Recall that, according to the Oxford English Dictionary, a factoid is "an item of unreliable information that is reported and repeated so often that it becomes accepted as fact." The famous "Dr. Fox Lecture," which was presented at the University of Southern California's Medical School, illustrates just how so-called "experts" can effectively work and influence a crowd. The lecture was presented by Dr. Myron Fox --an advertised heavyweight -- to an academic audience in 1970. The response to Dr. Fox's lecture was unanimously favorable. Little did the audience know that "Dr. Fox" was an actor who had been cloaked with an impressive fake curriculum vitae and trained to deliver a nonsensical lecture filled with contradictory statements, double-talk and non-sequiturs. Like it or not, when the big guns sound off, they are heard. Beware. –Professor Steve Hanke

In this issue

Phisix 7,800: Record Stocks, Incredible Misperceptions

-Peso Volume’s Divergent Stories: The Contrast Effect and Penetration Levels

-Peso Volume’s Divergent Stories: Special Block Sales, and Signs of Exhaustion

-Phisix 7,800: G-R-O-W-T-H Misperceptions: 2014 Price Earning Ratios

-Shopping Mall Vacancies: The Rental Rates Factor

-Shopping Mall Vacancies: Truck Ban and Port Congestion

-Phisix 7,800: Philippine Bonds Just Sold Off

-Global Record Stocks, Record Warnings from Authorities Too

Phisix 7,800: Record Stocks, Incredible Misperceptions

Once again, record upon record.

This marks the ninth consecutive weekly gains for the domestic benchmark which has already topped the 2013 streak of eight weeks.

Peso Volume’s Divergent Stories: The Contrast Effect and Penetration Levels

Following Friday’s record close, a jubilant Philippine Stock Exchange issues this press release[1]

Today's record close is the fourteenth for the PSEi since the start of the year.

"Trading activity may be muted because of the Lunar New Year break in other countries but it has obviously not kept the index from gaining. We are pleased that alongside the record highs, we have seen the market’s daily average turnover almost double to Php11.70 billion from the same period last year. We hope that this level of activity will be sustained, and hopefully even improve in the coming months," PSE President and CEO Hans B. Sicat said.

The PSEi has gained 8.2 percent year-to-date

Let us put the volume into perspective

| Year | iPsei level | Gross Peso volume | days | Average Peso daily |

| 2013 | 6,648.69 | 325,390,399,657 | 36 | 9,038,622,212.7 |

| 2014 | 6,352.76 | 215,222,266,509 | 35 | 6,149,209,614.53 |

| 2015 | 7,825.39 | 362,927,017,220 | 32 | 11,341,469,288 |

Perhaps I may have miscounted or there could have been changes in data, which I have not seen, but based on the PSE daily quotes, my tabulations for the daily activities year to February 20th have been the above.

It’s always important to look at the basis of comparisons, because different reference points can altogether reveal of divergent stories.

It’s true that based on 2014 figures the numbers have almost doubled. But it must be known that the Phisix was then at 6,352 compared to record 7,825 today or a 23% variance. February 2014 signified as the early stage of recovery from the losses incurred during May 2013s taper tantrum which brought the Phisix down to touch bear market levels. So the doubling of volume can be seen from the perspective of bear market recovery relative to record highs, hence the near doubling. This seems like an apple to orange comparison.

Yet if we base this on a similar upside pace or trend, in particular the path towards the first 7,400 which was over the same period in 2013, the gains would have been narrower. In February 20 2013, the Phisix was at 6,648.69 so the difference between then and today in terms of index was 17.7%, and in terms of volume 25.5%. If I base it on the above PSE press release, the change in terms of volume increases to 29%.

So seen from a different prism in the context of parallel momentum towards record levels, gains are still significant in 2015 but not as magnified when based on 2014.

What you see depends on where you stand.

But it is not just about nominal numbers. There is always the qualitative component.

The numbers tell us that in between the two record high of Phisix 2007 (October 3,873) and 2013 (May 7,392.2) or a 90.8% asset inflation, direct participation rates through stock market accounts, grew by only 36%. With a population approximated to have reached 100 million, stock market accounts at 600,000 would mean just .6% of people trading stocks directly.

