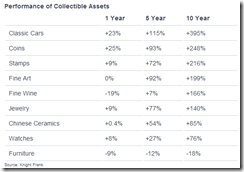

The global asset boom seems to be intensifying. And it bears the characteristics of a brewing credit bubble mania.

This comes amidst the combined efforts by global central banks to adapt and coordinate aggressive easing policies.

The Grand Era of Asset Class Bubbles

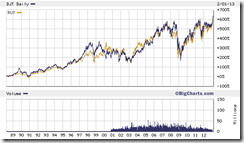

The confirmation[1] of the Bernanke led FOMC’s unlimited QE 4.0 which consists of $85 billion of monthly asset purchases ($40 billion on Agency securities and $45 billion in US treasuries) has coincided with a major push key US benchmarks.

The Dow Jones Industrial Averages (DJIA)—now is at the 14,000 level—along the S&P 500, have both breached the 5 year highs, and has returned nearly an incredible 8% for the first month of 2013.

It’s been a broad based run though.

If the actions of the broader Russell 2000 (RUT) and Dow Transports (DJT) should serve as clues, then we are bound to see the Dow Industrials and the S&P in new record territory soon. That’s because both the RUT (brown) and DJT (black) are at fresh milestone highs.

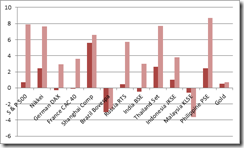

Japan’s Nikkei seems head to head with the US S&P 500, similar to the ongoing race between the Philippine Phisix and Thailand’s SET.

In the meantime, China’s Shanghai index powered up a substantial 5.57% weekly rally amidst a mixed economic picture. Manufacturing indicators grew less than expected while profits of industrial companies rose by 17% from last year according to Bloomberg[2].

But it seems most likely that the spike in China’s Shanghai index has been more about the belated effects from the ramping up of stealth government stimulus channelled through State Owned Enterprises (SOE) as accounted for by the surge in Fixed Asset Investments (FAI)[3] in 2012 and from the previous efforts by China’s central bank, the PBoC, to inject record amount of money into the system[4].

Of course the prominent features of manias are the aggravation of misperceptions between widely held beliefs—reinforced by ascendant prices and the widespread dissemination of misinformation or even propaganda—and reality, which results to the chasm of mispricing.

One would note that in today’s asset boom, there have been many evidences of what seems as a parallel universe.

The double dip recession in Spain’s economy has reportedly worsened during the fourth quarter of 2012[5]. Compounding on this negative sentiment includes last week’s revelation of a corruption scandal by the ruling party for operating or maintaining a slush fund from the donations of the construction industry[6].

Spain’s Madrid Index slumped by 5.7% this week but still on the positive side; up 1.8% for the year. The Madrid index lost 4.33% in 2012. Yet the above chart shows that even if we consider this week’s losses, the Spanish equity bellwether surged by about 38% from the trough of July of last year. Such rally came amidst the worsening of the economy.

And what the parallel universe truly represents are the deepening malaise of the global monetary system.

And this should hold the same for the Philippine Phisix.

Current developments have only been validating my view since late 2012 where I hold that the Phisix will have a strong performance into at least the first quarter of 2013[7],

While no trend moves in a straight line, which means there should be interim corrections, we are likely to see a reinforcement of the yearend rally which perhaps may get extended until the first quarter of 2013.

And that if the low interest rate regime remains unperturbed from either internal or external developments for the rest of the year, then we may see a blowoff phase that may bring the Phisix near my long held target of 10,000[8].

For the Phsix, if domestic interest rates continue to remain low, perhaps we may see a blowoff phase (Phisix 8,000-8,500???) by the yearend.

Such boom may be compounded by the acceleration of capital flight into ASEAN from developed economies whose central banks have been massively expanding their balance sheets such as Japan whose outflows to Emerging Markets have been ballooning

And that one of the most prominent character of an inflationary boom will be an internal rotation.

Nonetheless, for as long as the inflationary boom remains, I also expect a rotation towards last year’s laggards: the mining sector and possibly the service industry.

We are seeing signs of rotation alright.

But the blistering property sector just took the lead from the mining sector with a fantastic 6.56% surge this week.

Now the mines and the property sector seem to be in a tight race for the leadership.

Yet the ongoing rotation means that the general prices of securities listed in the PSE have been increasing, although at different rates and at different times: yes, all signs of an inflationary boom.

Again given the severely overbought conditions it would seem natural for profit taking to rule the day. Yet 5 weeks into 2013, the bullish sentiment, which signify as manifestations of a ballooning mania, seem relentless.

Such dynamic hasn’t been exclusive to the Philippines but covers the world as well.

With all the tsunami of money thrown to the US and Japan since 2008, there has been meagre impact on the real economy.

