The history of government management of money has, except for a few short happy periods, been one of incessant fraud and deception. Friedrich August von Hayek

There seems to be another brewing risk that the mainstream seems to ignore.

China’s Shanghai (SSEC) index seems at the verge of breaking down from a 3-year consolidation phase.

I previously explained how China’s non-recession bear market has actually signified as a boom bust cycle that has only shifted from the stock market to the real estate sector where the non-resolution (and even the expansion) of this cycle has only extended the duration of the bear market of the Shanghai index[1].

While important indicators suggest that China’s economy has materially been on a downdrift, such as the signs of slowing growth of air travel[2], decelerating electricity consumption and as well as a slowdown air cargo[3], may not signify as recessionary, my source of concern lies with the recent signs of increased credit stress.

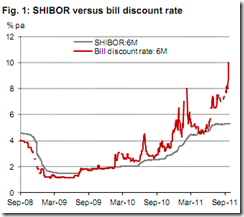

The rising rates of the 6 month bill discount rate and the Shanghai Interbank Offered (SHIBOR) rate appear to be heightened signs of credit stress[4].

This is very important because a huge segment of the current property boom has been financed by state owned and private owned off balance sheet companies estimated at US $1.7 trillion[5]

As Mises Institute President Douglas French in a book review writes[6],

The upshot from following the alphabet soup of entities, created to make loans to the state sector and friends of the state, is that when the loans go bad, which an extraordinary percentage do, then new entities are created into which to move the debts: from good banks to bad banks to worse banks…

Chinese bank depositors provide the capital to finance the insiders. But when the loans go bad and the banks go bankrupt, it's left to the party to provide continuous bailouts. "In short, China's banking giants of 2010 were under-capitalized, poorly managed and, to all intents, bankrupt 10 years ago."

As nonperforming loans are pushed from good banks to bad, with China's Ministry of Finance providing its guarantee to the bad loans at par, banking life goes on, and the economic miracle remains alive, backstopped by the lender of last resort, the People's Bank of China, levered at 1,233 to 1. The result is underlying assets are never liquidated and zombie banks and crony-led corporations are left in place to squander capital.

It’s one thing to see an economic growth slowdown, but it’s another thing for a bursting of massive Keynesian policies fuelled bubble.

And since China has been a major force in the growing demand for commodities worldwide which has partly driven up commodity prices (see chart below from Business Insider[7])…

..a bubble bust in China would send commodity prices crashing. Aside, there would be a risk of a disruption in the globalization model of transnational supply chain networks.

Also since hot money flows has functioned as a significant part of China’s bubble conditions, the likelihood is that such money flows could stampede for the exits, as shown by the January 2010 chart from Danske Bank[8].

In observation of the annual National Day celebration, China’s financial markets had been closed for the week

The coming sessions will be very interesting and crucial.

We will see if current market spasms in the Chinese markets are reflective of an economic slowdown or of an imploding bubble. And most importantly, how Chinese authorities will be dealing or responding to these events.

Bottom line:

The mainstream appears to be discounting events in China or has unduly been focusing on Europe or a potential recession in the US.

While it is unclear if the China has merely been experiencing a slowdown or a bursting bubble, growing signs of a credit stress could highlight risks of the latter similar to the developments in the Eurozone today or to the US Mortgage crisis of 2008.

A realization of the implosion of China’s bubble cycle would exacerbate the current market stress that would catch many off guard. Financial markets would gyrate wildly with a downside bias. This would function as the black swan (low probability, high impact event) for financial markets.

Of course we should expect Chinese authorities to step in and intervene as they did in 2008, by injecting a $586 billion stimulus package[9], and to parallel the activities with those of their Western contemporaries. However, again the timing, the size and the duration of the potential bailouts would serve as crucial factors in determining the market’s future trend.

Lastly in the event that China’s bubble has indeed imploded, then we could expect major central banks to reengage in more QEs (inflationism) and most possibly see more coordination of their activities.

Because of government’s management of our money, we indeed live in very interesting times.

For the meantime, buckle up for a roller coaster ride!

[1] See Phisix-ASEAN Market Volatility: Politically Induced Boom Bust Cycles, October 2, 2011

[2] Bloomberg.com China Air Travel Trails Capacity Growth in Golden Week Holiday, October 6, 2011 Businessweek.com

[3] Chang Gordon Is China's Economy Contracting? September 25, 2011 Forbes.com

[4] See Chart of the Day: Is China Suffering from a Credit Crunch?, October 4, 2011

[5] See China’s Bubble Cycle: Shadow Financing at $1.7 Trillion, June 28, 2011

[6] French, Douglas The China Model Is Unsustainable, Mises.org October 3, 2011

[7] Blodget Henry JEREMY GRANTHAM: We're Headed For A Disaster Of Biblical Proportions, June 13, 2011

[8] Danske Bank China: Hot money inflow heats up further, January 15, 2010

[9] Wikipedia.org Chinese economic stimulus program