This week, President Obama and Vice President Biden held a hastily arranged secret meeting with Federal Reserve Chairman Janet Yellen. According to the one paragraph statement released by the White House following the meeting, Yellen, Obama, and Biden simply “exchanged notes” about the economy and the progress of financial reform. Because the meeting was held behind closed doors, the American people have no way of knowing what else the three might have discussed.Yellen’s secret meeting at the White House followed an emergency secret Federal Reserve Board meeting. The Fed then held another secret meeting to discuss bank reform. These secret meetings come on the heels of the Federal Reserve Bank of Atlanta’s estimate that first quarter GDP growth was .01 percent, dangerously close to the official definition of recession.Thus the real reason for all these secret meetings could be a panic that the Fed’s eight year explosion of money creation has not just failed to revive the economy, but is about to cause another major market meltdown.Establishment politicians and economists find the Fed’s failures puzzling. According to the Keynesian paradigm that still dominates the thinking of most policymakers, the Fed’s money creation should have produced such robust growth that today the Fed would be raising interest rates to prevent the economy from “overheating.”The Fed’s response to its failures is to find new ways to pump money into the economy. Hence the Fed is actually considering implementing “negative interest rates.” Negative interest rates are a hidden tax on savings. Negative interest rates may create the short-term illusion of growth, but, by discouraging savings, they will cause tremendous long-term economic damage.Even as Yellen admits that the Fed "has not taken negative interest rates off the table," she and other Fed officials are still promising to raise rates this year. The Federal Reserve needs to promise future rate increases in order to stop nervous investors from fleeing US markets and challenging the dollar’s reserve currency status.The Fed can only keep the wolves at bay with promises of future rate increases for so long before its polices cause a major dollar crisis. However, raising rates could also cause major economic problems. Higher interest rates will hurt the millions of Americans struggling with student loan, credit card, and other forms of debt. Already over 40 percent of Americans who owe student loan debt are defaulting on their payments. If Federal Reserve policies increase the burden of student loan debt, the number of defaults will dramatically increase leading to a bursting of the student loan bubble.By increasing the federal government's cost of borrowing, an interest rate increase will also make it harder for the federal government to manage its debt. Increased costs of debt financing will place increased burden on the American people and could be the last straw that finally pushes the federal government into a Greek-style financial crisis.The no-win situation the Fed finds itself in is a sign that we are reaching the inevitable collapse of the fiat currency system. Unless immediate steps are taken to manage the transition, this collapse could usher in an economic catastrophe dwarfing the Great Depression. Therefore, those of us who know the truth must redouble our efforts to spread the ideas of liberty. If we are successful we may be able to force Congress to properly manage the transition by cutting spending in all areas and auditing, then ending, the Federal Reserve. We may also be able to ensure the current crisis ends not just the Fed but the entire welfare-warfare state.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, April 19, 2016

What Was the US Fed Chair Janet Yellen's Secret Meeting with US President Obama All About?

Thursday, September 03, 2015

US Stocks Buoyed by an Afternoon Delight Pump!

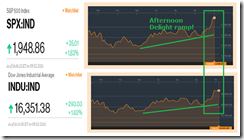

Let’s look at what happened to the stock market last week, and it’ll explain what I think those who audit the Fed need to look for.As you probably remember, stocks were headed for oblivion on Monday, Aug. 24. The Dow Jones industrial average was down 1,089 points early in the day before the index rallied for a close that was “only” 588 points lower.China’s problems. Weak US economic growth. Greece. The possibility of an interest-rate hike. Those and other issues were the root causes of last Monday’s woe.But Wall Street’s real problem is that there is a bubble in stock prices created by years of risky monetary policy by the Fed. Quantitative easing, or QE — the experiment in money printing that has kept interest rates super-low — hasn’t helped the economy (and even the Federal Reserve Bank of St. Louis concluded that). But QE did force savers into the stock market whether they wanted to take the risk or not.None of that is illegal.But the Fed now finds itself in the awkward position of having to protect the stock market bubble it created. So Yellen and her board of governors must have been pretty nervous when the Dow and other market indexes fell by an unprecedented amount on Aug. 24.Then, overnight, there was massive buying of Standard & Poor’s 500 Index futures contracts. This was the remedy proposed by a guy named Robert Heller back in 1989 just after he left the Fed board. The Fed, Heller proposed, should rig the stock market in times of collapse.Were those contracts being bought overnight by some Wall Street cowboy for whom potential losses in the disastrous market were of no concern? Or was it the Fed propping up the market?Stock prices initially reacted well to the mysterious overnight buying on Tuesday, and the Dow was up 442 points — until it wasn’t anymore. The blue-chip index finished Tuesday, Aug. 25, with a loss of more than 200 points.Then the same magical buying of S&P futures contracts happened Tuesday night and early Wednesday morning. Stocks again went up at the opening on Wednesday, but this time the gain held.

I guess the genius of Philippine stock market index manipulators have now been exported not only to China but to the US as well!

There's no denying that a collapse in stock prices today would pose serious macroeconomic challenges for the United States. Consumer spending would slow, and the U.S. economy would become less of a magnet for foreign investors. Economic growth, which in any case has recently been at unsustainable levels, would decline somewhat. History proves, however, that a smart central bank can protect the economy and the financial sector from the nastier side effects of a stock market collapse.

Don’t just stop at demanding for an audit on the Fed. End the Fed. Abolish the communist institution called central banking.

Thursday, April 16, 2015

Lady Protestor Disrupts ECB's Mario Draghi Speech, Shouts: “End ECB ‘dick-tatorship’”

Mario Draghi, the president of the European Central Bank, has been showered in confetti by a female protester who interrupted his monthly press conference in Frankfurt screaming: “End ECB ‘dick-tatorship’”.The woman, wearing a black T-shirt carrying the same slogan, clambered on top of the desk where Draghi was delivering his opening speech after the bank’s latest policy meeting. She threw a handful of papers at him, and sprinkled confetti into the air.It was unclear what point the protester hoped to make, but copies of the leaflets she was throwing, which later emerged on Twitter, accused the ECB of exercising “arrogance” and “autocratic hegemony”. She was identified by the police as a 21-year-old from Hamburg.

