Read Ben Graham and Phil Fisher, read annual reports, but don't do equations with Greek letters in them. - Warren Buffett

During casual conversations, and for those who are aware of my line of work, I am always asked whether the domestic stock market is headed up or down.

These lay persons can’t be blamed. They have been hardwired to resort to the law of least efforts or the “most convenient search method[1]” or the act to attain similar goals with the “least demanding course of action”. And as Nobel Prize psychologist Daniel Kahneman expounds “In the economy of action, effort is a cost, and the acquisition of skill is driven by the balance of benefits and costs. Laziness is built deep into our nature”[2].

The principle of least effort applies not only to physical activities but also on the mental sphere. That’s why people resort to mental short cuts or heuristics in almost everything including investments[3]. And that’s why mainstream media sells oversimplified narratives of events that cater to such popular demand for “lazy” information. And this is why politicians sell “lazy” but noble sounding programs to the gullible voters.

And when people ask for a definitive outcome, not only are they mistaking market analysis for soothsaying, usually these are signs of the layperson’s search for the confirmation of their ingrained beliefs.

And because I see markets as a function of risk and reward, a tradeoff of cost and benefits, my standard response has been to refer to the current risk environment in relation to its potential gains.

US Stocks and the Deepening Scarcity of Margin of Safety

Prudent investors look for a margin of safety on their investments rather than undertake activities that risks compromising the preservation of capital.

As the father of value investing and inspirational mentors of Warren Buffett, Benjamin Graham wrote[4]

Investment requires and presupposes a margin of safety to protect against adverse developments. In market trading, as in most other forms of speculation, there is no real margin for error; you are either right or wrong, and if wrong lose money. Consequently, even if we believed that the ordinary intelligent reader could learn to make money by trading in the market, we should send him elsewhere for instruction. But everybody knows that most people who trade in the market lose money at in the end. The people who persist in trying it are either (a) unintelligent, or (b) willing to lose money for the fun of the game, or (c) gifted with some uncommon and incommunicable talent. In any case they are not investors.

The current risk reward environment hardly seems conducive to providing a margin of safety for investors.

When markets appear to be entirely dependent or hostaged by political actions, and when market participants become confidentially resolute over their perceived outcomes of the markets without addressing the underlying risks factors then the markets are transformed from investment to gambling.

The late financial historian, economist and author Peter L. Bernstein reminds us that[5]

In their calmer moments, investors recognize their inability to know what the future holds. In moments of extreme panic or enthusiasm, however, they become remarkably bold in their predictions; they act as though uncertainty has vanished and the outcome is beyond doubt. Reality is abruptly transformed into that hypothetical future where the outcome is known. These are rare occasions, but they are also unforgettable: major tops and bottoms in markets are defined by this switch from doubt to certainty

So when the consensus has arrived with the conclusion with unwavering conviction that interventionist politics drives economic performance, the newfound established permanence of high flying statistical growth and when credit rating upgrades have been discerned as signs of international acceptance of such magical transformation of the economy, then this looks very much like a resonating switch from ‘doubt to certainty’ that compromises the margin of safety for stock market investing.

The recent wild pendulum swings in the US equity markets seems like a testament to such politically induced volatility. As measured by the Dow Jones Industrial Averages (DJIA), miniature boom bust inflection points have all been politically driven.

Note: The blue arrows above have not been meant to reveal precise dates of indicated events but rather to show of the reversal points of the violent fluctuations in reaction to political events.

As one would infer, each time the prospects of the curtailment of has been envisaged, e.g. the Fed’s Taper, Debt Ceiling over even a Larry Summers appointment for Fed chairmanship, the DJIA convulses.

On the other hand, every time the mainstream accepts political assurance that the easy money environment will be retained, the DJIA flies.

