Global equity markets remain complacent even as the rampaging bond vigilantes have been prompting for mounting losses on the vastly larger interest rate and related (even derivatives) markets.

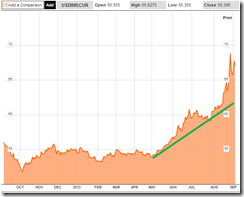

Last night the US and Euro based bond markets endured a massive selloff as manifested by substantial spikes in bond yields.

The contagion appears to have spread to Asian markets as of this writing.

Yields of 10 year US treasuries have fast been approaching 3%.

10 year UK bond yields pierced the 3% level and now has been at 2 year highs

Yields of German 10 year bonds are at one year highs

French 10 year bond yields soar past June highs and now also has been at 1 year highs.

Italian bonds seem as catching up.

And so with the yields of Spanish bond equivalent.

Yields of Japan’s 10 year bonds appear to be making a reversal.

China’s bond markets has also been reflecting on the global contagion where yields are at 2 year highs.

Mainstream media and the bulls say that we should “move along nothing to see here” promulgating a continuation of a risk on environment because rising bond yields are signs of “normalization”.

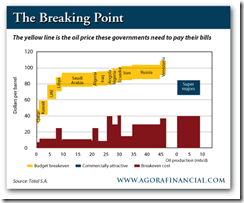

But there hardly seems anything "normal" with the unprecedented scaling up of debt levels as shown by government debt.

Government external debt levels and the average government debt as % of GDP seen from another perspective. Have you seen anything “normal”?

The only “normal” I can see has been one of an exploding global debt build-up amidst a low interest rate environment. The latter environment is facing a radical change as manifested by the actions in the global bond markets.

The broad increases of bond yields now effectively covers almost the entire spectrum of the US $ 99 trillion global bond markets where government bonds account for 43% share.

Global interconnectivity or interdependence (financial globalization) serves as transmission mechanism that would imply relative rising interest rates across the world.

And as I previously pointed out

This means that changes in global bond yields will also influence all these dynamics. That’s unless the Philippines operates in a vacuum or an imaginary world where prices have been stuck in a stasis.The bottom line is that changes in global bond markets, especially by the bond markets covering the big 4, will also influence domestic bond markets as well as interest rates.

When interest rates soar or when the cost of debt servicing grow faster than the ability of debtors to pay them, watch out.

The Wile E. Coyote moment is upon us. Expect the unexpected.