Part of those accounts have been institutions. Yet I hardly think that indirect participation by the public—via mutual funds or UITF or other managed funds—would substantially enhance on the penetration level. Even at optimistically 2-3%, this would mean 2 to 3 million people with exposure to stocks or even to bonds

Unlike the Chinese stock market boom which has been a magnet for a throng of retail participants, the Philippine record high as of 2013 has been mostly about a few retail and institutional accounts pumping and pushing the markets. Even at 7,800, I doubt if this dynamic has materially changed.

So volume growth means heavier exposure on stocks by a limited segment of society. Likewise this “doubling up” at record levels could have been funded by credit and by leverage from carry trades.

These are risks behind those flowery numbers which the PSE refuses to look at, or if they have, refrains from divulging.

So all such feel good “pat on the back” has mostly been about symbolism. Like politics, Phisix 7,800 has been about showbiz—form over substance.

The penetration level of the stock market along with bank and or insurance accounts reveals of the state of the Philippine financial markets or what the mainstream calls as “financial inclusion”—access to financial services. But the supposed shortcoming, the dearth of financial inclusion, can also be seen as a blessing—adverse developments that will occur on the domestic financial markets will largely be limited to the few lemmings.

Peso Volume’s Divergent Stories: Special Block Sales, and Signs of Exhaustion

Yet there is another factor: a significant contribution to the current volume has been special block sales.

Special block sales have contributed to 19% to the total volume from the start of the year through February 20th this 2015 as compared with 2.8% and 12.1% in 2014 and 2013 respectively. Special block sales are equity based deals by publicly listed firms that have been conducted through the PSE.

The rate of special block sales reflects on the market’s sentiment. As the market’s rise, debt and or equity instruments of many firms, especially the popular ones, may be transformed into “currencies”. The perception of increased liquidity or “moneyness”—brought about by inflated equity prices which create a perception of confidence—means that firms can easily tap funding from the markets or conduct deals (e.g. M&A, LBOs) in exchange for equity or debt deals collateralized by equity.

From the start of the year, major special block sales (based on 1 billion pesos up) has been from CMT (now FNI), ALI, FGEN, JGS, GTCAP, ISM and MPI.

In the case of raising money, such deals would signify as SUBSIDIES and a TRANSFER of risks on a wholesale basis from publicly listed firms to the public—channeled through sell side institutions.

Think of it when the market sinks, who will bear the risk of 40+ PERs or paying more than 40 years for current earning levels?

These companies would have likely paid out money raised from the public as dividends and or as executive bonuses. Yet the dividends paid will hardly offset capital losses from deflated equity values held by the equity owners.

So it would be natural for these companies to champion the status quo (asset inflation) and or even possibly partake to the recent recourse to “index management” mostly through “marking the close”. That’s because aside from the banks, and the government, these firms have been major beneficiaries of the stealth wealth transfer enabled and facilitated by zero bound-financial repression policies.

Anent marking the close, the Phisix had three last week even when there had only been 4 trading days; two were minor accounts of “pump”, the bigger one was a reverse or a “dump”.

Despite the PSE babble on record territory, here is another unstated development.

While it is true that volume year to date has doubled relative to last year, this week’s average daily volume at Php 6.86 billion has halved when compared from last week or from all the weekly average daily volumes during the previous 5 weeks! The collapse in the average daily volume has partially mirrored the daily trades (averaged weekly).

Two things. Last week posted trivial accounts of special block sales. So without amplified effect from major special block sales, volume becomes smaller.

Next, the decline in peso volume comes after record after record run. This means even while market breadth has shown marginal improvements the bulls have been losing steam.

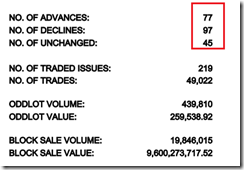

As for market breadth, advancers marginally led decliners 362 to 348 in a truncated trading week due to the Chinese New Year. In addition, advancers equaled decliners in the context of weekly activities.

In short, the present state of the markets has been showing signs of exhaustion or exhibiting signs for a correction.

But the index managers would have none of this. The pump and push vaudeville must go on.

And this is what the PSE hopes to be “sustained”.