Yet one shouldn’t omit the fact that the marked decline of investments in both countries have become an attribute, not only from the recent bust, but from earlier bubble busts (1990s) for Japan and (2001 dot com bust) for the US.

The reason for the bubble bust is a predecessor bubble boom caused by interventionist policies. So if the boom has been caused by interventions, the bust has been applied with more interventions that led to another boom-bust cycle. So current policies have merely been recycling via the same prescriptions whose impact of has been one of diminishing returns.

Pimco’s Bond guru Bill Gross hits the nail in the head in his latest outlook[9],

Unless central banks and credit extending private banks can generate real or at second best, nominal growth with their trillions of dollars, euros, and yen, then the risk of credit market entropy will increase.

So central banks will either unleash more and more money or face the risk of credit market entropy.

Rising stock markets detached from the real economic developments represents a massive flaw of perception in the perspective of George Soros’ reflexivity theory

This marks the grand era of the global asset class bubbles.

Differentiating Economics from Statistics

Most people think that when they communicate by referring to statistics they are making an economic argument. The fact is that these people tend to confuse economic reasoning, which is supposed to be based on human action, with historical or ex-post activities which is what statistics truly represents. These people have been allured to view where science is seen as measurement.

But since human action is complex, this means that people respond differently to a combination of changes in social interrelationships, in people’s interaction with the environment and in changes of the stream of knowledge from such interplay of unique events. The point is the past cannot be relied on to foretell of the future simply because future circumstances are predominantly different from the past.

As the great Ludwig von Mises explained[10],

Experience of economic history is always experience of complex phenomena. It can never convey knowledge of the kind the experimenter abstracts from a laboratory experiment. statistics is a method for the presentation of historical facts concerning prices and other relevant data of human action. It is not economics and cannot produce economic theorems and theories. The statistics of prices is economic history. The insight that, ceteris paribus, an increase in demand must result in an increase in prices is not derived from experience. Nobody ever was or ever will be in a position to observe a change in one of the market data ceteris paribus. There is no such thing as quantitative economics. All economic quantities we know about are data of economic history. No reasonable man can contend that the relation between price and supply is in general, or in respect of certain commodities, constant.

The validation of my prediction of the Philippine property boom when it was yet at the fringes should be an example,

Here is one more prediction.

The current “boom” phase will not be limited to the stock market but will likely spread across domestic assets.

This means that over the coming years, the domestic property sector will likewise experience euphoria.

For all of the reasons mentioned above, external and internal liquidity, policy divergences between domestic and global economies, policy traction amplified by savings, suppressed real interest rate, the dearth of systemic leverage, the unimpaired banking system and underdeveloped markets—could underpin such dynamics.

Then I was making a prediction predicated on how the markets will likely respond to first social policies, second, the prevailing state of the financial system and finally to the possible feedback mechanism between market forces and social policies. I was making use of theory buttressed by statistics to make my case.

When government and media chime in to say that 2012 economic growth has been “stellar”[12] which has been manifestations of “good economics” as consequence from good policies or from the political slogan of “good governance” assimilated by the incumbent authorities, they are essentially describing recent past events from where good news had been used as to generate political capital and passed off as an economic discussion

Yet hardly anyone dealt with the details to see if such ballyhooed economic growth deserves to be called good, if not sound or sustainable, economics.

‘Good’ economics or Bubble economics?

I have been warning about the growing risks of the shopping mall-property bubble.

Recent data sourced from the “good economics” department or from the Philippines’ National Statistics Coordination Board (NSCB) only reinforces my worries

I have been saying that the real estate sector which has been experiencing an accelerating boom, partly via shopping malls[13] and mostly via high rise or vertical projects, has been vastly overestimating the potential growth of Filipino consumers.

In reaction to the low interest rate regime, popular theme, competition, overconfidence and mainstream ideological espousal of the ‘consumption economy’ has been prompting for an onrush to build capacity through credit expansion.

One would note that Filipino consumers as measured by the Household Financial Consumption Expenditure (HFCE)[14] in 2012 have grown 6.11% in constant prices and 9.18% in current prices. In 2011 growth was 6.3% constant and 11.41% current.

Contrast this to the growth in the real estate sector (which is part of the NSCB’s Gross Value Added in Real Estate, Rental & Business Activities[15]) where in 2012 expanded at the rate of 18.89% (constant prices) and 22.58% (current prices). In 2011, it was 16.54% constant and 21.77% current.

The difference is remarkable. The growth rate on the supply side has been more than double whether measured from constant and current prices. Basic economics tells us that at the current rate of growth, such imbalances would translate to a net doubling of supply in about 6 years. Oversupply will thus function as a symptom of the deeper problem called misallocation of resources fuelled by a credit boom.

Economic theory, particularly the Austrian Business Cycle, tells us that malinvestments, which represents distortions in the capital structure by artificially prompting for a shift in the public’s savings-consumption patterns induced by policy induced credit expansion, will lead to capital consumption via a systemic bust.