Thursday, January 29, 2015

Ron Paul: Lessons to Be Learned from Failed Central Bank Policies

Over the last 100 years the Fed has had many mandates and policy changes in its pursuit of becoming the chief central economic planner for the United States. Not only has it pursued this utopian dream of planning the US economy and financing every boondoggle conceivable in the welfare/warfare state, it has become the manipulator of the premier world reserve currency.As Fed Chairman Ben Bernanke explained to me, the once profoundly successful world currency – gold – was no longer money. This meant that he believed, and the world has accepted, the fiat dollar as the most important currency of the world, and the US has the privilege and responsibility for managing it. He might even believe, along with his Fed colleagues, both past and present, that the fiat dollar will replace gold for millennia to come. I remain unconvinced.At its inception the Fed got its marching orders: to become the ultimate lender of last resort to banks and business interests. And to do that it needed an “elastic” currency. The supporters of the new central bank in 1913 were well aware that commodity money did not “stretch” enough to satisfy the politician’s appetite for welfare and war spending. A printing press and computer, along with the removal of the gold standard, would eventually provide the tools for a worldwide fiat currency. We’ve been there since 1971 and the results are not good.Many modifications of policy mandates occurred between 1913 and 1971, and the Fed continues today in a desperate effort to prevent the total unwinding and collapse of a monetary system built on sand. A storm is brewing and when it hits, it will reveal the fragility of the entire world financial system.The Fed and its friends in the financial industry are frantically hoping their next mandate or strategy for managing the system will continue to bail them out of each new crisis.The seeds were sown with the passage of the Federal Reserve Act in December 1913. The lender of last resort would target special beneficiaries with its ability to create unlimited credit. It was granted power to channel credit in a special way. Average citizens, struggling with a mortgage or a small business about to go under, were not the Fed’s concern. Commercial, agricultural, and industrial paper was to be bought when the Fed's friends were in trouble and the economy needed to be propped up. At its inception the Fed was given no permission to buy speculative financial debt or U.S. Treasury debt.It didn’t take long for Congress to amend the Federal Reserve Act to allow the purchase of US debt to finance World War I and subsequently all the many wars to follow. These changes eventually led to trillions of dollars being used in the current crisis to bail out banks and mortgage companies in over their heads with derivative speculations and worthless mortgage-backed securities.It took a while to go from a gold standard in 1913 to the unbelievable paper bailouts that occurred during the crash of 2008 and 2009.In 1979 the dual mandate was proposed by Congress to solve the problem of high inflation and high unemployment, which defied the conventional wisdom of the Phillips curve that supported the idea that inflation could be a trade-off for decreasing unemployment. The stagflation of the 1970s was an eye-opener for all the establishment and government economists. None of them had anticipated the serious financial and banking problems in the 1970s that concluded with very high interest rates.That’s when the Congress instructed the Fed to follow a “dual mandate” to achieve, through monetary manipulation, a policy of “stable prices” and “maximum employment.” The goal was to have Congress wave a wand and presto the problem would be solved, without the Fed giving up power to create money out of thin air that allows it to guarantee a bailout for its Wall Street friends and the financial markets when needed.The dual mandate was really a triple mandate. The Fed was also instructed to maintain “moderate long-term interest rates.” “Moderate” was not defined. I now have personally witnessed nominal interest rates as high as 21% and rates below 1%. Real interest rates today are actually below zero.The dual, or the triple mandate, has only compounded the problems we face today. Temporary relief was achieved in the 1980s and confidence in the dollar was restored after Volcker raised interest rates up to 21%, but structural problems remained.Nevertheless, the stock market crashed in 1987 and the Fed needed more help. President Reagan’s Executive Order 12631 created the President’s Working Group on Financial Markets, also known as the Plunge Protection Team. This Executive Order gave more power to the Federal Reserve, Treasury, Commodity Futures Trading Commission, and the Securities and Exchange Commission to come to the rescue of Wall Street if market declines got out of hand. Though their friends on Wall Street were bailed out in the 2000 and 2008 panics, this new power obviously did not create a sound economy. Secrecy was of the utmost importance to prevent the public from seeing just how this “mandate” operated and exactly who was benefiting.Since 2008 real economic growth has not returned. From the viewpoint of the central economic planners, wages aren’t going up fast enough, which is like saying the currency is not being debased rapidly enough. That’s the same explanation they give for prices not rising fast enough as measured by the government-rigged Consumer Price Index. In essence it seems like they believe that making the cost of living go up for average people is a solution to the economic crisis. Rather bizarre!The obsession now is to get price inflation up to at least a 2% level per year. The assumption is that if the Fed can get prices to rise, the economy will rebound. This too is monetary policy nonsense.If the result of a congressional mandate placed on the Fed for moderate and stable interest rates results in interest rates ranging from 0% to 21%, then believing the Fed can achieve a healthy economy by getting consumer prices to increase by 2% per year is a pie-in-the-sky dream. Money managers CAN’T do it and if they could it would achieve nothing except compounding the errors that have been driving monetary policy for a hundred years.A mandate for 2% price inflation is not only a goal for the central planners in the United States but for most central bankers worldwide.It’s interesting to note that the idea of a 2% inflation rate was conceived 25 years ago in New Zealand to curtail double-digit price inflation. The claim was made that since conditions improved in New Zealand after they lowered their inflation rate to 2% that there was something magical about it. And from this they assumed that anything lower than 2% must be a detriment and the inflation rate must be raised. Of course, the only tool central bankers have to achieve this rate is to print money and hope it flows in the direction of raising the particular prices that the Fed wants to raise.One problem is that although newly created money by central banks does inflate prices, the central planners can’t control which prices will increase or when it will happen. Instead of consumer prices rising, the price inflation may go into other areas, as determined by millions of individuals making their own choices. Today we can find very high prices for stocks, bonds, educational costs, medical care and food, yet the CPI stays under 2%.The CPI, though the Fed currently wants it to be even higher, is misreported on the low side. The Fed’s real goal is to make sure there is no opposition to the money printing press they need to run at full speed to keep the financial markets afloat. This is for the purpose of propping up in particular stock prices, debt derivatives, and bonds in order to take care of their friends on Wall Street.This “mandate” that the Fed follows, unlike others, is of their own creation. No questions