Since 2010, each time the US economy showed some signs of strength, Fed officials talk about “exit” strategies or the communications strategy proposing policy changes by the reduction on the amount of stimulus applied to the economy. Such farcical routine I have repeatedly called as “poker bluffing”.

Recent record stock market highs, a conspicuous rebound in the housing markets and some indications of economic “recovery” has again prompted Fed officials to blather anew about paring down stimulus.

From Bloomberg

Chairman Ben S. Bernanke will probably reduce the Federal Reserve’s monthly bond buying in the fourth quarter to $50 billion from $85 billion as he begins to unwind record stimulus, economists said in a Bloomberg survey.Policy makers must find a way to slow the pace of purchases enough to signal confidence the economy is strengthening without prompting a sudden rise in interest rates, said former Fed economists Michael Feroli and Joseph LaVorgna. They said that probably means the Fed, which concludes a policy meeting today, will follow a three-step strategy to wind down bond buying.

How it seems so simple.

Yet since 2010, each exit blarney has led to the opposite outcome. The US Federal Reserve’s stock holding of US treasuries for instance continues to balloon. The recent jump includes QEternity.

At the end of 2012, 90% of US treasuries issued were bought by the US Federal Reserve.

As explained before, the exit talk is likely a sham because there are hardly enough savings (domestic or foreign) that the US government can tap to finance her spendthrift ways.

Whatever recovery seen in the US economy are symptoms of inflationary boom rather than a genuine economic growth. Yet another economic bust would mean more debt from more bailouts and more inflationism.

Besides, US financial markets have become almost entirely dependent on government support which signifies as a byproduct of the wealth effect theory that undergirds such easing policies.

The removal or even a reduction of such stimulus essentially would “pull the rug from under” the inflationary boom and undermine the current government debt financing mechanics that would stir such massive market and economic disorder and volatility. This would raise the spectre of the “deflation”, a market phenomenon which incumbent authorities have a rabid phobia on, as well as, raise the risks of a default.

Also such policy reversals would undermine the interests of the political class and those dependent on them, which is why incumbent political officials aren’t likely to resort to them, except as trial balloon or as part of the manipulation scheme for the continued suppression of gold prices

Nevertheless, Simon Black of the Sovereign Man eloquently enunciates why US Federal Reserve has been TRAPPED by their own actions on financing the US government or the monetization of US treasuries.

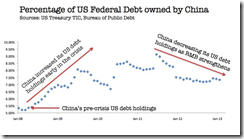

Now, bear in mind that US debt already exceeds 100% of GDP.Even using the US government’s own ridiculous budget projections (which assume 3.5% REAL GDP growth) Uncle Sam will still accumulate over $5 trillion in debt over the next decade.But here’s the thing– the current $16.75 trillion of US debt has an average maturity of just 65 months. This means that the US government will be on the hook to repay a huge chunk of its debt within the next 5 1/2 years.So in addition to issuing $5 trillion (optimistically) in new debt, they’ll also have to re-issue trillions more in existing debt.Someone is going to have to mop up all that debt. The question is… who?The Chinese are actually REDUCING their Treasury exposure as a percentage of total US debt (see chart). This is consistent with their objective to strengthen the renminbi.The story is the same with Japan at the moment, whose nominal US debt holdings have actually been decreasing.The US Social Security trust fund is also a major holder of US debt. Yet, according to the Washington Post, roughly 10,000 people EACH DAY become eligible to receive Social Security pension benefits.Given the increased outflows and high level of US unemployment (fewer people paying into the system), it’s doubtful that the Social Security trust fund will have sufficient cash to bail out the Federal government.This leaves the US Federal Reserve as the lone player to mop up all this debt. There simply are no other options; the US government will default in all likelihood, unless the Fed continues debauching the currency to buy Treasuries.

Yet the recent flash crash in gold has been used to justify calls from some quarters to indulge more rather than less inflationism.

Fed officials and their apologists will continue with their blandishments of steroid withdrawals but real political economic conditions suggests that all these represent as mere bluffs.

2 comments:

Thanks for the excellent article.

You write Whatever recovery seen in the US economy are symptoms of inflationary boom rather than a genuine economic growth. Yet another economic bust would mean more debt from more bailouts and more inflationism."

I comment that on Tuesday, April 30, 2013, Global ZIRP drove the S&P 500, world stocks, and nation investment to new monthly highs producing Liberalism’s peak sovereignty, peak seigniorage, and peak prosperity.

Global ZIRP is seen in World Treasury Bonds, BWX, Ultra High Yield Bonds, UJB, Junk Bonds, JNK, and Aggregate Credit, AGG, trading at an all time high, and is seen in the Interest Rate on the US Ten Year Note, ^TNX, trading at 1.67, which is just above its lows of 2013.

Monthly charts show World Stocks, VT, World Small Cap Stocks, VSS, Nation Investment, EFA, and Small Cap Nation Infestment, IFSM, traded to new highs. The daily chart of the S&P 500, $SPX, SPY, rose 0.25%, to close at a new all time high of 1997.47. The monthly chart of SPY, shows Global ZIRPs stunning stimulus beginning in January 2013 and lasting through the end of April 2013.

Jesus Christ, in dispensation, that is in the administration of the economy of God, Ephesians, 1:10, has used the world central bank’s monetary policies of easing to produce Global ZIRP which in turn has produced Liberalism’s Peak Wealth and Peak Prosperity by bringing investment completion and fullness to heavily indebted corporations, to corporations that are focused on banking and finance, leisure, booze production, entertainment, recreation, retail, gambling, vacationing and in vice in general. The Banker Regime’s Global ZIRP has produced the very final part, that is the very apex of Liberalism great crack up boom in wealth, VT.

Soon out of sovereign default, competitive currency devaluation, credit collapse, and financial system bust, as seen in bible prophecy of Revelation 13:1-4, the Beast Regime, where nannycrats such as Olli Rehn, will rise to rule the Eurozone,in Authoritarianism’s age of wildcat governance, yielding clubs of diktat, enforcing regional governance, debt servitude and austerity.

I do not see "Yet that another economic bust would mean more debt from more bailouts and more inflationism," rather I see the rise of regional governance, totaliarian collectivism, debt servitude, and labyrinthine measures of austerity

@theyenguy

Thanks for your comments

Post a Comment