Phisix 7,800: G-R-O-W-T-H Misperceptions: 2014 Price Earning Ratios

This has what Phisix 7,800 and 8.23% year to date gains has done so far.

From an industry basis, the gains have been skewed towards the holding sector with the property sector gaining ground. For the week, the activities in the industrial sector appears to have slowed but has been at pace with the property sector year to date.

Though still posting positive returns, the financial sector, service and mining have underperformed the benchmark.

What can be discerned from the above has been the seeming rotation occurring among the three leading sectors, the industrials, the holding and property.

Gains are being concentrated to a few leaders representing these sectors.

Broken down into the member issues within the Phisix basket, the divergences has become more apparent.

Eight of the top 15 biggest market cap has outperformed as against only six of the next half of member composite of domestic bellwether. So 14 of the 30 have borne the yoke of the Phisix at 7,800.

Evidently those pump and push mostly on the top 15, which has signified a carryover from last year, not only has been the reason behind Phisix 7,800, but has also levitated PER ratios of most of the PSE issues to absurd levels.

Based on the PSE’s February 18th PERs; for the top 15 biggest market cap Phisix companies, 9 of the 15 have PERs at 20 and above. This compares to 6 for the latter half. Overall, 15 or HALF of the entire Phisix have been trading at phantasmagoric levels!

But what has not been said is that because insurance policies have to be sold, and are best marketed on a backdrop of inflated returns, risks have been dismissed to justify higher valuations for the Phisix.

Such concealment of risks comes in the light of inflation of corporate earnings, the statistical economy and the government fiscal balance all of which has been pillared by credit inflation on mostly the private sector. This sidelining of risks accompanied by the expected projection of G-R-O-W-T-H in a linear trajectory becomes the foundations that rationalize the PERs of 18 to 20.

In short, what the consensus has suggested has been that structural changes in the economy would now accommodate earnings deviations from historical accounts by 20-33% (based on PER of 15). Wow!

This reminds me of the common denominator of all crises through time: This Time is Different. Again Harvard’s Carmen Reinhart and Kenneth Rogoff on their chronicle of 2 centuries of crisis: The essence of the this-time-is-different syndrome is simple. It is rooted in the firmly held belief that financial crises are things that happen to other people in other countries at other times; crises do not happen to us, here and now. We are doing things better, we are smarter, we have learned from past mistakes. The old rules of valuation no longer apply. The current boom, unlike the many booms that preceded catastrophic collapses in the past (even in our country), is built on sound fundamentals, structural reforms, technological innovation, and good policy. Or so the story goes

Yet if we apply the historical PE of 14 to 15 to the present basket, excluding BLOOM which has a negative PER, only THREE issues trades at or below historical levels!

Alternatively put, this means that 86% of the index members have valuations that have been ridiculously overstretched based on historical averages!

Moreover, even if we grant the consensus their idea of 18-20 PERs, the PER at 20s have been considerably breached!

Of course, the index is calculated based on the distribution of weights from the changes on market capitalization as reflected by the share prices of its composite members.

As of December 2014, the Phisix closed at 7,230.57, based on BSP data the December PER has been pegged at 21.46 (left table). This entails a 22.49% (21.46/17.52) jump from December 2013 PER at 17.52. The 22.49% PER growth reflects on the 22.76% nominal peso returns of the Phisix in 2014.

| Year | December close | PER December | EPS | EPS Growth |

| 2014 | 7,230.57 | 21.46 | 336.93 | .22% |

| 2013 | 5,889.83 | 17.52 | 336.18 | 3.9% |

| 2012 | 5,812.73 | 17.97 | 323.47 |

|

Now here is where things get more interesting.

If we apply the BSP’s PERs to the Phisix levels at the close of December for the year 2012-14 we get their corresponding EPS and the EPS growth rates.

In 2013, the Phisix eked out a 1.33% nominal gain yet eps grew by 3.9%. In 2014, eps grew by ONLY .22% yet the Phisix soared by 22.76%! That’s .22% or ONE FIFTH of ONE PERCENT! This shows how this has hardly been a story of earnings G-R-O-W-T-H but about a story of plain multiple expansions from rampant speculation. And the numbers hardly supports the supposed departures by EPS growth from historical accounts.

