new levies impel high earners to leave the country.

As for the reforms on the lips of every other policy maker in Europe, Mr. Sarkozy makes some of the right noises but won't even go as far as the (mostly broken) promises he made in 2007. In a 32-point plan issued this month, he offers some labor reform but more proposals that are vague (creating a "youth bank" for enterprising young people) or off-point (promoting French language and the values of the Republic).

Mr. Sarkozy proposes reducing payroll charges paid by employers but would make up for it by increasing VAT and taxes on investment income. This assumes there will be investment income left in France once Mr. Sarkozy's financial-transactions tax goes into effect in August.

Mr. Sarkozy's campaign is particularly disappointing compared to the one five years ago. Promising a "rupture" with France's old ways, he told voters in 2007 that they could no longer afford a sprawling state that coddled its workers and drove away entrepreneurs. Yet this year he seems content to reinforce a French model that's even more broken than before. If Mr. Sarkozy retakes the Elysée next month, he will have done so by turning his back on the center-right resurgence that he once led to victory.

The President's Socialist rival is a throwback of a different sort. François Hollande's campaign has adopted a fiery old-left style that most had taken for dead after the Socialists' 2007 defeat. All of Mr. Hollande's major economic policy plans have roots in a punitive populism that would make U.S. Congressional class warriors blush. According to the latest polls, he leads Mr. Sarkozy 29%-24% in the first-round vote and by an even wider margin in the likely runoff.

Mr. Hollande says he's "not dangerous" to the wealthy—he merely wants to confiscate 75% of their income over €1 million, and 45% over €150,000. He is, however, a self-avowed "enemy" of the financial industry, and he plans to impose extra penalties on oil companies and financial firms. He'd also raise the dividends tax and impose a new, higher rate of VAT on luxury goods. All of this is necessary, Mr. Hollande says, to chop the massive debt that President Sarkozy has heaped upon France.

But swiping at Mr. Sarkozy's debt record hardly makes sense when Mr. Hollande's own spending plans would pile on still more borrowing. The Socialist candidate is playing Santa Claus, promising lavish new goodies to French voters while other euro-zone governments are pulling back.

Inside Mr. Hollande's gift bag: 60,000 new teaching jobs, new housing subsidies and rent controls, and increased public funding for small and medium enterprises. He would raise the minimum wage to €1,700 a month and enact a new law to prevent and fight layoffs. He also promises to reverse Mr. Sarkozy's most important domestic-policy victory: raising the retirement age to 62 from 60.

So national elections in France has the usual dynamics of prompting politicians to pander to the gullible masses especially to “free market hostile” voters.

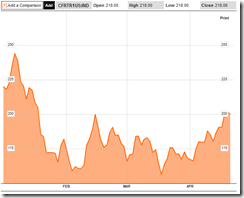

Chart from the Economist

Among major economies, the French population has been most averse towards to the free market.

Nevertheless France’s major benchmark the CAC 40, as of Friday’s close, has largely given up its gains and has now been unchanged on a year to date basis, perhaps partly due to the lingering Euro crisis as well as uncertainties from the outcome of elections.

Such concern has likewise been manifested on Credit Default Swaps (CDS) or the cost to insure debt, where there has been recent amplified concerns over the credit quality of French debt papers.

In case the winning French politician actualizes rhetoric into interventionist policies, then we can expect lesser resources to be available for productive ends as more of these will be diverted towards political projects. This also means the likelihood of migration of capital out of the French economy (capital flight), as well as, a transition to a larger informal economy.

With a prospective French political spending binge amidst a debt crisis plagued Europe, this means policies of interventionism will need to be backed by inflationism. Yet if such actions becomes deeply entrenched, then today’s election may have sealed the fate of the Euro.

As the great Ludwig von Mises warned

An essential point in the social philosophy of interventionism is the existence of an inexhaustible fund which can be squeezed forever. The whole system of interventionism collapses when this fountain is drained off: The Santa Claus principle liquidates itself.

Or as former British Prime Minister Margaret Thatcher once said,

The problem with socialism is that eventually you run out of other people's money [to spend].

Wednesday, October 05, 2011

Occupy Wall Street: President Obama’s Stealth Re-election Strategy?

