Over the past few weeks, US dollar prices of key agricultural commodities have soared.

Prices of corn, wheat and grains have reached their highest levels in 3 years.

And this has alarmed economic experts from Africa.

From Reuters, (bold emphasis mine)

Rising food prices could hit commodity producers in Africa with a dangerous "double whammy" when combined with an economic slowdown in Europe and China reducing African exports of oil and raw materials, a leading African economist said on Tuesday.

Mthuli Ncube, Chief Economist and Vice President of the African Development Bank (AfDB), saw the threat of a food price spike casting a shadow over an otherwise positive growth outlook for Africa that will outpace much of the rest of the world.

"Certainly, there is a lot of reason to worry," Ncube told Reuters, recalling a food and fuel prices squeeze in 2008 that touched off social unrest and food riots in several African nations and also directly affected the continent's growth.

Global economic slowdown compounded by surging food prices would mean stagflation.

From the same Reuters article,

Despite Africa's comparatively strong economic expansion rates, the continent was experiencing "jobless growth", particularly in relation to its huge reservoir of unemployed youth, Ncube said.

Youth represented 60 percent of Africa's unemployed, and despite recording world-topping growth rates between 2000 and 2008, the continent was failing to create the number of jobs necessary to absorb the 10-12 million young and increasingly educated people entering the labor market each year.

Ncube said a major obstacle to more job creation was the persistence of what he called "one-sided economies" in Africa that exported oil and raw materials instead of moving decisively to diversify into job-multiplying manufacturing, commercial agriculture or agro-processing.

"It's a painful slog to diversify," he said.

"We need entrepreneurs to do it. We need to spend the time to build that business culture, the entrepreneurs," he added.

While Africa has taken important steps towards embracing liberalization, their hefty dependence on commodity exports remains an impediment to economic freedom which is the reason for the dearth of entrepreneurs.

This serves as more evidence where the supposed blessing from abundant resources can in fact translate to disadvantage—resource curse. Politicians and their cronies who benefit from commodities have little incentive to open their respective economies until forced by economic reality.

Although the bright side is that multilateral experts from Africa, who provide policy recommendations to political leaders, have exhibited increased recognition of the importance of entrepreneurship and of a political friendly business environment to economic development.

Yet while news tell us that drought in the US has mainly been the catalyst for the spike in prices of agri commodities, others share my insight that an integral element of these price surges has been because of central bank actions.

From yesterday’s Bloomberg article, (bold emphasis mine)

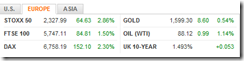

For the first time in more than two years, commodities, equities, bonds and the dollar posted gains, as the U.S. drought sent corn prices to a record and European Central Bank President Mario Draghi’s pledge to protect the euro buoyed stocks.

Raw materials led the increase as the Standard & Poor’s GSCI Total Return Index of 24 raw materials rose 6.4 percent in July, the most since October. The MSCI All-Country World Index of equities rallied at the end of the month for a 1.4 percent gain. The Dollar Index, a measure against six currencies, added 1.3 percent. Bonds of all types returned 1.4 percent on average, the most since December, Bank of America Merrill Lynch’s Global Broad Market Index shows.

The last time all four measures rose for a month was in April 2010, when concerns about Greece were heating up and U.S. economic reports were improving. While corn rose the most last month in almost a quarter century and wheat reached a four-year high, financial assets gained as policy makers worked to boost global growth. Federal Reserve Chairman Ben S. Bernanke said he’s prepared to take more steps, and Draghi pledged to do “whatever it takes” to preserve the euro.

“A lot of the rally in everything is central-bank led,” said Jason Brady, a managing director at Thornburg Investment Management in Santa Fe, New Mexico, which oversees $80 billion. “So now we have a world where central-bank actions are really what people are looking at, and those actions are really positive for all asset prices and negative for savers and folks who are looking to put money in at reasonable levels over a longer period of time.”

And Africa’s stagflation concerns should also haunt Asia, and the Philippines, whom have been major agricultural commodity importers

As Zero Hedge points out, (bold original)

The level of inventories were already low going in and as Bloomberg notes, consumers around the world will feel the effect of higher food prices as the worst drought in 50 years impact the world's largest exporter of corn and wheat (and 3rd largest of soymeal). Within Asia, Korea and Malaysia will be most adversely affected, considering direct effects referenced in per capita and GDP terms. Indonesia and Japan are Asia’s largest importers of wheat, both importing roughly 5.7 million metric tons on average. China is by a wide margin the region’s largest importer of soy, with average imports of 49.9 million in the last five years. The impact on headline inflation in Asia will be stronger for the economies with lower per capita incomes — Vietnam, India, the Philippines and Indonesia — where food and food products account for a larger share of the typical consumption basket. Even in places where incomes are high, such as Singapore, food accounts for 22 percent of the consumer price index.

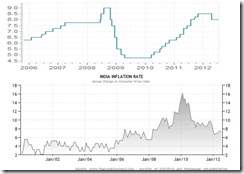

This only means that high commodity prices will be transmitted to Asia, whom has been inflating too (mostly through negative real interest rates).

And that a prolonged environment of elevated prices in agricultural commodities will likely induce an adverse impact to the region’s domestic economies too. (chart from Financial Times)

Stagflation risks therefore represents as another potential source of contagion.

Yet the most likely political response from the risks of a food crisis will be protectionist in nature (couched through cries of “self sufficiency”) that will only exacerbate such conditions.

In the Philippines, the risks of global and local food crisis may have been amplified by the desire by the Philippine central bank, Bangko Sentral ng Pilipinas’ (BSP) to stoke inflation through the recent cut of policy interest rates to new lows.

As the Inquirer reported last week,

Lower interest rates are expected to spur demand for loans which, in turn, could help boost purchases of goods and services. Higher demand, if supply remains constant, will help accelerate inflation.

The BSP said preventing the consumer price index from falling below target was as important for the economy as avoiding a higher-than-target inflation. Depending on variables, a very low inflation rate can be just as bad for business as high inflation, according to economists.

The BSP shares the same demand side interventionist creed as her international contemporaries.

They believe that the stealth redistribution of resources from the society (which includes the poor) to the cronies and to the political class will ‘help the economy’. In reality, this functions no more than a political setup, where markets will eventually get the blame, and thus lays the groundwork for more interventionism.

The great Ludwig von Mises presciently warned of this in his Theory of Money and Credit (bold highlights mine)

The undesirable but inevitable consequence of inflation, the rise in prices, provides them with a welcome pretext to establish price control and thus step by step to realize their scheme of all-round planning. The illusory profits which the inflationary falsification of economic calculation makes appear are dealt with as if they were real profits; in taxing them away under the misleading label of excess profits, parts of the capital invested are confiscated. In spreading discontent and social unrest, inflation generates favourable conditions for the subversive propaganda of the self-styled champions of welfare and progress. The spectacle that the political scene of the last two decades has offered has been really amazing. Governments without any hesitation have embarked upon vast inflation and government economists have proclaimed deficit spending and 'expansionist' monetary and credit management as the surest way towards prosperity, steady progress, and economic improvement. But the same governments and their henchmen have indicted business for the inevitable consequences of inflation. While advocating high prices and wage rates as a panacea and praising the Administration for having raised the 'national income' (of course, expressed in terms of a depreciating currency) to an unprecedented height, they blamed private enterprise for charging outrageous prices and profiteering. While deliberately restricting the output of agricultural products in order to raise prices, statesmen have had the audacity to contend that capitalism creates scarcity and that but for the sinister machinations of big business there would be plenty of everything. And millions of voters have swallowed all this.

So the next time a food crisis erupts, you should know the real culprit.