Over the past few days gold prices has been whacked.

![clip_image002[1] clip_image002[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh_y4pVetCDzweE0SWFyxcF2cyPMIOVSDnQr4gRbl75m72aTZBfQ0J__6S6ttDUH5lN0Rd9y2KtA0HersNQvnLSABOkBaYqqD6GK7T40O91j-kcg_ocx5zbKERxiQTAbQLYD2pY/?imgmax=800)

Gold prices have breached the 200 day moving averages.

Immediately gold bears scream “This heralds the end of the gold bull market!”.

Not so fast.

As I earlier said, gold has been reflecting signs of global liquidity conditions which may have been affected by perceptions of inadequate actions by the global central bankers, a China slowdown (or perhaps a bubble bust?) and the MF Global fallout.

Heavily politicized and inflation addicted markets tend to selloff when policymakers declare “discipline”. For instance, last night Ben Bernanke said that the FED won’t be bailing out Euro banks.

From the Bloomberg,

Federal Reserve Chairman Ben S. Bernanke told Republican senators the Fed plans no additional aid to European banks amid the region’s sovereign debt crisis, according to two lawmakers who attended the meeting.

Senator Bob Corker, a Republican from Tennessee, said Bernanke made it “very clear” in closed-door comments today the central bank doesn’t intend to rescue European financial institutions. Lindsey Graham, a South Carolina Republican, said Bernanke told lawmakers that “he doesn’t have the intention or the authority” to bail out countries or banks. Both senators spoke to reporters after leaving the one-hour session at the Capitol in Washington.

In setting boundaries to Fed aid, Bernanke referred to steps beyond the currency-swap lines that were revived in May 2010 to help Europe alleviate its crisis, Corker said. Last month, the Fed led six central banks in announcing a half percentage-point cut in the cost of emergency dollar funding for financial companies overseas through the Fed’s swap lines.

Ben Bernanke has been under fire for having to bailout Euro banks, aside banks of other nations, in 2008. So the act to project an image of nonpartisanship is understandable.

Of course there are many ways to go about conducting a bailout…

The same Bloomberg article observed,

While the Fed may not be able to lend directly to banks outside the U.S., it can provide loans to their U.S. branches through the discount window. The Fed’s currency-swap lines also provide indirect dollar funding to overseas banks through the ECB and other central banks who assume the credit risk.

Lending through the swap lines peaked at $586 billion in December 2008. The swaps are separate from Fed emergency loans to banks and other businesses that peaked at $1.2 trillion the same month, including about $538 billion that European financial companies borrowed directly, according to a Bloomberg News examination of available data.

And once conditions worsens, you may expect the FED to reverse tune.

And paradoxically, Ben Bernanke’s has been signaling that the FED may ease further (QE 3.0) if contagion risks from the Europe escalates [Businessweek/Bloomberg]—a sign of ambiguity.

Besides, the EU has been preparing to mount another grand rescue scheme.

From the Economic Times.

Germany is reactivating its financial sector rescue fund as the eurozone debt crisis raises increasing questions about how banks can cover their capital needs.

Chancellor Angela Merkel's spokesman, Steffen Seibert, said the Cabinet decided Wednesday to reopen the (euro) 360 billion ($474 billion) fund, first established at the height of the 2008 financial crisis.

The fund closed to new applications at the end of 2010. But much of the money _ which totaled (euro) 60 billion for potential capital injections and (euro) 300 billion for loan guarantees _ remains untapped.

European authorities have determined that German banks require a total of (euro) 13.1 billion in new capital to comply with tougher new requirements. The country's second-biggest bank, Commerzbank AG, has been told it needs (euro) 5.3 billion.

And Japan and possibly ex-European nations will be part of the rescue operations. Reports the AFP

Japan has purchased 13 percent of the eurozone rescue fund's latest bond sale, a government official said Wednesday, as the region continues fundraising to help contain its sovereign debt crisis.

The Japanese government bought 260 million euros ($338 million) of the three-month bills, or 13 percent of the 1.972 billion euros raised by the bailout fund, the official said.

Data published by Germany's Bundesbank showed there was strong demand for the debt issued by the European Financial Stability Facility (EFSF).

The sale was oversubscribed by more than three times with investors bidding a total 6.286 billion euros, the German central bank said.

So as I have been saying, you can’t depend on reading current trends and use these to make forecasts. Policymakers will be responding to market developments which will have repercussions.