There has been a brewing grassroots discontent at Wall Street, and they are partly right, Wall Street has been party to America’s social woes.

But the political solution to this has been divided; on the one hand, one camp blame Wall Street as inextricably tied to the US government and the US Federal Reserve. The other believes in the socialist resolution.

As Anthony Gregory writes,

Although there is no single ideology uniting the movement, it does seem to have a general philosophical thrust, and not a very good one at that. OccupyWallStreet.org has a list of demands, and while the website does not represent all of the protesters, one could safely bet that it lines up with the views of most of them: A "living-wage" guarantee for workers and the unemployed, universal healthcare, free college for everyone, a ban on fossil fuels, a trillion dollars in new infrastructure, another trillion in "ecological restoration," racial and gender "rights," election reform, universal debt forgiveness, a ban on credit reporting agencies, and more power for the unions. Out of over a dozen demands there is only one I agree with — open borders — and, ironically, many on Wall Street probably favor that as well.

All in all, this wish list is a terrible recipe for moving far down the road toward socialism. On the way to achieving these goals, totalitarian controls on the population would be necessary. Some of these demands are merely horrible ideas that would injure the economy severely — such as the huge expansion of public infrastructure. But others are so fancifully utopian — such as a living wage guaranteed to all, especially when combined with free immigration — that their attempted implementation would confront the many disasters and horrors we have seen in every nation that has seriously attempted socialism. Such policies would vastly expand the government, including its manifestations in the corporate state and police power that these protesters find so unsavory. All of the corruption and brutality they think they oppose are symptoms of the same essential political ideology they favor.

It must NOT be forgotten that Wall Street’s political and economic privileges emanates from the role it plays in the current political economy of the US.

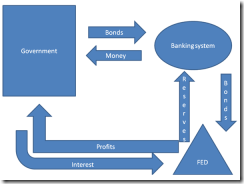

Fundamentally, Wall Street functions as the major conduit in the financing of the US government.

As explained by Professor Philipp Bagus,

For governments, the mechanism works out pretty well. They usually spend more than they receive in taxes, i.e., they run a deficit. No one likes taxes. Yet, most voters like to receive gifts from their governments. The solution for politicians is simple. They promise gifts to voters and finance them by deficits rather than with taxes. To pay for the deficit, governments issue paper tickets called government bonds such as US Treasuries.

An huge portion of the Treasuries are bought by the banking system, not only because the US government is conceived as a solvent debtor, thanks to its capacity to use violence to appropriate resources, but also because the Fed buys Treasuries in its open-market operations. The Fed, thereby, monetizes the deficit in a way that does not hurt politicians.

In other words, the incumbent architecture of the welfare state applies Financial Repression by channeling the savings of the private sector to the US government via the banking system which has been backed, coordinated and supervised by the US Federal Reserve.

I would like to add that capital adequacy laws have likewise been designed to designate US sovereign liabilities as ‘risk free’ which ‘incentivizes’ banks to hold government securities as its main assets.

Not only that, major Too Big to Fail Banks of Wall Street are the chief conductors of the US Fed’s monetary policy, which goes to show the depth of their intertwined relationships. A list of Primary dealers here.

And further proof that Wall Street benefits from the welfare state is the example of JP Morgan’s role as processor of food stamp benefits.

From the Economic Collapse Blog

JP Morgan is the largest processor of food stamp benefits in the United States. JP Morgan has contracted to provide food stamp debit cards in 26 U.S. states and the District of Columbia. JP Morgan is paid for each case that it handles, so that means that the more Americans that go on food stamps, the more profits JP Morgan makes. Yes, you read that correctly. When the number of Americans on food stamps goes up, JP Morgan makes more money.

And it is no doubt that such cozy relationship represents a classic text book example of regulatory capture —when a state regulatory agency created to act in the public interest instead advances the commercial or special interests that dominate the industry or sector it is charged with regulating (Wikipedia.org)

And an ostensible symptom of this has been the revolving door relationships—the movement of personnel between roles as legislators and regulators and the industries affected by the legislation and regulation and on within lobbying companies (Wikipedia.org)—between Wall Street and the US government.