are asked by the legislators, who are always in need of monetary inflation to paper over the debt run up by welfare/warfare spending. There will be a day when the obsession with the goal of zero interest rates and 2% price inflation will be laughed at by future economic historians. It will be seen as just as silly as John Law’s inflationary scheme in the 18th century for perpetual wealth for France by creating the Mississippi bubble – which ended in disaster. After a mere two years, 1719 to 1720, of runaway inflation Law was forced to leave France in disgrace. The current scenario will not be precisely the same as with this giant bubble but the consequences will very likely be much greater than that which occurred with the bursting of the Mississippi bubble.The fiat dollar standard is worldwide and nothing similar to this has ever existed before. The Fed and all the world central banks now endorse the monetary principles that motivated John Law in his goal of a new paradigm for French prosperity. His thesis was simple: first increase paper notes in order to increase the money supply in circulation. This he claimed would revitalize the finances of the French government and the French economy. His theory was no more complicated than that.This is exactly what the Federal Reserve has been attempting to do for the past six years. It has created $4 trillion of new money, and used it to buy government Treasury bills and $1.7 trillion of worthless home mortgages. Real growth and a high standard of living for a large majority of Americans have not occurred, whereas the Wall Street elite have done quite well. This has resulted in aggravating the persistent class warfare that has been going on for quite some time.The Fed has failed at following its many mandates, whether legislatively directed or spontaneously decided upon by the Fed itself – like the 2% price inflation rate. But in addition, to compound the mischief caused by distorting the much-needed market rate of interest, the Fed is much more involved than just running the printing presses. It regulates and manages the inflation tax. The Fed was the chief architect of the bailouts in 2008. It facilitates the accumulation of government debt, whether it’s to finance wars or the welfare transfer programs directed at both rich and poor. The Fed provides a backstop for the speculative derivatives dealings of the banks considered too big to fail. Together with the FDIC's insurance for bank accounts, these programs generate a huge moral hazard while the Fed obfuscates monetary and economic reality.The Federal Reserve reports that it has over 300 PhD’s on its payroll. There are hundreds more in the Federal Reserve’s District Banks and many more associated scholars under contract at many universities. The exact cost to get all this wonderful advice is unknown. The Federal Reserve on its website assures the American public that these economists “represent an exceptional diverse range of interest in specific area of expertise.” Of course this is with the exception that gold is of no interest to them in their hundreds and thousands of papers written for the Fed.This academic effort by subsidized learned professors ensures that our college graduates are well-indoctrinated in the ways of inflation and economic planning. As a consequence too, essentially all members of Congress have learned these same lessons.Fed policy is a hodgepodge of monetary mismanagement and economic interference in the marketplace. Sadly, little effort is being made to seriously consider real monetary reform, which is what we need. That will only come after a major currency crisis.I have quite frequently made the point about the error of central banks assuming that they know exactly what interest rates best serve the economy and at what rate price inflation should be. Currently the obsession with a 2% increase in the CPI per year and a zero rate of interest is rather silly.In spite of all the mandates, flip-flopping on policy, and irrational regulatory exuberance, there’s an overwhelming fear that is shared by all central bankers, on which they dwell day and night. That is the dreaded possibility of DEFLATION.A major problem is that of defining the terms commonly used. It’s hard to explain a policy dealing with deflation when Keynesians claim a falling average price level – something hard to measure – is deflation, when the Austrian free-market school describes deflation as a decrease in the money supply.The hysterical fear of deflation is because deflation is equated with the 1930s Great Depression and all central banks now are doing everything conceivable to prevent that from happening again through massive monetary inflation. Though the money supply is rapidly rising and some prices like oil are falling, we are NOT experiencing deflation.Under today’s conditions, fighting the deflation phantom only prevents the needed correction and liquidation from decades of an inflationary/mal-investment bubble economy.It is true that even though there is lots of monetary inflation being generated, much of it is not going where the planners would like it to go. Economic growth is stagnant and lots of bubbles are being formed, like in stocks, student debt, oil drilling, and others. Our economic planners don’t realize it but they are having trouble with centrally controlling individual “human action.”Real economic growth is being hindered by a rational and justified loss of confidence in planning business expansions. This is a consequence of the chaos caused by the Fed’s encouragement of over-taxation, excessive regulations, and diverting wealth away from domestic investments and instead using it in wealth-consuming and dangerous unnecessary wars overseas. Without the Fed monetizing debt, these excesses would not occur.Lessons yet to be learned:1. Increasing money and credit by the Fed is not the same as increasing wealth. It in fact does the opposite.2. More government spending is not equivalent to increasing wealth.3. Liquidation of debt and correction in wages, salaries, and consumer prices is not the monster that many fear.4. Corrections, allowed to run their course, are beneficial and should not be prolonged by bailouts with massive monetary inflation.5. The people spending their own money is far superior to the government spending it for them.6. Propping up stock and bond prices, the current Fed goal, is not a road to economic recovery.7. Though bailouts help the insiders and the elite 1%, they hinder the economic recovery.8. Production and savings should be the source of capital needed for economic growth.9. Monetary expansion can never substitute for savings but guarantees mal–investment.10. Market rates of interest are required to provide for the economic calculation necessary for growth and reversing an economic downturn.11. Wars provide no solution to a recession/depression. Wars only make a country poorer while war profiteers benefit.12. Bits of paper with ink on them or computer entries are not money – gold is.13. Higher consumer prices per se have nothing to do with a healthy economy.14. Lower consumer prices should be expected in a healthy economy as we experienced with computers, TVs, and cell phones.All this effort by thousands of planners in the Federal Reserve, Congress, and the bureaucracy to achieve a stable financial system and healthy economic growth has failed.It must be the case that it has all been misdirected. And just maybe a free market and a limited government philosophy are the answers for sorting it all out without the economic planners setting interest and CPI rate increases.A simpler solution to achieving a healthy economy would be to concentrate on providing a “SOUND DOLLAR” as the Founders of the country suggested. A gold dollar will always outperform a paper dollar in duration and economic performance while holding government growth in check. This is the only monetary system that protects liberty while enhancing the opportunity for peace and prosperity.

