Media, politicians and the US stock market operates in a cognitive dissonance. Cognitive dissonance is the confusion arising from the state of holding (Wikipedia.org) “two or more conflicting cognitions: ideas, beliefs, values or emotional reactions”

Here good news is seen as bad news.

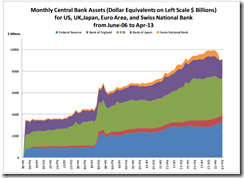

From the above account, one wonders whether the “growing” economy is really good or bad for stocks? Or whether “growth” has merely served as a cosmetic for the deepening addictions by the markets on the FED's steroids?

More rhetorical conflict of rhetoric from Media, Wall Street, and the US government;

A number said they were willing to taper bond buying as early as the next meeting on June 18-19 if economic reports show “evidence of sufficiently strong and sustained growth,” according to the record of the April 30-May 1 gathering released today in Washington.

“Most observed that the outlook for the labor market had shown progress” since the-bond buying program began in September, according to the minutes. “But many of these participants indicated that continued progress, more confidence in the outlook, or diminished downside risks would be required before slowing the pace of purchases would become appropriate.”

On the other hand, Ben Bernanke contradicts the above by stating that the economy doesn’t seem to be strong enough for premature withdrawal of stimulus

Federal Reserve Chairman Ben S. Bernanke defended the central bank’s record stimulus program under questioning from lawmakers, telling them that ending it prematurely would endanger a recovery hampered by high unemployment and government spending cuts.

“A premature tightening of monetary policy could lead interest rates to rise temporarily but would also carry a substantial risk of slowing or ending the economic recovery and causing inflation to fall further,” Bernanke said today in testimony to the Joint Economic Committee of Congress in Washington.

From Mr. Bernanke’s point of view, “premature tightening of monetary policy could lead interest rates to rise” implies the exposing of the risks of the highly leverage markets and economy. And that such tightening would extrapolate to a bubble bust or in economic gobbledygook “the risk of slowing or ending the economic recovery and causing inflation to fall further”

So essentially, people at the Fed have been talking at different wavelengths. Bernanke's discourse has been premised on the entrenched bubble conditions, whereas other Fed officials have used statistics to generate economic forecasts (or reading history as the future).

Thus Fed officials seem as clueless as to the real direction of the economy or of the markets. Or are they?

And a bollixed FED has been used by the stock markets as a reason to retrace. From intraday gains, US stocks went from green into the red yesterday (stockcharts.com)

Why is this important? Because, aside from direct and indirect interventions, the state of bewilderment of the causal process of the current environment by the media and political agents has contributed immensely to the skewing of price signals and to the accumulation of imbalances in the system. This has also been used to sabotage gold prices.

The annualised growth rate of the US economy in the first quarter was 2.5 per cent; the annual gain in earnings per share was 5.2%; the annualised gain in the market was 46%. Of course, as has been pointed out by the assiduous Marsh, Dimson and Staunton, or by Jay Ritter, there is no clear statistical link between GDP growth and equity returns at all.

The mainstream has now been recognizing this.

And as I have been pointing out this is not your daddy or your granddaddy's stock markets.

And more on why the current environment or the parallel universe is unsustainable, again from the Buttonwood… (bold mine)

The hope is that higher share prices can eventually produce a self-fulfilling cycle via a wealth effect (and on this note, the University of Michigan survey last week showed consumer confidence at a six-year high) or indeed on business investment. Mr Makin notes that real household net worth is up by about $4 trillion over the last year, helped by houses as well as stocks. He estimates the wealth effect at about 4% over a year; thus the boost to consumer spending was $160 billion, or 1% of GDP. This may indeed explain why US consumer have shaken off the effect of the rise in payroll taxes this year.

But the offset of this wealth effect is that the household savings rate fell to 2.6% in the first quarter, down from 5.1% in 2010. As Mr Makin points out, this is ominously similar to the pre-2007 pattern of high consumption based on the hope that asset prices would stay high. The potential long-term problem here is that asset prices tend to revert to the mean; people may be saving too little for their retirement on the view that markets will do all the work. As in 2007 and 2008, they may get a nasty shock later on. One could make quite a bearish case for US equities in the long run, on the grounds that share price valuations (as measured by the Shiller p/e) are higher than average and profits are at a post-1947 high as a proportion of GDP.

The lesson is whatever statistical growth seen from today is mostly a reflection of credit driven elevated prices of financial assets rather from real economic growth. The same holds true for the Philippines.

The mirage of statistical growth.

Hence Ben Bernanke realizes that any pullback of steroids would expose on this sham that would undermine the banking sector’s balance sheets.

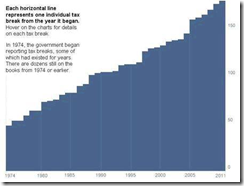

Also an ‘exit’ would also mean the pulling of the proverbial rag underneath the FED’s monetization of US debts which hardly anyone talks about.

Bottom line: The protection of the banking sector and the Fed’s financing of US government debt have been the main pillars that undergirds the FED’s credit easing policies. That’s why such “exit” or “withdrawal” blarney are what I call as poker bluff. The Fed cannot afford it.

IN withholding the truth, the Fed’s communication’s strategy seems as the guileful employment of cognitive dissonance in order to confuse the public.

Political language…is designed to make lies sound truthful and murder respectable, and to give an appearance of solidity to pure wind. One cannot change this all in a moment, but one can at least change one's own habits, and from time to time one can even, if one jeers loudly enough, send some worn-out and useless phrase — some jackboot, Achilles’ heel, hotbed, melting pot, acid test, veritable inferno, or other lump of verbal refuse — into the dustbin where it belongs.