The opinion of ten thousand men is of no value if none of them know anything about the subject. –Marcus Aurelius Antoninus Augustus (121-180) Roman emperor (161-180)

In this issue:

Phisix: The Speculative Mania Galore In Full Throttle!

-Thank You, Errors.

-Deeply Held Convictions are Signs of Major Market Inflection Points

-The Speculative Mania Galore In Full Throttle!

-Philippine Asset Valuations: When The Tide Goes Out, Who Will Be Caught Swimming Naked?

-Has the BSP been worried over the Unwinding of Carry Trades?

-Domestic Sources of Risk, Redux

-Cracks in Asia’s Casino Bubble

-A Note on 10,000 Phisix and Back to the Future

Phisix: The Speculative Mania Galore In Full Throttle!

One of the most unforgettable life changing moments of my stock market career was during the Phisix nadir of 2002.

Thank You, Errors.

2002 marked my third return to the stock market, this time as a serious occupation. My previous two engagements had merely been part time experiments, one of which tragically ended with my fingers burned via dabbling with margin trade where I swore off the stock markets. It took my mentor, my golfing buddy, who had been a former president of a foreign stock market brokerage, to convince me back.

In my return one of the first tasks was to revive dormant accounts where I had to call on the clients assigned to me. In process of doing so, I encountered what turned out to be a gem of a lesson.

In one of my client calls, after introducing myself as the new account manager, the client suddenly unleashed a barrage of invectives at me, called me names and denounced me for being part of the alleged cabal or “syndicate” of manipulators whom had short changed retail investors like him. My previous experience at handling objections as salesman helped me through this turbulent conversation. But having been initially shocked at the adverse reception, I had mostly listened at his virtual virulent monologue for about a few minutes or so until he hanged up.

This was a defining moment for me for two reasons.

One, as a ‘novice’, where most of my understanding of stocks have initially been grounded on technical analysis, but thanks to my mentor’s books, I gained some knowledge about how stock market cycles operate; the client’s overzealous reaction reinforced my gut feel or my intuition that the market’s bottom has been reached. Such psychological revulsion, for me, signaled a major reversal or inflection point that would usher in a bull market.

I became wildly bullish on the Phisix, particularly on telecoms and the mining industry. Yet since nearly everyone I spoke with practically refused to engage, as they didn’t immediately share my optimism, the feeling of solitariness hardly dampened my enthusiasm. Nevertheless, eventually I had been proven right, or might I say, the rest is history.

The lesson here is that today’s bullmarket has been a product of the early skepticism. Applied in the opposite context, the coming full bear market will be an offspring of today’s euphoria. As the legendary contrarian investor Sir John Templeton once counseled, “Bull-markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.”

Second and the more important point have been for me to come understand why the retail client responded in such heated or impassioned manner. Obviously the client agonized from the losses which emerged out of a ‘buy high’ position most likely executed during the pre-Asian crisis boom. And more, it could be possible that his ‘trading’ portfolio had been transformed into a ‘long only investor’.

Since it took 6 years for the completion of the bear market cycle or for the Phisix to finally hit a bottom, this means he excruciatingly watched the evisceration of his portfolio as market values collapsed overtime.

Why did he incur such loses? He was obviously seduced by the fad during those boom days, possibly abetted by his previous account manager.

Nonetheless his experience can be seen in the light of the paradigm of another legendary investor, Jesse Livermore’s guidance[1] against people who think with the eyes. [bold mine]

But the average man doesn’t wish to be told that it is a bull or bear market. What he desires is to be told specifically which particular stock to buy or sell. He wants to get something for nothing. He does not wish to work. He doesn’t even wish to have to think. It is too much bother to have to count the money that he picks up from the ground.

And because the client couldn’t take to own up or admit to his mistakes, particularly for falling into the groupthink trap, he sought an outlet to vent his frustrations which he saw in me. His actions depicted the capitulation phase for the bulls.

The second lesson from this unfortunate but fruitful encounter has been my epiphany. Over the years, I labored to deepen my understanding of the practical applications of economics, especially when applied to finance, the tradeoff between risk and reward. I also learned of the ethics of the principal agent problem—the potential conflict of interest issues between the varying roles of financial market participants. So it became imperative for me to present the objective side of risk-reward balance.