As the great dean of Austrian economics, Murray N. Rothbard wrote[16],

For businessmen, seeing the rate of interest fall, react as they always would and must to such a change of market signals: They invest more in capital and producers' goods. Investments, particularly in lengthy and time-consuming projects, which previously looked unprofitable now seem profitable, because of the fall of the interest charge. In short, businessmen react as they would react if savings had genuinely increased: They expand their investment in durable equipment, in capital goods, in industrial raw material, in construction as compared to their direct production of consumer goods.

Businesses, in short, happily borrow the newly expanded bank money that is coming to them at cheaper rates; they use the money to invest in capital goods, and eventually this money gets paid out in higher rents to land, and higher wages to workers in the capital goods industries. The increased business demand bids up labor costs, but businesses think they can pay these higher costs because they have been fooled by the government-and-bank intervention in the loan market and its decisively important tampering with the interest-rate signal of the marketplace.

Yet there are real economic risks from fallouts of bubble cycles.

The domestic hotel industry, for instance, hardly seems as a bubble. The industry has reported a growth of only 3.2% from 2004 until 2011[17] with most of the growth occurring at the upscale level which accounts for 57% of the hotel pie. Over the next five years growth will accelerate to 37% which implies 7.4% on the average. Yet the average foreign visitor growth has been at 8% a year[18], according to local economist.

Yet not all tourism is about foreign visitors. In fact, domestic tourists accounted for 59.1% share of tourism spending in 2011[19].

This implies that there is a risk of contagion from the prospects of a property-shopping mall bubble busts that can adversely impact on the tourism industry, despite being in a non-bubble state. But the impact will likely be less than her contemporaries. But again this will depend on how companies within the industry are leveraged.

This also exhibits the concentration or clustering effects of bubble cycles.

Theory likewise posits that economics cannot be treated as isolated variables, as all human actions are interconnected or deeply entwined.

For instance whether tourism, retail trade, food-agriculture, services, housing or other sectors including the government, all these sectors will compete for the limited Peso of the domestic consumers.

Aside, all these sectors will also compete for available resources in the domestic markets. The Philippine government’s proposed expenditures for Php 432.15 billion ($10.8 billion) of infrastructure projects[20] should also put strains on the available resources and labor in competition with booming sectors.

Economic theory also tells us that the competition for scarce resources from credit expansion will lead to relative increases in prices, and secondarily, but not necessarily to ‘general price levels’.

Again from the late Professor Rothbard[21],

as the early-eighteenth-century Irish French economist Richard Cantillon, that, in addition to this quantitative, aggregative effect, an increase in the money supply also changes the distribution of income and wealth. The ripple effect also alters the structure of relative prices, and therefore of the kinds and quantities of goods that will be produced, since the counterfeiters and other early receivers will have different preferences and spending patterns from the late receivers who are "taxed" by the earlier receivers. Furthermore, these changes of income distribution, spending, relative prices, and production will be permanent and will not simply disappear, as the quantity theorists blithely assume, when the effects of the increase in the money supply will have worked themselves out.

Today’s deepening of financialization reveals of how policy induced credit expansion tends to flow into asset prices and germinate into boom bust cycles rather than outright price inflation.

Moreover greater demand for credit will lead to higher interest rates that will put to risks marginal projects that have existed only because of artificially low interest rates.

Theory also suggests that faddish themes may represent as “displacements” or “new paradigms” that may be large and pervasive enough to fuel a bubble cycle as proposed by the late economist Hyman Minsky through the late author and historian Charles Kindleberger.

Mr. Kindleberger in Manias, Panics and Crashes wrote[22] (bold mine)

According to Minsky, events leading up to a crisis start with a “displacement,” some exogenous, outside shock to the macroeconomic system. The nature of this displacement varies from one speculative boom to another. It may be the outbreak or end of a war, a bumper harvest or crop failure, the widespread adoption of an invention with pervasive effects—canals, railroads, the automobile—some political event or surprising financial success, or debt conversion that precipitously lowers interest rates. An unanticipated change of monetary policy might constitute such a displacement and some economists who think markets have it right and governments wrong blame “policy-switching” for some financial instability. But whatever the source of the displacement, if it is sufficiently large and pervasive, it will alter the economic outlook by changing profit opportunities in at least one important sector of the economy. Displacement brings opportunities for profit in some new or existing lines and closes out others. As a result, business firms and individuals with savings or credit seek to take advantage of the former and retreat from the latter. If the new opportunities dominate those that lose, investment and production pick up. A boom is under way.

Moreover, faddish themes may also rely on stories to feed on the bubble cycle, as Gene Callahan and Austrian Professor Roger Garrison writes[23],

every bubble needs a story, which early investors can tell to later ones to justify rising asset price

The fictional tale of the consumption economy that underpins the shopping mall bubble fits such theories to a tee.

