Euro Commission officials has proposed to phase out small denomination coins. Such proposals follows other nations like Canada, Netherland and Finland whom has similarly embarked on extinguishing coins from circulation.

From Reuters:

Saving pocket change may not end the euro zone crisis, but the European Commission hopes that scrapping the smallest coins could help penny-pinching governments cut costs.The European Commission outlined proposals this week for the 17 euro zone countries to scrap their 1 and 2 cent coins, leaving 5-cent pieces as the smallest in circulation.The Commission says the cost of making the coins has exceeded their face value for the past 11 years, effectively costing member states 1.4 billion euros ($1.8 billion).More than 45 billion of the 1 and 2 cent coins have been minted since the euro entered circulation in 2002, but many are now buried behind sofas, lost in back pockets or left on the street rather than making their way to cash registers.While scrapping them all together may appear to make sense, some consumers worry that rounding prices up to the nearest 5 cents will prove inflationary. On the other hand, rounding prices down to the nearest 5 cents might be beneficial.

Some observations:

European officials admit that these coins have greater value than the designated official face value.

Here is the content of the euro coins, according to the Wikipedia.org

The euro 1 and 2 coins are two-toned. The "gold" is an alloy, 75% copper, 20% zinc and 5% nickel. The "silver" is cupronickel, 75% copper, 25% nickel. The 10, 20 and 50-cent coins are a proprietary alloy known as "Nordic gold", consisting of 89% copper, 5% aluminium, 5% zinc and 1% tin. The 1, 2 and 5-cent coins are copper-coated steel fourrées. The copper alloys make the coinage antimicrobial.

So for the EU bureaucracy to cut further losses, it has been alleged, coin production need to be halted.

Next, EU officials imply that the public has been unintentionally hoarding coins: “buried behind sofas, lost in back pockets or left on the street rather than making their way to cash registers”.

Authorities acknowledge that such coins have higher value, but they insinuate that their constituents, the average citizens, don’t see or realize this. So the public is completely ignorant from real world affairs.

Such is an example where authorities are engaged in what seems as rhetorical sophistry which media imbibes as the gospel of truth.

In reality, such proposal has been all about political subterfuge.

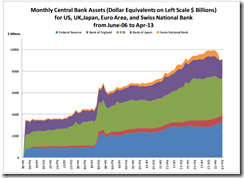

Even if the ECB has been inflating less than her peers, they have been inflating. (charts from Cumber.com)

Yet by holding coins, one’s resources will affected less from the stealth transfer of being wealth conducted through inflationist policies.

In other words, coins provides refuge against policies that facilitate indirect looting of people’s savings, especially during run away inflation.

Recognizing this, the German central bank or Bundesbank president Jens Weidmann in an interview at the Bild.ge indirectly expressed opposition on such proposals…

In the German population, the desire to hold on to the coinage. Personally, I can only agree with that.

This is natural given the trauma from horrors of the Weimar hyperinflation as shown by the coin above in stating that “On 15 November 1923 1 pound of bread cost 80 billion, 1 pound of meat: 900 billion, 1 glass of beer: 52 billion”

Albeit, Mr. Weidmann leaves the decision on reducing the circulation of coins to the EU finance ministers than to central bankers.

Again whether it is cash transactions, gold and other precious metals, crypto-currencies like bitcoins or even government made coins, world governments have been working around the clock to ensure forced access on people’s savings.

No comments:

Post a Comment