The big profits go to the intelligent, careful and patient investor, not to the reckless and overeager speculator. Conversely, it is the speculator who suffers losses when the market takes a sudden downturn. -J. Paul Getty

In this issue

Phisix: What Janet Yellen’s “Irrational Exuberance” Speech Implies

-Fed Chair Janet Yellen’s Version of “Irrational Exuberance”

-Parallel Universes and Differentiating Symptoms from the Disease

-Mother of All Bubbles is Global in Scope

-US Financial Markets as Core of the Mother of all Bubbles

-US Government Sows the Seeds of the Loss of US Dollar’s Currency Reserve Status

-Philippine FDI Spike: More Signs of Debt Accumulation from External Sources

Phisix: What Janet Yellen’s “Irrational Exuberance” Speech Implies

It was just last May when I noted that bubbles have become so obvious such that[1] “as you can see, bubbles have risen to levels where authorities can’t hide them anymore. Instead of denying them, what they are doing today has been to downplay their risks.”

Fed Chair Janet Yellen’s Version of “Irrational Exuberance”

Well it appears that US Federal Reserve Chairwoman Janet Yellen affirmed this view in her latest speech before the US Congress.

I also noted just two weeks back that the kernel of policy communications can be analogized as: I admit there is a problem of alcoholism. But don’t take the alcohol away from the alcoholic, because the withdrawal syndrome would be catastrophic![2]

Echoing her predecessor Alan Greenspan’s 1996 “irrational exuberance” speech, Ms Yellen’s “Greenspan moment” admits to growing financial instability risks…

On the credit markets

Signs of excesses that could lead to higher future defaults and losses have emerged in some sectors, including for speculative-grade corporate bonds and leveraged loans[3].

Twice she mentioned in her report of the “substantially stretched” valuation of metrics of some segments in the equity markets[4] (bold mine)

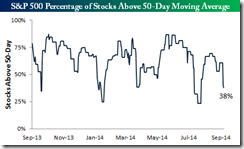

Some broad equity price indexes have increased to all-time highs in nominal terms since the end of 2013. However, valuation measures for the overall market in early July were generally at levels not far above their historical averages, suggesting that, in aggregate, investors are not excessively optimistic regarding equities. Nevertheless, valuation metrics in some sectors do appear substantially stretched—particularly those for smaller firms in the social media and biotechnology industries, despite a notable downturn in equity prices for such firms early in the year. Moreover, implied volatility for the overall S&P 500 index, as calculated from option prices, has declined in recent months to low levels last recorded in the mid-1990s and mid-2000s, reflecting improved market sentiment and, perhaps, the influence of “reach for yield” behavior by some investors.

However, signs of risk-taking have increased in some asset classes. Equity valuations of smaller firms as well as social media and biotechnology firms appear to be stretched, with ratios of prices to forward earnings remaining high relative to historical norms. Beyond equities, risk spreads for corporate bonds have narrowed and yields have reached all-time lows. Issuance of speculative-grade corporate bonds and leveraged loans has been very robust, and underwriting standards have loosened. For example, average debt-to-earnings multiples have risen, and the share rated B or below has moved up further for leveraged loans. The Federal Reserve continues to closely monitor developments in the leveraged lending market and, in conjunction with other federal agencies, is working to enhance compliance with previous guidance on issuance, pricing, and underwriting standards.

Ms Yellen seems to employ a semantical sleight of hand in her assessment of market risks.

In the admission that current pricing levels have generally been “not far above their historical averages” which implies that current valuations are above previous levels but have not reached similar levels as those “smaller firms as well as social media and biotechnology firms”, she uses the contrast principle or citing the “difference between things, not absolute measures” to deduce and arrive at the conclusion that “investors are not excessively optimistic regarding equities”.

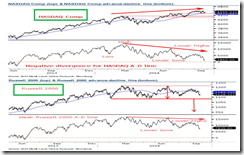

Let me explain this in numbers. According to Wall Street Journal’s Market Data Center as of July 18, 2014, 12 month trailing PE ratios for Russell 2000 is at 75.01 (!!!), the S&P 19.54 and Nasdaq 23.16.

Ms. Yellen posits that Russell 2000 at 75.01 appears to be “substantially stretched”. But because the S&P PERs are at 19.54, even when this has been above historical averages, since the latter has not reached 75 PER, the entire stock market have therefore been perceived as “not excessively optimistic regarding equities”! In short, her benchmark for market excesses has been Russell’s 75 PER where anything below would translate to “not excessively optimistic”.

