I am delighted to say that despite some short term setbacks, global sentiment on free trade appears to be gaining significant ground over the long term, and importantly, remains a dominant theme for the world.

This from the Economist, (bold emphasis mine)

FAITH in the free market is at a low in the world's biggest free-market economy. In 2010, 59% of Americans asked by GlobeScan, a polling firm, agreed "strongly" or "somewhat" that the free market was the best system for the world's future. This has fallen sharply from 80% when the question was first asked in 2002. And among poorer Americans under $20,000, faith in capitalism fell from 76% to 44% in just one year. Of the 25 countries polled, support for the free market is now greatest in Germany, just ahead of Brazil and communist China, both of which have seen strong growth in recent years. Indians are less enthusiastic despite recent gains in growth. Italy shows a surprising fondness for markets for a place that is uncompetitive in many sectors. In France under a third of people believe that the free market is the best option, down from 42% in 2002.

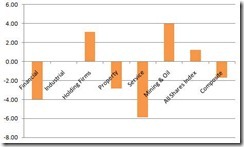

While free trade sentiment has skidded to low in the US, as a consequence of the crisis, the poll shows of an offsetting surge over most parts of the world.

A broader view of the poll shows this:

From Global Scan

Globescan.com writes, (bold highlights mine)

The results mean that a number of the world’s major emerging economies have now matched or overtaken the USA in their enthusiasm for the free market. The Chinese and Brazilians, 67 per cent of whom regard the free market system as the best on offer, are now more positive about capitalism than Americans, while enthusiasm in India now equals that in the USA, with 59 per cent rating the free market as the best system for the future.

Among the 20 countries polled in both 2009 and 2010, an average of 54 per cent today rate the free market economy as the best economic system, unchanged from 2009.

I am even more pleasantly surprised to see that the Philippines seems more “free market” oriented than some developed economies (e.g. Japan, Australia, France) or to some EM contemporaries (e.g. Indonesia).

Although operating from ground zero, I’d say that the free market sentiment may not be significantly accurate: many (even in the business community or in the elite academe or the media) don’t seem to understand or even resists the notion of free markets at all!

Some local 'free trade' experts see free markets more of a convenience or perhaps even a fad.

But there’s got to be some truth to this. that’s because probably the benefits of free trade (seen via globalization)—broader array of choices, cheaper and more affordable and quality and technologically enhanced products and services plus social mobility (tourism, migration) and more job or earning opportunities from external exposures (trade and remittances)—may have sublimely filtered to the sensibilities of the domestic populace.

Simply said, much of the world, including the Philippines, has been benefiting from increasing exposure to market economies and globalization.

And this has remarkably helped improved free market sentiments, mostly seen on the emerging markets which has been major beneficiaries of trade liberalization.

I am reminded of one of the champions of capitalism and free trade, the great Milton Friedman, in this historic interview about greed who said, (bold highlights mine)

Well first of all tell me, is there some society you know that doesn’t run on greed? You think Russia doesn’t run on greed? You think China doesn’t run on greed? What is greed? Of course none of us are greedy. It’s only the other fella that’s greedy. The world runs on individuals pursuing their separate interests. The greatest achievements of civilization have not come from government bureaus. Einstein didn’t construct his theory under order from a bureaucrat. Henry Ford didn’t revolutionize the automobile industry that way. In the only cases in which the masses have escaped from the kind of grinding poverty that you are talking about, the only cases in recorded history are where they have had capitalism and largely free trade. If you want to know where the masses are worst off, it’s exactly in the kind of societies that depart from that.