Reading media can be toxic to one’s intelligence.

Mainstream media applauds Japan’s statistical growth from “Abenomics”.

First, the statistics from he Bloomberg:

Japan’s economy expanded more than analysts estimated in the first quarter on gains in consumer spending and exports, building momentum for Prime Minister Shinzo Abe’s campaign for a sustained growth revival.Gross domestic product rose an annualized 3.5 percent, the most in a year, a Cabinet Office report showed in today in Tokyo. The median estimate of 36 economists in a Bloomberg News survey was for a 2.7 percent gain. In the fourth quarter, growth was a revised 1 percent. GDP rose 0.9 percent on quarter.

Then the flawed interpretation:

Japan’s surging stock market is making consumers feel wealthier, helping to fuel spending and growth in the world’s third-biggest economy. Now, Abe needs to convince businesses to invest and boost wages to pull the nation out of a decade-long deflationary funk, a challenge highlighted by a decline in company spending in the first quarter.

Surging stock markets in Japan can HARDLY make the consumers feel wealthier because only 6.8% of Japanese households own stocks according to the Bank of Japan as of December 2012.

Granted let us say that these may have grown, perhaps even doubled today. But how will the 15% of households logically be sufficient to make the entire economy grow? What about the 85%? Multiplier, where?

Now the self contradiction:

Consumers are spending while businesses have been reluctant to invest, “Abe needs to convince businesses to invest and boost wages”.

Great. Spending grows the economy. But businesses are not investing. Where are people getting the goods to spend on?

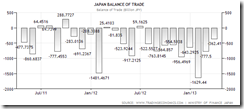

Obviously from imports. Japan’s trade balance has been in a deficit. (tradingeconomics.com)

What the Japanese has been doing is simply running down on their savings or drawing from their external assets and or accumulating debt to finance such spending.

How does spending without producing extrapolate to growth? If there are no businesses where will income be generated from? Who provides the money to spend?

Another article reinforces the supply side problem where today’s falling stocks signifies a shortfall in earnings expectations.

From the Bloomberg:

Most Asian stocks fell as Japanese banks declined after forecasting lower earnings, offsetting a report that Japan’s economy expanded faster than analysts estimated in the first quarter.

Media doesn’t tell us that devaluing money would prompt for lesser demand to hold cash by spending, by buying hard assets or by sending them abroad. Just ask the citizens of Argentina.

Media also doesn’t say that price distortions reduces the incentives for investors to invest because price instability impedes on economic calculation. If Abenomics intends to produce 2% inflation, what happens if inflation goes beyond it? McDonald's increased prices by about 25%, demand slumped. Rising petrol prices reduced fisherman's cost-benefit incentives to catch squid, thus a big shortage on squid. So how will uncertainties from unstable prices driven by policies motivate investments?

I earlier pointed to the financial losses incurred by Japan's McDonald’s even with the recent hefty hikes in prices of their products. Japan’s major multinational company Sharp Corporation similarly posted the biggest losses over the past 100 years!

Japan’s 3.5% statistical growth is a function of higher prices and not because more output. Printing money increases prices but not necessarily quantitative output. Real growth comes with output not from prices.

Besides as also previously pointed out living tax increases will frontload spending and thereby boosts spending over the interim.

What would really matter is the interest rate trends, particularly the 2-5 year JGBs. That’s because a continuous surge in yields would increase rollover and credit or default risks where 2-5 year maturing JGBs account for 76% and 60% in 2013 and 2014 respectively.

There has been a material increase in such yields over the month according to the table from Bloomberg

As said before, Abenomics operates in an incorrigible self-contradiction: Abenomics has been designed to produce substantial price inflation but expects interest rates at permanently zero bound. Such two variables are like polar opposites. Thus expectations for their harmonious combination are founded on whims rather from economic reality.

And this why whatever stock market boom we are seeing will eventually metastasize into a crisis that will shake the world, if these policies will be sustained.

As for media’s misrepresentation, Nassim Nicolas Taleb recently posted at Facebook this apt description:

Journalists cannot grasp that what is interesting is not necessarily important; most cannot even grasp that what is sensational is not necessarily interesting.

No comments:

Post a Comment