The Malaya reports

President Aquino appears unfazed by US President Barack Obama’s endorsement of House Bill No. 3596 or "Call Center and Consumers Protection Bill" pending in the US Congress saying it may be an election-related statement.

"We have to take into account that this is an election year but at the end of the day, like any other country, the US would want to make their companies more effective, more competitive, etc. and outsourcing is one of the keys towards that," Aquino said in an ambush interview at the EXL Service Philippines Site at the Mall of Asia in Pasay City.

"At this present time, I was made to understand, that this was an issue that was brought up during the last elections in America and from that time which was four years ago and now, the situation has not changed. Perhaps there isn’t that much of a danger," Aquino said.

"I will assume that it (BPO) will continue, hopefully it will not change because that is one of our sunrise industries," he said.

Aquino said there are no plans at the moment to lobby against the passage of the bill and that he prefers to "cross the bridge" only when the bill is passed.

It’s good to know that Philippine President Noynoy Aquino recognizes what looks like an election ploy. It really takes one to know one.

But it’s unfortunate that President Aquino, beneficiary of the outsourcing boom, would remain passive on this issue. Never mind if America’s turn to protectionism might indeed harm the industry. It would seem better to be bullied into submission. Yet fawn over with plans by the US to expand military presence here.

President Aquino doesn’t seem to realize that the divide-and-conquer and class warfare strategies have been the hallmark of the Obama administration.

As Mike Brownfield of the conservative Heritage Foundation writes,

Obama enacted a purely progressive agenda with his expansion of the state under Obamacare, his trillion-dollar stimulus bill, the government takeover of the auto industry, the proliferation of regulations under the Dodd-Frank regulatory reform bill, the crony capitalism of the Solyndra scandal, and the illegal appointments to the unrestrained Consumer Financial Protection Agency and the National Labor Relations Board. The result: Some 13.1 million Americans remain unemployed, job creation has been abysmal for much of the past three years, and the President’s promise to turn around the U.S. economy has gone unfulfilled.

The difference is that Mr. Obama’s progressive agenda, during this election season, seems to have transitioned from a moderate to hard line stance.

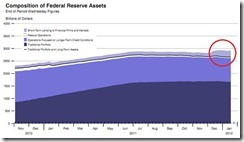

Maybe’s this also part of the desperation to get re-elected considering the Mr. Obama’s near record low approval rating. (chart from Gallup)

Yet here is more proof of President Obama's protectionist urge.

From the Wall Street Journal,

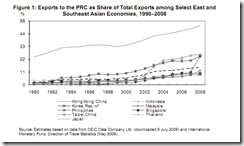

China was dragged into the 2010 U.S. midterm elections, and President Obama is busy ensuring that it will be an even bigger political target during the 2012 campaign. In Tuesday night's State of the Union address, the President joined Republican candidate Mitt Romney in singling out China as a special trade violator.

In announcing that he will set up a new Trade Enforcement Unit to investigate "unfair trade practices in countries like China," Mr. Obama is promising to increase investigations against Chinese exporters. His Administration has so far brought five cases against China in the World Trade Organization (WTO). Late last year it began targeting China's solar industry, while last week it said it would investigate Chinese makers of wind energy towers.

By the way one looks at it, protectionism has been rearing its ugly head as politicians like President Obama and the mainstream Republican candidates appeal to the emotions of the uninformed via nationalism/patriotism to solicit for their votes.

Many are unaware that economic nationalism (or protectionism) fundamentally underpins the philosophy of war or of military conflicts. World War II, for instance has mainly been caused by rabid nationalism.

Again current events have been affirming the admonitions of the great Ludwig von Mises,

Economic nationalism is incompatible with durable peace. Yet economic nationalism is unavoidable where there is government interference with business. Protectionism is indispensable where there is no domestic free trade. Where there is government interference with business, free trade even in the short run would frustrate the aims sought by the various interventionist measures…

What generates war is the economic philosophy almost universally espoused today by governments and political parties. As this philosophy sees it, there prevail within the unhampered market economy irreconcilable conflicts between the interests of various nations. Free trade harms a nation; it brings about impoverishment. It is the duty of government to prevent the evils of free trade by trade barriers. We may, for the sake of argument, disregard the fact that protectionism also hurts the interests of the nations which resort to it. But there can be no doubt that protectionism aims at damaging the interests of foreign peoples and really does damage them. It is an illusion to assume that those injured will tolerate other nations' protectionism if they believe that they are strong enough to brush it away by the use of arms. The philosophy of protectionism is a philosophy of war.

In short the President Obama’s war on outsourcing constitutes part of what seems to be an overall protectionist agenda, which translates to a war on trade against every nationality (including the Philippines).

President Aquino should negotiate to retain and expand free markets and abide by such principles. Otherwise, perhaps Marc Faber’s prediction may come true.