The interests behind the Bush Administration, such as the CFR, The Trilateral Commission -- founded by Brzezinski for David Rockefeller -- and the Bilderberger Group, have prepared for and are now moving to implement open world dictatorship within the next five years. They are not fighting against terrorists. They are fighting against citizens."-- Dr. Johannes B. Koeppl, PhD, former German defense ministry official and advisor to former NATO Secretary General Manfred Werne

I have gradually[1] been making made my case[2] for a Santa Claus-Chinese New Year rally for global equity markets and the resumption of the region and domestic inflation driven bullmarket.

Parameters for the Resumption of the Bullmarket

Essentially what I think will drive this rally will mainly be the cumulative credit easing and bailout policies, which will be seconded and or buttressed by seasonal forces going to the first quarter of 2012.

One must not forget that in developed economies, stock markets are partly seen as targets of monetary policies which underpins the ‘confidence’ factor that drives the orthodoxy’s perceived economic transmission from the fallacious theory of spending, based on the wealth effect multiplier.

Additionally, with the politically advantaged banking and financial sector’s substantial exposures to the stock markets, this implies that part of bailout mechanism will be channeled through policies supportive of global stock markets. In short, a bailout of stock markets signify as partly a bailout of the banking and financial sector.

In the US, in 2010, life insurance, pension funds, mutual funds and exchange traded funds accounted for 38% of net equity purchases by investor type[3]. Whereas household investors which comprises 36% of equity ownership, are the largest group of investors in funds and registered investment companies accounting for 23% of the household’s financial assets at the year-end 2010[4]

Yet, unknown to most, such bailout policies constitute as a redistributive mechanism from the real economy to financial markets. In short, looting society to save the banking and political elites.

Moreover, while I have ruled out the risks of recession in the US, I continue to maintain vigilance over the highly fragile developments of the Eurozone and on China.

So far China appears to be exhibiting tentative signs of economic recovery.

Signs of improvements in new orders and industrial production aside from moderating inflation rate, which in October fell to 5.5 percent from 6.1% the previous month—the biggest drop in the annual rate from one month to the next since February 2009 -- and a further pullback from July's three-year peak of 6.5 percent[5].

Some have been speculating that monetary tightening policies may come to a halt and even bring about greater chance of “a small easing in the reserve requirement ratio”[6]

Nevertheless, the recent slowdown which has affected some sector has forced China’s government to banks sell bonds to raise money for loans to small enterprises and tolerate higher rates of non-performing loans among other measures to encourage bank lending[7]. Further, the collapse of some manufacturers in Wenzhou, which I earlier mentioned[8], has forced the government to set up an emergency 1 billion yuan fund and launched an anti-loan shark campaign which led to the Oct. 27 arrest of a couple suspected of illegally raising 1.3 billion yuan

Overall like in the West, the intuitive response has been to provide liquidity to parties affected by the slowdown.

I have also outlined my parameters in ascertaining the impact of the aforementioned global policies on the financial markets and the respective economies which should either confirm or falsify on my expectations of a bubble cycle at work.

Here I pointed out that for a meaningful recovery to occur, ASEAN region’s stock markets in conjunction with the commodity markets should pick up the tempo and begin to outperform other financial assets. And such dynamic should also be supported by recovering US and global equity markets.

Internal dynamics should also support the resumption of the Phisix bullmarket. These should be seen in improvements in the volume of trading, Philippine Peso, foreign trade, sectoral performance and the general market breadth.

Global Ruling Elites Tightens Grip

Again the sharp vicissitude in the marketplace only proves how global political developments have become the dominant factor in driving investor sentiments, and equally, how financial markets have been transformed into a short-term oriented financial rollercoaster underwritten by casino like demeanor through the growing dependence on policy steroids.

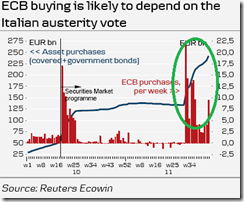

Last Wednesday, as Italian sovereign yields soared beyond 7% major global equity markets tanked[9].

Nevertheless, the losses has swiftly been neutralized as Greece has named former central banker Lucas Papademous as the new Prime Minister[10] the next day.

And as of this writing, Italy’s politics has Mario Monti[11], another Goldman Sachs adviser and who is also chairman of the David Rockefeller’s think tank, the Trilateral Commission[12] and a member of the highly enigmatic and exclusively for people with immense political clout, the Bilderberg group[13], has replaced Prime Minister Silvio Berlusconi[14].

Along with ECB President Mario Draghi[15], who has also been a Goldman Sachs alumnus, the Draghi-Papademous-Monti appointments appear to be growing evidence where global ruling elites appear to be flexing their political muscles to maintain their stranglehold over the crumbling welfare states.

And these are the same “behind the scene” working group, who mostly represents the heads of big banking houses, who played a major role in the establishment of the US Federal Reserve and whom has long been promoting a centralized foundation of fiat paper money standard system (a global central bank) and crony capitalism through statist laws.