The Business Insider shows 29 famous revolving door cases where Wall Street personalities went on to work for the government and vice versa, and the list includes Hank Paulson, Robert Rubin, Lawrence Summers, Martin Feldstein and many more

Bottom line: While it would seem right to put the load of the blame to the financiers of the government, solutions that further socializes Wall Street would only serve to perpetuate the current malaise or even worsen them.

And given the penchant of the emerging grassroot’s movement for bigger government, it would seem that such actions could signify as a stealth political strategy to promote President Obama’s re-elections. After all, Wall Street as scapegoat has been used before and at the end of the day had been settled amicably.

Looks and smells like the same old trick.

Monday, March 08, 2010

Why The Presidential Elections Will Have Little Impact On Philippine Markets

In this issue:

Why The Presidential Elections Will Have Little Impact On Philippine Markets

-Patronage Based Political Economy And The Fantasy of Change

-Minor Changes Won’t Cause Mass Uncertainties

-China And Regional Integration As Growing Influences To Domestic Political Trends

-Seasonal Patterns Of The Philippine Presidential Cycle Reflects On Fed Bubble -Policies

-Summary and Conclusion

Last week a friend asked if the upcoming national or the Philippine Presidential elections would have a perverse effect on the domestic market.

My reply is, why so?

Isn’t this what the people want, a “perceived” change in the leadership? So how can such percipient “change” translate to a net negative for the asset markets (stocks, bonds, real estate peso)? This may be true if a radical left leaning (or even a communist) candidate looms likely as the new leader, but this isn’t likely to be the case.

Patronage Based Political Economy And The Fantasy of Change

In the survey of leading candidates that are within the ambit of winning the electoral pageantry, all of them hail from the political elite strata. This suggests that none of them are likely to “rock the boat”, since they have all benefited from today’s environment.

What you and I are most likely to see is only a change of the guards and NOT a change in the welfare based patronage rent seeking system.

It’s equally the typical voter’s delusion to see a “clean” government when an awesome and fantastic eye-popping amount is being spent for the “marketing” these candidates![1]

Common sense or dispassionate reasoning will never add up to the voter’s faith.

Gargantuan money spent for elections are NOT for altruism purposes but as investments that will be recompensed, or translated into returns on investments (ROI), by virtue of covert political privileges: concessions, subsidies, monopolies, rebates, commissions, tacit partnerships etc...

And it isn’t a question about who among the candidate spends most, but about HOW THESE EXPENDITURES WILL BE REDEEMED!!

Does one ever think that the vested interest groups in support of their candidates (or even the candidate him/herself) will be satisfied in merely getting back of their investments once they are successful in capturing the highest office of the land-which incidentally is endowed with a huge discretionary public fund and with the ultimate say on how the swelling public coffers should be dispensed with?

The primary reason for people to invest or risk personal money is to profit from risk opportunities. Since elections are risk opportunities in the political spectrum, so the realistic and commonsensical answer is a NO!

The fact that using directly or indirectly public funds to offset private campaign expenses is most likely to signify largesse from a booty! But who cares? It is usually the political outcast or its “fall guy” equivalent who carries the brunt of “social justice” to somewhat satisfy the expectations of the masses for virtue.

Moreover, in the aftermath of elections, we are likely to see alliances forged from among the opposing camps with the winner. This will be a fodder for publicity that would project magnanimous efforts by the winners to “unify” the nation. In actuality, these will be designed to suppress or contain the opposition, by indirectly buying them by allowing them to recoup campaign expenditures!

Besides since democracy is a popularity contest, isn’t it quite obvious that all candidates will not only ride along with the most popular issues but likewise take upon a centrist or non radical stance just to lure votes?

Public choice economics calls this the “median voter” theorem. William F. Shughart II writes, (bold highlights mine)

``If voters are fully informed, if their preferred outcomes can be arrayed along one dimension (e.g., left to right), if each voter has a single most-preferred outcome, and if decisions are made by simple majority rule, then the median voter will be decisive. Any proposal to the left or right of that point will be defeated by one that is closer to the median voter’s preferred outcome.”

In short, what you see and hear in campaign platforms, isn’t what we are going to get.