Monday, January 19, 2015

Ron Paul: If the Fed Has Nothing to Hide, It Has Nothing to Fear

Since the creation of the Federal Reserve in 1913, the dollar has lost over 97 percent of its purchasing power, the US economy has been subjected to a series of painful Federal Reserve-created recessions and depressions, and government has grown to dangerous levels thanks to the Fed’s policy of monetizing the debt. Yet the Federal Reserve still operates under a congressionally-created shroud of secrecy.No wonder almost 75 percent of the American public supports legislation to audit the Federal Reserve.The new Senate leadership has pledged to finally hold a vote on the audit bill this year, but, despite overwhelming public support, passage of this legislation is by no means assured.The reason it may be difficult to pass this bill is that the 25 percent of Americans who oppose it represent some of the most powerful interests in American politics. These interests are working behind the scenes to kill the bill or replace it with a meaningless “compromise.” This “compromise” may provide limited transparency, but it would still keep the American people from learning the full truth about the Fed’s conduct of monetary policy.Some opponents of the bill say an audit would somehow compromise the Fed’s independence. Those who make this claim cannot point to anything in the text of the bill giving Congress any new authority over the Fed’s conduct of monetary policy. More importantly, the idea that the Federal Reserve is somehow independent of political considerations is laughable. Economists often refer to the political business cycle, where the Fed adjusts its policies to help or hurt incumbent politicians. Former Federal Reserve Chairman Arthur Burns exposed the truth behind the propaganda regarding Federal Reserve independence when he said, if the chairman didn’t do what the president wanted, the Federal Reserve “would lose its independence.”Perhaps the real reason the Fed opposes an audit can be found by looking at what has been revealed about the Fed’s operations in recent years. In 2010, as part of the Dodd-Frank bill, Congress authorized a one-time audit of the Federal Reserve’s activities during the financial crisis of 2008. The audit revealed that between 2007 and 2008 the Federal Reserve loaned over $16 trillion — more than four times the annual budget of the United States — to foreign central banks and politically-influential private companies.In 2013 former Federal Reserve official Andrew Huszar publicly apologized to the American people for his role in “the greatest backdoor Wall Street bailout of all time” — the Federal Reserve’s quantitative easing program. Can anyone doubt an audit would further confirm how the Fed acts to benefit economic elites?Despite the improvements shown in the (government-manipulated) economic statistics, the average American has not benefited from the Fed’s quantitative easing program. The abysmal failure of quantitative easing in the US may be one reason Switzerland stopped pegging the value of the Swiss Franc to the Euro following reports that the European Central Bank is about to launch its own quantitative easing program.Quantitative easing is just the latest chapter in the Federal Reserve’s hundred-year history of failure. Despite this poor track record, Fed apologists still claim the American people benefit from the Federal Reserve System. But, if that were the case, why wouldn’t they welcome the opportunity to let the American people know more about monetary policy? Why is the Fed acting like it has something to hide if it has nothing to fear from an audit?The American people have suffered long enough under a monetary policy controlled by an unaccountable, secretive central bank. It is time to finally audit — and then end — the Fed.

Thursday, June 26, 2014

Former Fed Chief Paul Volcker on the Gold Standard

There is an almost superstitious truculence on the part of world monetary elites to consider the restoration of the gold standard. And yet, the Bank of England published a rigorous and influential study in December 2011, Financial Stability Paper No. 13, Reform of the International Monetary and Financial System. This paper contrasts the empirical track record of the fiduciary dollar standard directed by Secretary Connally and brought into being (and then later administered by) Volcker. It determines that the fiduciary dollar standard has significantly underperformed both the Bretton Woods gold exchange standard and the classical gold standard in every major category.As summarized by Forbes.com contributor Charles Kadlec, the Bank of England found:When compared to the Bretton Woods system, in which countries defined their currencies by a fixed rate of exchange to the dollar, and the U.S. in turn defined the dollar as 1/35 th of an ounce of gold:

Sunday, November 17, 2013

Video: What it means to end Central Bank (Should we end the FED?)

What would it mean to "end the Fed"? Professor Larry White says that in order to know the effects of such a measure, we must first understand the role of "the Fed".The Federal Reserve is the central bank of the United States and the institution at the center of the nation's monetary and banking systems. It has five main functions, including controlling monetary policy. Could the United States even survive without the Federal Reserve?In order to answer this question, Professor White examines countries throughout history that did not have an established central bank, including Scotland, Sweden, Switzerland, and Canada. Hong Kong, he points out, still does not have one. So who performs the functions of a central bank in these countries?Professor White cites private institutions, including clearing house systems, banks, and financial companies, as the main actors in the monetary systems of countries without a central bank. Ultimately, Professor White concludes that the Federal Reserve is not necessary. Evidence shows that nations can survive without a central bank. What the Federal Reserve does well can be done even better by private institutions, and the institution is capable of serious errors.

Tuesday, August 06, 2013

Video: F.A. Hayek, on Milton Friedman, Monetarism and Monetary Policy

Statistics offer you a no substitute for the detailed knowledge of every single price relations to each other which really guide economic activities. That's a mistaken attempt to overcome our limited knowledge. (2:08)No government is capable of politically or intellectually providing the exact of amount of money which is needed for economic development (2:55)Abolishing the government monopoly to issue money would deprive government of the possibility of pursuing monetary policy. That's what I want (4:40)

Thursday, July 26, 2012

Do We Need Central Banks?

Tim Price at the Sovereign Man asks why the need for a central bank? (bold emphasis original)

A typical if feeble answer is that we need a lender of last resort. To which the answer is… Why? Why do we need a government-appointed entity to support banks that get in over their heads?

A typical answer is that if our banks start failing, our society starts going down the toilet. (It already has, but never mind.)

