The consensus has basically downplayed almost all forms of risks in the face of a US inspired global stock market melt UP.

Yet the resurfacing turmoil in the interest rates markets in the Chinese economy suggests otherwise.

Newswires say that the Chinese central bank, the PBoC, has re-initiated a tightening of the monetary noose following the recent reports of a rise in ‘inflation’ [euphemism for the runaway credit fueled property bubble].

From yesterday’s Bloomberg:

China’s benchmark money-market rate jumped the most since July as the central bank refrained from adding funds to markets and corporate tax payments drained cash.The seven-day repurchase rate, a gauge of funding availability in the banking system, surged 47 basis points, or 0.47 percentage point, to 4.05 percent as of 4:21 p.m. in Shanghai, according to a weighted average compiled by the National Interbank Funding Center. That was the biggest advance since July 29. The overnight repo rate jumped 72 basis points, the most since June 20, to 3.80 percent.The People’s Bank of China has suspended selling reverse-repurchase contracts since Oct. 17, leading to a net withdrawal of 44.5 billion yuan ($7.3 billion) from the financial system last week. The authority asked commercial banks to submit orders today for 28-day repurchase contracts, 91-day bills, and 14-day reverse repos planned for tomorrow, according to a trader at a primary dealer required to bid at the auctions…The PBOC may lean toward tightening should there be an acceleration in consumer-price gains, Song Guoqing, a central bank academic adviser, said over the weekend. Inflation was 3.1 percent in September, the fastest pace since February.

The interest rate squeeze in the repo markets have likewise put pressure on the yields of China’s 10 year sovereign bonds (investing.com). Yields have reached 4.23% as of this writing from 4.2%.

According to a fresh Wall Street Journal report.

The yield on the benchmark 10-year bond hit 4.20% Thursday, the highest since it reached 4.60% in November 2007."Rising inflationary pressures, a rebound in economic growth and the central bank's shift toward a slightly more hawkish monetary policy have led to tighter liquidity conditions," said Chen Long, an analyst at Bank of Dongguan. "These have made bonds less attractive to investors."

The article blames ‘inflation’ partly to the recent surge in capital flows.

The PBOC's move also reflects an intention to offset the inflationary pressures created by surging capital flows into China, said Peng Wensheng, chief economist at China International Capital Corp.China's central bank and financial institutions bought a net 126.4 billion yuan of foreign currency in September, compared with 27.32 billion yuan in August, according to calculations by The Wall Street Journal based on central bank data issued Monday. These figures are viewed by most analysts as a proxy for inflows and outflows of foreign capital, as foreign currency entering the country is generally sold to the central bank. September is the second straight month of net purchase—after two months of net sales—suggesting continuing capital inflows.

Consumer Price ‘Inflation’, which are symptoms of credit fueled asset bubbles, essentially signifies a domestic dynamic as explained here. Existing bubble conditions have only lured foreign money or local money based overseas to piggyback on yield chasing activities.

Notice too that since the liquidity crunch last June, yields of Chinese bonds has been steadily rising.

Yet this comes in the face soaring debt levels and runaway property bubbles. In short, the Chinese economy looks very vulnerable.

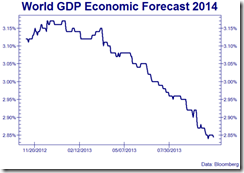

And my guess is that the Chinese political leadership have been aware of this and could be trying to put a brake on her homegrown bubbles since they have already accomplished attaining their statistical growth targets. (chart from FT Alphaville).

The June liquidity crunch has also been ventilated on China’s equity benchmark, the Shanghai Index.

Since the PBoC’s action during the last few days, the Shanghai index has once again manifested signs of renewed weakening.

Japan’s equity benchmark, the Nikkei 225’s sharp decline last June has also coincided with the China interest rate spike. We can note of a seeming resemblance today as the Nikkei has demonstrated signs of weakness.

As of this writing the Nikkei has been down by more than 2% while China’s stock markets are also in deep red (table from Bloomberg).

Bottom line: Underneath many complacent markets are many potential flashpoints (or booby traps) for a black swan event.

Also policymakers hold global financial markets by their necks. One moment policymakers decide to inject money to the system which incites a boom, the next moment the same policymakers withdraw money from the system that prompts for a selloff.

In other words, financial market’s mini-boom bust cycles reveal how they have been hostaged to the whims of political agents.

![[image%255B11%255D.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhGXldVYiudP7Z2-AuW7IaznC4reAq16oxzudSf9hTORnQge4Q_-tk5iIkg9Us45BU0l6CAuMUwa5T4ot4zPaM9riqFDY8w1Ipe-qMX8L7Fp6Pi1SJZDGTPj4b1KA2b8HKrA8kU/s1600/image%25255B11%25255D.png)

![[clip_image009%255B3%255D.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh5zLN_BZQ9W5f4txrRC6PqnBuhu4NkgrO6V5LYpnkhdpTbo-3qjcsdirIlUJV716ZCq6txnIk1Gq8TssDR13cqoa_7HDwjsvJK07caIhRIt8zsqev33CQAEmk7BQuKmFiYBHsP/s1600/clip_image009%25255B3%25255D.png)