And I will like to further emphasize that the recent drop in gold is being accompanied by a slump in developed economy equity markets

![clip_image003[1] clip_image003[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjMgrmaEtl6MBbWTV_OztZeFtvnt_poWv9_ve2XQ7bBcbfQ6pDunJ3RpQojeNZyLFIKa1He17v8Xb-epEKUKVtiTMj9bNAbaFfFp9T4DU2EKO8y6Ps5BUfEKubjcuWAIHzP32CF/?imgmax=800)

Chart from Bespoke

Correlation between gold and stocks has intensively tightened.

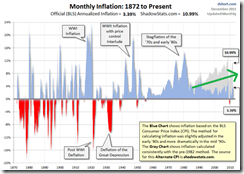

This exhibits more evidence that in an environment faced by liquidations, margin calls and increased demand for money for safekeeping reasons, gold won’t likely function as refuge. This isn’t the Great Depression era of the 1930s where the gold was money.

In short, gold isn’t a refuge against deflation under a fiat paper money system

![clip_image004[1] clip_image004[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEirB-KBqaeN6vhepYsegjCl-7JBxk7lnfm-c2xiZntgA2H_tYFvCZRa6NYYJppIFZ6aonYOS2fUfmxOM7kwIe5j4Spu2CPzUIV27ku5XzU3OGub2cj3gFAQEjBqNfA-LB49Lnoc/?imgmax=800)

Here is a graph of the ECB’s deposits in relation to margin calls (from the Financial Times Blog) [hat tip Bob Wenzel]

We can expect that political authorities will continue to refuse adjustments from the markets, because these would imperil the interests or the beneficiaries of the incumbent political economic system—the political and banking class.

Thus, we will see them resort to accelerating inflationism or policies that will “extend and pretend” or “kick the can down the road” which only exacerbates the current problems. We can construe that most of the signals of “discipline” represent political posturing.

What will happen is that funds will be provided by political institutions (central banks or rescue funds) to allow banks to buy sovereign debt (to keep down yields) which will be used by banks as collateral for acquiring loans from the ECB. This will be like two drunks attempting to prop up one another. (to borrow the analogy from Professor Arnold Kling)

And banks will profit from arbitrages on the manipulated yield spreads.

So inflationism will be a policy that should be expected to continue.

For all of history commodities/gold has served as money or as refuge against inflationism. Thus we should expect gold to eventually find a bottom and begin to reverse the current downtrend once such policies are announced and triggered.

As a final note, the US dollar is the world’s premier currency reserve, which means global banks, finance companies and governments hold as reserves [The US dollar and the Euro make up 90% of Allocated Reserves globally. Unallocated Reserves are not included in this graph, although they make up over 45% of total world foreign exchange holdings-Wikipedia.org] and comprises about 70% of the world trade/transactions [China Daily].

Thus, we shouldn’t be surprised, as this would be intuitive if not commonsense, that the US dollar will serve as temporary lightning rod against the current turbulence, in an environment where demand to hold money increases (again from liquidation, margin calls or safety reasons).

It will take the US Federal Reserve to hyperinflate to drastically reduce the role of US dollar, an event which has not been happening yet.

So I would rather use this opportunity to accumulate gold or gold related investments.

![clip_image002[1] clip_image002[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh_y4pVetCDzweE0SWFyxcF2cyPMIOVSDnQr4gRbl75m72aTZBfQ0J__6S6ttDUH5lN0Rd9y2KtA0HersNQvnLSABOkBaYqqD6GK7T40O91j-kcg_ocx5zbKERxiQTAbQLYD2pY/?imgmax=800)

![clip_image003[1] clip_image003[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjMgrmaEtl6MBbWTV_OztZeFtvnt_poWv9_ve2XQ7bBcbfQ6pDunJ3RpQojeNZyLFIKa1He17v8Xb-epEKUKVtiTMj9bNAbaFfFp9T4DU2EKO8y6Ps5BUfEKubjcuWAIHzP32CF/?imgmax=800)

![clip_image004[1] clip_image004[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEirB-KBqaeN6vhepYsegjCl-7JBxk7lnfm-c2xiZntgA2H_tYFvCZRa6NYYJppIFZ6aonYOS2fUfmxOM7kwIe5j4Spu2CPzUIV27ku5XzU3OGub2cj3gFAQEjBqNfA-LB49Lnoc/?imgmax=800)

![clip_image001[4] clip_image001[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEii8py7OMGXZ_aNdBvQXhp2T3fWwNTi93tewL8totTmCXD5LOVdQ6ej5WPrVKzRhZGW1ippdiqYmdtf5I_Jx8pQl8wXkPgdLjT6c-BLxy1cvpQBfgbCGpHS4vPEJNirFvO7X82c/?imgmax=800)