So now we have the worst of all possible worlds. Our banks are already failing, in the sense of no longer functioning according to the principles of offering an economic rate to depositors and offering economic funding to borrowers.

Plus, now we have ended up with a handful of quasi-nationalised banking group zombies that appear to be being run for the sole purpose of being granted dollops of money that they are free to hoard whenever the central bank deems it appropriate to depreciate our currencies some more.

If our banks were free to fail, a) we would have no need of a central bank, and b) we would have no need for banking guarantees.

Banking deposit agreements would simply come with a giant ‘Caveat Emptor’ on them, and depositors might be able to start earning a positive real interest rate on their savings again.

Abolishing central banks and their core functions would have the happy and non-trivial side effect of reintroducing something akin to sound money into the world economy, rather than live with permanent inflation and have the entire economy held hostage by banking interests.

In reality central banks exists as backstop financiers to the welfare-warfare state. For instance, wars has been facilitated and enabled by the existence of central banks.

Professor Gary North explains

The sinews of war are strengthened by central banking. This is why textbooks praise the Bank of England. It let the British fight longer wars and more destructive wars. The message: get a central bank for your nation, so that your politicians can declare war more readily and stay in that war far longer.

Central banks signify as central planning and the politicization of money. They are part of the 10 planks of Karl Marx’s Communist Manifesto.

Centralization of credit in the hands of the state, by means of a national bank with state capital and an exclusive monopoly.

Yes it's a delusion to equate capitalism with 'communist' central banking.

Central banks also promote the interests of the banking and political class at the expense of society through inflationism which not only causes boom bust cycles, but importantly has been diminishing the purchasing power of our currencies. This why a huge amount of the public’s resources have been funneled to insolvent “zombie” banks and bankrupt states.

And this is why once zombie institutions become desperate they resort to other measures of financial repression and take the political route towards despotism. And this is also why the private sector will always become the scapegoat for policy errors. That's until people don't understand the essence of central banking.

Yes, I agree Mr. Price, we need the de-politicization of money or the return to sound money through the free markets.

End the Fed. End all central banking.

Thursday, May 10, 2012

Ron Paul: Federal Reserve System is the Epitome of Crony Capitalism

Here is the gist of US congressman Ron Paul’s courageous talk before the Committee on Financial Services, Subcommittee on Domestic Monetary Policy & Technology, United States House of Representatives, May 8, 2012 (From Lew Rockwell)

Much confusion exists over what the Federal Reserve System actually is. Some people claim that is a secret cabal of elite bankers, while others claim that it is part of the federal government. In reality it is a bit of both. The Federal Reserve Board is a government agency, while the Federal Reserve Banks are privately-run government-chartered institutions, and monetary policy decisions are made by the Federal Open Market Committee, which has members from both the Board and the Reserve Banks.

The Federal Reserve System is the epitome of crony capitalism. It exemplifies the collusion between big government and big business to profit at the expense of the taxpayers. The Fed's bailout of large banks during the financial crisis propped up poorly-run corporations that should have gone under, giving them an advantage that no other business in the United States would have received. The bailouts continue today, as banks maintain $1.5 trillion worth of excess reserves at the Fed, reserves which were created through the Fed's purchase of worthless securities from banks. The trillions of dollars that the Fed has injected into the system have the goal of forcing down interest rates. But the Fed fails to realize that interest rates are a price, the price of money and credit, and that forcing interest rates down will only create an even bigger bubble and an enormous economic depression when this entire house of cards comes falling down.

The Federal Reserve is statutorily required to focus on three aims when engaged in monetary policy: full employment, stables prices, and moderate long-term interest rates. In practice, only the first two have received any attention, the so-called "dual mandate." Some reformers have called for the full employment mandate to be repealed, in order to allow the Fed to focus solely on stable prices. But these critics ignore the fact that stable prices are not a desirable goal. After all, with increasing productivity and technological innovation, the natural trend for most goods is for prices to decrease. By calling for the prices of goods to remain stable, the Fed would have to inflate the money supply in order to counteract this trend towards price declines, pumping new money into the system and creating economic distortions. This is exactly what happened during the 1920s, as the Fed's monetary pumping was masked by rising productivity. The result was stable prices, but the malinvestment caused by the Fed's loose monetary policy became evident by 1929. There is no reason to expect that focusing on stable prices today would have a dissimilar outcome.

Other reformers have called for changes to the composition of the Federal Open Market Committee, the body which sets the Fed's monetary policy objectives. On Constitutional grounds, the FOMC is undoubtedly problematic, as government appointees and the heads of the private Federal Reserve Banks work together to set monetary policy objectives that directly impact the strength of the dollar. While all of the members of the FOMC ought to be confirmed by the Senate, debates about the size of the FOMC or whether Reserve Bank Presidents should make up a majority of the members or whether they should even serve at all are largely a sideshow. While the only dissent to monetary policy decisions in recent years has come from Reserve Bank Presidents, there is no reason to think that expanding the FOMC to include more Reserve Bank Presidents would lead to any greater dissent or to any substantive changes to the conduct of monetary policy.

Another proposal for reform is for outright nationalization of the Fed or its functions. No longer would the Fed create money; that function would be taken up by the Treasury, issuing as much money as it sees fit. No longer would the Treasury issue debt to cover fiscal deficits, it would just issue new money to cover budget shortfalls. If what the Fed does now is bad, allowing the Treasury to print and issue money at will would be even worse. These types of proposals hearken back to the days of the first greenbacks, which the U.S. government began issuing in 1863. A pure fiat paper currency, unbacked by silver or gold, the greenbacks were widely reviled. Only once the greenbacks were made redeemable in gold were they accepted by the American people. The current system of Federal Reserve Notes is even worse than the greenback era in that there is no hope that they will ever be redeemable for gold or silver. The only limiting factor is that the Federal Reserve System only creates new money when purchasing assets, normally debt securities. Allowing the federal government to print money without at least a nominal check on the amount issued would inevitably lead to a Weimar-like hyperinflation.

