I have been pounding on the table that the current bubble dynamics will evolve from the periphery-to-the-core sequence. Despite denials by the mainstream that there will be no contagion from the recent emerging market meltdown, I keep pointing out that changes in prices will affect people’s preferences, knowledge and economic calculation and thus eventually expressed through the allocations of resources. And the impact of such derivative actions would be to reverberate on prices, thus the slomo or gradual transition or the market’s time consuming process. Politics is just one avenue expressive of the response from the recent emerging market crisis.

I share fund manager Doug Noland opinion[1] that emerging markets, who had been last shoe to drop in the 2007-8 global crisis, has become the US crisis equivalent of the global subprime.

Here is what I wrote about the potential transmission link from Emerging Markets to Developed economies[2].

Even when the exposure would seem negligible, if the adverse impact of emerging markets to the US and developed economies won’t be offset by growth (exports, bank assets and corporate profits) in developed nations or in frontier nations, then there will be a drag on the growth of developed economies, which would hardly be inconsequential. Why? Because the feedback loop from the sizeable developed economies will magnify on the downside trajectory of emerging market growth which again will ricochet back to developed economies and so forth. Such feedback mechanism is the essence of periphery-to-core dynamics which shows how economic and financial pathologies, like biological contemporaries, operate at the margins or by stages.

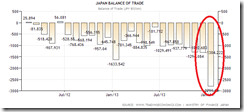

I recently pointed to the ongoing slowdown in exports of major exporting nations as reinforcing signs of a significantly slowing global economy[3].

More importantly the biggest emerging market, the Chinese economy has been showing signs of fatigue from credit based economic inflationism. Aside from the February export collapse, recently the growth rate of Chinese retail sales (slowest pace since 2004), fixed asset investment (13-year low) and industrial production (weakest start since 2009) has fallen significantly[4].

In addition, prices of Dr. Copper have recently crashed and so with signs of renewed weakening of the Baltic Dry Index. Meanwhile the Chinese yuan continues to weaken vis-à-vis the US dollar, this should continue to put pressure on firms with US dollar indentures.

When I said that the bubble bust process will undergo first, financial market disruptions, then liquidity squeeze and lastly either we see economic crisis trigger a financial crisis or vice versa, we can see this progression in China.

From Bloomberg[5]:

Chinese steel companies, the world’s largest, helped drive a regional industry benchmark index to a seven-month low as concern builds that some mills face financial difficulty amid a government credit squeeze…Closely-held steel mills in China are struggling to get funding at the moment and that’s led to panic selling of iron ore, according to Morgan Stanley. The nation’s top banking regulator said yesterday strict credit guidelines will be imposed on mills that were big polluters and users of energy.

The sharp reduction in the access of credit will magnify on China’s credit problems. On the other hand, amplified credit problems will mean a spreading of losses in companies and more defaults which should translate to a pronounced economic slowdown. For an economy that has been horribly distorted by both inflationism and myriad of political interventions or financial repression, I doubt if the transition to clear such existing credit excesses will be orderly.

The Shanghai composite lost 2.6% this week but this would have been even deeper whereas not from the growing expectations by mainstream that the Chinese government will be conducting a stimulus. China’s stock market rallied as Premier Li spoke in the annual meeting of the National People’s Congress[6]. This reaction is pure Pavlovian. The mainstream has been so desperate as to fail to recognize that China’s current debt problem has been an offspring of the 2008 stimulus.

If you see in the above charts, the German Dax has broken two support levels. UK’s FTSE seems headed in Germany’s path and the Nikkei crashed 6.2% this week.

A note on Japan. I wrote that “a bet on the Nikkei is a bet on the direction of stimulus”[7]. Japan’s sales taxes is about to come online in April. I believe that this will backfire on the struggling Japanese economy also heavily distorted by interventions and inflationism. The market seems to recognize this, but has latched on to the Bank of Japan for short term panacea. This week, the Bank of Japan refused to accommodate[8] their expectations for expanded stimulus and thus the 6.2% crash. The reaction is pure Pavlovian

And out of desperation to raise wages, the Japanese government has embarked on ridiculing or putting to shame on public, companies that refuse to hike pay[9].

Such reaction reminds me of former US President Franklin D. Roosevelt’s response to the Great Depression by implementing the New Deal which forced companies to pay salaries higher than should be.

In a study by two UCLA professors Harold L. Cole and Lee E. Ohanian they discovered that artificially elevated wages then resulted to substantially higher employment[10].

President Roosevelt believed that excessive competition was responsible for the Depression by reducing prices and wages, and by extension reducing employment and demand for goods and services. So he came up with a recovery package that would be unimaginable today, allowing businesses in every industry to collude without the threat of antitrust prosecution and workers to demand salaries about 25 percent above where they ought to have been, given market forces. The economy was poised for a beautiful recovery, but that recovery was stalled by these misguided policies.

So China won’t just be the culprit to more financial tremors, expect Japan’s added role post-sales tax April.

Yet today’s pressures come from another front: the standoff by Russia and the West via the Ukraine political crisis.

The US Federal Reserve reported a record $104.5 billion plunge in US government bonds held in custody by them in favor of foreign central banks and other overseas investors. Rumors have floated that the Russian government, in fear of economic sanctions by the West, may have initiated a move out of the US Federal Reserve[11].

On the other hand, other reports say that out of the same fear of economic and financial sanctions, Russian investors have been pulling out of Western banks[12]. So aside from the impact of China, possibly part of the ongoing market liquidations may have emanated from Russians bailing out of Western markets and banks.

So has China and Russia triggered the spreading of the Wile E. Coyote moment?

We will see.

Yet by the second quarter, Japan may play a bigger role in the unfolding saga.

So if my suspicions will hold true then we are likely to see permeation and intensification of financial market jitters and economic earthquakes on a global scale as time goes by.

It seems time to batten down the hatches.

[1] Doug Noland EM, Hedge Funds and Corporate Debt Credit Bubble Bulletin February 7, 2014 PrudentBear.com

[2] See Phisix: Will the Global Risk OFF Environment Intensify? February 3, 2014

[3] See EM Contagion: Based on Exports, Global Economic Growth appears to be Downshifting Fast March 12, 2014

[4] Bloomberg.com China Data Show Economy Cooling March 13, 2014

[5] Bloomberg.com China Steel Mills Slide as Credit Squeeze, Iron Ore Panic Grips March 12,2014

[6] Bloomberg.com China Stimulus Decision Looms as Investment Slows March 14, 2014

[7] See Japan’s Ticking Black Swan February 24, 2014

[8] Bloomberg.com Bank of Japan Sticks to Easing Plan as Sales-Tax Increase Looms March 11, 2014

[9] Japan Times Japan to name, shame firms that refuse to hike pay March 13, 2014

[10] UCLA Newsroom FDR's policies prolonged Depression by 7 years, UCLA economists calculate August 10, 2004

[11] Wall Street Journal Money Beat Blog Did Russia Just Move Its Treasury Holdings Offshore? March 14, 2014

[12] Financial Times Russian companies withdraw billions from west, say Moscow bankers March 14, 2014