Now we have a better picture of the ongoing selloffs in gold.

We have been told that overall demand of gold slumped during the first quarter to a nine year low, primarily due to Paper Exchange Traded Products (ETP) gold.

From Bloomberg: (all bold mine)

Gold demand dropped 13 percent to the lowest in nine years in the first quarter as record exchange-traded product sales by investors outweighed a surge in buying from China and India, the World Gold Council said.

Yet most of the selling in Paper gold has been US based. Same article...

Prices that rallied as much as sevenfold in the past 12 years entered a bear market last month as inflation failed to accelerate and as equities climbed on mounting optimism that the U.S. will lead a global economic recovery. Some investors’ loss of faith in gold as a protection of wealth is being reflected in ETP holdings that have declined every month this year. About 75 percent of the ETP sales were from U.S. products, the council estimates. The price slump boosted demand for coins and jewelry….Investors sold a record 182.1 tons of gold through ETPs in the three months through March, data compiled by Bloomberg show. Assets have since dropped another 230.1 tons, falling to 2,219.7 tons by May 14, the lowest since July 2011. Holdings are down 16 percent this year after increasing every year since the first product was listed in 2003.

The impression painted by the media is that buyers of jewelry and coins have not been due to monetary "purchasing power preservation" reasons. Only Wall Street people are qualified to be labeled as "investors".

On the other hand, falling prices have boosted demand for physical gold around the world

Global jewelry demand rose 12 percent to 551 tons in the latest quarter, as purchases jumped 19 percent to 184.8 tons in China and climbed 15 percent to 159.5 tons in India, the report showed. U.S. jewelry consumption was up 6.2 percent, the first quarterly increase since 2005, Grubb said…Total consumer demand in China jumped 20 percent to 294.3 tons, beating Indian consumption that climbed 27 percent to 256.5 tons, the council said. Bar and coin investment advanced 22 percent to 109.5 tons in China and rose 52 percent to 97 tons in India. While the council previously said China will probably overtake India as the biggest buyer on an annual basis, it expects Indian demand may reach about 965 tons this year, remaining above Chinese consumption of about 880 tons.“You may see a situation in the future where these two markets change places with each other on quite a regular basis,” said Grubb. “Before, it did look as if China was going to accelerate through India quite quickly and become the larger market for a sustainable period. I think that’s now much less clear. The good thing is you’ve got two big markets now.”Global coin sales were up 19 percent from a year earlier and bar demand rose 8.1 percent. Over-the-counter and stock flow demand, partly a statistical residual, was at 119.6 tons, compared with sales of 75 tons a year earlier, the council said. That left total investment little changed at 320.4 tons.

So essentially this reveals of the escalating conflict between Paper Wall Street gold versus Physical real gold: Wall Street versus the world.

Current activities validates my perception where paper gold sales in the US are being transferred to the physical market across the globe. More from the same article:

There’s a dichotomy here between what’s happened in the ETFs, which is mainly U.S. based, and what’s happened in OTC investment, which is more outside the U.S.,” said Grubb. The OTC estimate “suggests that some investors in other geographies were buying gold and they were doing it through allocated and unallocated bullion accounts. My hunch is that a lot of that increase in demand will have been outside North America.”

It’s not just physical markets though, emerging market central banks have remained as vigorous net buyers too

Central banks added 109.2 tons to reserves in the three months through March, a ninth successive quarter of net buying, the council said. Nations from Brazil to Russia added 534.6 tons to reserves last year, 17 percent more than in 2011 and the most since 1964, it estimates. Buying may be between 450 and 550 tons this year, Grubb said.

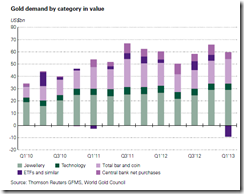

The chart, courtesy of the World Gold Council shows of the distribution of gold demand. It also has been a revelation of the current activities in the gold markets: Wall Street versus the world

Let us summarize: the major categories of gold demand specifically jewelry, bars and coins and central banks remain net buyers, whose rate of purchasing activities have been robustly growing even as prices fall.

Net sellers have mostly been ETFs which are 75% based on the US. Technology demand which is a fraction of the overall also posted a slight decline.

Bottom line: the current selling pressures in gold has MOSTLY been a Wall Street dictated affair.

So how large are the ETFs?

According to the World Gold Council’s latest report

As of end-March, total ETF gold holdings accounted for just 1% of the entire 175,000t above-ground stock of gold. The outflow of from ETFs in the first quarter, while sizeable and significant in its impact on the overall demand figures represents an equally small proportion of the overall stock gold held by private investors.

In the latest press release, the WGC confirmed the substance of the real markets over ETFs:

Marcus Grubb, Managing Director, Investment at the World Gold Council commented:“The price drop in April, fuelled by non-physical moves in the market, proved to be the catalyst for a surge of buying that has left many retailers short of stock and refineries introducing waiting lists for deliveries. Putting this into context, sales of bars and coins, jewellery and consumption in the technology sector still make up 81% of the market

And who are these ETP/ETF holders?

Wall Street people like George Soros, Blackrock Inc. and etc.…

If ETF products are just a smidgen of the overall markets how can they negate the influence of the much larger physical real markets?

The answer: through leveraged derivatives gold markets

Former Assistant Secretary of the US Treasury Paul Craig Roberts at the lewrockwell.com explains:

The price of bullion is not set in the physical market where individuals take delivery of bullion purchases. It is set in the paper futures market where short selling can drive down the price even if the demand for physical possession is rising. The paper gold market is also the market in which people speculate and leverage their positions, place stop-loss orders, and are subject to margin calls.When the enormous naked shorts hit the COMEX, stop-loss orders were triggered adding to the sales, and margin calls forced more sales. Investors who were not in on the manipulation lost a lot of money.The sales of GLD shares are accumulated by the banksters in 100,000 lots and presented to GLD for redemption in gold acquired at the driven down price.The short sale is leveraged by the stop-loss triggers and margin calls, and results in a profit for the banksters who placed the short sell order. The banksters then profit again as they sell the released gold into the physical market, especially in Asia, where demand has been stimulated by the sharp drop in bullion price and by the loss of confidence in fiat currency. Asian prices are usually at a higher premium above the spot prices in New York-London.Some readers have said “don’t bet against the Federal Reserve; the manipulation can go on forever.” But can it? As the ETFs such as GLD are drained of gold, their ability to cover any of their obligations to investors diminishes. In my opinion, these ETFs are like a fractional reserve banking system. The claims on gold exceed the amount of gold in the trusts. When the ETFs are looted of their gold by the banksters, the gold price will explode, as the claims on gold will greatly exceed the supply.Kranzler reports that the current June futures contracts are 12.5 times the amount of deliverable gold. If more than 8 percent of these trades were to demand delivery, COMEX would default. That such a situation is possible indicates the total failure of federal financial regulation.

12.5 times leveraged!! No wonder Wall Street can dictate on such terms.

Unfortunately, Wall Street cannot print gold. Physical gold buyers will demand possession.

Thus the ongoing fire sale in gold which also means shifting ownership from Wall Street to the world, would eventually translate to less leverage for the former to manipulate on the gold markets

For now, Wall Street hope and prays that given their huge leverage, claims on Paper gold will not be transformed into demand deliveries.

No comments:

Post a Comment