So what then is the solution? The Fed maintains that a paper standard can be adequately managed without causing malinvestment, inflation, or other economic distortions. If the Fed were omniscient and knew the wishes, desires, and future actions of all Americans, this might be possible. But the Fed cannot possibly aggregate or act on the information necessary to engage in monetary policy. The actions of hundreds of millions of individuals, all seeking to better their position in life, acting purposefully towards that aim, cannot possibly be compiled into aggregates or calculated through mathematical equations or econometric models. Neither a single person, nor the members and staff of the FOMC, nor millions of people with millions of computers working in a new Goskomtsen will ever be able to accumulate, analyze, and act upon the information required to create a centrally planned monetary system. Centrally planned fiat paper standards such as the one currently in place in this country are doomed to failure.

This brings us to the question of the gold standard. The era of the classical gold standard was undoubtedly one of the greatest eras in human history. For a period of several decades in the late 19th century, largely uninterrupted by war, the West made enormous advances. Economic productivity increased, art and culture flourished, and living standards rose so that even the poorest citizens lived a life their forebears could have only dreamed of.

But the problem with the gold standard is that it was run by the government, which exercised a monopoly over monetary affairs. The temptation to suspend gold redemption, so often resorted to by governments throughout history, reared its head again with the outbreak of World War I. Once the tie to gold was severed and fiscal restraint thrown to the wind, undoing the damage would have required great fiscal austerity on the part of governments. Emancipated from the shackles of the gold standard, the Western world proceeded to set up a gold-exchange standard which lasted not even a decade before the easy money policies it enabled led to the Great Depression. While returning to the gold standard would certainly be far better than maintaining the current fiat paper system, as long as the government retains the power to go off gold we may end up repeating the same mistakes that occurred from 1934 to 1971 as the government went first off the gold coin standard and finally off the gold bullion exchange standard.

The only viable solution for monetary stability is to get government out of the money business permanently. The way to bring this about is through currency competition: allowing parallel currencies to circulate without any one currency receiving any special recognition or favor from the government. Fiat paper monetary standards throughout history have always collapsed due to their inflationary nature, and our current fiat paper standard will be no different. The Federal Reserve is currently sowing the seeds of its own destruction through its loose and reckless monetary policy. The day of reckoning may still be many years in the future, but given the lack of understanding on the part of the Federal Reserve's decision makers, it is quickly coming upon us.

Incidentally and ironically archrivals Ron Paul and Fed Chair Ben Bernanke had a face to face breakfast meeting the following day.

Here’s the Wall Street Journal Blog reporting on what transpired.

Still, Wednesday’s breakfast brought together two figures who publicly agree on very little. A longtime critic of paper currency and fan of the gold standard, Mr. Paul’s fiery Fed-bashing has enthused his campaign trail supporters, who often start rallies with loud chants of “end the Fed!”

Mr. Bernanke, meanwhile, dedicated a significant chunk of his first lecture at George Washington University in March to enumerating the flaws associated with a system in which the dollar is valued at a fixed price per unit of gold.

So did Wednesday’s meeting overturn any deep-set beliefs?

“He’s for the gold standard now,” joked Mr. Paul.

End the Fed. End Central Banking. End the politicization of money.

Thursday, April 26, 2012

An Austrian Economist’s Message to the US Federal Reserve: Lock the Doors and Leave the Building

Austrian economist Robert Wenzel in a stirring speech in front of central bankers at the New York Federal Reserve has a poignant message for them: Abandon Ship.

Mr. Wenzel's closing statement:

Let’s have one good meal here. Let’s make it a feast. Then I ask you, I plead with you, I beg you all, walk out of here with me, never to come back. It’s the moral and ethical thing to do. Nothing good goes on in this place. Let’s lock the doors and leave the building to the spiders, moths and four-legged rats.

Read Mr. Wenzel’s provocative speech here.

Video: Milton Friedman: Abolish the Fed! (2)

Unfortunately, as David Kramer points out at the Lew Rockwell Blog, while Mr. Friedman desired the elimination of the FED, he maintained a pro-central banking stance, which seemed a bizarre paradox.

Wednesday, March 28, 2012

US Federal Reserve Admits Bailout of the Eurozone

The US Federal Reserve finally admits or officially confirms of their bailout of the Eurozone

The Bloomberg reports,

Federal Reserve Bank of New York President William Dudley said that the central bank holds a very small amount of European sovereign debt and that he sees a “high bar” to additional purchases.

The standard for buying more European sovereign debt “is extraordinarily high for the U.S., for the Federal Reserve, to actually go out and buy foreign sovereign debt for its own portfolio, apart from the very small foreign exchange holdings that we have,” Dudley said today to a House Financial Services subcommittee hearing.

And US intervention in the EU has been no dollop, they consist of nearly hundred of billion of dollars of which ups the stake of US taxpayers on the EU. Well, billions in a bailout world of trillions does look like a "very small amount", but this would be linguistic misrepresentation.

The US has been expanding its ‘imperialist’ interventions formerly limited in the scope of foreign policies (military and geopolitics), which now seems to be swiftly expanding to cover finance and banking aspects.

In other words, the US is not just a policeman of the world, but also the world’s lender or banker of last resort.

Ron Paul recently wrote to expose on this central banking legerdemain

Essentially, beginning late last year the Fed provided U.S. dollars to the European Central Bank in exchange for Euros-- sometimes as much as $100 billion at a time. The ECB then funneled those dollars to European banks to provide liquidity and prevent crises from bank insolvencies. Since the currency swap was not technically a loan, the Fed did not have to embarrass itself by openly showing foreign bank debt on its balance sheet. The ECB meanwhile did not have to print new Euros and expose the true fragility of big European banks.

The entire purpose of this unholy arrangement was to obscure the truth: namely that the Fed was bailing out Europe with U.S. dollars.

But why is it the business of the Federal Reserve to bail out European banks that find themselves short of dollars to pay their dollar-denominated contracts? After all, those contracts often were hedges taken to protect banks against weakness of the Euro. Hedges are supposed to reduce risk, but banks that miscalculate should suffer their own losses accordingly. It’s not our business if the ECB chooses to create moral hazards by providing liquidity to European banks, but why should the Fed prop up Europe’s bad decisions!