From both the aspects of finance and ethics emerged my theme: prudent investing.

Our client’s bitter episode or his failures can serve as our learning experience. As my favorite iconoclast Nassim Taleb writes about the importance of decentralized distribution of errors[2], “In a system, the sacrifices of some units—fragile units, that is, or people—are often necessary for the well-being of others units or the whole. The fragility of every startup is necessary for the economy to be antifragile, and that’s what makes, among other things, entrepreneurship works: the fragility of individual entrepreneurs and their necessarily high failure rate.” In a market economy, learning from failures should help make us become stronger.

Deeply Held Convictions are Signs of Major Market Inflection Points

Yet it’s been a totally diametrical scenario between 2002 and 2014.

In 2002, psychological revulsion governed people’s sentiment of the stock market. Today the very entrenched populist notion has been that Philippine stock markets have been predestined to reach nirvana!

And part of the signs of such euphoric conviction can be gleaned from a recent rebuke I received from an industry participant chieftain who implied of the supremacy of social acceptance or popularity in terms of conducting economic analysis or even presumably stock market investing.

Interesting objection. But the logical assumption that the crowd or the popular is always right means that panics, crashes and recessions would not exist even in the dictionary and that we should be in utopia today. But how true is this?

A better frame is that the crowd is always right during major trends, but crowd is always wrong during major inflection points.

Yet such assumptions are disturbing signs for a few reasons.

First, to argue the primacy of the popular fails to appreciate the role of diversity of opinions that leads to market actions.

Stock market transactions are basically a consummation of buy and sell orders from different entities of a specific issue based on an agreed price and volume. This means that the matching of transaction orders for both the buy side and the sell side depends on the diverse-opposing opinions or preferences of the buyer and the seller. Thus a failure to appreciate diversity redounds to a failure to grasp the basic principles of stock market operations. Such is instead a manifestation of a ONE WAY trade mindset.

Second, this seems as more signs where political correctness has pervaded into the domestic stock market. Is it now politically taboo to question the sustainability of stock market boom? Has it been immoral to provide competing or alternative insights for investors protect themselves from the mainstream’s uniformity or even possibly from widespread disinformation?

Third, social acceptance as “priority” means to forsake economic calculation, risk-reward assessment and critical thinking. For the individual to submit to the popular assumes the impeccability, infallibility and the inviolability of the crowd’s concept of reality.

Abandoning economic calculation also means allocation of money or resources based on where the crowd is, or to chase momentum. Yet here is the erstwhile value investor Warren Buffett’s take on momentum trades: (bold mine)

For some reason, people take their cues from price action rather than from values. What doesn't work is when you start doing things that you don't understand or because they worked last week for somebody else. The dumbest reason in the world to buy a stock is because it's going up.

Let me repeat: The DUMBEST reason in the world to buy a stock is because it’s going up.

Yet the advocacy of groupthink reminds me of the mainstream’s adaption of their economic deity John Maynard Keynes’ sound banker approach “A sound banker, alas, is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional way along with his fellows, so that no one can really blame him.” (bold mine)

In other words, the mainstream provides leadership to the crowd during the boom, but absconds under the skirt of the crowd to elude responsibility when all things fail.

Do you now see why the opprobrium vented by the dejected client who bought into the voguish days of the pre Asian crisis boom? His “ruination” was almost entirely due to being blindsided by the risks facing him. And this has substantially been due to the systematic brainwashing of the supposed reality of the permanence of credit inflated booms peddled by the mainstream and their favorite experts who in truth have been oriented as “not one who foresees danger and avoids it”. In short, this serves as example of the principal-agent problem or the Wolf of Wall Street Philippine edition.

Fourth, such views represent a deepening conviction about the sustainability of today’s presumed “risk free or low risk” conditions—again a ONE way manic trade.

Unfortunately, the perception of “risk free” or “low risks” are instead flagrant symptoms of “overconfidence” articulated in the ambiance of recklessness and hubris.

Notice the sentimental and psychological character of the climax of every boom in the above chart: They have been dominated by “I am smart” and the “new paradigm” mindset.

In other words, to suggest of the omnipotence of social acceptance or of the popular in terms of economic analysis or stock market investing seems representative of what the investing legend Sir John Templeton has warned of as the four most dangerous words of investing…“This Time is Different”

And what has been the common denominator of all financial-economic crises through history?

