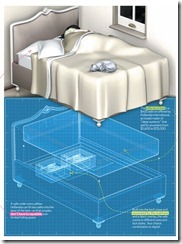

In the US, home safes or vaults seem to be in fashion

From Smart Money

In an era marked by financial turbulence, it's probably not surprising that safes have become a popular commodity, with some manufacturers, retailers and installers reporting sales increases of as much as 40 percent from a few years ago. But the bigger eyebrow-raiser is what has happened to those iconic gray-steel boxes of yore: They've undergone an extreme makeover -- or several of them. Taking the place of those old square combination jobs are a range of custom safes, from boutique showpieces to decoy models for the family den -- not to mention the truly offbeat (a hideaway lockbox resembling, ahem, a pair of men's underwear) and the seriously safe (an in-home vault with a price tag of more than $100,000). And that's not even getting into the ever-broadening array of color choices (champagne marble, anyone?) "None of our safes should be hidden in a closet," says Markus Dottling, principal at Dottling, a German specialty-safe manufacturer whose museum-worthy designs can cost more than the average American house.

One thing that isn't driving the safe boom, apparently, is crime. Indeed, U.S. burglary rates have been plunging for years. Still, experts say that many savers and investors feel a lingering sense of insecurity in their finances -- a hard-to-shake fear borne out of the jolting recession and, at times, wobbly recovery -- which is helping to spur the new safeguarding mentality. Tyler D. Nunnally, founder and CEO of Upside Risk, an Atlanta firm that researches investor psychology, says sticking tangible assets in a safe can be a natural reaction to volatility in the markets. "People dislike loss twice as much as they like gains," he says. "They want to protect what they have." Growing numbers of these fearful types simply don't trust their banks to protect them: In a Gallup poll last year, a record-high 36 percent of Americans said they had "very little" or "no" confidence in U.S. banks. (In 2008 and 2009, when the financial crisis was peaking, that figure stood at 22 and 29 percent, respectively.) And growing concern about identity theft has made some people more eager to keep their assets in a form they can see and count, says R. Brent Lang, an investment manager in Surrey, British Columbia: "By acquiring one password, someone can wipe out all your digital wealth," he says.

That’s because many people seem to be taking measures to protect their wealth. “Don’t trust their banks”, “insecurity in their finances” “identity theft” and “crime” has been cited as reasons for the dramatic shift in the perception of risks.

Yet mainstream experts will see “stashing or hoarding cash” as “negative” for the economy which is hardly accurate. As the great Professor Murray N. Rothbard explained in What has Government Done to Our Money? (bold emphasis mine, italics original)

Why do people keep any cash balances at all? Suppose that all of us were able to foretell the future with absolute certainty. In that case, no one would have to keep cash balances on hand. Everyone would know exactly how much he will spend, and how much income he will receive, at all future dates. He need not keep any money at hand, but will lend out his gold so as to receive his payments in the needed amounts on the very days he makes his expenditures. But, of course, we necessarily live in a world of uncertainty. People do not precisely know what will happen to them, or what their future incomes or costs will be. The more uncertain and fearful they are, the more cash balances they will want to hold; the more secure, the less cash they will wish to keep on hand. Another reason for keeping cash is also a function of the real world of uncertainty. If people expect the price of money to fall in the near future, they will spend their money now while money is more valuable, thus "dishoarding" and reducing their demand for money. Conversely, if they expect the price of money to rise, they will wait to spend money later when it is more valuable, and their demand for cash will increase. People's demands for cash balances, then, rise and fall for good and sound reasons.

Economists err if they believe something is wrong when money is not in constant, active "circulation." Money is only useful for exchange value, true, but it is not only useful at the actual moment of exchange. This truth has been often overlooked. Money is just as useful when lying "idle" in somebody's cash balance, even in a miser's "hoard." For that money is being held now in wait for possible future exchange--it supplies to its owner, right now, the usefulness of permitting exchanges at any time--present or future--the owner might desire.

In short, since people don’t know the future and where the perception of the risk of uncertainty are being amplified, the increased demand for money represents people’s satisfaction.

However the mainstream would then use “lack of aggregate demand” or insufficient consumption as further justification for government intrusion. In reality, today’s uncertain environments have been caused by excessive and obstructive role of governments.

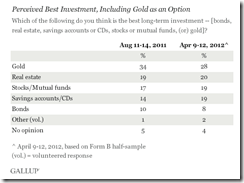

Record gun sales (Telegraph) and gold seen as the "best investment option" (Gallup) seem to correspond with the growing demand for home safes or vaults. All these add up to highlight heightened uncertainty.

Add to this a bleak report which noted that the US government may be preparing for a “civil war”.

From Beacon Equity Research,

In a riveting interview on TruNews Radio, Wednesday, private investigator Doug Hagmann said high-level, reliable sources told him the U.S. Department of Homeland Security (DHS) is preparing for “massive civil war” in America.

“Folks, we’re getting ready for one massive economic collapse,” Hagmann told TruNews host Rick Wiles.

“We have problems . . . The federal government is preparing for civil uprising,” he added, “so every time you hear about troop movements, every time you hear about movements of military equipment, the militarization of the police, the buying of the ammunition, all of this is . . . they (DHS) are preparing for a massive uprising.”

Hagmann goes on to say that his sources tell him the concerns of the DHS stem from a collapse of the U.S. dollar and the hyperinflation a collapse in the value of the world’s primary reserve currency implies to a nation of 311 million Americans, who, for the significant portion of the population, is armed.

Uprisings in Greece is, indeed, a problem, but an uprising of armed Americans becomes a matter of serious national security, a point addressed in a recent report by the Pentagon and highlighted as a vulnerability and threat to the U.S. during war-game exercises at the Department of Defense last year, according to one of the DoD’s war-game participants, Jim Rickards, author of Currency Wars: The Making of the Next Global Crisis.

Where government interventionism and inflationism has been intensifying, all designed to protect the interests of vested interest groups (unions), cronies (such as green energy, banking system, and others) and the welfare and warfare state, then the risks of a political economic meltdown grows.

I hope that Americans will come to the realization that interventionism and inflationism are economically unsustainable policies and promptly act to reform the system before disaster strikes. Remember, what happens to the US will most likely ripple across the globe.

Nevertheless, as for everyone else, while we should hope for the best, we should prepare for the worst.