As Hans-Hermann Hoppe in an interview with the Daily Bell recently said[16],

And they realized that their ultimate dream of unlimited counterfeiting power would come true only if they succeeded in creating a US-dominated world central bank issuing a world paper currency such as the bancor or the phoenix; and so they helped set up and finance a multitude of organizations, such as the Council on Foreign Relations, the Trilateral Commission, the Bilderberg Group, etc., that promote this goal. As well, leading industrialists recognized the tremendous profits to be made from state-granted monopolies, from state-subsidies, and from exclusive cost-plus contracts in freeing or shielding them from competition, and so they, too, have allied themselves to and "infiltrated" the state.

So it would signify as obtuseness for some to argue that adapting inflationary policies (e.g. devaluation) has been meant to attain “employment equilibrium” through adjustments on “real wages” using the money illusion, when evidence reinforces the political incentives behind all these.

The attempt to takeover control of EU’s political institutions looks increasingly like signs of desperation by global financial elites to preserve their politically enshrined privileges.

Going back to the equity markets, while expectations of the passage of the proposed austerity based reforms combined with hopes on the efficacies from technocratic based governance may have helped market sentiment to expunge earlier losses, in reality the driving force of the weekend gains has primarily been due to the European Central Bank’s intercessions whom has been acquiring Italian bonds to calm twitchy markets[17].

The point is that anytime the markets suffer from a convulsion whether in the US, Europe, Japan, China or elsewhere, the mechanical or impulsive response by central bankers has been to inject massive dosages of liquidity into the system or by manipulating or the easing of interest rates, which also means liquidity injections.

And as earlier pointed out, the easing process seems like a worldwide phenomenon.

To quote Morgan Stanley’s Spyros Andreopoulos & Manoj Pradhan[18]

Global re-easing is underway as the global central bank reacts to the risk of recession in the major economies. The central banks of Australia and Romania became the latest to cut policy rates this week, joining the central banks of Switzerland, Turkey, Brazil, Russia, Israel and Indonesia. G4 central banks have been active too, on the unconventional side. Mostly because of the lack of conventional room to ease, the Fed, the ECB, the BoJ and the BoE have all delivered unconventional packages. The result? An increase in the G5 excess liquidity metric we track, though liquidity in the BRICs has not yet turned thanks to China's monetary policy maintaining its position and a recent tightening from the RBI.

These cumulative easing measures being undertaken by global central banks are likely to buttress risk assets as equities.

Gold & Oil Signals Inflation Ahead

I have pointed out lasted week that gold prices seem to be indicating to us the liquidity conditions of the world.

My guess is that once gold prices breaks above the $1,800 psychological barrier, we will likely see a test of the recent record high which if successfully encroached would probably imply another test of the psychological $ 2,000 level. We may see $ 2,000 sometime early 2012.

There appears to be a developing ‘tight correlation of oil and of the US S&P 500’ as shown in the upper window of the chart above.

According to US Global Investors’ Frank Holmes[19]

The EIA says “the recent strong relationship between oil and equity prices resembles that seen during the economic downturn and recovery in 2008-2010.” According to EIA data, crude oil and the S&P 500 Index have had a positive correlation in 12 of the past 13 quarters. A positive correlation had not occurred once in the previous 35 quarters. In fact, crude oil and equities experienced a negative correlation during five quarters over that time period.

This implies if this oil-stocks correlation should hold, then rising US equity markets will be supported by higher oil prices.

In addition, the Brent-WTI oil spread which recently hit a record has been precipitously falling.

The widening spread of the Brent oil[20], which represents the international benchmark sourced from the North Sea and traded in London, compared to the WTI, the US benchmark, has been attributed to the glut of supplies from infrastructure restrained refinery system at Cushing Oklahoma which have been receiving inputs from expanding supplies of unconventional shale oil and bitumen[21] and partly due to growing demand from Asia, who imports[22] more of the region’s oil requirements from London.

While Bespoke Invest says that the narrowing spread could be because of the “lack of a meaningful rally in Brent North Sea crude”[23], I would add that the relatively faster increase in money supply in the US, which may partly translate to relative to stronger inflation driven “economic growth” could also serve as the cause.

Besides, the embattled Eurozone has just commenced to use their printing presses more aggressively. This means that the effects from such policies has yet to filter into their markets and economy. (chart from Danske Bank[24])

In other words, the inflationary momentum seems stronger in the US than in the Euro-Asia sphere.

Thus I expect such momentum to likewise be expressed in the relative performance of the global equity benchmarks.

Mixed Showing of ASEAN Bourses and the Phisix

This week’s volatility has not left ASEAN markets unscathed.

Instead this week’s market actions appear to have generated mixed results for the ASEAN-4.

The Philippine Phisix (PCOMP) and the Thailand (SET) posted modest gains, while Indonesia (JCI) and Malaysia (FBMKLCI) registered marginal losses, one should expect that if global central banks continue with this easing environment, then these markets should regain its lost footing and resume with their outperformance.