Let us hear it again from Harvard’s Carmen Reinhart and Kenneth Rogoff[3]: (bold mine)

The essence of the this-time-is-different syndrome is simple. It is rooted in the firmly held belief that financial crisis is something that happens to other people in other countries at other times; crises do not happen here and now to us. We are doing things better, we are smarter, we have learned from past mistakes. The old rules of valuation no longer apply. The current boom, unlike the many previous booms that preceded catastrophic collapses (even in our country), is built on sound fundamentals, structural reforms, technological innovation, and good policy. Or so the story goes…

Investing guru George Soros in his Reflexivity theory says that market tops can be identified by “the flaw of perception” that leads to “THE climax”.

Objections catering to the appeal to the popular or the appeal to the majority (Argumentum ad populum) in defense of the bubble signify “overconfidence to the max”. This would seem to confirm of THE climax phase of the boom.

The bottom line: The zeitgeist of every major inflection points can be seen by the degree of the ardent defense of the status quo.

The Speculative Mania Galore In Full Throttle!

And speaking of the deepening populist—one way—crowded trade…

Folks, lo and behold…

...the spectacle of the UNLEASHED EXPLOSION of speculative orgy!

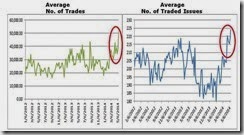

In the Phisix daily quotation there are two data which I use to gauge sentiment. These are the number of trades and number of issues traded daily which I average for each week. These figures have been largely ignored by the mainstream. Yet what is garbage for them is treasure for me.

The number of trades represents the completed transactions of the day. The number of issues traded covers the issues from all the transactions of the day. The latter is limited to the number of issues listed (344 as of 2012).

Hardly anyone noticed that as the Phisix attempted to breach the 6,900, the recent explosion of trade churning which involves equally a broader breadth of the markets—set a remarkable milestone. Trade churning has not just broken out. They have not only topped the June 2013 highs when the Phisix was at 7,400, trade churning has blasted to the upside by about 25% from June last year.

Trade churning can mean the inclusion of more participants and or simply increased participation from existing participants. The former is less likely a scenario. Despite the raging bullmarket, new Brokerage accounts grew by only 22% from 2007 (430,631) to 2012 (525,850)[4]. Any increases today may be stronger but they will likely be marginal. This means current participants have increased their trading activities where they see only sustained increases for Philippine equity asset prices—again a ONE direction trade.

The Phisix posted its first week down following 7 weeks of the relentless climb. It’s really been a pseudo correction. While the broader market was slightly down for the week, which was responsible for the decline in the index, the HIGH PER and PBV stocks continued with its unwavering march forward. As one would note in the right window, high flying property index was slightly off or almost unchanged. While consumer stocks in the industrial sector held off a broad based decline by pulling the index up.

Peso trading volume has spiked over this week in support of the record run by speculators (left window). Notice that despite the recent jump, the average daily peso volume for the week has still been way below the June 2013 highs.

Yet this week’s crescendoing frenzied speculation in the face of the pseudo correction means that locals sold the “blue chips” but the selling pressure has been negated or cushioned by foreign buying. Foreign buying even pushed popular high PE/PBV stocks higher. Thus the paltry decline of the Phisix or the pseudo correction. Both locals and foreigners have been conditioned to see a one way trade.

Meanwhile proceeds of the sales by locals on their blue chip holdings have been used to churn second-third tier issues. In short, locals rotated into the more ‘speculative’ and illiquid issues that paved way for the spectacular record trade churning run supported by the record breaking broader market activities.

Behold the speculative mania galore in full throttle!

Philippine Asset Valuations: When The Tide Goes Out, Who Will Be Caught Swimming Naked?

It’s been an incredulous sight to see domestic ‘blue chips’ priced at the valuation levels of US technology and small cap stocks which has similarly been sold on ‘growth’! Yet the growth story represents a mere mainstream populist canard.

