Strictly unedited. I am in a hurry so I won’t be posting a quote for today.

It would seem as another victory lap for us considering that events continue to validate our assessment and prognosis of the markets.

Last week, we focused on several clues which possibly heralded on the next major move of the market over the short and medium term. This week highlighted the fulfillment of this short term prognosis.

This remarkable substantiation by the market of our analysis justifies as another “I told you so” moment.

Again, all signs have been in apparent consolidation, which prominently foretells of this rapturous pivotal moment of truth: bullish chart formation, rallying peso, improving market breadth, expanding bullish sentiment of both local and foreign investors, and now the transition from divergences to convergences in the price actions of global equity markets.

It has definitely been a rare instance to see all these variables move in harmony, which gives us further confidence to say that the next leg up should account for as a major move (barring any external shock)

The Causal Realist Approach versus Mechanical Charting

I would like add to my previous discourse about the ubiquitous brilliance of everyone during bullmarkets especially when applied to the value of charts.

As previously noted[1] charts should function as guidepost to measure theory. Charts should not be substituted for theory.

From a Mengerian causal-realist perspective, the search for cause-and-effect relationships or causal laws "exact laws" in the marketplace under the fundamental economic dimensions such as prices, wages and interest rates, as observed in reality should be the imperative analytical approach.

As Dr. Carl Menger wrote on the preface of his magnum opus[2], (bold highlights mine)

I have devoted special attention to the investigation of the causal connections between economic phenomena involving products and the corresponding agents of production, not only for the purpose of establishing a price theory based upon reality and placing all price phenomena (including interest, wages, ground rent, etc.) together under one unified point of view, but also because of the important insights we thereby gain into many other economic processes heretofore completely misunderstood. This is the very branch of our science, moreover, in which the events of economic life most distinctly appear to obey regular laws”

In other words, mechanical charting does not establish the cause and effect relationship of economic variables relative to the possible distribution outcomes that would be reflected on future prices.

Instead, mechanical charting assumes that all relevant information have been incorporated in past and present prices from where patterns and formations are used as the principal metrics to ascertain future prices or outcomes.

All these are based on historical determinism where past performance is presumed to sufficiently impute the necessary statistical relevance to produce high rates of predictive successes.

This echoes the highly flawed Efficient Market hypothesis[3] which sees financial markets as “financially efficient” which have been founded on Rational Expectations theory[4] which similarly sees errors as emanating from ‘random’ factors than from inherent knowledge asymmetry, in the assumption that “outcomes that are being forecast do not differ systematically from the market equilibrium results. As a result, rational expectations do not differ systematically or predictably from equilibrium results”.

With the way various government interventions has been distorting the distributional balance of the marketplace and the economy, information asymmetry has been magnified enough to undermine such assumptions—and this is precisely why boom bust cycles exists!

Warren Buffett has been right. There won’t be the investment savant Warren Buffett whom we know of, if financial markets resembled ‘efficiency’.

To quote Mr. Buffett[5],

I'd be a bum on the street with a tin cup if the markets were always efficient.

Investing in a market where people believe in efficiency is like playing bridge with someone who has been told it doesn't do any good to look at the cards.

It has been helpful to me to have tens of thousands (of students) turned out of business schools taught that it didn't do any good to think.

Bottom line: Each tool has its proper use.

The Causal Realist Perspective to the Phisix-Peso Momentum

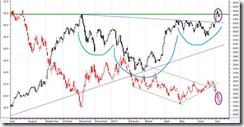

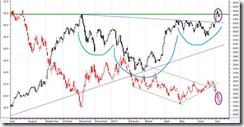

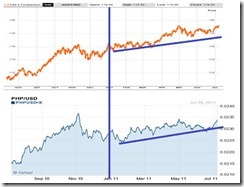

Applying the Causal-Realist approach to the local markets, a review of the Phisix chart (black candle) reveals that last week’s head and shoulder breakout (blue trend line and light blue arcs) was further confirmed by this week’s .92% advance (violet circle). Year-to-date, gains of the Phisix have accrued to 4.53% the highest for 2011.

However, the local benchmark attempted a similar breakout from the nominal all time high record set last November at 4,413 (green horizontal line) but apparently was repulsed by intra-week profit taking.

This resistance level poses as the NEXT TARGET which I think should be encroached anytime soon.

The Philippine Peso (red candle) further confirms the action of the Phisix.

The Peso’s continued rise vis-a-vis the US dollar decline appears to be representative of the relative demand for Peso assets. Part of this can be seen through the actions of foreign fund flows into the Philippine Stock Exchange. Fund flows can also happen to other domestic assets as real estate, bonds, FDIs or etc...