Remember the consensus sold the idea that earnings growth for 2014 will be about 6% and 16% for 2015. But with .22% growth, the 22.76% pump means that earnings G-R-O-W-T-H in 2014 have been entirely a mirage!

Philippine stocks have been pulling away from reality and this will be reflected on sustained multiple expansions!

Yet there is no stopping the misperceptions as seen by record upon record stocks.

Such wild and unbridled speculations have all been founded on the Pavlovian conditioned stimulus (classical conditioning) from the utterances by media and establishment of G-R-O-W-T-H that has been positively reinforced by operant conditioning through a feedback loop mechanism of rising prices and the bandwagon effect.

December’s PE levels signify as the second highest for the year 2014 and the fifth ranked if we include the trek to 7,400 of March, April and May of 2013. How much more if we apply the current year to date 8.23%? Has current earnings outgrown the rate of price growth? If not, has the Phisix now traded at the range of 22 PER levels? Has it exceeded the April 2013 22.1 level? To what extent will markets continue to accommodate frenetic punts?

Or has the domestic stock market’s price discovery function as discounting mechanism been totally been broken?

Again the composite equity yardstick represents a distribution of weightings, thus the 21.46 PER have been representative of PERs of half of the issues with 20 and over (outperformers; 9 from the top 15 and 6 from the next 15) as against the other half (underperformers) with PERs below 20. The latter offsets the increases of the former.

In short, the Phisix PER of 21.46 masks or sanitizes the imbalances behind the outlandish mispricings especially seen in the most popular issues. Ten or one third of the Phisix issues have PERs at 30 and above!

Perhaps history could be irrelevant. But what if it is not? What if this time is NOT different? Current PERs 21.46 have vastly exceeded the 1995 and 1996 PER levels as I have shown before (see right table). Then, the outcome hasn’t been positive. Market participants saw their portfolio eventually slaughtered.

So when the PSE regales the public that record stocks will be sustained based on (italics mine)…“we expect corporate profits and dividend stories to continue to lift the market[2]”…they are right, the entire saga of brazen speculation has been based on tall tales.

The Phisix PE ratio tells it all.

Finally I’d be very concern about buyside institutions selling products heavily based on expectations of beyond historical average returns. Those rose colored glasses may be a function of endowment effect—people value things highly because they own them. If the portfolio of buyside institutions have been largely weighted on such expectations, and if such expectations fail to take hold, a big mismatch in the asset—liability could result to a lot of pain for the clients.

Shopping Mall Vacancies: The Rental Rates Factor

Because I have been anticipating (since 2013) that the Philippines will import what has been happening to the US and China, I have been periodically visiting malls. The current material changes in the malls have prompted for my observations of last two weeks.

Personally, I love shopping malls. It’s where I see a lot of people interact with the markets at different levels. It’s also where I see competition bring about positive changes in quality and services, and where innovations take place, as well as, gives hints on the preferences of consumers. It’s also a great place to try out diverse gastronomes. Importantly it’s also a place where I can make long walks…safely and under a cold environment.

But as an investor and an analyst, it’s just sad for me to see how resources are being misdirected due to the tampering of interest rates by the central bank. The distortion of interest rates has resulted to a cluster of entrepreneurial errors, in specific, the ongoing overbuilding and overcapacity dynamic in the sector.

Yet shopping malls have become a catechism for many, particularly the participants of the relentless pump and push of asset prices, whereby any criticism has been viewed as impiety thus will be subject to denial or vehemently objected upon without dealing with the basics.

The dilemma has been simple and elementary: what needs to be shown is the balance between the demand and supply side. Said differently, income has to grow faster or at least match the growth rate of credit and supply side.

This has not been what government data has been showing us. To the contrary as I have been pointing out the race to build malls financed by debt, not only by the major operators and developers, but even by small players reveals why excess supply will take hold. The supply side have been burgeoning at a rate faster than income. Worst, they have been financed by credit.

A dear friend recently gave a valuable input.

In the case of EDSA Shang mall, the increase in vacancies, he posits, may have possibly been due to a ‘surge’ in rental rates.

Let us go to basics. Unless they are from the public sector, most of the mall tenants are profit and loss enterprises.