Let us take for example, company XYZ with a PE ratio of 40 and an expected forward earnings growth rate of 15%. By the end of the year, if the company does live up to expectations, at current prices the PE ratio falls to the lower 30s. But the stockmarket huckster will say that 15% will be sustained (in perpetuity) so encourages everyone to buy. So the stock goes up by 15%. The 15% stock price increase will offset the 15% earnings growth. Essentially “growth” becomes a pretext for unbounded multiple expansion via sky high prices. Risk vanishes! This TIME is DIFFERENT! Yet this is another example of the one way trade. Yet the assumptions I make here is that the growth projections will be accurate. They are not. Inflated revenues, earnings and asset values will TANK when the BSP pulls back on the 30+% money supply growth rate.

And given the composite members of Phisix represents the largest companies spread over different industries—a perpetual over the GDP growth rates are mathematically impossible because there are natural limits to profit growths[5], such as competition, the law of compounding, inflationism and more.

Bubbles have become so evident almost everywhere. The fabled growth story of US small caps has even caught the eye of US Federal Reserve chairwoman Janet Yellen. From the CBS[6]: “But the big surprise from Yellen was her comment that small-cap stocks were showing pockets of possible overvaluation.” (bold mine)

The Zero Hedge[7] points to a speech by German Finance Minister Wolfgang Schaeuble in Munich last week where the Mr. Schaeuble remarked that “Financial markets have almost 'Excessive Confidence'” and “Market liquidity points to new bubbles” (bold mine)

Mr. Richard Fisher Dallas Federal Reserve President in a recent speech[8] tacitly admits to how FED policies have influenced bubbles, “The answer is an admission of reality: We juiced the trading and risk markets so extensively that they became somewhat addicted to our accommodation of their needs. You may remember the “taper tantrum” market operators threw last spring when we broached the idea of temperance. It went over about as big as would saying you wanted to ban Hurricanes and other happy-making libations here in New Orleans! (bold mine)

As you can see, bubbles have risen to levels where authorities can’t hide them anymore. Instead of denying them, what they are doing today has been to downplay their risks.

In the local setting, basking in the glory of inflationary boom, authorities deny them and proclaim that they are in control of the situation. The BSP chief, Amando Tetangco, offers their guarantees From the Strait Times[9]: “Our policy will continue to be geared towards ensuring that inflows do not generate financial stability concerns”

Yet the charming part about such rhetorical assurance is that they signal the authority’s control over current conditions. But without specifying the details, the BSP’s opaque communications only leaves us in the dark as to what their true parameters for identifying “financial stability” risks, if there is ever one at all. Yet does 30,40,50,60+ PE ratios and PBV values of 4,5,6,7,8+ have not been “signs of financial stability concerns? The ultimate question is where does the BSP draw the line demarcating normative financial conditions relative to financial excesses? And what are consequent actions need to be done?

And why confine or restrict burden of financial stability concerns to only “inflows”? Are foreigners the only source of financial stability concerns? What about the locals?

The fact that the BSP refuses to act on her self-imposed 20% banking loan cap on the property and property related sector which in May of 2013[10] (exactly a year ago) was already at the 20 percent threshold (20.68%) reinforces my suspicion that they have been reluctant to pull a brake on what seems as mounting financial excesses.

If the Philippine economy has truly been strong as they claim, then why have they been dithering at withdrawing excess liquidity or tightening money in order to ensure financial stability? Why use the reserve requirements tool when modern central banking suggests that the BSP provides the required reserves on banks rather than the banking system limiting their loans via reserve mandates[11] which means using reserve requirements have been symbolical rather than real?

Why spend countless money in managing (implied price controls) of the peso and bond levels? Why not raise interest rates or enforce banking caps on property loans (which obviously will raise rates)? Has the government and their vested interest groups been so very deeply addicted to this negative real rate stimulus that they can’t wean from it? Are they afraid that a monetary retreat would expose who, to borrow from Mr. Warren Buffett has been “swimming naked when the tide goes out”?

Has the BSP been worried over the Unwinding of Carry Trades?

The BSP chief rightly mentions the concerns over “inflows”. Does he know something that the public doesn’t?

Magicians perform by having their hands move faster than the eyes (now aided with technology). Where the attention of their audiences has been fixated on what the performer intends them to see rather than what the magician moves behind the scenes to produce the desired magical effect.

The same applies to the many type of social activities, particularly in politics, policymaking or even in the markets.

People see domestic markets rising so they assume something extraordinary from such actions. Their beliefs (endowment bias) are magnified by news about statistical economic data or positive developments as credit rating upgrades.

