The paradox of skill says that as people become more skillful in a given activity, luck becomes more important in determining the outcome. It seems backwards, but more skill equals more luck. —Michael Mauboussin, Chief Investment Strategist, Legg Mason as interviewed by Josh Wolfe

[Note: This will be my last stock market commentary for the year]

The correction from an overbought and overheated Philippine stock market has finally arrived. The Phisix fell 1.5% over the week, the first weekly decline in four.

The Phisix has already been emitting signs of having an overextended run.

As I wrote two weeks back[1]

However, given the steep ascent and overbought conditions by the Phisix, expect temporary corrections and possibly rotational activities.

I followed this up last week[2]

I believe that should an interim correction emerge from an overheated Phisix occur, then rotation dynamic will reinforce the current inflationary boom.

This week’s natural profit taking phase has indeed been accompanied by rotational activities.

The year’s only losing sector, mining-oil jumped 5% and stole the limelight from most of the previous outperformers.

This is inflationary boom at its finest.

Despite this week’s retrenchment, the Phisix remains technically overbought as shown above. Whether it is Relative strength index (RSI), moving averages or Moving Average Convergence-Divergence (MACD), all have chimed to suggest of a still overextended Phisix despite this week’s retrenchment.

Perhaps this could mean more profit taking sessions following the recent milestone high.

However given the bullish backdrop provided by monetary authorities in the Philippines and most especially by major developed economies, one can’t discount that inflation of asset prices could be rekindled or that corrections may be short-circuited

Nonetheless this week’s rotational activities towards the mining sector will likely herald the theme for 2013.

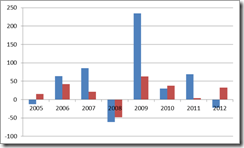

Although the mining oil industry did have two consecutive years of gains in 2006-2007, the mining-oil sector (blue) has practically been in an alternating leadership role with the Phisix (red) since 2007, a pattern that is likely to be extended in 2013.

Such pattern will most likely be supported from rallying international prices of commodities.

Nevertheless, the resumption of the commodity boom will be rationalized from the standpoint of a reflation of China’s bubbles, which will also likely be reinforced by a credit driven boom in emerging markets, a continuing inflation driven recovery of US real estate and from a local perspective—the possibility of political compromises between the Philippine government and the today’s politically persecuted industry which may happen after the May national elections in 2013.

Yet the biggest force that will drive the commodity prices will be continued easing policies by global central banks.

The US Federal Reserve’s Version of ‘Hotel California’

As early September, I have been saying[3] that the US Federal Reserve will aggressively expand on their balance sheet in order to finance the intractable but bulging fiscal deficits.

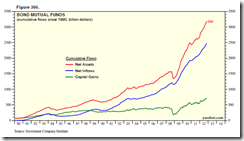

In spite of all the euphoria, the FED’s operations may likely be reaching a tipping point.The combined monthly $40 billion MBS purchases by US Federal Reserve, as well as, the $45 billion long term (10-30 year) US treasury bond buying from Operation Twist means that the Fed’s balance sheet is likely to expand to about $4 trillion by the end of 2013 from $ 2.8 trillion or an increase of about $1.17 trillion, according to Zero Hedge.Yet the sterilization measures by Operation Twist of selling $45 in short term bonds to offset the long end buying will likely end by this year as the Fed runs out of short term securities to sell.Essentially, roughly half of the US budget deficit will be monetized by the FED.

I predicted then that with the announcement of QE 3.0, the risk ON environment has been reactivated.

This week the US Federal Reserve basically confirmed my prognosis. Operation Twist had been converted into $45 billion a month of non-sterilized purchases of US treasuries or QE 4.0 under the unlimited QE scheme[4]. This would supplement QE 3.0 which has been programmed to acquired $40 billion a month of mortgage securities.

Together the two buying programs would add up to $85 billion a month which should expand the FED’s balance sheet to around $4 trillion in 2013, $5 trillion in 2014 and $6 trillion by 2016, in the assumption of the constancy of the program. But this looks unlikely as the FED may add to on to it sooner than later.

The FED has essentially doubled down on its QE policies. (chart from Casey Research[5])

Importantly, the FED has launched the grandest and boldest experiment by continually changing the parameters guiding the implementation of the said policies.

The Fed has now adapted what many call as the Bernanke-Evans rule[6] which ties such program to employment and inflation data. Chicago Fed President Charles Evans initially proposed 7 percent unemployment and a 3 percent inflation limit, but the Fed has modified this to 6.5% for the jobless rate and an implicit inflation target at 2.5% compared to the official target at 2%.

The latest policy essentially throws the initial 2015 year[7] target off the window by making ultra-low rates indefinite or open ended.