An increase in rental rates would mean that tenants will either have to depend on improvements on growth rates in retail sales or make sufficient upside price adjustments to offset changes in rental overhead cost in order to maintain profits.

Apparently, in the case of EDSA Shang, the same tenants most probably saw that the growth trend in retail sales or price adjustments required will not justify the rental rate increases, thereby the string of closures.

This means that problem once again stems from both demand and supply. Insufficient demand, prompted by growing discrepancy between the industry’s supply and demand balance, along with a recent slowdown in consumer demand, has exposed on the mall tenant’s sensitivity to higher operating costs.

Therefore, the issue of rental rates reinforces the dynamics of imbalances from overbuilding financed by overborrowing.

It’s also been a clash of expectations. While mall operators seem to expect sustained strong retail demand for them to demand higher rental rates, real time commercial activities on the store level has indicated that this has not been the case. So the conflict of expectations has prompted for the closures.

Yet such incongruity of expectations—where developers see retail trends as a one way street as against dynamic non-linear changes in store level activities—has been the reason for the system’s massive capacity buildup.

In addition, if a surge in rental rates has been mainly the case, then EDSA Shang’s plight should have been isolated. There would have been a flight of EDSA Shang tenants to other malls, or malls within the area would have absorbed most of EDSA Shang’s tenants. In short, EDSA Shang’s loss would have been the gain of the others.

But evidently this has hardly been the case as store vacancies have swelled even at the neighboring malls, but at a rate lesser than EDSA Shang’s.

Nonetheless, increases in rental rates may partly explain the yawning gap between the vacancy rates of EDSA Shang (my estimates at 10%+) with that of neighboring malls (my estimates 1-3+%).

Also the rental factor could have partly influenced the store closing incidences IF lease contracts of EDSA Shang with tenants have the same expiry dates. Remember most of these vacancies seem to have happened in a short time window of December 2014 and January 2015. This is unless tenants paid penalties for early termination.

Nevertheless if the rental factor has been true, then this would dovetail with the law of demand: “as the price of a product increases, quantity demanded falls”—which should affirm my warnings in 2013[3] that property inflation or property bubbles are destructive to the real economy: (bold mine)

Property bubbles will hurt both productive sectors and the consumers. Property bubbles increases input costs which reduces profits thereby rendering losses to marginal players but simultaneously rewarding the big players, thus property bubbles discourage small and medium scale entrepreneurship. Property bubbles can be seen as an insidious form of protectionism in favor of the politically privileged elites.

Property bubbles also reduces the disposable income of marginal fixed income earners who will have to pay more for rent and likewise reduces the affordability of housing for the general populace.

Unless there will be a meaningful jump in investment, which should filter into as income growth, the retrenchment in retail activities seen in 4Q GDP will hardly help to improve household income-spending conditions going forward. Of course growth of OFW remittances will be a factor too, but it won’t match the scale of growth from internal investments.

Shopping Mall Vacancies: Truck Ban and Port Congestion

How about the Truck ban and the recent port congestion?

I raised the issue of the city of Manila’s “truck ban” as a being a factor blamed by media on spiking inflation in July 2014. Reports suggest that easing of port congestion has occurred during the last quarter of 2014.

Both the truck ban and port congestion implies of supply side obstacles. It also hints of temporary dislocations.

For clues, let us revert back to the government’s data. This is data from the National Statistical Coordination Board. Anyone can go to the site and plot the growth rates on the spread sheet and do their interpretation.

Let us focus first on wholesale trade (green line). Wholesale trading activities seem to suggest of seasonal factors. For the past two years, there has been strong growth in Q1 which peaked at Q2 while Q3 seems to be in a hiatus. In the meantime, 4Q performance of 2013 and 2014 seems to have diverged.

Nevertheless, growth rates for the entire 2014 has been higher than 2013. Annual change according to the NSCB has been at 7.5% (2000 constant prices) 2013-14 as against 3.4% in 2012-13. That’s more than double the growth rates! That’s a lot of supplies.

Let us now input the truck ban and port congestion. My report on the truck ban was during early 3Q. So the port congestion may have partly influenced the decline in 3Q which adds to the seasonality factor.

But remember wholesale growth rates in 2014 have surpassed 2013 levels except for Q1. So this hardly exhibits of signs of supplyside shortages.