So far, it looks as if the recent highs made by the ASEAN bourses could be tested by the end of the year, if not during the first quarter of 2012.

Again we would like to see material improvements in the actions within the Philippine Phisix.

This week’s gains have yet to diffuse into the average daily Peso volume traded, market breadth and the Peso.

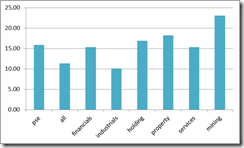

And the largely mixed showing can partly be seen in the sectoral performances where in 4 of the 6 industries, the top two gainers led by property and services has provided much of the weight of gains of the Phisix composite.

Another bright development is that while the Phisix wasn’t able to dodge the selloff in the Wednesday’s US-European equity markets, the magnitude of the decline was a lot less than the developed economy counterparts.

Investing in the Higher Order Stages of Production

So far, from the depth of September 26th shakeout, the mining index appears to have recovered most. This has been followed by the property index which apparently has been this week’s best gainer.

Although I am not sure which sector should give the best returns over the short term, I am predisposed towards what Austrian economics calls as the higher order stages of production or the capital goods industries, which are likely the beneficiaries of the business cycle, specifically, mining, property-construction and energy, as well as financials whom are likely to serve as funding intermediaries for these projects.

As the great Murray N. Rothbard wrote[25]

Now what happens when banks print new money (whether as bank notes or bank deposits) and lend it to business? The new money pours forth on the loan market and lowers the loan rate of interest. It looks as if the supply of saved funds for investment has increased, for the effect is the same: the supply of funds for investment apparently increases, and the interest rate is lowered. Businessmen, in short, are misled by the bank inflation into believing that the supply of saved funds is greater than it really is. Now, when saved funds increase, businessmen invest in "longer processes of production," i.e., the capital structure is lengthened, especially in the "higher orders" most remote from the consumer. Businessmen take their newly acquired funds and bid up the prices of capital and other producers' goods, and this stimulates a shift of investment from the "lower" (near the consumer) to the "higher" orders of production (furthest from the consumer) — from consumer goods to capital goods industries

Finally one can’t discount that volatile pendulum swings will remain a common trait of the financial markets as investors attempt to decipher on the political directions of crisis affected nations.

But so far political developments continues to point towards central bank policies taking the centerstage, which implies that for ASEAN equities which includes the Philippine Phisix, an inflation fueled boom phase of the current bubble cycle, is likely ahead.

[1] See Global Risk Environment: The Transition from Red Light to Yellow Light, October 30, 2011

[2] See Gold Prices Climbs the Wall of Worry, Portends Higher Stock Markets, November 6, 2011

[3] US Census Bureau Equities, Corporate Bonds, and Treasury Securities--Holdings and Net Purchases, by Type of Investor (December 31st 2010), 2012 Statistical Abstract

[4] ICI.org 2011 Investment Company Fact Book A Review of Trends and Activity in the Investment Company Industry

[5] Reuters.com China inflation, output create room for pro-growth steps, November 9, 2011

[6] von Mehren Allan Forecast update: Euro area in recession, US and China recover, Danske Research Global, November 9, 2011

[7] Bloomberg.com, China Credit Squeeze Prompts Suicides, Violence, November 7, 2011

[8] See More Evidence of China’s Unraveling Bubble?, October 16, 2011

[9] See Politically Driven Global Stock Markets Slammed Anew, November 10, 2011

[10] See Former Central Banker Papademos Is Greece New Prime Minister, November 11, 2011

[11] Wikipedia.org Mario Monti

[12] Wikipedia.org Trilateral Commission

[13] Wikipedia.org Bilderberg Group

[14] Bloomberg.com Berlusconi Resigns as Monti Prepares New Italian Government, November 13, 2011

[15] See Revolving Door Syndrome: European Central Bank’s New Head was Goldman Sach’s Honcho, June 25, 2011

[16] Hoppe Hans-Hermann The Mind of Hans-Hermann Hoppe, Mises.org, April 13, 2011

[17] CNN money Italian bonds on ECB life support, November 10, 2011

[18] Andreopoulos Spyros and Pradhan Manoj Global Re-Easing, November 7, 2011 Morgan Stanley Global Economic Forums

[19] Holmes, Frank The Many Factors Fueling a Return to $100 Oil, November 11, 2011 US Global Investors

[20] Wikipedia.org Brent Crude

[21] Vuk Verdan Understanding Oil Price Differences, August 19, 2011 Casey Research

[22] Fontevecchia, Agustino, Oil Prices: Brent-WTI Spread Above $22 And Here To Stay, July 8, 2011 Forbes.com

[23] Bespoke Invest Brent - WTI Spread Drops to Lowest Level Since June, November 10, 2011

[24] von Mehrn Allan Spotlight turns to Italy November 11, 2011 Weekly Focus, Danske Bank

[25] Rothbard, Murray N. How the Business Cycle Happens, September 6, 2005 Mises.org