It is ironic to see the Fed anchor its policies on employment statistics, a variable which it does not control. The elixir of inflationism designed from econometric models by academic pedants linked to the MIT clique[8], will not solve the micro real world problems of interventionism.

Money printing and zero bound rates hardly provides any redress to lost incomes from businesses that will not emerge or that has become bankrupt due to the lack of business permits, mandated standards, and etc.., all manifested as anti-business policies channeled through political institutions—regulatory, bureaucratic and tax obstacles. The problems endured by Small Businesses, the largest employers of US economy, underscore this[9].

Instead since newly created money will have to flow somewhere and affect relative prices, such policies will inflate on global asset bubbles and realign production towards malinvestments.

As the great Austrian economist Friedrich von Hayek wrote[10],

But it seems obvious as soon as one once begins to think about it that almost any change in the amount of money, whether it does influence the price level or not, must always influence relative prices. And, as there can be no doubt that it is relative "prices which determine the amount and the direction of production, almost any change in the amount of money must necessarily also influence production

In addition, such policies magnify the risks of price inflation.

The newly constructed parameters of the QE policy can be seen as explicitly promoting price inflation. The editorial of the Wall Street Journal has a provocative rejoinder[11],

That is a 2.5% inflation target by any other name, and it's striking to see a central bank in the post-Paul Volcker era say overtly that it wants more inflation

The FED’s buying program has now been estimated to constitute about NINETY percent of US treasury issuance or “net new dollar-denominated fixed-income assets” by JP Morgan[12].

While price inflation may not yet be seen as clear and present danger, deep reliance on the FED in financing of US deficits fertilizes the already sown seeds of hyperinflation.

As Professor Peter Bemholz in his book Monetary Regimes and Inflation stated[13]

there has never occurred a hyperinflation in history which was not caused by a huge budget deficit of the state.

And that the inflationary impact from the transmission of the Fed’s buying of government bonds as explained by former and now mutual fund owner Professor John Hussman[14], (italics original)

It's tempting to think that somehow printing money means an increase in spending power, while issuing bonds means that the government is taking something in return for what it spends, but it's important to focus on the general equilibrium. In both cases, regardless of whether government finances its spending by printing money or issuing bonds, the end result is that the government has appropriated some amount of goods and services, and has issued a piece of paper – a government liability – in return, which has to be held by somebody. Moreover, both of those pieces of paper – currency and Treasury securities – compete in the portfolios of individuals as stores of value and means of payment. The values of currency and government securities are not set independently of each other, but in tight competition...To the extent that real goods and services are being appropriated by government in return for an increasing supply of paper receipts, whatever the form, aggressive government spending results in a relative scarcity of goods and services outside of government control, and a relative abundance of government liabilities. The marginal utility of goods and services tends to rise, the marginal utility of government liabilities of all types tends to fall, and you get inflation.This is important, because it means that the primary determinant of inflation is not monetary policy but fiscal policy.

And the trillions of dollars of banks reserves held at the FED may aggravate rather than cause the expanded risks of price inflation.

Even Dallas Fed President Richard Fisher has stated concerns over what he analogizes as “Hotel California” type of monetary policy[15]. By invoking the pop rock song popularized by The Eagles, Mr. Fisher said that the Fed’s “engorged balance sheet” may extrapolate to the FED as being able to "check out anytime you like, but never leave." In other words, the Fed seems TRAPPED from its own making.

This is not to suggest of the imminence of hyperinflation, rather this is to say that the continuity of present path policies increases the risks of such scenario.

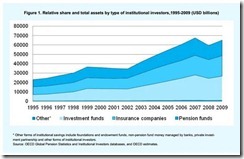

And this has not just been about the US Federal Reserve.

The ECB with their unlimited buying program already in place[16], via the Outright Monetary Transaction (OMT)[17] which will supposedly be fully sterilized (which I doubt) has now been dabbling with the idea of interest rate cut and even a negative deposit rate[18].

The FED’s doubling down on QEs simply suggests of the increasing desperation by political authorities in attempting to preserve the status quo.

Yet both programs espoused by FED and the ECB have been manifesting signs of diminishing returns.

The combined easing tools have been increasing in frequency and in size as the ‘positive effects’ have become smaller. This can be seen via the “days between unsterilized actions” where FED-ECB QE policies would likely enlarge on the size of their purchases possibly by the first quarter of 2013.

As the Zero Hedge notes[19], (italics original)

At the current average decay period of around 40% per action, we should see the ECB or Fed enact something new by around February 4th (just as the debt-ceiling comes to a head).

What to Expect: Asset Bubbles, Greater Volatility and Bullish Gold

What we can infer from the current policies:

-such policies would not affect market prices uniformly.

While newly injected money will inflate bubbles in the asset markets and in the real economy worldwide, the impact of such policies will vary across time, in scale, and in depth.

This should include the Phisix, the Peso, Philippine bond markets and the Philippine property bubble.