Yet they seem ignorant of the fact that this hasn’t just been a Philippine only phenomenon.

In fact for 2014, the biggest equity gainers thus far have been last year’s most troubled emerging market economies.

I might add that civil war torn and a potential tinderbox for World War III, Ukraine’s stocks (PFTS index) have been one of the world’s best performers up by 32.47% year-to-date as of Friday’s close. Amazingly the bankrupt Ukraine has inflated two stock market bubbles from 2005-2012, all of which returned to earth. Now could be the third bubble. If a new Ukraine government decides to nationalize everything, then goodbye investments.

Joyce Poon of the Hong Kong based Research outfit, Gavekal Dragonomics makes a riveting observation[12] of the current Emerging Market rallies “The defining feature of the current run-up in emerging markets is that the greater the sell-off a country suffered last year, the stronger the rally it has enjoyed this year.” (bold mine)

The Gavekal team observed further that inflation pressures will extrapolate to national central banks of emerging markets as taking the easing option off the table, while most forward looking indicators, “especially in Asia, are signaling no prospect of any decisive upturn in the growth outlook”. With growth expected to underperform, this leaves the current rallies in emerging assets a function of “the search for carry”.

In short, as credit markets led by the US balloon to record levels, part of this credit expansion has been channelled through carry trades. And such carry trades has found their way to pump up on emerging market assets, currencies, bonds and stocks. Emerging markets have already substantial exposure to carry trades as I pointed out last February[13].

The problem is once that volatility returns for any reason at all, these juicing up of emerging market assets may suddenly reverse.

And this is what perhaps bothers the BSP chief more for them to cite “inflows” as possible sources of “financial stability concerns”.

But the BSP chief ignores the fact that “sudden stops” can be a function not only of exogenous factors but also endogenous forces. A simple loss of confidence for any matter, like the escalation of the territorial dispute with China that may lead to Vietnam type of anti-Chinese and anti-Asian riots* can serve as trigger.

*As per CNN[14] “the arson was indiscriminate, with Korean-, Taiwanese- and Japanese-owned properties also torched by the angry mob.”

As a side note: it would represent arrant foolishness for anyone to brush aside the risks of the escalation from the region’s territorial dispute. The Vietnam riots shows how nationalism based domestic political frictions can cause economic disruptions that may not only lead to economic slowdown and a reduction—or even subsequent withdrawal—of investments but to outright protectionism, that exacerbates the chances of a realization of military conflict.

Here is an example. From the Wall Street Journal[15]: “Foxconn—the world's biggest electronics contract manufacturer, whose official name is Hon Hai Precision Industry Co.--said Friday it would halt production at its Vietnam units through Monday "for safety reasons." The plants of the Taiwanese company, a major supplier to Apple Inc., haven't been attacked by protesters.”

If these riots continue or even spread not only to affected countries but to the region then expect more suspension of operations and investments, and eventually withdrawals. And if the Vietnamese government and other Emerging Asian government counter with capital flow restrictions then one can expect a regulatory tit-for-tat. Protectionism rises. Trade grinds to a halt. Asia’s supply chain network crumbles.

The Philippines has no riots yet. But from street protests, which could be inflamed further by politicians and media, riots will not be far away.

And to add to the observation of Gavekal, even the mainstream news network, the Financial Times, in carrying the analysis of HSBC points to the increasing vulnerability of Emerging Asia’s growth model as she becomes deeply reliant on debt to produce statistical “growth”, or simply the diminishing returns of debt, which the HSBC calls “credit intensity”.

Asia is addicted to debt bannered the Financial Times[16]. How? “From Credit levels have risen sharply since 2008 in Hong Kong, Singapore, Thailand and Malaysia, while already high levels of household debt in South Korea and Taiwan have tracked even higher. During times of accelerating growth, that might not be a cause for concern. But now much of Asia is faltering. Credit intensity – the amount of borrowing needed to generate a unit of output – has surged, while productivity growth has tumbled. The debt train appears to be fast running out of track just as the world prepares for higher interest rates.” (bold mine)

The chart from the right window resonates with the Philippine statistical growth version that has increasingly been relying on the bubble industries.

So stock markets have been rising along with debt levels as growth underperforms while productivity lags. All these come at the heels of the prospects of higher interest rates. This IS sustainable?