I pointed out last week that foreign buying manifested seminal signs of expansion as the Phisix crawled higher prior to these colossal breakouts.

This week, net foreign buying nearly trebled. This was apparently boosted by Metro Pacific Investment’s [PSE: MPI] $200 million (P 8.64 billion) private placement[6], half of which was subscribed by MPI parent First Pacific Co. of Hong Kong.

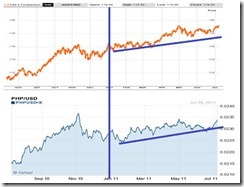

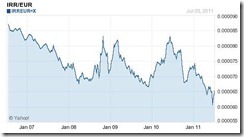

Yet the Peso’s action (yahoo lower window) seems congruent with the actions of Asia’s currencies.

The ferocious rally of the Peso (1.01%) this week was equally reflected on the Bloomberg-Reuters ADXY (a basket of Asian currencies, upper window) although the latter’s gain came at a much modest pace.

And the rally on Asian currencies seems to have been bolstered by net foreign inflows into the region. But this week’s inflows comes with a particular oomph for the Philippines, according to the Emergingmarkets.me[7] (bold emphasis mine)

Asia funds attracted the greatest volume of new money, totalling $634 mln and equal to 0.26% of AUM. China funds attracted $355 mln (0.4% of AUM), their best week since end April as investors were not put off by the disappointing PMI Manufacturing report and prospects for further rate rises. In terms of % of AUM, Philippine funds attracted the most new money equal to 12.4% of AUM[8] and Malaysia funds reported new money equal to 7.5% of AUM

This explains the significant role of the Peso’s outperformance.

Similarly the buoyancy of Asian currencies has been manifested on the equity markets where most of Asian bourses have posted advances.

ASEAN markets seem to have reconverged and has exploded this week.

Despite Thailand’s SET amazing 4.51% post election jump (red orange), the SET remains slightly off the recent highs compared to this week’s simultaneous breakouts of the Indonesia’s JCI (orange) and Malaysia’s KLCI (red).

Of course the Phisix (green) is just about to surpass the record threshold set last November, along with her neighbors.

As one would note, evidences all add up to suggest that this nominal resistance level, which the Phisix attempted to breakout, will likely be history in the coming sessions.

The reconvergences of ASEAN and Global Equity markets could be adding fuel to the bullish momentum.

Secondary Effects: Market Sentiment, Breadth and Sectoral Gains

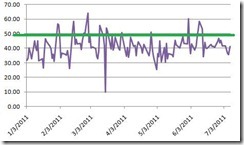

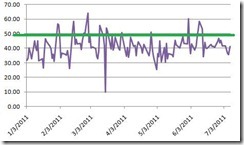

Despite the hefty gains by the Peso predicated on foreign inflows, local investors still dominates trading, the share of foreign transactions as % to total trade (in Pesos) remain below 50% (green line).

This implies that aside from the growing positive sentiment being exuded by foreign entities, locals have been net buyers, which also suggest that locals have been turning broadly sanguine.

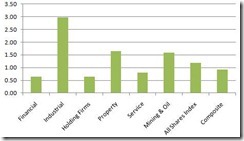

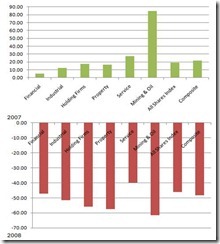

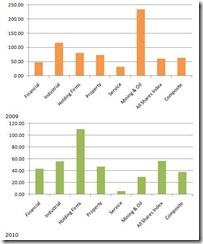

And this buoyant sentiment has been clearly reflected on the improvements in the sectoral performance, market internals and market breadth.

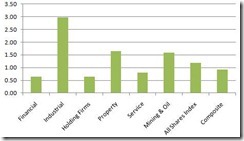

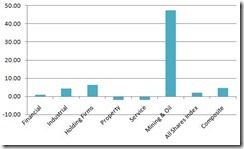

The advances have been broad based. Basically, ever sector posted gains.

However, the industrial sector vastly outclassed all other sectors powered by hefty gains of San Miguel, Petron and Universal Robina. In second place was the Property sector which had been followed by the mining and oil sector.

So apparently we seem to be encountering signs of the rotational process at work

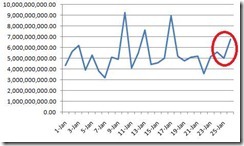

This brings us to Peso volume.