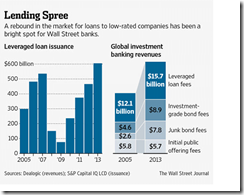

The addiction to debt hasn’t been merely a government spending affair. Market participants have deepened the used of debt as tools to chase yields and to squeeze earnings thus higher stock market prices

Behind the scenes, or what the mainstream overlooks or deliberately ignores has been that near record US stocks have been accompanied by the swelling of net margin trades to likewise near record levels as shown by the chart from Bank of America Merrill Lynch via the Zero Hedge[6].

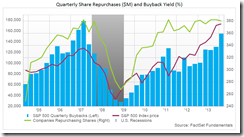

And corporations have been increasingly been resorting to debt to undertake equity buybacks[7] which also helps boost stock prices.

In other words, debt or inflationary credit has become the principal force in driving stock market pricing and valuations.

And this seems why US equity markets have become highly sensitive to developments in the political sphere as market participants have largely anchored their perceptions and positioning on the influence of the fluid political dynamics on the credit environment.

Can US stocks continue to head higher? Sure. But this now represents a confidence game that stands on the delicate tolerance level of companies and of the system to absorb more debt intertwined with the actions of the bond vigilantes.

Will returns from speculation be higher than climbing cost of servicing such debts? If so, then the game can play on. If not, more firms will likely resort to Ponzi financing, in the hope that debt IN-debt OUT and further increases in security prices would camouflage the structural impairments of a company’s operations.

This may continue for as long as the confidence levels on such tenuous dynamics hold or will be maintained and for as long as the bond vigilantes will be kept restrained.

This also means that to push stocks higher there needs to be even greater absorption of debt. So debt begets more debt, thereby intensifying systemic vulnerability.

So it has not been a surprise to see signs of reluctance to invest or of the verbalizing of concerns over market conditions from celebrity gurus and billionaires such as George Soros, Warren Buffett, John Paulson[8], Stanley Druckenmiller, Paul Singer, Seth Klarman[9], Howard Marks, Julian Robertson and Jim Chanos, whom has reportedly reduced exposure on US equities[10].

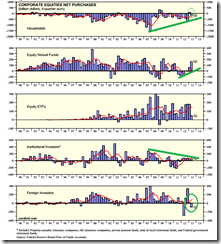

The character of equity ownership has also been changing. During the second quarter, US Federal Reserve’s Equity “Flow of funds”[11] indicates a marginal reversal or net selling for the households. Net purchases by Equity ETFs also materially slowed. On the other hand, Equity mutual funds more than doubled from the 1st quarter.

Since Equity ETFs and mutual funds are largely household financial assets, this may be indicative of a shifting by household accounts from direct to indirect ownership. Americans may be relying more on “experts” than from directly dabbling with the stock markets.

Meanwhile institutional investors which include property-casualty insurance, life insurance, private pension funds, state and local retirement funds and Federal government retirement funds posted marginal gains whereas foreign investors have posted sizable outflows, the second largest since 1990s.

In the other words, record US stocks has mainly been driven by demand from funds servicing the household or retail sector.

Rising stocks based on debt erodes one’s margin of safety.

Value investor Benjamin Graham warned on this too[12]…(bold mine)

The first and most obvious of these principles is, “Know what ou doing—know your business.” For the investor this means: Do not try to make “business profits” out of securities—that is, returns in excess of normal and dividend income—unless you know as much about security values as would need to know about the value of merchandise that you proposed to deal or manufacture

Higher Philippine Stocks Doesn’t Exorcise Risks

Can Philippine stocks move higher?

Why not? As I reported last week[13], BSP loans seem to have emitted signs of reversal from a marginal declining trend which commenced in the 1st quarter in August. Some of those loans may have been re-channelled to the stock market. If the August reversal on what the BSP calls as “loans for production” or general loans by the banking system (and particularly the financial intermediary sector) will be sustained or re-accelerates, then the Phisix may edge higher. The Philippine credit market participants appear to have shrugged off the August stock market convulsion. This serves as more signs of a shift from doubt to certainty.

