I have been saying that price controls functions as the alter ego or the twin sibling of inflationism where both operates under the umbrella of financial repression (euphemism legal plunder of people's resources via social policies).

I have also been pointing out that depending on statistics (historical data) to establish a theory can hardly be relied on because statistics does not capture real human events, and can be manipulated to serve political goals.

Here is how it works. First government inflates money supply via credit expansion. Next, the resultant higher prices will be blamed on “greed” on the private sector, thus, justifying price controls. Then government imposes price controls and other related restrictions.

Price controls effectively mutes statistical inflation. But on the other hand, price controls provides disincentives for producers to produce, thereby leading to goods shortages, and thus, leads to social deprivation and hardships.

At the end of the day, inflationism-price controls brings about economic crises and social unrest.

Cato’s Steve Hanke says the spreading use of price controls in Latin America, while reducing statistical inflation, has been depriving the public access to goods. (italics original)

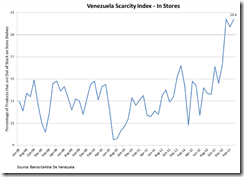

Argentina, Venezuela, and now even Ecuador have all embraced an unfortunate, if familiar, economic craze currently sweeping the region – price controls. In a wrong-headed attempt to “suppress” inflation, the respective governments have attempted to fix prices at artificially low levels. As any economist worth his salt knows, this will ultimately lead to scarcity.Consider Venezuela, where the government sets the price of a number of goods, including premium gasoline, which is fixed at only 5.8 U.S. cents per gallon. As the accompanying chart shows, 20.4% of goods are simply not available in stores.While price controls ostensibly keep the prices of goods on official markets low, they ultimately lead to empty shelves, depriving many consumers access to essential goods (such as toilet paper). This, in turn, leads to “repressed” inflation – given the price controls that exist, the “true” rate of inflation is held down, or repressed through Soviet-style government intervention. As the accompanying chart shows, the implied annual inflation rate for Venezuela (using changes in the black-market VEF/USD exchange rate) puts the “repressed” inflation rate at 153%.Likewise, Argentina is facing a similar dilemma (see the accompanying chart).In addition to scarcity and repressed inflation, price controls can lead to unintended political consequences down the road. Once price controls are implemented it is very difficult to remove them without generating popular unrest – just consider the 1989 riots in Venezuela when President Carlos Perez attempted to remove price controls.

This only proves my observations that Venezuela and Argentina, as enduring episodes of hyperinflation (the new generation of Zimbabwes), although at different stages; Venezuela is at a more advanced state relative to Argentina’s incipient phase from earlier stagflation.

I expect stagflation-hyperinflation to occur in many parts of the world as governments rely on the printing press and financial repression to advance their interests.