As I said last week, (bold emphasis mine)

A rising Phisix will induce more trades that will be reflected on volume expansion. That’s how reflexivity theory incentivizes people: As prices go higher more people will start chasing prices and higher prices will be read as improvements on economic and corporate output which will further lead to rationalizing of price chasing dynamics, hence, the feedback loop.

In further validation of our observation, the surge of the Phisix has been accompanied by a spike in Peso weekly volume. Although part of this jump can be attributed to the special block sales of the MPI.

We should expect the ascendant Phisix to be accompanied by higher volume. The growth in volume should confirm the strength and the continuity of the current uptick. [Of course we can argue how this reflexivity feedback mechanism will be financed. But this won’t be my story today]

Bottom line: All these demonstrates how the Austrian causal-realist theory is strongly being confirmed or supported by current market actions whether seen in the Peso or the Phisix or Asian equities and currencies.

These indicators seem to be reconverging to reinforce our prediction that momentum will strongly favor the bulls where a successful breakout from this nominal resistance level should posit that the Phisix will likely be headed for the 4,900-5,000 level at the end of the year.

And as with last week’s experience, no trend will move in a straight line.

We are likely to see vastly mightier upside actions than downside swings over a cumulative basis. Such actions will be represented through the price trends.

Yet barring any emergence of fat tail risk, we should expect this bullish momentum to continue.

Post Script: Seasonal Forces and US Consumer Credit Growth

As a final thought, some might argue that the strength we are seeing this July could signify as seasonal forces at work. And that the next two months, which traditionally represent the weakest seasonal link, could jeopardize or upset this evolving dynamic.

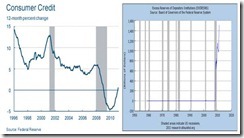

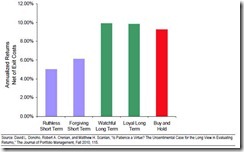

While seasonal factors may have some statistical influence over the markets over the past years, as shown in the chart above[9], which applies to the US and which would have a spillover effect to the Asian region, given today’s highly fluid environment where the marketplace has constantly been bombarded with all sorts of government interventionism, my impression is that the cumulative effects of these policies will tend to overrule the influences of seasonal forces.

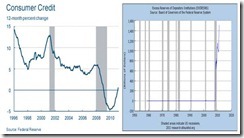

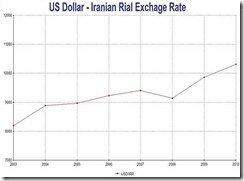

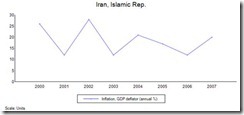

In addition it’s worth pointing out that consumer credit growth in the US has been vigorously expanding[10].

While others may see this as constructive, once the trillions of dollars in excess reserves held at (and created by) the US Federal Reserve for the banking system[11] (right window), will be converted into loans (probably consumer loans) then we should see further spike in inflation down the road (yes this means higher commodity prices). Thus, the current surge in US equities could be reflective of this inchoate symptom, which again could be a factor in taking precedence over seasonal forces.

[1] See I Just Can’t Get Enough: Philippine Phisix Emits Intensely Bullish Signals, July 03, 2011

[2] Carl Menger, Principles of Economics, Preface p. 49, Mises.org

[3] Wikipedia.org Efficient-market hypothesis

[4] Wikipedia.org Rational expectations

[5] Optimmumz.com Efficient market hypothesis

[6] Inquirer.net Metro Pacific raises P8.64B to finance infrastructure projects, July 8, 2011

[7] Weafer Chris WEAFER COMMENT: Equity fund flows: Keeping the faith…but hedging the specifics July 8, 2011 EmergingMarkets.me

[8] AUM means Assets Under Management.

[9] Chartoftheday.com Dow Average Monthly Gain

[10] Federal Bank of Cleveland Data Updates, July 8, 2011

[11] Federal Reserve Bank of St. Louis Graph: Excess Reserves of Depository Institutions (EXCRESNS)

![clip_image002[4] clip_image002[4]](http://lh3.ggpht.com/-DbMXhB0MxII/ThUEVz2K1CI/AAAAAAAAG2c/SaCRKzGSGwE/clip_image002%25255B4%25255D_thumb.jpg?imgmax=800)

![clip_image002[6] clip_image002[6]](http://lh5.ggpht.com/-4royrtj4bLU/ThUEWj49JPI/AAAAAAAAG2k/zyj9eKAe7_Y/clip_image002%25255B6%25255D_thumb.jpg?imgmax=800)