People hardly ever learn from history.

Popular Presidents as the current incumbent US President Barack Obama has seen a steep decline in approval ratings in just one year in office.[2]

Former Philippine President Joseph Estrada, who walloped former rivals by a landslide in pluralistic victory in 1998, was ousted in the 2nd chapter of People Power’s revolution in 2001, about halfway during his tenure.

The former president, who had been pardoned by outgoing incumbent Philippine President GMArroyo in 2007, is now one of the many challenger-aspirants to the crown this May, perhaps in a quest for personal exoneration.

Minor Changes Won’t Cause Mass Uncertainties

It is unfortunate that people can’t seem to differentiate between what truly matters and what has been a longstanding fable.

Wall Street Street Journal Op-ed columnist Daniel Henninger, who argues for a return of the Robber Barrons, aptly identifies on such nuances,

``Market entrepreneurs like Rockefeller, Vanderbilt and Hill built businesses on product and price. Hill was the railroad magnate who finished his transcontinental line without a public land grant. Rockefeller took on and beat the world's dominant oil power at the time, Russia. Rockefeller innovated his way to energy primacy for the U.S.

``Political entrepreneurs, by contrast, made money back then by gaming the political system.”

In other words, Filipinos ought to realize that an environment of political entrepreneurship, the transference or the sucking out of taxpayer’s money from productive market activities to non-productive ventures due to the dispensation of political privileges or patronage economics, will unlikely provide for any material improvements in the system.

It is market entrepreneurship that is required for our economic upliftment.

And once the ball of “political entrepreneurship and paybacks” gets rolling, who or what should serve as “check” to sufficiently restrain abuses? Media?

Unless we are so gullible to “swallow hook line and sinker” the bunkum of media’s puritanical traits, the truth is media is just another self-interested agent that could be laced or infected with partisan politics or embroiled with conflicts of interests with that of public welfare. A recent example is ABC’s reporter Brian Ross caught lying in video in attempt to stage manage his Toyota death ride.

Hence, electing new leaders with fundamentally the same set of guiding incentives to prospective political actions do not actually trigger an abrupt systematic shift in the underlying nature of our political economy.

In short, the old aphorism “the more things change the more they remain the same” will most likely be a realistic application for today’s evolving political trends.

Thus, the outcome from the upcoming elections is unlikely to generate massive uncertainties in the market given the implied policies of continuity.

Yet public expectations from the “lotto” mentality of delusional “change” based on personality based politics will translate to effectively having “the rubber meeting the road” epiphany, post-elections. And this is the principal reason why ratings of populist leaders tend to collapse thereafter. Reality will expose that the emperor is naked.

And that’s why I’d prefer to see a tightly fought election so as to reduce the odds of the winning party to ‘confidently’ impose polarizing radical interventionist measures in the mistaken belief that a popular mandate backs their actions.

China And Regional Integration As Growing Influences To Domestic Political Trends

A one major positive (hopefully) structural factor OUTSIDE the range of political elections is that the Philippines, despite being a reluctant participant, has been enlisted in ASEAN’s pursuit of a free trade zone with China[3] (see figure 1)

As you will note from the above chart, the changes in the trade composition of the Asian-8 nations; namely Hong Kong, Taiwan, Singapore, Korea, Malaysia, Indonesia and Thailand aside from the Philippines, has materially shifted- where the chunk of its business is now with China than from the US.

And given this increasing prospects of deepening regionalism, this is likely to also manifest in the direction of regulatory and political trends- hopefully against the prospects of a surprise emergence of a clandestine zealot socialist leader.

This means that China will likely have an increasing influence in shaping our political order at the expense of the US.

This also means that we should expect the course of our domestic political affairs to tilt its balance towards the incremental accommodation to greater integration of trade, finance and investment and migration, with the region, as the opportunities from the ramifications of free trade presents itself.

