I find it odd or self-contradictory for a high profile investment expert[1] to claim that Eurozone bondholders should accept losses while declaring US muni bonds as a “buy”. In short, bearish Euro bullish USD. I view this more as an endowment bias where people place a higher value on objects they own than objects that they do not[2] (That’s because the expert is domiciled in the US).

It may true that state of the US muni bonds should be seen at the local level, but this should apply to the Eurozone too. In other words, prospective haircuts should apply to any nations/state where the cost to maintain debt levels can’t be economically sustained and where the policy of bailouts ceases to be part of the picture.

The cost to maintain debt levels can also be read as the willingness to pay, as Dr. Antony P. Mueller rightly commented[3],

``With debt it is as much the willingness to pay as it is the ability to pay. One could even say that the willingness to pay precedes de ability to pay.”

In addition, there is the tendency to ignore the role played by central banks. In as much as the US Federal Reserve can print money to conduct bailouts, so as with the Europeans through the ECB. So who prints more money will likewise impact on the relative economics of debt.

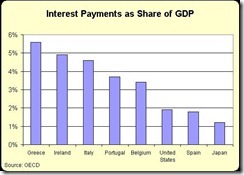

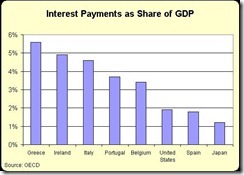

While it may be true that interest rates would impact the Eurozone more than the US (see figure 2), interest rate dynamics can swiftly change depending on either rate of change of inflation at the national level or on the public’s fluid perception of credit quality conditions.

Interest Payments as share of GDP[4]

Besides, both the US dollar and the Euro are fiat based money that are structurally flawed, as it is being shown today with a gamut of bailout policies left and right, targeted at rescuing the banking system and welfare nations/states in distress.

Thus, like all paper money subject to currency debasement and currency wars or competitive devaluation, that would make both like a race to the bottom.

So it’s a matter of which country (US or the Euro) would make more policy errors.

So even while I may be bullish the Euro over the US over the short-term, I wouldn’t recommend positioning on either one of them over the opportunity costs of holding other assets.

Why the USD or the Euro when there are others to choose from?

And many investors seem to share my view and vote with their money. According to analyst Doug Noland[5]

``The past year saw another $500 billion flee the U.S. money fund complex in search of higher yields. Tens of billions flooded into perceived low-risk bond and muni funds, while tens of billions more headed overseas. Meanwhile, money flowed into the hedge fund community, where assets and leverage are said to now approach pre-crisis levels. All of this amplifies systemic risk.”

So while it may hold the US dollar may rally, mostly as a result of a weakened Euro, I think this could be temporary.

Yet even as the USD should rally, we shouldn’t expect the same pattern of asset behaviour to occur as with the 2008 paradigm as some other experts seem to suggest.

It’s not true that a strong USD automatically translates to weakness in all other assets.

In 2005 the US dollar rallied alongside commodities and global equity markets. Thus, reference points can give divergent views and the view that a strong USD means automatic weakness in all others means anchoring to the 2008 post Lehman bankruptcy episode.

For me, it will always be a question of how authorities are likely to respond to any unfolding problems than simply projecting past or present conditions into the future.

For now, the auto response mechanism or path dependency by policymakers has been to engage in bailouts. Thus, in sustaining these policies means we should position for boom bust cycles, or at worst, insure ourselves from the prospects of a crack-up boom phenomenon (flight to commodities) since money is never neutral.

In a similar vein, it would seem to be impractical to be bearish on gold or precious metals for the same reasons.

And in growing recognition of these reckless monetary policies, in the US, lawmakers of some 10 states have reintroduced bills to recognize gold and silver as money[6].

Thus, it would misguided to suggest that democracy can’t be compatible with gold.

As Professor Tibor Machan points out[7]:

In a just society it is liberty that is primary – the entire point of law is to secure liberty for everyone, to make sure that the rights of individuals to their lives, liberty and pursuit of happiness is protected from any human agent bent on violating them. Democracy is but a byproduct of liberty

Thus if gold should represent liberty then democracy, as a byproduct of liberty, should blend well with gold as money.

And this may be zeitgeist of the current trend of gold prices

[1] Moneynews.com Pimco’s El-Erian: European Bond Investors Must Accept Losses, January 14, 2011

[2] Wikipedia.org, Endowment Effect

[3] Mueller, Antony P. Portuguese Bond Sale, cashandcurrencies.blogspot.com, January 12, 2011

[4] Mitchell J. Daniel Which Nation Will Be the Next European Debt Domino…or Will It Be the United States?, Cato.org, January 11, 2011

[5] Noland Doug Issues 2011 Credit Bubble Bulletin, PrudentBear.com, January 14, 2011

[6] TPMDC At Least 10 States Have Introduced Gold Coins-As-Currency Bills, January 5, 2011

[7] Machan Tibor R. Reexamining Democracy, January 4, 2011