It is a sign that either Ms. Yellen has been oblivious with how stock markets operate which she apparently sees as a one-size-fits-all phenomenon or she has deliberately downplayed risks through communications sophism. [As a side note, this has been a similar communications framing approach used by Philippine officials and their mainstream apologists when discussing relative debt levels]

Yet Ms Yellen appears to be lost in explaining the relationship, which she partially admits to have influence on the “reach for yield” on stock valuations and debt.

Now the “Don’t take away the alcohol” segment of the speech…

The financial strength of the banking sector has continued to improve. Bank holding companies (BHcs) have pushed up their regulatory capital ratios, continuing a trend seen since the first set of government stress tests in 2009…

To support continued progress toward maximum employment and price stability, the FOMC has maintained a highly accommodative stance of monetary policy.

Also seen at the question and answer portion at the Senate Banking Committee Ms Yellen further noted[6] (bold added): There are mixed signals concerning the economy, we need to be careful to make sure that the economy is on a solid trajectory before we consider raising interest rates.

Another seemingly patent inconsistency is: how can financial strength of the banking sector improve, when general leverage has been robustly expanding to include “speculative-grade corporate bonds and leveraged loans” which she further notes that “underwriting standards have loosened”?

How does massive expansion of risky loans been associated with the health of the balance sheets of US financial institutions? Does the ramping up of issuance of speculative grade bonds and dicey leverage loans represent signs of strength for the US banking and financial system? Has the loosening of lending standards been associated with soundness of banking and financial sector practices? Or has this been harbinger of credit risks or a precursor to crisis?

Credit Bubble Bulletin’s Doug Noland who sedulously tabulates on US and global credit markets has this priceless picture to offer[7] (bold mine)

This year’s booming M&A market has posted the strongest activity since 2007. Second quarter global M&A volume of $1.06 TN was up 72% from the year ago period. Here at home, M&A more than doubled year-on-year to $473 billion, pushing record first-half volume to $749 billion. The proliferation of deals was fueled by the loosest Credit conditions in years. First-half global corporate bond issuance hit an all-time high $2.29 TN. A record $286 billion of junk bonds were issued globally, as average junk yields traded to the lowest level ever. At $642 billion, first-half U.S. investment-grade company bond sales easily posted an all-time high. The first six months of 2014 also saw record issuance of collateralized loan obligations (CLOs). A record number of global IPOs were sold in the first half, with $90.6 billion of offerings 54% above comparable 2013. Led by technology and biotechnology issues, U.S. IPO sales enjoyed the strongest first-half since the height of the technology bubble back in 2000. According to Dealogic, year-to-date total global sales of corporate stock and equity-linked securities reached an unmatched $510 billion, outpacing 2007’s record pace.

Various measures of market risk perceptions – from corporate risk premiums to the VIX equities volatility index – have this year sunk back to 2007 Credit Bubble heyday lows. Ominously reminiscent of the second-half of 2007, Treasury yields have unexpectedly turned lower in the face of overheated risk markets. I have posited that respective rate “conundrums” can both be at least partially explained by safe haven buying in anticipation of mounting market vulnerability. Recalling 2007, market exuberance is these days fueled by the perceptions of endless cheap liquidity and adroit policymakers with everything under control. Quite simply, it is taken as indisputable fact that global central bankers will not tolerate a return to financial crisis.

From all time high to record first half to unmatched highs…in almost all aspects of credit and credit related market activities as seen in global and US M&A, global corporate bonds, global junk bonds, US investment grade bonds, global and US IPOs and to corporate stock and equity linked securities… to record low volatility as measured by record low risk premium and volatility indices, haven’t these been signs of simmering instability waiting for the right opportunity to be ventilated???

And yet all such massive credit expansion backed by corporate buybacks plus manic retail investors has led to a widening chasm between Wall Street and Main Street. This Bloomberg article aptly describes (bold mine) the brewing disconnect [8]: Main Street and Wall Street are moving in opposite directions. Individual investors are plowing money back into the U.S. stock market just as professional strategists say gains for this year are over. About $100 billion has been added to equity mutual funds and exchange-traded funds in the past year, 10 times more than the previous 12 months, according to data compiled by Bloomberg and the Investment Company Institute. The growing optimism contrasts with forecasters from UBS AG to HSBC Holdings Plc, who say the stock market will be stagnant with valuations at a four-year high. While the strategists have a mixed record of being right, history shows the bull market has already lasted longer than average and individuals tend to pile in at the end of the rally. (Does the latter not ring a bell for the Phisix?)

This is a sign that risks of bubbles have already hit mainstream consciousness.

