France holds its elections today with 10 candidates in contention. Currently all the leading candidates appear to be rabid interventionists and inflationists who appeals to class warfare, protectionism, anti-immigration and nationalist platforms,

Writes the Wall Street Journal, (bold emphasis mine)

Nicolas Sarkozy, the center-right incumbent, is proposing to shrink the budget deficit by raising taxes in the name of "solidarity." On top of his already-passed hikes in corporate and personal income taxes, and his 4% surcharge on high incomes, Mr. Sarkozy also promises an "exit tax" on French citizens who move abroad, presumably to make up for the revenue that goes missing when all those new levies impel high earners to leave the country.

As for the reforms on the lips of every other policy maker in Europe, Mr. Sarkozy makes some of the right noises but won't even go as far as the (mostly broken) promises he made in 2007. In a 32-point plan issued this month, he offers some labor reform but more proposals that are vague (creating a "youth bank" for enterprising young people) or off-point (promoting French language and the values of the Republic).

Mr. Sarkozy proposes reducing payroll charges paid by employers but would make up for it by increasing VAT and taxes on investment income. This assumes there will be investment income left in France once Mr. Sarkozy's financial-transactions tax goes into effect in August.

Mr. Sarkozy's campaign is particularly disappointing compared to the one five years ago. Promising a "rupture" with France's old ways, he told voters in 2007 that they could no longer afford a sprawling state that coddled its workers and drove away entrepreneurs. Yet this year he seems content to reinforce a French model that's even more broken than before. If Mr. Sarkozy retakes the Elysée next month, he will have done so by turning his back on the center-right resurgence that he once led to victory.

The President's Socialist rival is a throwback of a different sort. François Hollande's campaign has adopted a fiery old-left style that most had taken for dead after the Socialists' 2007 defeat. All of Mr. Hollande's major economic policy plans have roots in a punitive populism that would make U.S. Congressional class warriors blush. According to the latest polls, he leads Mr. Sarkozy 29%-24% in the first-round vote and by an even wider margin in the likely runoff.

Mr. Hollande says he's "not dangerous" to the wealthy—he merely wants to confiscate 75% of their income over €1 million, and 45% over €150,000. He is, however, a self-avowed "enemy" of the financial industry, and he plans to impose extra penalties on oil companies and financial firms. He'd also raise the dividends tax and impose a new, higher rate of VAT on luxury goods. All of this is necessary, Mr. Hollande says, to chop the massive debt that President Sarkozy has heaped upon France.

But swiping at Mr. Sarkozy's debt record hardly makes sense when Mr. Hollande's own spending plans would pile on still more borrowing. The Socialist candidate is playing Santa Claus, promising lavish new goodies to French voters while other euro-zone governments are pulling back.

Inside Mr. Hollande's gift bag: 60,000 new teaching jobs, new housing subsidies and rent controls, and increased public funding for small and medium enterprises. He would raise the minimum wage to €1,700 a month and enact a new law to prevent and fight layoffs. He also promises to reverse Mr. Sarkozy's most important domestic-policy victory: raising the retirement age to 62 from 60.

So national elections in France has the usual dynamics of prompting politicians to pander to the gullible masses especially to “free market hostile” voters.

Chart from the Economist

Among major economies, the French population has been most averse towards to the free market.

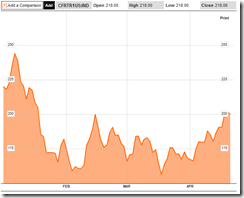

Nevertheless France’s major benchmark the CAC 40, as of Friday’s close, has largely given up its gains and has now been unchanged on a year to date basis, perhaps partly due to the lingering Euro crisis as well as uncertainties from the outcome of elections.

Such concern has likewise been manifested on Credit Default Swaps (CDS) or the cost to insure debt, where there has been recent amplified concerns over the credit quality of French debt papers.

In case the winning French politician actualizes rhetoric into interventionist policies, then we can expect lesser resources to be available for productive ends as more of these will be diverted towards political projects. This also means the likelihood of migration of capital out of the French economy (capital flight), as well as, a transition to a larger informal economy.

With a prospective French political spending binge amidst a debt crisis plagued Europe, this means policies of interventionism will need to be backed by inflationism. Yet if such actions becomes deeply entrenched, then today’s election may have sealed the fate of the Euro.

As the great Ludwig von Mises warned

An essential point in the social philosophy of interventionism is the existence of an inexhaustible fund which can be squeezed forever. The whole system of interventionism collapses when this fountain is drained off: The Santa Claus principle liquidates itself.

Or as former British Prime Minister Margaret Thatcher once said,

The problem with socialism is that eventually you run out of other people's money [to spend].