Heightened volatility is hardly a sign of a salutary bull market. On the contrary it is a sign of toppish market.

We have seen a parallel of this story during the pre-Asian crisis era.

Following the 1993 juggernaut (blow off top) by the bulls where the Phisix racked up a stunning or fantastic 154% nominal currency return, the Phisix encountered two years of extreme volatility. Two years seem as maximum pain for either the bull or bears.

Since the peak in January 1994, the Phisix endured three bear markets assaults through the last quarter of 1995.

Over two years the Phisix fell into a quasi bear market and lost 33.3% from the January 1994 peak to the November 1995 trough.

I call this three bear market strikes in 1994-1995 “the boy who cried wolf”. This is because the financial markets seem to have wanted to substantially correct on the excesses of the 1993 gains, but this “this time is different” outlook powered by a swift spike in credit growth in the real economy prevented this from happening.

Domestic credit as a % of the economy skyrocketed or more than doubled from 25.18% of the GDP in 1992 to 62.2% in 1997[14]. That’s how rapidly things evolve when doubt is substituted with certainty.

The bears appear to have relented to the bulls a temporary upper hand, where in one year the bulls recovered all the losses from the peak of January 1994 to score 56.9% return in 1 year and three months.

By February 1997, or when the bulls pushed the Phisix a little above the 1994 highs, the bears reasserted their dominance by drubbing the bulls with the final massive bear market strike in just three months that finalized the contest.

Two months later, the Asian crisis was formally unveiled.

In 19 months the entire gains of 1993 had been wiped out, and the Phisix lost a ghastly 68.6%. The bear market from the Asian crisis would lead to culmination of the bear market 7 years after or in 2003.

In late 2002 I was shouting at the top of my lungs for “a buy”. But the consensus would have none of it. [As a side note: You can see my bullish call on the mining sector in 2003 as published by safehaven.com[15]]

I even remembered being cussed at during my first call to a dormant client assigned to me by my principals which was a shock to me. The client accused me of partaking in the syndicate (the Philippine Stock Exchange) that has short-changed stock market investors. This encounter reinforced my belief that the PSE hit a nadir. The PSE was an orphan then. Doubt prevailed.

How things have changed. Today 10 years after, where the Phisix peaked at nearly 7,400 in May 2013 or or nearly 7.4x the nadir, PSE has a thousand fathers, particularly most of the industry participants, the political class and the toady media.

Following two attempted thrusts to the bear market levels in June and August, the Phisix has been inching higher. This resonates on the actions of her neighboring bellwethers. The Phisix is still about 900 points away from the recent highs

Based on the 1997 and 2008 experience, previous highs had never been successfully encroached and in fact, became critical turning points for a full blown bear market.

Will this time be different?

Ultimately the continuity of the bullmarket will depend on the actions of the bond vigilantes.

On Domestic Credit-to-GDP ratio: Money doesn’t grow on trees

Today the mainstream backed by declaration from the official pooh-poohs the risks from over leveraging.

This is a re-quote from a speech by BSP governor Amando M Tetangco Jr in the Euromoney Philippine Investment Forum in Manila last March 12, 2013[16] (bold mine)

It is also important to note that indebtedness in the Philippines is still quite low. Domestic credit-to-GDP ratio at 50.4% (Q4 2012) still ranks one of the lowest in the region, This would suggest that the risk of excessive leverage is less and the threat to financial stability is likewise lower, should asset prices correct.

I had to quote Mr. Tetangco because there has been some figures going around stating that as of the end 2012, Domestic credit-to-GDP is at the 31+% levels. With Mr. Tetangco repeating the same figure over a news article interview 2 days after, my guess is that this serves as official figure[17].

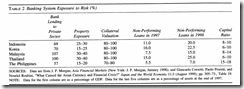

Mr. Tetangco also referenced his claim that Philippine debt levels “ranks one of the lowest in the region” in a footnote, “Latest available Indonesia 40.2%, Malaysia 133.3% Singapore 151.8%, Thailand 129.4% Japan 221.2% China 153.1% and Korea 104.1%.”

