Despite the blaring headlines, the domestic equity market seems to have discounted the supposed impasse between China and the Philippines over the disputed Scarborough Shoal.

I think the market response over risks of a military confrontation of war seems justified.

Media’s report of the territorial contest between the Philippines and China has been rife with insinuations that the motivations of the kerfuffle has been about “ rich in oil and gas reserves as well as fish stocks and other commercially attractive marine life”[1].

Yet current developments have not been supportive of such oversimplified implications.

China as Major Beneficiary of the Shale Oil Revolution

First of all, the growth of China’s crude oil imports has been falling.

That’s because China’s slackening demand for crude oil has been substituted for soaring demand of cheaper natural gas. China’s natural gas imports are expected to balloon by 45% in 2012[2].

Next, media entirely overlooks the ongoing Shale gas boom where advancements in technology principally through hydraulic fracking and horizontal drilling—complimented by computer programs which simulates well development before drilling (which controls costs), advance fiber optics and even use of microphones to measure seismic events[3]—has enabled access to immense commercial quantities of shale based natural gas.

The shale gas revolution has not just been transforming the energy sector, but changes have been diffusing into a vast area of the global economy.

Author Matt Ridley explains[4],

Chemical companies, which use gas as a feedstock, are rushing back from the Persian Gulf to the Gulf of Mexico. Cities are converting their bus fleets to gas. Coal projects are being shelved; nuclear ones abandoned.

The shale gas revolution has become a key factor in bringing back many energy intensive manufacturing companies to the US such as steel, chemical and fertilizer companies[5].

So contrary to the claims of mercantilists, who blindly and wrongly sees protectionism through inflation or devaluation as means to regain competitiveness, access to abundant and cheap energy can be one avenue towards attaining competitive and comparative advantages.

Yet a deepening of the Shale gas revolution would benefit China too, since China has the largest technically recoverable resources of shale gas[6] in the world.

As proof the intensifying trend towards Shale gas revolution, just recently, French Total SA[7] and British Royal Dutch Shell PLC[8] have just forged deals to explore, develop and produce shale oil in China. There will be massive investment flows to develop Shale not only in China but around the world.

Mostly because of Shale, Natural gas around the world is expected to boom and has the biggest potential to replace crude oil.

In China, production of natural gas via shale, coal bed methane and tight gas are expected to explode[9]. This would mirror on the skyrocketing demand for natural gas[10].

With China’s shale oil boom having yet to ignite, it would seem a paradox for China to politically squabble over relatively meager oil and gas field as compared to the immense domestic reserves that has yet to be tapped. Besides China can do more by investing in other countries than trigger a shooting war.

Political Smoke and Mirrors over Scarborough Shoals and Spratlys

In addition, China’s political economy has now been highly dependent on international trade.

Merchandise trade (sum of imports and exports) is now about half of China’s economy. This means that since China has deeply been embedded to globalization, any military conflict or a war would be self-destructive not only to the average Chinese but to the China’s incumbent political institutions and leaders, as well.

Moreover, given that most of ASEAN nations has been “closely linked[11]” to the US, any military clash may be a magnet for the involvement of the US militarily.

And conventional warfare will be dissimilar from the way wars has been fought in the 20th century, given the proliferation of nuclear armaments. Future wars will likely be more about technology based engagements (computer, robotic, biotech and nanotech along with nuclear and special ops[12]) than conventional warfare or guerrilla or terror tactics. Yet China has yet to reach such state of sophistication

And as I have mentioned in the past[13], the gunboat diplomacy would work against China’s attempt to establish the use her currency the yuan as the region’s currency reserve[14].

And given the above, China’s antagonistic foreign policy approach over the disputed islands hardly seems about the securing more “oil and gas reserves”, and seems patently contradictory to her overall interests.

This brings us again to the following postulates.

China has been buying less of US treasuries[15] or financing less the US. China has also been taking flaks from US politicians whom have used “blame China” (as well as “blame the rich”) to advance their political platforms in the coming elections.

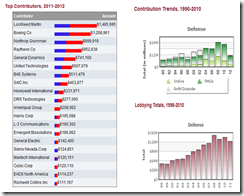

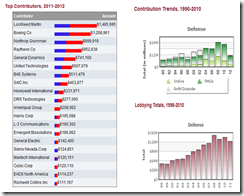

And perhaps one way to placate US politicians has been for China to act as a complicit bogeyman in order to promote US arms sales to Asia. More arms sales could translate to more donations by US defense industry to candidates of both parties in the coming elections.

Notes the opensecret.org[16]

Although the defense sector contributes far less money to politicians than many other sectors, it is one of the most powerful in politics. The sector includes defense aerospace, defense electronics and other miscellaneous defense companies.

I have been repeatedly pointing out such a possibility[17].

Also another possible angle would be to use current territorial disputes as diversion to current internal political struggles in China. Last Thursday most websites in China became inaccessible[18]. Was the widespread internet blackout a result of Indonesia’s quake? Or has this been related to recently rumored coup attempt[19]? Appeal to nationalism via military conflicts or nationalism based controversies are frequently used by politicians as decoy or diversion to real (social, economic or political) problems.

China could also be testing the strength of ASEAN ties to the US, to ascertain or measure as to what extent growing trade relations have brought Chinese influence into the region’s politics.

Bottom line: Unless China political leaders have lost their minds, I find the unfortunate Scarborough Shoal affair (as well as Spratly’s incidents) as suspiciously more about political ‘smoke and mirrors’ maneuvering and more vaudeville than an issue about territorial claims.

[1] Inquirer.net 9 Chinese boats leave Scarborough shoal, April 15, 2012

[2] China.org.cn Oil imports to grow slower, February 3, 2012

[3] See Shale Oil Revolution: (Laissez Faire) Capitalism Deals Peak Oil a Fatal Blow, March 24, 2012

[4] Ridley Matthew Gas Against Wind, March 13, 2012 Rationaloptimist.com

[5] Wall Street Journal, Steel Finds Sweet Spot in the Shale, March 26, 2012

[6] Nextbigfuture.com Global shale gas boosts total recoverable natural gas resources by 40%, April 6, 2011

[7] Wall Street Journal Total Extends Its China Ties, March 18, 2012

[8] Wall Street Journal Shell Reaches Chinese Shale-Gas Deal March 21, 2012

[9] US Energy Information Administration INTERNATIONAL ENERGY OUTLOOK 2011, September 19, 2011

[10] The Energy Markets and Money blog China Shale Gas... The New Frontier, March 19,2012

[11] Xinhuanet.com Interview: ASEAN members may be manipulated by U.S. on South China Sea issue: analyst, November 11, 2011

[12] Casey Doug Learn To Make Terror Your Friend January 7, 2012 lewrockwell.com

[13] See China Deepens Liberalization of Capital Markets April 4, 2012

[14] See Why China’s Currency Regime Shift Is Bullish For The Peso, June 28, 2010

[15] Merk, Axel Falling Treasuries: A Currency Perspective, March 20, 2012 gold-eagle.com

[16] opensecret.org Defense

[17] See Has the Tensions over Spratly’s Islands been about US Weapons Exports? June 28, 2011

[18] Wall Street Journal Blog, Mystery Blocks Put China Internet on Edge, April 12, 2012

[19] See China’s Coup Rumors: Signs of the Twilight of Centralized Government?, March 22, 2012