To believe that domestic or external markets are rising because of “sound fundamentals” can be analogous to the belief that Peter Pan and fantasyland have been more than a cartoon, merchandise stuffs and fun rides.

Domestic Sources of Risk, Redux

This brings us to the potential internally sourced risks

Funny but the 30+% money growth rate which has been consistent for the past 9 months IS also sustainable? Economic theory tells us that price inflation comes in stages[17]. The first stage is when prices hardly rise in the proportion of the rate of money creation. This is because the public sees inflation as a temporary dynamic, thus the increase in social demand for money. In this phase, prices even fall. This is the longest phase of the inflation cycle.

The second stage of inflation is when prices rise in proportion to the rate of money creation. This means if the banking system prints 30+%, consistently for a long period, eventually real price inflation will rise to match the 30+% levels even if manipulated statistics don’t say so.

This has been true with Argentina. As I have recently shown[18], Argentina’s government has been inflating 25-30+% a year for the past four years. Prior to the January sharp interest rate increases, Argentina’s implied inflation has reached about 25% before dropping to 16% after the interest rate hikes and now back to 21% today. Official rates say only 10%. As reminder, Argentina’s government has been inflating because they lack of access to international credit, thus in order to finance her deficit spending programs, the government has been the fountain of money creation growth.

And this is what differentiates the Philippines and Argentina. Unlike Argentina, because of the illusions from a credit financed supply side boom, the Philippine has wider access to cheap credit. The Philippine government recently got a fresh credit rating upgrade from the S&P.

Inflated revenues and profits from the boom has financed government spending while at the same time financial repression policy of negative real rates has kept cost of public borrowing in check—all such invisible transfers have been financed by peso holders.

This means that instead of the government responsible for money creation as in Argentina, the Philippines’ banking system has been the key source of money creation. Based on BSP’s data about 68% of M3 has been banking claims on the private sector[19]. This is the source of the delusions of transformative growth touted by the mainstream.

So even if the BSP claims that the banking system sufficiently capitalized[20], whose Tier 1 capital have been all based on inflated asset valuations and retained earnings, the rate of banking loan growth ventilated through money supply growth figures shows that these forces are incompatible. Why? Simple: Growing debt loads means greater sensitivity to interest rate risks. Yet fast expanding debt means that the infusion of money streams will affect the real economy through the price channel which subsequently impacts economic coordination and production process. This means higher inflation rates. Yet rising price inflation will extrapolate to higher interest rates, which will be compounded by the fall in the peso. So once we reach a critical tipping point where inflation rates will influence interest rates enough to adversely affect ‘demand’ (top line figures) and debt serviceability of listed and unlisted companies we will see constriction of profits that will be followed by retrenchment and liquidations.

And it is not just interest rate and inflation, growing debt size or levels alone can represent a threat. Yet who are the borrowers of the banking system and why are they borrowing? The borrowers have been mostly the bubble sectors: real estate, construction, hotel (casino) and restaurant, wholesale and retail trade (shopping malls) and financial intermediaries. Based on BSP data these industries constitute about 50% or half of overall banking loans to the formal economic industry. The same industries are borrowing mainly to finance their capital expansion. But what if they current rate of expansions lead to overcapacity or what if supply growth exceeds demand growth? What if these industries collectively miscalculate on demand?

Where will the borrowers get the wherewithal to fund these liabilities? Will these companies employ the debt version of Russian roulette of imbuing more debt to finance existing debt? If so, then a surge of adaption of Ponzi financing will translate to even greater systemic risks.

Essentially four factors say that current conditions are not sustainable: 1) Growing debt levels, 2) excessive money supply rate growth as manifestation of debt levels, 3) overcapacity financed by debt and 4) escalating inflation-interest rate risks.

Mind you, these factors are NOT isolated but instead they are interrelated or deeply entwined. Yet all these are symptoms of the policy of generating something from nothing—bubbles.

Think of it, if the bubble bursts, do you think these accrued excess capacities (malls, hotels and high rise) can be immediately converted into manufacturing centers? The answer is no. They account for as sunk costs. They will have to massively re-priced lower for new investors to find high value uses for these idle properties.

As example, just look at how US shopping malls are being demolished. Here is a list of demolished malls and this list will expand[21].