In addition, if we add to the picture trends of retail growth, then stark divergence emerges. Retail activities have been slowing from its zenith in Q4 2013. As I have been pointing out, Q4 2013 posted a 33% collapse in growth rates from 6.1% 3Q to 4.1%. The implication is that wholesalers have been building inventories more than consumers can absorb through retail outlets.

Now the port congestion easing during the 4Q may have led to a spike in wholesale growth rates, but ironically this comes as retail activities plummeted. I earlier suspected this to be channel stuffing which remains a possible factor.

So given the huge 2Q 2014 growth rates PLUS growth rates above 2013 levels during the 3Q for the wholesale sector, a supply driven retail slump doesn’t seem logically coherent.

Yet the antipodal activities between the wholesale and retail looks ominous to future activities. If retail activities don’t recover soon or continues to stagnate, then there will be lesser inventory accumulation activities from both manufacturing and from importations. This means a slowdown in the real formal economy.

Of course, this is unless those government statistics have been largely inaccurate.

So while government may pad G-R-O-W-T-H statistics via public spending, the real economy will diverge.

I also explained earlier that unsold perishable goods will lead to losses. This eventually will also apply for existing nonperishable items as well. The question is how has these inventories been funded? If they have been funded by debt, then losses will incur and this will lead to credit problems.

The trade industry has been one of the biggest sponges of debt. The trade industry’s share of loans from the banking system has been at 15.77% in 2012, 15.82% in 2013 and 16.03% in 2014.

Growth trends of the trade industry have been shown sharply growing from 2013 to August 2014 (see right chart). However 4Q growth rates have tumbled along with retail activities.

So even if the BSP comes up with all florid statistics about those low NPLs of the banking system (universal-commercial and thrift) has been, economic reasoning tell us that those statistics may not reflect on actual or on developing conditions.

The growing imbalances between retail and wholesale suggest that losses may have already been emerging. Loans that have financed either one of them will lead to debt problems.

And I would suppose that many of the numbers have been camouflaged via accounting magic.

Phisix 7,800: Philippine Bonds Just Sold Off

Government statistics and market manipulation may hide progressing entropy, but somehow somewhere cracks will appear.

The fissures have become apparent in the bond markets which continue to tell of a different story from record stocks.

The Philippine bond markets sold off last week. This happened to most of the maturities with the exception of the 3 months and 20 year.

The 4 and 5 year inversion has been rectified. They have become normal. There have been previous attempts to correct the inversion. The former attempt has been to push down yields, apparently this failed. This week, the 5 year yields vaulted and had been sold off the most.

This week’s almost broad based sell off has incited for a mix signal. Because 10 year yields climbed higher than the 1 and 2 year counterparts, their corresponding spreads have widened. But all the rest continues to narrow.

With the yields of 6 months and 1 year yield continuing with its upside moves and now nearing the December highs, this only shows of how short term funding pressures remains—or has been seething underneath.

Remember the domestic sovereign bond markets are held by a select few, particularly the banking system and their clients and the government. So the sustained flattening of the yield curve defies whatever rosy picture that has been peddled by the establishment and by government sycophants. The establishment and the consensus can deny, manage the indices or suppress information. What their action does will be is to buy time. But this won’t prevent reality from happening.

Developments on the domestic bond market reveals of innate tension progressing, tensions that appears to building from within the banking system.

Has this been the reason why banks have been underperforming of late?

The camouflaging of debt reminds me of the Kaisa Group, a property and shopping mall developer in China but whose shares are listed in Hong Kong.

The once “fundamentally” strong company suddenly surprised the market when they announced of their inability to pay interest rates on foreign denominated loans. So the Chinese government worked behind the scenes to find a buyer to bailout the beleaguered company.

Last week, the company’s debt suddenly DOUBLED. Since the company didn’t disclose why the debt has swelled, media has been speculating on its possible causes. They point out that “home buyers may have unwittingly turned into lenders” where advance proceeds and deposits were converted into debts. They also attributed the possibility of debt from trade credit (credit to suppliers and contractors) and from legal actions, or even from off balance sheet debts.

The obvious lesson is that credit booms have always masked the disease. It’s when the loans have been called in, when the proverbial Pandora’s Box gets to be opened.