And this does not entail the need to mimic the Eurozone’s route towards integration, as fund manager Andrew Foster of Matthews Asia writes,

``Developing a unified monetary framework within Asia Pacific is unlikely in light of the region’s history; the region holds too many memories of conflict and mutual distrust. Forging a unified currency out of such a construct is even less likely. However, what may occur is a gradual and de facto harmonization of interest rate cycles, dictated by the business cycles of the largest economies in the region. This may ultimately prove to be a more sustainable union. While a political project would likely fail to get off the ground, Asia’s currencies and interest rate cycles may align based on underlying trade flows, capital markets and other linkages in the real economy.” (bold highlights mine)

So yes, political and monetary integration may not be feasible at the moment, but what matters most is for the economic environment to operate freely.

Although I’d be more optimistic for Asia to adopt China’s yuan (the renminbi) as a regional currency reserve especially once the impact of monetary inflation from OECD policies becomes increasingly evident on the markets. And this will also depend if China has taken the necessary steps to avoid the same path.

China needs to only hasten the convertibility of her currency which implies more liberalization of capital flows to compliment the region’s free trade covenants.

Of course, for us, one possibility to defuse a ballooning endogenous bubble is to allow for liberalized capital flows as money trapped by capital controls has been forced to bid up domestic asset prices. Nevertheless, there is hardly any anti-bubble measure that is likely to succeed for as long as her government continues with its ‘accommodative’ money printing policies.

Meanwhile, I don’t think a political integration is a realizable option for Asia. Perhaps not until there will be cultural immersion and integration from substantially increased migration flows and or intermarriages. Such prospects are likely beyond our lifetime.

I’d also reckon that the new Free Trade Agreements (FTA) as more of open markets/market liberalization measures, as they are not “free trade” in the theoretical sense.[4]

Lastly, based on the above premises, it seems foreseeable that domestic political actions will likely be in response to the pressures extended by external forces, through the evolving changes in the macro picture than from internally impelled initiatives, unless the next batch of political stewards will resist or fight rather than accept these trends.

As economist Peter Boettke writes about Transitional Economies[5], ``The scourge of successful reform efforts is the desire to protect people from the rigors of market discipline. This is as true for the labor force as it is for the entrepreneurial class. Persistence of inefficient organizations and patterns of resource (both capital and labor) use simply ensure that short-term pain is sacrificed for long-term misery and economic deprivation.” (emphasis added)

Figure 2: DBS Research/Philippine Dealing System: Peso And Remittances Hardly A Correlation To Justify Causality

Figure 2: DBS Research/Philippine Dealing System: Peso And Remittances Hardly A Correlation To Justify Causality

This should be congruent to the political transition of the Overseas Filipino Workers (OFW), whom once had been reckoned as ‘victims’, and now having accumulated a vote rich constituency via their increased contributions to the economy, is now hailed as “heroes”.

The greatly embellished political role of the OFWs have prompted mainstream media and analysts to even exaggerate on the strength of Peso as having been ‘caused’ by remittances; a causation that isn’t even justified by [tight] correlation, as we have time and again debunked[6] (see figure 2)

Seasonal Patterns Of The Philippine Presidential Cycle Reflects On Fed Bubble Policies

As human beings, we have been hardwired to a pattern seeking behaviour. This apparently has been inherited from our ancestors, whom depended on such instincts so as to deal with the harshness of nature, given the primal era, for survivorship goals.

Despite the notable manifold advances in the realm of science and technology, people resort to the same intuitive approaches today. And this can be observed in many accounts, studies or reports from media or from institutional or academic experts which are fundamentally nothing more than schematics based on pattern searching framework masquerading as analyses. There is this propensity to construct paradigms or models similar to natural sciences, even when conditions are different in the context of social sciences, in order to argue or justify for a possible similarity in the assumed outcome.

I have to say that I am occasionally guilty of this too. For instance, I have made much out of the bullish outcome based on the seasonal performances of the Phisix relative to presidential election cycles which seemed quite compelling as argued here before[7] (see figure 3).

The Philippine stock market has boomed after every election, so far.

On an annualized basis, only 2004 produced the most impressive returns with 26.37% gains. The 1992 and 1998 elections produced an uneventful 9% and 5.3% respectively.

One would notice through the red ellipses in the chart that post election returns were quite significant. This means that the gist of the gains all came in the years following the election, except for 1998 which had a truncated honeymoon.

The easy part is to “rationalize” on the newfound confidence awarded to the new leadership.