Implying that Philippine credit can grow as much as the other nations signifies a fallacy of division or “what is true of a whole must also be true of its constituents and justification for that inference is not provided”[18]. Such is mistaking forest for the trees.

One reason why other nations have greater tolerance level for credit is that except for Indonesia, on a per capita GDP level, other nations have been way way way higher than the Philippines.

Theoretically, credit should be more accessible to those with higher income.

As per World Bank 2012 figures per capita GDP[19]: the Philippines $4,410, Indonesia $4,956 Malaysia $17,143 Singapore $61,803 Thailand $9,820 Japan $35,178 China $9,233 and South Korea $30,801.

The other reasons are in the context of the state of the financial system.

With a very low participation rate by the population, credit growth has been concentrated to those with access to the formal banking system. Only an estimated 21% of Philippine households have the privilege to benefit from the Php 8.117 trillion banking system (as of March 2013[20]).

This includes elected officials, bureaucrats, and employees whose stipend and perquisites (or even Pork) have been channelled through government owned banks or to their private sector affiliates.

Therefore domestic to credit ratio will remain disproportionately reliant on the conditions of the current bank account holders which will be limited to their capacity to access credit, via income conditions, perceived credit quality, reputation, willingness of the bank to lend and available collateral.

Yet most of the credit growth has been taking place in the supply side. This means big companies who increasingly use leverage for expansion or operations. And this why risks of bubbles have become ‘systemic’; where the concentration of credit to a few theoretically should mean ‘greater’ threat to financial stability.

But if the banking system has a low penetration level, this even applies more to the non-banking channels, particularly to the capital markets. The PSE has only 525,000 accounts even when these participants now control resources at over 100% of GDP.

The same applies to the Philippine bond market which has been dominated by government debt. Government debt as of the 2nd quarter constitutes 86% of both US$ denominated and LCY bonds[21]. Meanwhile, private corporate bonds are largely from publicly listed companies. So the same set of people who are principal beneficiaries of the stock market are likewise the beneficiaries of the bond markets.

This means that the idea that the “threat to financial stability is likewise lower” is correct seen from a different sense; should a credit bubble pop, the threat to financial stability will fall upon the lap of mostly the political economic elites than to the general unbanked public. Like in 1997 the politically tormented informal economy will save the day.

Yet the elites desire more credit to fuel a larger bubble which the BSP has been happy to oblige.

Additionally, the domestic to credit ratio will improve only when the informal economy migrates to the formal banking industry.

But the informal economy is a product of government failure, particularly of the policies of financial repression, overregulation and weak property rights as imposed on the public by the government.

By keeping markets underdeveloped the government can capture resources owned by the private sector through the captive banking system and through the reduction of purchasing power of the domestic currency, the peso. This is the financial repression aspect.

So the transfer of resources from the general economy to the political class means that resources for entrepreneurship have been constrained.

Add to this the over-politicization of the marketplace via overregulation. Overregulation has its attendant costs, particularly high costs of compliance, high taxes and non-pecuniary burdens to comply with the bureaucratic regulations or red tape. This means that time, effort and money spent on regulatory compliance equally reduces resources for commerce or entrepreneurship which further implies a reduction of productive activities and the incentive to undertake survivalship through the informal sector.

It is true that the informal sector holds a lot of potential capital that could spur a real economic boom. However most of these are what Peruvian economist Hernando de Soto[22] calls as “dead capital” or as per Wikipedia[23], “property which is informally held that it is not legally recognized. The uncertainty of ownership decreases the value of the asset and/or the ability to lend or borrow against it. These lost forms of value are dead capital.”

Institutional deficiencies that facilitate weak protection of property rights and the lack of the rule of law have been responsible for this lack of conversion of dead capital to productive capital.

