In China, rising food prices have been blamed on speculators. Now that select food prices have slumped, particularly vegetables, the culpability has been assigned to speculators anew.

From Business China,

Farmers across China are suffering from unmarketable vegetables since the arrival of spring, hurt by an increase in output following speculation last year’s surge in demand would continue in 2011.

Last week, the average price of 19 kinds of vegetables in 286 wholesale markets nationwide was RMB 2.66 per kilogram, down 11.4% from the previous week, according to data from the Ministry of Agriculture.

Many farmers blamed oversupply as the main reason for the poor market. Due to climate factors, leaf vegetables from northern and southern China came onto the market almost at the same time, making the supply much higher than last year.

Speculators also played a major role in the price collapse, as they dumped vegetables that they had been hoarding onto the market.

Since the markets have always been the villains then obviously the government, as hero, would come to the rescue.

From the same article,

Chinese government authorities have stepped in to help the farmers and deal with the vegetable oversupply.

Some supermarkets, schools and company canteens are on a buying spree in east China's Shandong province as the government urged them to help relieve farmers from a glut of vegetables.

Municipal authorities should take immediate action to "help farmers tackle difficulties in selling their produce and maintain a stable market," said a notice from Shandong's commerce department released on April 22.

The Ministry of Commerce (MOFCOM) and the Ministry of Agriculture have also issued a notice to ask local authorities to take immediate action to "help farmers tackle difficulties in selling their produce and maintain a stable market".

Of course, the article has not been that candid.

A better explanation from the World Bank’s quarterly report on China comes with the supply side perspective, (bold emphasis mine)

In addition to normalizing the overall macro policy stance it took some measures to boost food supply and reduce the cost of production and logistics, including releasing grain from China’s large reserves, increasing subsidies to farmers, exempting transport of vegetables from road toll, and boosting food imports. More recently, this was followed by limiting the increase in domestic fuel prices arising from higher oil prices and applying moral suasion on manufacturers of food and consumer products.

So a combination of price controls, import liberalization, targeted subsidies and tax reliefs has been applied.

In essence, massive interventions has been employed to control inflation, from which the effects could likely be temporary, and could further add to the imbalances from the previous actions of China’s government to blow bubbles.

Importantly, if inflation is a monetary phenomenon as Milton Friedman would have it, then the bust in the vegetable market in China could be a symptom of the prevailing monetary policies...

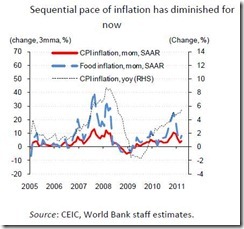

Again from the World Bank, (bold emphasis mine)

Since October 2010 the government has raised benchmark interest rates 4 times and RRRs 7 times. Most importantly, quantitative guidance on bank credit, traditionally the backbone of monetary policy tightening, began to be reinforced, especially in early 2011. As a result, M2 growth came down from 19.5% in the fourth quarter to 16.6% on average in the first quarter, close to the target for the end of 2011, with a similar slowdown in bank lending. In recent years, total bank credit extention has been significantly larger than headline data suggests as banks expanded the use of credit instruments such as designated loans, trust loans and corporate paper, financed in part by trust and wealth management products that are not counted as deposits and are not part of M2, in order to evade lending quotas, capital requirements and RRRs.

China’s equity markets, specifically the Shanghai index appears to have recoiled after hitting the resistance levels as earlier discussed.

This is the interim price action of the Shanghai Composite bellwether. (chart from Bloomberg)

In my view, the current retracement of the Shanghai index could also be reflecting on the current monetary tightening environment.

If there should be a broader weakening of consumer and financial market prices then this would possibly prompt Chinese authorities to unleash their main Keynesian weapon--inflation.

I’d posit that since the stage of China’s inflation cycle looks more advanced than the rest of the world, then the ongoing developments in China’s financial markets needs to be closely monitored.