But I found such explanation as too facile to be true.

This doesn’t explain the outsized movements of the Phisix during the heydays and this also doesn’t adequately clarify on the fleeting glory of 1998. And importantly, in contrast to the mainstream ideology, asset prices don’t get massively overvalued out of overconfidence or “animal spirits”.

In the basic understanding that shifting bubble cycles are products of government policies then this only means that the essence of bubbles are founded on excessive credit or leverage.

Only waves of speculative money from easy money policies could engender such dramatic movements.

With this in mind, the so-called honeymoon or confidence bestowed to a new leadership is likely to be superficial, coincidental and representative of a secondary effect rather from an ultimate cause.

This type of rationalization, which is often used by media or by surface looking analyst is typically known in the behavioural science as the “available” bias.

Well my suspicion appears to have been given some credible evidence.

We found that in every occasion that the Phisix materially rose in conjunction with the aftermath of Philippine Presidential elections, we discovered that US interest rates have been at the bottom of cycle (see figure 4).

All the blue arrows above have corresponded with the red ellipses in the previous PSE chart.

The explanation is that the low US interest rates, mostly in response to a previous crisis, were meant to provide a cushion on asset prices (except in 1980-1986). This has been popularly known as the Greenspan Put or in the definition of wikipedia.org, ``During this period, when a crisis arose, the Fed came to the rescue by significantly lowering the Fed Funds rate, often resulting in a negative real yield. In essence, the Fed pumped liquidity back into the market to avert further deterioration.” (emphasis added)

The cascading Fed Fund rates of 1980-86 were in reaction to the subsiding inflationary pressures (first arrow). This had been followed by the Black Monday crash in the 19th of October 1987. Incidentally, Black Monday of 1987 proved to be a baptism of fire for the then newly appointed Federal Reserve Chairman Alan Greenspan (August 1987)

Japan’s property and stock market bubble imploded in 1991 which was nearly concurrent with the US Recession of 1990-1991 triggered by the Savings and Loans crisis (second arrow).

The Asian crisis of 1997 rippled into a Russian financial crisis in 1998. Russia defaulted on her debt and subsequently triggered the Long Term Capital Management (LTCM) crisis. The LTCM crisis was resolved by a rescue from Mr. Greenspan’s US Federal Reserve.

The LTCM episode was further compounded by the concerns over what was deemed as a risk of massive dislocations from the computer and automated adjustments to the new millennium (third arrow).

Finally since bubble after bubble popped around the world (this comprised as the periphery), hot money finally thronged back towards the center or the source of munificent money flows (a.k.a inflation).

And this culminated with the bust of dot.com bubble in 2000 (exacerbated by the 9/11 of 2001), which prompted the Federal Reserve to intensely pare down rates which it held until 2004 (fourth arrow).

Put differently, every time the Philippines held a Presidential election, Fed fund rates were coincidentally were at the maximum state of ‘negative real yields’ from which prompted US based hot money to look for asset markets from which it could push.

And the Phisix bullmarket of 1986-1997 simply accommodated the movements of global hot money flows, which apparently provided a boost to the Presidential honeymoon story which turned out to be more a descriptive narrative than a real causal event.

Yet the lowering of Fed Fund rates in 1998, failed to sustain the rally in the local market because the latter had been afflicted by massive malinvestments from the previous boom, and was yet undergoing a market clearing process which extended until 2003 (if measured from the performance of the Phisix).

As a caveat, I don’t have access to the actual data representing the fluxes of money in and out of the Phisix or in the Philippines, prior to 2003. Nevertheless the Asian crisis was blamed by policymakers on speculative capital or hot money and serves as circumstantial evidence on money flows.

Fortuitously, we find ourselves at the same cycle anew.

But this time, instead of simply the US we have major OECD economies in concert with zero bound policy rates. (see figure 5)

To quote the BIS, [bold emphasis added]

``Expectations that exceptionally low policy rates would prevail for some time in major developed economies meant that banks and other investors could continue to exploit cheap funding and invest in higher-yielding assets. In fixed income markets, yield curves remained extraordinarily steep, highlighting the potential profit from investing long-term with short-term financing (left-hand panel). The taking of such positions may also have contributed to recent downward pressure on long-term yields. Implied volatilities on interest rate derivatives contracts declined further, suggesting that the perceived risk associated with such investments continued to drop (centre panel).

