Sad to see of what seems as escalating political instability around the world (mostly in emerging markets).

The backlash from hyperinflation by the Venezuelan government has become apparent as rioting has been intensifying.

First the crashing bolivar and spiraling price inflation.

Now writes Zero Hedge (bold original)

the situation in Venezuela has once again escalated as protest leader Leopoldo Lopez' arrest (and possible 10 year jail sentence) prompted more violence overnight. However, as we warned, the government crackdown is starting to raise concerns about the stability of the government.

The populist government recently even put a Happiness Ministry and promoted the public’s looting of “greedy”companies to enforce price controls.

The result has been obvious: the cumulative demand (printing money) and supply side (price controls) interventions has prompted businesses to refrain from operations. Thus all money printed by the government has emptied shelves and sent prices skyrocketing. The ensuing hunger now drives people into the streets. The riots even claimed the life of a Venezuelan beauty queen.

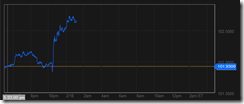

Nonetheless Venezuela’s stock market continues to remain buoyant amidst all the unrest as people use stocks as shield against a collapsing currency.

In Ukraine, anti-government protests seem to have turned into a civil war as the riots have now claimed 26 lives as of this counting.

One region the Lviv has even declared independence from the Ukraine’s government

It is easy to look at the riveting rivalry between areas supportive of Europe on the one hand and areas supportive of Russia as causing the current troubles.

But there may be more than meets the eye.

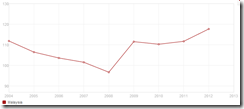

Ukraine’s currency the hryvnia has seen a massive devaluation in 2008 and remained at this level prior to the political upheaval. Currently the hryvnia has been sold off as rioting spread.

But there has been a sharp deterioration in external and domestic financing even prior to the unrest.

Ukraine’s government budget deficit has been widening since 2008. Ukraine has also swelling deficits in both trade and current accounts.

Over the same period, loans to the private sector has been exploding to the upside, which likely means both the private sector and the government contributing to broadening deficits in the merchandise trade.

Meanwhile Ukraine’s external debt has risen by almost 3.5x from 2006…

…as forex reserves plunge by almost half.

And soaring private and public sector loans has led to a spike in M3 from 2009 onwards.

And of course, driving all the soaring debt and money supply levels has been the same zero bound rates.

So Ukraine has been financing the splurge with debt which has resulted to the current financial and economic strains

And despite the so-called low inflation rate figures, what the above data suggests is that inflationism has driven a deep chasm to Ukraine’s fragmented society that has enflamed today’s violent riots.

Amazingly Ukraine’s easy money policies inflated a stock market bubble twice which also blew up in a span of 5 years. The above is a shining example of bubble driven volatility in both directions but with a downside bias.

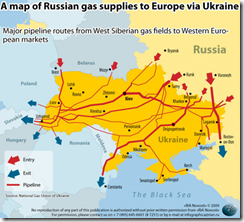

Ukraine is largely a commodity commodity and energy based economy. The shadow economy has been estimated to contribute to about 40%.

And energy geopolitics may have played a secondary role in the growing schism. The zero hedge quotes one analyst… (bold original)

BOTH the USA and EU will now fund the rebels as Russia will fund Yanukovych. At the political level, Ukraine is the pawn on the chessboard. The propaganda war is East v West. However, those power plays are masking the core issue that began with the Orange Revolution – corruption. Yanukovych is a dictator who will NEVER leave office. It is simple as that. There will be no REAL elections again in Ukraine. This is starting to spiral down into a confrontation that the entire world cannot ignore

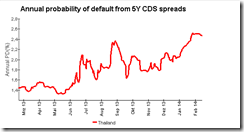

Political instability seem to percolate into emerging markets, as we see the same violence in Thailand, Saravejo Bosnia and Conakry Guinea, which represents troubling signs of contagion (from economic sphere to the political sphere).

Yet political problems in Thailand, Ukraine and Venezuela has a common largely "invisible"denominator: inflationism

The advocate of inflationism John Maynard Keynes saw of the destructive capacity of inflationism on society (yet ironically he still promoted this):

Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security but [also] at confidence in the equity of the existing distribution of wealth.Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become "profiteers," who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

Political instability in the above countries reveals how “Lenin was certainly right” on how inflationism destroys society.