From Bloomberg,

The Philippines’ debt rating was raised to the highest level since 2003 by Standard & Poor’s, taking President Benigno Aquino nearer his goal of attaining investment grade.

The nation’s long-term foreign currency-denominated debt was raised one level to BB+ from BB, S&P said in a statement yesterday. That’s one step below investment grade and on a par with neighboring Indonesia. The outlook on the rating is stable.

The foreign currency rating upgrade reflects our assessment of gradually easing fiscal vulnerability,” Agost Benard, a Singapore-based analyst at Standard & Poor’s, said in the statement. “The rating action also reflects the country’s strengthening external position, with remittances and an expanding service export sector continuing to drive current- account surpluses.”

Emerging nations from Brazil to Indonesia have won credit- rating upgrades in the past year as governments contained budget deficits. A higher assessment for the Philippines will help Aquino as he moves to boost spending to a record this year and seeks $16 billion of investment in roads, bridges and airports to shield the economy from Europe’s sovereign-debt crisis.

This is exactly the reflexivity theory at work. Here is how I described it earlier

The foundation of this theory seems to be anchored on the confirmation bias, where changes in prices that reinforces the underlying trend, gives confidence or strengthens the convictions of people to undertake action in the direction of the same trend. Such action feeds into the price mechanism and thus the feedback loop.

Applied to the Philippine equity market, many people will interpret the current state of the Phisix, which is at fresh record levels, as positive changes in the real economy. Believers would see this as having raised confidence levels, which that merits further actions through additional investments. Again this eventually feeds into higher prices.

The reality is that whatever appearance of progress the Philippines has been experiencing has been impelled by internal (negative real rates) and external (negative real rates through Zero Interest Rate Policy, QEs and other forms of inflationism) monetary policies rather than real changes in the economy.

It would be a mistake to generalize surging prices asset markets as “economic improvement” when they are veiled symptoms of underlying bubble policies.

The other factor is about perceptions management. This can be called as PR work, or in political vernacular, propaganda.

Campaign to weed out corruption have mostly been superficial as these have not addressed the roots: arbitrary statutes. Unknown to the public, corruption is not about virtuosity but about the tentacles of crooked laws.

The huge informal sector and the reliance on OFW remittance are really NOT signs of progress. They are symptoms of regulatory failure.

The plight of the OFWs have converted into a publicity stunt meant to evince of a positive political light, when they are manifestations of the failure to create domestic jobs through stagnant investments and falling standards of living.

Look at media’s exaltation from the S&P upgrade…“higher assessment for the Philippines will help Aquino as he moves to boost spending to a record this year and seeks $16 billion of investment in roads, bridges and airports”…this is proof of the dearth of investments. Investors have been reluctant to provide capital, therefore jobs.

Yet the implication is that government spending is an elixir to the economy. In reality, this $16 billion of government spending will be taken off from the private sector. And this also means $16 billion money funneled to the cronies or political favorites of this administration. Also that would extrapolate to $16 billion of tax onus to the productive sector

So the S&P upgrade actually rewards cronyism and advocates more burden for the taxpayers.

What the S&P upgrade does is to SOW the seeds for future downgrades as the current administration goes into a spending binge.

Credit upgrades means only MORE debt acquisition by the Philippine government. This will be financed by the mostly the domestic banking sector and partly by foreign money (foreign banks). So more of local savings will be channeled into unproductive political ventures as public liabilities expand.

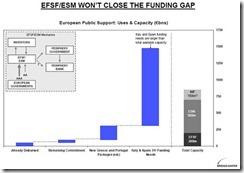

In the light of concerns over the growing shortages of global “safe assets”—government bonds, which in reality is a myth, I believe that credit rating agencies have been rushing in aid to the banking system of major economies in order to provide bridge “safe assets”.

Since the banking system of major economies have been in dire straits, they will be in need of “safe assets” to bolster their balance sheets. So emerging market debts, such as the Philippines, could provide temporarily some of the supply of “safe assets”.

Have we forgotten too that credit agencies had been party (or may I say functional stamp pads) to the US property and mortgage bubble which blew up in 2007-2008?

Also government debt spree will likely be accompanied by a private sector debt expansion on the belief of the sustainability of a boom or from capital flight from economies inflating away their debt problems or from “bridge” collateral or a combination of these.

So will likely there be a surge in hot money.

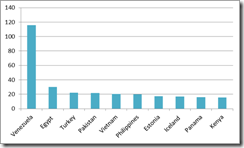

This would seem like a déjà vu of the Asian Crisis of the 90s (Wikipedia.org)

Thailand's economy developed into a bubble fueled by "hot money". More and more was required as the size of the bubble grew. The same type of situation happened in Malaysia, and Indonesia, which had the added complication of what was called "crony capitalism". The short-term capital flow was expensive and often highly conditioned for quick profit. Development money went in a largely uncontrolled manner to certain people only, not particularly the best suited or most efficient, but those closest to the centers of power

Eventually the entire thing collapses.

Only when the tide goes out, to quote Warren Buffett, do you discover who's been swimming naked.

Party on. But be aware that this is a bubble and not about politically driven progress. Politics is about redistribution or a zero sum game--where someone's gains comes at the expense of another.

It is the markets that provide real growth.

Updated to add:

Below is an example of why credit rating agencies cannot be trusted:

From Bloomberg,

Morgan Stanley successfully pushed Standard & Poor’s and Moody’s Investors Service Inc. to give unwarranted investment-grade ratings in 2006 to $23 billion worth of notes backed by subprime mortgages, investors claimed in a lawsuit, citing documents unsealed in federal court.

According to the plaintiffs, the documents reveal that what the ratings companies describe as independent judgments were actually unsupported by evidence and written in collaboration with the bank that was packaging the securities. Morgan Stanley and the ratings companies deny the allegations.