``The combination of higher returns and lower risk meant that such positions were gaining in attractiveness from a risk-adjusted perspective too. Notably, measures of “carry-to-risk”, which gauges return in relation to a risk measure, reached new highs for this type of position (right-hand panel). Given such incentives, one concern was that financial institutions could be taking on excessive duration risk. Once expectations change and interest rates begin to rise, the unwinding of such speculative positions could reinforce repricing in fixed income markets and result in yield volatility.”

As you would note, the record steep yield curves, by artificially lowering of the interest rates, provides a very compelling incentive to get cheap financing over the short term in order to profit from investing or speculating on the long term high yielding assets.

And forcing down rates has created an impression of a stable environment conducive to risk taking.

Essentially you have the seeds of a global bubble in place. Next is to see financial institutions (private or even government institutions) taking on more leverage and this means bidding up asset prices.

Carry trades that arbitrages OECD currencies to invest in high yielding emerging markets like the Philippine Stock Exchange (PSE) or commodities will likely intensify, and other forms of vehicles for leveraging could surface.

Nevertheless, the inflationary bias by global policymakers are very very clear. And this reflects on the revolting fear by central bankers on the prospects of deflation.

As Frederick Hayek once wrote[8], ``the chief source of the existing inflationary bias is the general belief that deflation, the opposite of inflation, is so much more to be feared that, in order to keep on the safe side, a persistent error in the direction of inflation is preferable. But, as we do not know how to keep prices completely stable and can achieve stability only by correcting any small movement in either direction, the determination to avoid deflation at any cost must result in cumulative inflation." [emphasis added]

Summary and Conclusion

In summary, we don’t expect to see any material changes in the Philippine political economy emanating from a change in leadership from the upcoming elections. It’s more about a change of guards than from an overhaul of a system that will still be dominated by the same patronage-rent seeking politics.

Hence, markets are not likely to also reflect on uncertainties by a new face at Malacañang, unless an underdog outside the sphere of candidates among political elites surprises the public.

What would matter more will be the political reactions by the new stewards to the growing influence of external forces. We expect political trends to increasingly be shaped by the free trade zone recently established with our neighbours and with China, aside from the growing foreign policy influence of China in Asia, at the expense of the US.

Finally, it is more likely that zero bound OECD monetary policies will provide traction to the domestic market action than from the results of election. The steep yield curve, from artificially reduced rates induces the public to undertake speculative and encourages international carry trade or currency arbitrages. Such dynamic should underpin the activities in the Philippine Stock Exchange.

One must be reminded that due to the morbid fear of policymakers of deflation, they have inexorably taken an inflationary bias that punishes savers. This is likely to fuel bubble cycles in several parts of the world.

To my mind, the Phisix seems likely a candidate.

[1] see Philippine Election Myth: "I Am Not A Thief!"

[2] See Popularity Based Politics Equals Waking Up To Frustration

[3] See Asian Regional Integration Deepens With The Advent Of China ASEAN Free Trade Zone

[4] "It is a mistake to assume that as long as such conceptions prevail any endeavors to lower the obstacles to international trade could be successful. If the theories in favor of protection and self-sufficiency are considered as right, then there is no reason to bring down trade barriers; only the conviction that these theories are wrong and that free trade is the best policy can shake them. It is inconsistent to support a policy of low trade barriers. Either trade barriers are useful, then they cannot be high enough; or they are harmful, then they have to disappear completely". see von Mises, Ludwig, The Disintegration of the International Division of Labor, Money, Method, and the Market Process, Chapter 9

[5] Boettke Peter, An Austrian Economist Perspective on Transitional Political Economy

[6] See How The Surging Philippine Peso Reflects On Global Inflationism

[7] see Focusing On The Future: the Phisix and the Philippine Presidential Cycle

[8] Boettke, Peter Reading Hayek -- Or Why I Think Monetary Policy Based on Monetary Equilibrium Theory Might Run Into Problems in a World of Central Banking