Central Banks are in a record spree of slashing interest rates.

Notes the Central Bank News:

Global interest rates fell further last month as eight central banks eased their policy stance - most notably the Bank of Japan with its “new phase of monetary easing” - pushing the average global monetary policy rate down to 5.70 percent at the end of April from 5.79 percent at the end of March and 6.2 percent at the end of 2012.Central banks cut their key rates by a total of 774 basis points in April, the highest monthly amount this year, boosting this year's total rate cuts to 1876 basis points.

Central bankers continue to believe that zero bound rates will spur the economy.

But there has been little evidence on these.

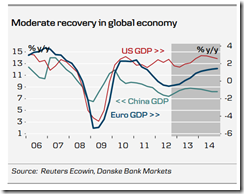

Danske Bank believes that it will work, even if Euro and China’s economic growth rate have been on a decline since 2010 while the US economy zigzagged.

Despite their bullishness, the OECD’s leading economic indicator (LEI) also reveals of stagnation.

Meanwhile, the Zero hedge points to a Goldman Sachs outlook which sees a downside risk from the LEI.

In short, most of the bullishness has been wishful thinking.

The reality is that zero bound rates have produced nothing but marginal growth, if not stagnation, and a rapidly expanding debt.

Yet global central banks continue to force the issue. They don’t seem to realize that there is such a thing called diminishing returns.

Next, macro policies don’t address the real micro socio-economic problems: specifically policy obstacles on capital accumulation via voluntary trade and production.

On the contrary, zero bound rates which spawns price instability distorts economic calculation. Such policies instead promotes rampant speculation rather than productive activities.

So you have rising stock markets globally as shown by the MSWorld or the MSCI World (ex USA) Index, the emerging markets via the MSEMF or the MSCI Emerging Markets Free Index (EOD) and in Asia through the AAXJ or the iShares MSCI All Country Asia ex Japan Index Fund, even as global growth have been marginal or in stagnation.

Why invest when there has been big uncertainties on the direction of policies and prices? Why invest when all these raises the cost of doing business and increases the hurdle rate for the survival of businesses?

And why not trade financial markets instead when there has been implied or direct guarantees on them?

The parallel universe or financial market-real economy disconnect only means more capital are being misallocated on short term yield chasing debt expanding activities. Such parallel universe are manifestation of bubble cycles. This also means deepening of systemic fragility.

Yet political authorities continue to ante up on policies that don't work.

The thrust to abolish interest rate represents a fallacious doctrine embraced by policymakers who believe in the inflation elixir which have been based on "something for nothing concept" or the sham miracles of interventionism. All these will have bad consequences.

As the great Ludwig von Mises warned:

In the eyes of cranks and demagogues, interest is a product of the sinister machinations of rugged exploiters. The age-old disapprobation of interest has been fully revived by modern interventionism. It clings to the dogma that it is one of the foremost duties of good government to lower the rate of interest as far as possible or to abolish it altogether. All present-day governments are fanatically committed to an easy money policy.

No comments:

Post a Comment