The Fed has promised to provide unlimited amounts of dollars to the ECB, should circumstances require it. It boggles the mind. Of course when Fed officials first entered into these swap agreements with the ECB last September, they did so quietly. The American public only found out via websites of the ECB, the Bank of England, or the Swiss Central Bank.

The Fed already has pumped trillions of dollars into the economy since 2008, and US banks currently hold $1.5 trillion of excess reserves. So why don't American banks lend those excess trillions to European banks if they really need dollars? If US banks could earn 1 or 2 percent on those loans, they might just be interested. But they can't compete with the ½ percent interest rate charged by the Fed to the ECB. That's one glaring example of the harm caused by the Fed's ability to create money and loan it at below-market interest rates.

The Fed argues that these loans will be temporary, merely providing a little boost to get Europe over the hump. But that's what they thought a few years ago when such lines of credit to the ECB were set to expire, only to see the Fed reauthorize them. What happens if the European financial system collapses? Will the Fed be left holding a bunch of worthless Euros? Will the ECB simply shrug and turn over the collateral it received from European banks, maybe in the form of bonds from Ireland, Italy, or Greece? Have the 17 individual central banks backing the ECB pledged their gold holdings as collateral?

The Fed has placed a hundred-billion dollar bet on the future of the Euro, with the strength of the dollar on the line. This is absolutely irresponsible, and directly contrary to market discipline. Let private banks, European or otherwise, take their own risks. Let foreign central banks inflate their own currencies and suffer the consequences. In other words, it’s time to apply market principles to banks and money.

Clearly, Fed policies have not been designed to "devalue" the US dollar, which many in the left alleges as meant to promote exports (putting lipstick on a pig), but to survive the incumbent the crumbling unsustainable welfare-central banking and banking cartel based political institutions.

The world operates in a de facto US dollar standard or a banking system whose currency reserves have been built mostly on US dollar holdings. This means that Fed policies does not only expose US taxpayers to undue burden from policy risks, Fed policies has far reaching consequences which needlessly exposes the world to destabilizing financial and monetary risks that could ripple throughout national economies.

This also shows how centralized actions engender systemic risks.

This is just one fundamental reason to abolish the FED.

End the Fed. End central banking and the politicization of money.

Friday, March 16, 2012

Paul Volcker Warns Ben Bernanke: A Little Extra Inflation Would Backfire

For the second time, Paul Volcker, the predecessor of the incumbent US Federal Reserve chief Ben Bernanke takes the latter’s policies to task.

From Newsmax,

The U.S. economy is recovering "pretty well" and trying to juice it up by allowing a little extra inflation would be disastrous, said Paul Volcker, the former Federal Reserve chairman known for successfully reining in double-digit inflation.

"I think that is kind of a doomsday scenario," Volcker told an economic summit when asked if the Fed should foster higher inflation to stimulate faster growth.

Higher inflation would backfire by causing interest rates to rise. "You are not going to get any stimulus and you are going to make it much harder to restore price stability," Volcker told the Atlantic magazine conference.

I candidly don’t believe that Mr. Ben Bernanke is entirely clueless on the risks of the policies he has implemented. While part of these may have been ideology based, I don’t think this tells the entire story.

Mr. Bernanke, as an insider, may not just be working around economic and financial theories. My guess is that the directions of policymaking may have been substantially influenced by pressures from entrenched powerful interests group.

While Paul Volcker’s reputation has been built from his inflation fighting stance, I am not sure he would depart from adapting Bernanke’s policies if he is in the latter’s shoes today.

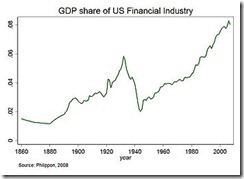

Circumstances during Mr. Volker’s time have immensely been different than today. There has been a vast deepening of financialization of the US economy where the share of US Financial industry to the GDP has soared. In short, the financial industry is more economically (thus politically) important today than in the Volcker days. Seen in a different prism, the central bank-banking cartel during the Volcker era has not been as embedded as today.

This is not to defend Bernanke, but to exhibit the divergence in the degree of political ties between US Federal Reserve and Wall Street.

Bailouts, Quantitative Easings, currency swaps and zero bound rates only reveals of the priorities of team Bernanke which have mostly been designed to protect the banking and financial industry.

And the only way to eradicate these cozy crony relationship which thrives upon policies that “privatize profits, socialize losses” is to end the Federal Reserve and the central banking system.

Thursday, March 01, 2012

Video: Ron Paul to Bernanke: The Fed is Going to Self Destruct Eventually

Some note worthy quotes

System designed to pyramid debt. We have a debt based system. The more debt we have, the more debt the Federal Reserve buys, the more currency they can print. And they monetize this debt. No wonder we are in debt crisis, it’s worldwide. I think this something we have never experienced before 2:48By the way in confirmation to Mr. Paul's statement here is a fresh news report from Bloomberg anent China's slowdown in US treasury acquisition in 2011.

The Fed is going to self destruct eventually anyway when the money is gone 6:42

The Fed remains the top holder of U.S. debt with $1.66 trillion on its balance sheet.

Gold’s near $100 Price Drop Hardly has been about Bernanke’s Stimulus Statement

Media attributes the slump in gold prices to the US Federal Reserve chair Ben Bernanke’s statement last night.

From Bloomberg,

Gold futures fell as much as $100 to below $1,700 an ounce on signs that that the Federal Reserve will refrain from offering more monetary stimulus to bolster the U.S. economy.

In testimony before Congress today, Fed Chairman Ben S. Bernanke gave no signal that the central bank will take new steps to boost liquidity. The dollar rose as much as 0.8 percent against a basket of major currencies, eroding the appeal of the precious metal as an alternative investment. Yesterday, gold reached $1,792.70, a three-month high, even as coin sales by the U.S. mint slumped in February

I am not persuaded that the the reaction in the gold market has entirely been about “refrain from offering more money stimulus”, this seems more like the available bias or post hoc fallacy

That’s because the sell-off seems to have been limited to gold and silver prices. Oil prices seems to have shrugged off the stimulus issue (No, oil prices has hardly been about Iran). The US stock markets too which closed modestly lower has hardly reflected on the the scale of gold’s collapse.