This only means that the belief in the longevity or even perpetuity of government manipulated booms are a mirage, as the great Austrian economist Ludwig von Mises warned[22], (bold mine)

Public opinion is utterly wrong in its appraisal of the phases of the trade cycle. The artificial boom is not prosperity, but the deceptive appearance of good business. Its illusions lead people astray and cause malinvestment and the consumption of unreal apparent gains which amount to virtual consumption of capital. The depression is the necessary process of readjusting the structure of business activities to the real state of the market data, i.e., the supply of capital goods and the valuations of the public. The depression is thus the first step on the return to normal conditions, the beginning of recovery and the foundation of real prosperity based on the solid production of goods and not on the sands of credit expansion.

Cracks in Asia’s Casino Bubble

And to compound on the pressures on the Philippine bubbles has been the current bear markets of Macau based “blue chip” casinos[23], particularly MGM China Holdings Galaxy Entertainment Group, Sands China Ltd., Wynn Macau, Melco Crown Entertainment and SJM Holdings owner of the Grand Lisboa

Media reports 5 reasons for the ongoing Macau casino bearmarket 1) Chinese government crackdown on illegal fund transfers and potential restrictions on the mobility of Chinese gamblers. 2) Overcapacity 3) Chinese government clampdown on corruption 4) Overvalued stocks. 5) Slowing Chinese economic growth

Two favorite excerpts from article.

On overcapacity. “The companies are spending billions of dollars to expand facilities that cater to tourists in the city of about 600,000 people, the only place in China where casinos are allowed.”

The above shows how Macau’s gambling market has been totally dependent on the Mainland. Yet the boom has encouraged capacity expansions amidst a China economic slowdown. This is an example of gross miscalculation emanating mostly from the distortions of price signals and from overconfidence.

Yet compounding on Macau’s casino woes has been political uncertainties from the Mainland. The focus will swing to how these expansions have been financed. If they have been financed by debt then falling revenues in the wake of large debt burden will amplify the profit margin squeeze. Such would likely to raise their respective credit risks.

So from Macau’s casinos we find that problems can emanate from both directions: internal and external.

Next On overvaluation. “Even after this year's declines, casino operators aren't cheap, according to Pruksa Iamthongthong, who helps oversee $US541 billion at Aberdeen Asset Management and said she doesn't hold any Macau gambling stocks. Wynn Macau trades at 19 times reported earnings, versus 10 times for the Hang Seng Index. MGM China has a multiple of 17, compared with 25 for Sands China, 23 for Galaxy and SJM's 15.”

Remember mainstream media always attempts to oversimplify or rationalize the current market actions. For instance, in the above quote, media doesn’t explain why despite overvaluations, Macau casino stocks boomed before they cracked.

And a further more important note look at the comment of the analyst where he says “casino operators aren't cheap”. 15-25 PERs for him are not considered cheap. How would he reckon with Philippine blue chips with PERs of 30,40,50,60?

The current boom in the domestic hotel industry has been primed by a race to build casinos. These casinos have been intended to compete and to grab a pie of the regional markets as I pointed out last year[24]. If Chinese gamblers comprise the key markets to the Asian casino industry then a sustained slowdown in China and political uncertainties will affect demand for the regional casinos including the Philippines.

Will domestic gamblers be sufficient to sustain the rampant buildup of casinos? If not, then Macau’s overcapacity will apply to the Philippine casinos. Boom goes bust.

A Note on 10,000 Phisix and Back to the Future

And despite all my bearish outlooks, most of you think that I have abandoned my Phisix 10,000 forecast. Sorry but No I haven’t.

I hold a long term view for the markets. Unlike the mainstream, I don’t see events to “just happen”. Instead I see markets as a process or I read markets based on business or stock market cycles.

At the depth of 2009, the Phisix was at about 1,700. That was when I was also screaming a buy. Exactly one year ago, the Phisix posted a record high at 7,400. That was when like today I was already skeptical of the sustainability of the boom.

From 2009-2013 the Phisix returned 3.35x.

Even if the Phisix should fall to 2,500 or 3,000, the same rate of return will mean over 10k+ Phisix. The rally can be driven by three factors, real economic reforms (low probability), another boom bust cycle (high probability) or Argentina-Venezuela like deficit spending monetization (medium probability)

But the Phisix will have to fall into a bear market first to cleanse its system from all the cumulative excesses or the government will have to launch a massive bailout and/or takeover from the banking system the role of money creator.