In short, the structural inability to intermediate savings from the private sector to productive activities functions as the major constraint to expansion of domestic credit to gdp ratio.

Money, as the above shows, doesn’t grow on trees.

Philippine Economy: Inflationary Debt Boom is a Bad Policy

Yet the Philippines hasn’t been taint free from debt, au contraire

The Philippine debt stock has ballooned to nearly 150% of GDP (left window) growing along with the rest of the neighbors.

The World Bank in a recent report seems concerned on the potential impact of the FED’s tapering and of rising rates on an increasingly levered Emerging Asia[24] (bold mine)

Economies may be especially vulnerable to the extent that they have significant external financing requirements, saw rapid credit growth when interest rates were low, or have experienced large increases in debt. Indeed, markets appear to be discriminating on the basis of country fundamentals. Indonesia’s high bond yields partly reflect its current-account deficit. Again, in Indonesia, and in Malaysia, the Philippines, and Thailand, there are concerns about rapid credit growth leading to financial-sector overextension. Gross national debt now exceeds 150 percent of GDP in Malaysia, China, and Thailand, and 100 percent of GDP in the Philippines (Figure 29; see also note on “China’s Credit Binge May Have Run Its Course,” in this Economic Update). Specific concerns include a sharp increase over the last few years in household debt in Malaysia and Thailand, and high leverage in state-owned enterprises in Vietnam.

While the World Bank sees that Emerging Asia should be “in a relatively strong position to face this shock”, given the “significantly lower vulnerabilities than in the run-up to the 1997–98 Asian crises” they are concerned of the unclear potentially large impact on capital flows from the actions of the US Federal Reserve

Notice that the nations of ASEAN have a distinct distribution of debt stock. This implies of the difference in the degree of credit risk exposure.

While Malaysia’s risks, for instance, have been one of the overexposed credit by the household, credit risk on the Philippines has been from the financial sector.

And notice too that today’s potential flashpoint for a regional crisis has been Indonesia which ironically has the smallest debt exposure.

Notice too that given the variance between per capita levels between the Philippines and her neighbors as noted above, the Philippine debt levels have now been in proximity to her counterparts. So domestic credit seem to have been growing relatively faster than her neighbors

This reminds me that in the 1997 Asian crisis, the Philippine banking system had relatively less exposure to leverage[25] compared to the regional peers but nonetheless suffered from the contagion effects from the ASEAN meltdown.

This shows that there simply is NO one-size fits all formula for debt composition, degree of debt levels, or debt tolerance. A sudden reversal of confidence by creditors will only expose on the degree of debt tolerance and malinvestments a nation has. And worst, the ramification is likely a contagion.

Additionally, the Philippines have the smallest household exposure to debt.

Moreover, Philippine debt stock has been concentrated on the financial sector, and secondarily, the government. Based on my interpretation of the World Bank chart, the financial sector has been lending to the government (as major buyers of bonds), secondarily to the non-financial resources. Lending to the household signifies a morsel of total banking activities.

This validates all my previous writings including the above about the myth of the consumer economy[26], vital role played by the highly underappreciated large informal economy and of the concentrated or biased nature of economic growth favouring those with access to the banking system, capital markets, the politically connected and the political class.

And this shows how the current supply side growth dynamic, which the credit rating agencies and the consensus worship as the growth ‘elixir’ has really been cosmetic and will eventually prove to be unsustainable.

And while today’s high growth rates could mean, as the great Austrian economist Friedrich von Hayek pointed as “the more the available opportunities of a country remain unexploited, the greater its opportunities for growth; this often means that a high growth rate is more a sign of bad policies in the past than of good policies in the present”[27], high growth rates via inflationary boom which really means redistribution of resources to a select privileged few, that temporarily generates high statistical growth rates, but leaves a large segment of the available opportunities of a country unexploited is also a bad policy.

[12] Benjamin Graham op.cit. 249