Any concerns over ‘stimulus’ which extrapolates to 'liquidity' would bring about an across the board selling pressure similar to September of 2011

While Mr. Bernanke’s statement may have served as aggravating circumstance, I’d say that either profit taking (yes gold market looked for an excuse and found one in Bernanke) or some unseen developments over the past 24 hours may have led to a crash in gold’s prices.

Nevertheless this is likely to be a temporary episode which means gold prices will recover...soon.

Another important issue to bring up is how mainstream now associates policy stimulus to gold prices. When the public gets to realize that money debasement (inflationist) policies have been the principal cause of price inflation in the asset markets which eventually diffuses into the real economy, the political heat against central banking or central banking policies will intensify.

So far central banks can still afford to hide underneath the cover of esoteric econometrics which the public does not comprehend--a tenuous cover which will eventually be unmasked.

End the Fed, abolish central banking.

Friday, February 24, 2012

Transparency Issues on the US Federal Reserve

Former IMF chief Economist Simon Johnson takes the US Federal Reserve to task for their lack of transparency,

The Wall Street Journal reported on Tuesday that during the 1980s the Fed’s board held 20 to 30 public meetings a year, but these dwindled during the Greenspan years to fewer than five a year in the 2000s and “only two public meetings since July 2010.” At the same time, “the Fed has taken on a much larger regulatory role than at any time in history” — including “47 separate votes on financial regulations” since July 2010, The Journal said.

This high level of secrecy is a concern. It is particularly alarming when combined with the disproportionate access afforded to industry participants in the arguments about what constitutes sensible financial reform.

Just on the Volcker Rule — the provision in Dodd-Frank to limit proprietary trading and other high-risk activities by megabanks — Fed board members and staff members apparently met with JPMorgan Chase 16 times, Bank of America 10 times, Goldman Sachs nine times, Barclays seven times and Morgan Stanley seven times (as depicted in a chart that accompanies the Wall Street Journal article).

How many meetings does a single company need on one specific issue? How many would you get?

For example, Americans for Financial Reform, an organization that describes itself as “fighting for a banking and financial system based on accountability, fairness and security,” met with senior Federal Reserve officials only three times on the Volcker Rule. (Disclosure: I have appeared at public events organized by Americans for Financial Reform, but they have never paid me any money. I agree with many of its policy positions, but I have not been involved in any of their meetings with regulators.)

Americans for Financial Reform works hard for its cause, and it produced a strong letter on the Volcker Rule — as did others, including Better Markets and Anat Admati’s group based at Stanford University.

Based on what is in the public domain on the Fed’s Web site, my assessment is that people opposed to sensible financial reform — including but not limited to the Volcker Rule — have had much more access to top Federal Reserve officials than people who support such reforms. More generally, it looks to me as though, even by the most generous (to the Fed) account, meetings with opponents of reform outnumber meetings with supporters of reform about 10 to 1.

According to those records, for example, the Admati group has not yet managed to obtain a single meeting with top Fed officials on any issue, despite the fact that the group’s members are top experts whose input is welcomed at other leading central banks. To my definite knowledge, they have tried hard to engage with people throughout the Federal Reserve System; some regional Feds are receptive, but the board has not been – either at the governor or staff level…

I do not understand the Fed’s attitude and policies — if it is serious about pushing for financial reform. No doubt they are all busy people, but how is it possible they have time to meet with JPMorgan Chase 16 times (just on the Volcker Rule) and no time to meet Anat Admati – not even for a single substantive exchange of views?

People’s actions are driven by incentives or purpose behavior. So are the actions of those running government bureaucracies. The fundamental difference is that the incentives of bureaucrats are prompted for by political exigencies against market participants who are guided by profits and losses.

Researcher Jane Shaw expounds on the public choice theory

Their incentives explain why many regulatory agencies appear to be "captured" by special interests. (The "capture" theory was introduced by the late George Stigler, a Nobel Laureate who did not work mainly in the public choice field.) Capture occurs because bureaucrats do not have a profit goal to guide their behavior. Instead, they usually are in government because they have a goal or mission. They rely on Congress for their budgets, and often the people who will benefit from their mission can influence Congress to provide more funds. Thus interest groups—who may be as diverse as lobbyists for regulated industries or leaders of environmental groups—become important to them. Such interrelationships can lead to bureaucrats being captured by interest groups.

The political relationship between the regulator and the regulated always impels for a feedback mechanism, such as lobbying, as the regulated will always find ways to circumvent or to relax on the rules which restricts or inhibits their actions. And the typical outgrowth to such relationship has always been the lack of transparency, revolving door relationships (Wikipedia: movement of personnel between roles as legislators and regulators and the industries affected by the legislation and regulation and on within lobbying companies), logrolling and corruption. Such "conflict of interests" relationships frequently make regulatory agencies “captured” by special interest groups.

And what is the ultimate cause for this?

To quote Milton Friedman in Capitalism and Freedom

Any system which gives so much power and so much discretion to a few men that mistakes – excusable or not – can have such far-reaching effects is a bad system. It is a bad system to believers in freedom just because it gives a few men such power without any effective check by the body politic – this is the key political argument against an "independent" central bank. But it is a bad system even to those who set security higher than freedom. Mistakes, excusable or not, cannot be avoided in a system which disperses responsibility yet gives a few men great power, and which thereby makes important policy actions highly dependent on accidents of personality. This is the key technical argument against an "independent" bank. To paraphrase Clemenceau, money is much too serious a matter to be left to the Central Bankers.

In short, the kernel of the transparency issues surrounding the US Federal Reserve has been about the negative ramifications from the centralization of power. Conflicts of interests and regulatory capture signifies as issues which won’t go away for as long political power (in relation to money, but applies elsewhere) remain concentrated to a few men. The more the power assumed by central bankers, the greater the risks of political indiscretions and secrecy.

Thus, the transparency issue can be resolved by the abolishment of central banks.

This means, yes, End the Fed.

.bmp)

.bmp)

.bmp)