-financial markets could be susceptible to outsized volatility which could go on both directions but with an upside bias

-courtesy of the Fed’s policies, US bond markets have recently financed buybacks on the stock market that has led to the latter’s recent strength.

This implies that the fate of US stock markets and the bond markets and or even the housing markets may have been intertwined[20]. Tighter correlations imply greater contagion risks

-even if gold-silver has not moved as expected, this doesn’t mean that the foundations that has undergirded the 11 year bullmarket has been undermined.

To the contrary, the prospects of more increases in current expansionary policies, which should erode the purchasing power of money, should point to future gains of such hedges against currency devaluation.

Evidence suggest that gold prices may have departed from real world activities. Sales of physical gold have exploded to record highs[21]. Moreover central bank buying has been gathering steam, which seems on path to hit new highs this year (500 tons), along with record ETF gold holdings at 2,627 tons[22].

In addition, the broadening rally of commodities, particularly energy (DJUSEN Dow Jones oil and gas), agriculture (GKX) and industrial metals (GYX) seem supportive of higher prices precious metals.

Ironically too, just recently gold seems to be tracking the US dollar (vertical line) rather than rallying along with a firming euro. US dollar gold seems to have established a new correlationship. I would guess a temporary one.

Yet to claim that the present sluggishness of gold prices, which has not moved according to bullish expectations is “wrong” seems pretty much naïve. Such view can’t see beyond the developments outside of the ticker tape.

In reality, NO trend goes in a straight line. Yet gold prices managed to score 11 straight years of gains as of the end of 2011[23]. This could be the 12th. Year to date gold prices are up by about 8%. A year where gold underperforms doesn’t spell an end to the bullmarket.

Yet there may be some idiosyncracies (hedge fund liquidations, imbalances in the Commodity Futures’ Bank Participation Report[24] or others) that may be inhibiting current dynamics which might be resolved soon.

In the investing world, a perceived mistake should be addressed by liquidation and by moving on. If one sees gold’s current trend as having reversed, then the corresponding action should be to sell and transfer to other investments, or to short gold.

But that’s not I see things. Unless financial markets around the world start to weaken dramatically and simultaneously, current price infirmities should instead be seen as buying windows

[1] See Phisix at 5,600: Emergent Signs of Euphoria? December 3, 2012

[2] See E-Vat 15%: Possible Consequence from Current Quasi Boom Policies December 10, 2012

[3] See FED-ECB’s Nuclear Policies: Risk ON is Back! September 17, 2012

[4] See FED Converts Operation Twist to QE 4.0 December 13, 2012

[5] Bud Conrad, The Fed's QE4EVA Confirms Their Support for the Government's Deficit, Casey Research December 14, 2012

[6] NationalReview.com The Fed Now Playing by Its Own Rule, December 12, 2012

[7] Abcnews.go.com Federal Reserve Expects to Keep Interest Rates Low Through Mid-2015, September 13, 2015

[8] See Graphic of the Day: MIT Academes Govern World’s Money Policies December 13, 2012

[9] See Are Taxes and Regulations as Primary Business Obstacles a Myth? September 16, 2012

[10] Friedrich von Hayek, Prices and Production p.28 Mises.org

[11] Editorial of the Wall Street Journal The Fed's Contradiction, December 12, 2012

[12] Bloomberg.com Treasury Scarcity to Grow as Fed Buys 90% of New Bonds December 4, 2012

[13] Peter Bemholz Monetary Regimes and Inflation History, Economic and Political Relationships goldonomic.com p. 12

[14] John P. Hussman Ph. D. Inflation Myth and Reality, January 19, 2012 Hussman Funds

[15] CNBC.com Fisher: Fed Risks 'Hotel California' Monetary Policy December 14, 2012

[16] See ECB’s Mario Draghi Unleashes “Unlimited Bond Buying” Bazooka, Fed’s Ben Bernanke Next? September 7, 2012

[17] Guardian.co.uk ECB introduces unlimited bond-buying in boldest attempt yet to end euro crisis September 6, 2012

[18] Reuters.com ECB discusses rate cut, depicts bleak 2013, December 16, 2012

[19] Zero Hedge Chart Of The Day: The Collapsing Half-Life Of Unsterilized Central Bank Intervention December 12, 2012

[20] See How US Federal Reserve Policies Linked the Bond Markets with Equity Markets, December 13, 2012

[21] Zero Hedge The Chart That Keeps Ben Bernanke Up At Night, December 1, 2012

[22] Arabianmoney.com Central bank gold purchases to top 500 tons this year in a new record supporting prices

[23] Reuters.com Gold's 10 percent gain in 2011 extends run to 11th year, December 30, 2011

[24] Alasdair Macleod Are Precious Metals Futures Heading for a Crisis? ResourceInvestor.com December 11, 2012