The worship of central banking as superheroes continues

From today’s Bloomberg headline: Swiss Seen Immune From Euro Recession as SNB Holds Firm

The Swiss National Bank (SNBN) has shielded the economy from the effects of the slump in the euro region with its currency ceiling of 1.20 francs per euro. Such a policy has helped ensure Switzerland suffered only one quarter of contraction since the cap was imposed in September 2011, and an unemployment rate about a quarter of that in the 17-nation bloc.

So far yes.

But what will be the long term costs of shielding the economy by massively expanding the SNB’s balance sheets?

Media believes in the philosopher's stone or of attaining something from nothing or that there are no costs from money printing.

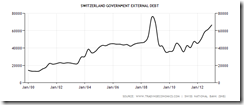

But the Swiss government and the SNB’s policies has prompted for a ballooning of external debt.

Likewise domestic credit to the Private sector continues to swell

Moreover the growth of domestic credit Provided by the Banking sector has been accelerating.

Swiss stock market measured by the SMI has been making a run but still short of the 2007 high. Above charts courtesy of tradingeconomics.com

Swiss housing prices continues to spiral higher. The reflexive feedback loop in play Higher prices, more debt. More debt. Higher prices

And the Swiss banking sector as % of GDP is about to 400% which ranks third only to France and Netherland.

Unless one comes to believe that interest rates will stay low forever, the crux of the question is how will all these measure up when interest rates rise?

No comments:

Post a Comment