That’s the usual question posed by people who read articles about the grim political economic situation in the Eurozone.

Since the Greece debt crisis has began unraveling in 2009 (see timeline here), the Euro had initially been affected (see red arrows) but eventually as the price chart shows, the Euro has been discounting the issue.

This isn’t to say the crisis isn’t real, but rather the crisis is a relative issue. One cannot tunnel on Europe without looking at the conditions of the US or of the other economies.

I superimposed gold’s price trend to illustrate the strong correlation between the Euro and gold. My bullishness in the Euro had been validated (see here and here).

Now going back to the question

Here is my terse reply:

The Euro has been strong because the problems of the US dwarfs the crisis in Europe.

Proof?

From Danske Bank

The Euro has been validating the theory of the great Ludwig von Mises [Causes of Economic Crisis, Stabilization of the Monetary Unit—From the Viewpoint of Theory] who wrote, [emphasis added]

These observers do not understand that the valuation of a monetary unit depends not on the wealth of a country, but rather on the relationship between the quantity of, and demand for, money. Thus, even the richest country can have a bad currency and the poorest country a good one.

The above chart puts the entire global debt crisis predicament into perspective by showing how central banks has responded with ‘bailouts’ of their respective financial system

From the supply side, massively printing of money to resolve the debt issue represents the diminishing marginal value of additional money into the economic system.

Here the ECB has printed a lot less of money compared to the US Federal Reserve, perhaps owing to the trauma experienced from the hyperinflation of the Weimar Republic in 1921-23.

From the demand side, the quality and price value of securities absorbed and held in the balance sheets of the US Federal Reserve from the banking system during the crisis should be viewed as a continuing concern.

It’s a misplaced idea or belief that the seeming tranquil conditions today in the US be interpreted as the policy of inflation having successfully settled the legacies of the economic and financial crash in 2008.

The Fed has printed trillions yet home price indices appear to be in a double dip recession.

From yesterday’s S&P press release [bold highlight mine]

This month’s report is marked by the confirmation of a double-dip in home prices across much of the nation. The National Index, the 20-City Composite and 12 MSAs all hit new lows with data reported through March 2011. The National Index fell 4.2% over the first quarter alone, and is down 5.1% compared to its year-ago level. Home prices continue on their downward spiral with no relief in sight.” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “Since December 2010, we have found an increasing number of markets posting new lows. In March 2011, 12 cities - Atlanta, Charlotte, Chicago, Cleveland, Detroit, Las Vegas, Miami, Minneapolis, New York, Phoenix, Portland (OR) and Tampa - fell to their lowest levels as measured by the current housing cycle. Washington D.C. was the only MSA displaying positive trends with an annual growth rate of +4.3% and a 1.1% increase from its February level.

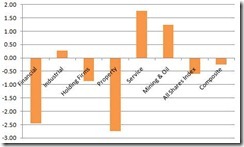

Chart from CLSA Greed and Fear

A double dip in home prices suggests that the value of the Fed’s assets have been deteriorating considering huge amounts of exposure on mortgage and agency papers.

So neither does this represent as a plus for the US dollar.

Add to that the unresolved fiscal issues.

So how will the US government act on the above? Quantitative Easing 3.0, 4.0, 5.0...nth? Will these make the case for a stronger US dollar relative to the Euro?

To argue so means that money printing won’t have negative effects on the US economy. This would be like believing in a philosopher’s stone—the alchemy of turning lead into stone.

Of course it’s also nonsense to believe in the argument that fiscal restraint or “austerity” as the sole or main basis for bearishness on the Euro, except when you see the world as being driven by “spending” alone. Yet this view appears gradually being disproven.

Putting one’s house in order should be seen as a virtue and not a vice.

Also the above discussion hasn’t been new, I have dealt with this before here

True, political events (the clash between the ECB and national officials) can undermine the Euro, but again the big picture, based on the above, says the balance of risks has been tilted against the US dollar.

And it isn’t in the political interests of both contending political entities to see a worsening of schism that would only undermine their statures and importantly their tenures.

As fund manager Axel Merk writes, (bold emphasis mine)

We have long argued that it is not in Greece's interest to default at this stage because Greece needs to get its primary deficit under control before restricting its debt. As further reforms are implemented, the risk/reward ratio for Greece will change to potentially favor a default to reduce its debt burden. Delaying any default benefits Greece because any default now would impose an immediate adjustment of the primary deficit as it may be impossible to get new loans at palatable terms.

However, if ECB deserts Greece, the risk/reward assessment for Greece is changing. If the ECB gets too tough on Greece, dynamics in Greece may drive political dynamics to favor a default or even a re-introduction of the drachma.

Mind you that this would not be in Greece's interest: a default now won't fix Greece's underlying structural issues. Leaving the eurozone might cause an implosion of Greece's financial system. But from Greece's point of view, if they feel deserted by the ECB, political dynamics may favor the worst of the bad choices at hand.

And that’s why a second round of bailout seems to be at work as of this writing. So both the US and the Euro will be inflating again and that the question would be which currency inflates more.

Popular analyst John Mauldin predicts “The euro appears to me to be a massive short.” I hope he puts his money on his forecast, and wish him a lot of good luck.

I’d be taking the opposite fence though, until I see signs of the Eurozone inflating more than the US or an imminent political instigated collapse of Euro.

However, instead of buying the Euro, the best position in my view, would be to buy gold.

Gold would not share the same risk of the Euro although both of them have paralleled each other’s moves.

Gold’s nemesis would be a fiscally disciplined limited government, sound money and free markets, forces which we won’t be seeing anytime soon yet.

![clip_image002[4] clip_image002[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjsFxwpSShobrMCoCyZEmM2K_DMdi0LEN50Z1Vl4x8ePW9vRFivrlr4-L_qyxs1WRUpmRXt8hxojK818sxnrbg_UE0PurSavO3TPJ_ihtAvix38VH4YbJaWOmRjjyRLLrXbtL6t/?imgmax=800)

![clip_image004[4] clip_image004[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgbjsf3MMlyRg78SMMi3bqpoiC5RhpIFVSm-ikJ43a3PKFuiZnczsTYQVh767Y1nceq-XRZusJ-ciDiiWdZCXNRHNnyal1UkG0WY0aXjlwI3hnmwqgfEXS_GYmpksb0lWSeI7Pj/?imgmax=800)