For investors that would mean to navigate today’s treacherous high risk waters by avoiding substantial nominal losses, real (inflation adjusted) losses and opportunity costs. I previously pointed out that despite two booms and one bust, and the stagflation of the 1970-80s, anybody invested in the Philippine equities from 1970 until 2012 would have posted a NEGATIVE return[25].

So the best way to maximize profit with lesser risks will be to understand how cycles work and to surf them. This would better than to trade based on the fear of being missed out that prompts for a frenzied chasing of the unsustainable crowded trade pillared on perilously flaky fundamentals.

All these may take years unfold but that’s the way domestic financial markets—under the current political environment—works.

And I will probably be calling for a buy when I see the same scenario in the 2002 where the mainstream capitulates from their ONE way trade mentality with stark revulsion to the markets.

To heed one of the most precious or best advices from Warren Buffet:

Be fearful when others are greedy, and be greedy when others are fearful

or

Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can't buy what is popular and do well.

My encounter with a dispirited client in 2002 will be what I expect to see in the future.

This means we are headed back to the future.

A relevant quote from the 1989 movie Back to the Future II

Marty McFly (Michael J. Fox): Okay. Okay! Relax, Doc! It's me! It's Marty!Doc Brown (Christopher Lloyd): No! It can't be! I just sent you back to the future.Marty: I know. You did send me back to the future, but I'm back. I'm back from the future.Doc: Great Scott! [faints]

[1] Edwin Lefèvre Reminiscences of a Stock Operator Chapter 7, Austrocycle.net

[2] Nassim Nicolas Taleb Antifragile: Things That Gain from Disorder (Incerto) p 65 Random House

[3] Carmen Reinhart and Kenneth Rogoff From Financial Crash to Debt Crisis Harvard University

[4] See Phisix: Will the Fed’s Spiking of the Punchbowl Party Be Sustainable? September 23, 2013

[5] See Phisix: The Stock Market Mania Deepens March 10, 201

[6] CBSNews.com Janet Yellen's surprising warning about small caps May 7, 2014

[7] Zero Hedge German Finance Minister Admits To "New Bubbles" & "Excessive Confidence" May 13, 2013

[8] Richard W. Fisher Comments on Tailored Regulation and Forward Guidance Remarks before the Louisiana Bankers Association 114th Annual Convention and Expo New Orleans, Louisiana · May 9, 2014 Dallas Federal Reserve

[9] Strait Times.com Manila central bank says ready to guard against financial excesses May 13, 2014

[10] Bangko Sentral ng Pilipinas BSP Releases Results of Expanded Real Estate Exposure Monitoring, May 10, 2013

[11] See Showbiz S&P Upgrade & BSP Actions Sends Phisix and the Peso into a Frenzied Blow off Top May 12, 2014

[12] Joyce Poon Gavekal Dragonomics Outside the Box: EM Carry Trade Looks Vulnerable MauldinEconomics.com May 15, 2014

[13] See Emerging Market $2 trillion Carry Trade: The Pig in the Python February 24, 2014

[14] CNN.com Protestors torch factories in southern Vietnam as China protests escalate May 15, 2014

[15] Wall Street Journal Foreign Firms Regroup After Vietnam Riots, May 16, 2016

[16] Financial Times Asia: Addicted to debt May 12, 2014

[17] See Phisix: In 2009, the BSP Engineered a Crucial Pivot to a Bubble Economy April 14, 2014

[18] See Phisix Melts Up as Money Supply Growth Sizzles for the Eight Month April 7, 2014

[19] See Phisix Mania Rages As Money Supply Sizzles for the 9th Month! May 5, 2014

[20] Bangko Sentral ng Pilipinas U/KBs Remain Well-Capitalized Against Risks May 14, 2014

[21] See Hard Lessons from the US Shopping Mall Bust February 10, 2014

[22] Ludwig von Mises The Economic Consequences of Cheap Money September 10, 2012 Mises.org

[23] See Has Macau’s Casino Bubble Been Pricked? May 15, 2014

[24] See The Philippine Casino Bubble April 11, 2014

[25] see Phisix: The Convergence Trade in the Eyes of a Prospective Foreign Investor November 11, 2013