And inflation (asset boom) has always been followed by deflation (asset bust).

Global Record Stocks, Record Warnings from Authorities Too

Stocks have been rampaging around the world. This comes in the light of many central banks working feverishly to slash interest rates. The general idea is that rate cuts will augment aggregate demand and forestall what the mainstream sees as deflation risk. That’s the headline story.

I have yet to know how many have increased rates. But obviously with majors like China, Japan, Europe, on the side rate cuts, much of the world has been desperately trying to prop up domestic conditions.

The alleged deflation risk peddled by the mainstream has been euphemisms about governments and their allies going broke.

So the rush to ease has spawned a spate of negative yield debt instruments. Savers and creditors now pay debtors to borrow money. Credit risk has been buried alive. Economic forces have been mangled beyond recognition. It’s all about borrow borrow borrow to buy buy buy stocks and bonds and borrow borrow borrow to spend spend spend.

I have recently noted of a seeming rebellion against Japan Government Bonds via a recent spike in yields. I asked[4]: Will the BoJ accommodate the desire for more easing? Or will this herald an inflection point for BoJ’s subsidy to the Japanese government and their private sector allies?

Last week I got an answer. From Business Times Singapore: Bank of Japan Governor Haruhiko Kuroda has helped calm expectations for price swings in government debt by leaving open the possibility of more monetary stimulus.[5]

So with the BoJ’s assuage, JGB rebellion has been temporarily quashed.

Interestingly China’s head of State Administration of Foreign Exchange (SAFE), the institution responsible for forex reserve management shockingly admitted that China’s conditions resembled the Asian Crisis.

Let me quote the Bloomberg[6]: (bold mine) China is increasingly finding itself in a situation similar to the 1998 Asian financial crisis with emerging markets under pressure from capital outflows as the dollar strengthens, Guan Tao, head of the State Administration of Foreign Exchange’s international payment department, said at a forum in Beijing on Feb. 14. There will be uncertainties this year while the nation remains attractive to long-term capital, SAFE said in a report Sunday.

Authorities around the world have been steadily issuing sanitized warnings or escape clauses on the possibility of a crisis.

It’s also interesting to learn that the financial engineering of debt securities via slicing and dicing of Collateral Loan Obligation (CLOs) has been mimicked in China and the adaption of which has been spreading fast.

From the Financial Times[7]: (bold mine) Call it déjà vu with Chinese characteristics: collateralised loan obligations, the sliced and diced loan bundles that helped tip the world into financial crisis in 2008, are surging in China. While CLOs fell into disrepute in the US and Europe after the crisis, China is promoting issuance of asset-backed securities as a means of weaning investors away from riskier shadow bank products while also ensuring enough credit flows to the slowing economy. Issuers appear to be heeding the message. Following years of delays and false starts, CLOs are now the fastest growing asset class in China’s financial system, with issuance of asset-backed securities up more than tenfold to Rmb326bn last year. A senior China Banking Regulatory Commission official predicted last month that China’s CLO market would “grow by leaps and bounds” this year, adding that Rmb90tn in outstanding bank loans could theoretically be eligible for securitisation.

But also ensconced within the minutes has been another “irrational exuberance” warning sounded out by the FED (bold mine)[8]: However, the staff report noted valuation pressures in some asset markets. Such pressures were most notable in corporate debt markets, despite some easing in recent months. In addition, valuation pressures appear to be building in the CRE sector, as indicated by rising prices and the easing in lending standards on CRE loans. Finally, the increased role of bond and loan mutual funds, in conjunction with other factors, may have increased the risk that liquidity pressures could emerge in related markets if investor appetite for such assets wanes. The effects on the largest banking firms of the sharp decline in oil prices and developments in foreign exchange markets appeared limited, although other institutions with more concentrated exposures could face strains if oil prices remain at current levels for a prolonged period.

As you can see record stocks comes about with record warnings from authorities too.

For now those rate cuts/easing/negative yields may have positive influence on stocks. But since we live in a world of scarcity, the deformation from such policies will hit a natural limit.

I foresee the rate cut mania to likewise hit the Philippine shores.

.png)

.png)

.png)

.png)

.png)