I have already mentioned the psychology of bubbles advocated by George Soros via the Reflexivity theory where people’s view of the market will be based on convictions or entrenched beliefs that departs from reality. Such perceptive failure will eventually be upended. So when people yammer about economic booms from zero bound rates we know how the public is being seduced by the outcome bias.

Theory also says that given the world of scarcity, we can only spend what we produce. In short, no economy can spend their way to prosperity. Artificial stimulants are likely to engender massive misallocation of the capital structure that will eventually backfire, as the Japan-US experience above.

While individuals may spend through income, or by running down on savings, or from borrowing, they can also generate spending from one-off events like winning the lottery, from inheritance or from theft.

However in the real economy, real spending growth for an economy emanates from productivity growth. Digital money entries or zero bound rates will not solve the problem of scarcity or opportunity costs. Credit based expenditures only frontloads such activities at the expense of the future.

And along that plane, since the basic economy is about people’s activities broken down into savings, consumption or investment, in looking at the potential effect of the real estate imbalances one doesn’t have to rely on government data alone, as if to imply that government statistics are infallible, accurate or even divine, one can look at real economic growth, per capita growth, wage levels and other related data, perhaps even provided by the private sector, or even the stock market to countercheck on the validity of imbalances.

So far the growth rates of the Philippine real estate sector appear to confirming the rate of the industry’s borrowings to bankroll their growth.

As I previously pointed the BSP noted[24] that last November on a year on year basis, real estate, renting, and business services borrowing soared by a hefty 24.8 percent while wholesale and retail trade by 26.9 percent.

So from the bubble theories of the Austrian school, Hyman Minsky-Charles Kindleberger, George Soros or even from the behavioral perspective, what is said of good economics is really about bubble economics

Welcoming the Greater Fool

This week’s astronomical 6.56% sprint by the domestic property sector may have been parlaying the manic-blowoff phase in the Phisix and exhibiting signs of the property-shopping mall economic bubble.

The rally was actually spearheaded by Ayala Land’s [PSE: ALI; black candle] phenomenal 9.9% weekly gains combined by the exemplary performances by the other heavyweights as SM Prime Holdings [PSE:SMPH; red line] 5.89% and Megaworld [PSE: MEG; blue line].

From the market troughs of 2009, the returns of the top 4 majors, has been 510%, 287% and, 489% respectively. One of the fourth biggest property market cap Robinson’s Land Corporation [PSE: RLC] yielded 269% over the same period.

Unless there would be a major positive development in the consumer front, I don’t believe that those prices are manifesting the state of the industry’s economics.

Such accelerating gains only signify the time where the public have come to believe that stock markets are all about easy money or free lunches.

I am thus reminded by the legendary trader Jesse Livermore, whom I will quote again[25],

But the average man doesn’t wish to be told that it is a bull or bear market. What he desires is to be told specifically which particular stock to buy or sell. He wants to get something for nothing. He does not wish to work. He doesn’t even wish to have to think. It is too much bother to have to count the money that he picks up from the ground.

The same “something for nothing” speculative orgy has been the mirror image of the same “something for nothing” policies that has led the public astray and straight into a virtual trap of bubble cycles.

The Greater Fool theory[26] —the theory premised on hope where making money from stocks would mean buying securities, whether overvalued or not, and later selling them at a profit based on the anticipation that there will always be someone (a bigger or greater fool) who is willing to pay the higher price—which is largely momentum trading or price chasing actions will become the dominant feature of the market

Let me be clear. We are seeing increasing signs of a blowoff phase. Yet such mania doesn’t automatically mean the end of the cycle or a reversal or inflection point today, or perhaps this year. It means that the feedback loop of the market’s prices and the real economy will extrapolate to an acceleration of leverage in the economic and the financial system—which is where all the risks lies.

And as the boom prevails, people’s risk appetite grows. Lending standards will decline as borrows jump into the bandwagon to take advantage of what appears as free lunches in the stock market and the property sector.

In addition, as I have been saying if interest rates remain at current low levels throughout the year, then we may see the Phisix hit 8,000-8,500 or even more. That’s a big IF.

Yet markets will be driven ultimately by the actions policymakers.

And as previously discussed, 1993 brought about a stratospheric 154% nominal returns for the Phisix. Huge extraordinary gains are the typical outcomes of manic phases. I am not suggesting for 154% returns, I am saying that it would not be a surprise to see really enormous gains if indeed we are in such a transition. But as markets get higher, risks also becomes bigger.

And yet the build up of credit risks will likely become apparent over the coming year or two. And this will be accompanied by more entrenched belief by the public of “good governance equals good economics” charade which will be exposed when the bubble pops.

In the meantime, fasten your seatbelt enjoy your ride while it lasts.