And the palpable swelling of cognizance of asset bubbles has pervaded Wall Street to the extent that in a recent Bloomberg poll, FORTY-SEVEN percent of the 562 investors surveyed said that “equity market is close to unsustainable levels while 14 percent already saw a bubble”, amidst “biotechnology stocks trading at more than 500 times earnings”. 500 times earnings, Yikes!!!

And yet the Bloomberg article calls the intensifying alarmism “Paranoia”[9]

How would you call a market which prices in shares of a company that “has no revenue… no physical location… and no working phone numbers. It doesn't even have employees” to be valued at the $4 billion dollars? How do you call a market that accommodates chimerical 35,966% returns in just 56 days[10] based on the said almost zero fundamentals before the US SEC intervened??!!! Not a bubble????

Parallel Universes and Differentiating Symptoms from the Disease

Ironically as manic bullishness deepens, the consensus view of the US economy continues to be downscaled. The Wall Street Journal Survey reveals of a steep drop in growth expectations based on July which from a month ago registered 2.2% inflation adjusted GDP to just 1.6% for the year 2014[11]. Five months ago growth expectations were at 2.7-2.8%, so the consensus has pared growth expectations by an astounding two-fifths.

And it is not just the US, essentially global growth forecasts by mainstream has been materially downgraded for 2014[12].

But again if the consensus has been substantially retreating on growth expectations, I ask what if 2Q 2014 growth turns out to be negative??? What if the US enters a technical recession?

To reprise my concerns[14]: So how would record overvalued US stocks and other financial markets react to a possibility of recession? How will the cumulative liabilities acquired to pump up record stocks based on buybacks be paid when earnings are likely to decline too? Will the FED reverse their “tapering”? And more than this, US financial markets are at record low volatility while stock markets, like the Philippines, has completely departed from fundamentals or in a parallel universe, thus the multiple expansion.

While Greenspan’s irrational exuberance took 3 years to unravel, given the colossal amount of accruing leverage and asset mispricing, it’s unclear how the manic phase US stocks can last so long.

For instance, Andrew Smithers, the chairman of Smithers & Co. says that US stocks signify “the third largest bubble in history” where U.S. stocks are now about 80% overvalued on certain key long-term measures[15].

Fund manager Jeremy Grantham recently warned that the stock market is expensive and is priced to deliver paltry returns for years to come but predicted that the S&P to hit 2,250 to reach a full pledge bubble based on an M&A boom before a ‘veritable explosion’[16].

For me, massive overvaluations and outlandish mispricing represent symptoms of credit bubbles. So while there may be manifold ways to measure the symptoms from which to argue or debate about, what has hardly been examined is the disease: credit expansion—and how the pathology of inflationary credit impacts valuations, incomes, and or earnings.

It has rarely been asked why stock market valuations have reached outlandish levels in the first place. Obviously the answer is multiple expansions, where returns on stocks vastly outpace earnings growth.

The other circumstantial evidence has been record debt instruments that have financed stock buybacks, Leveraged Buyouts (LBO) and M&As. With reference to Mr. Noland’s data all these seem as at fresh record highs. So to argue solely about stock levels is to miss the real drivers, credit expansion, where the other symptoms as revealed by debt levels, are all at record highs.

So in the face of a slowing economy, financial engineering partly propped up earnings, which have been bidded up by credit financed speculators predicated on hope and or merely by an electrified animal spirits whom has been hardwired to gamble or to stretch for yield as inspired by central bank guarantees.

Yet the rate of speculative orgy financed by credit growth has vastly outpaced economic returns thereby leading to fundamental disconnect or the multiple expansions. So while financial returns has grown almost at par or in line with credit, which has sustained this bubble gush, eventually the law of diminishing returns will prevail which means more credit will be required to push up or even just to maintain current frothy or bubbly levels. So when asset returns lag credit growth then trouble arises.

This also means that eventually debt burdens will become real and weigh on the risks to balance sheets by entities indulged in the “reach for yield” shindig.

Yet for those promoting aggregate policies which include central bank authorities, political demagogues and their mainstream supporters, risks to balance sheets exist in a vacuum. So when untoward event occur, their blindness which has been self-inflicted becomes a personalized black swan.

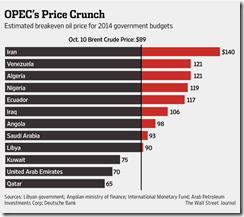

Mother of All Bubbles is Global in Scope

Given the kaleidoscope of record credit expansion on a global scale, these means that current conditions don’t just represent the third largest bubble, instead this has been a manifestation of the MOTHER of all bubbles.

The bubble epidemic has hardly been confined to the US but has percolated into the entire world, including the Philippines, ASEAN or even many frontier markets.

Frontier markets have recently been key recipients for Ms Yellen’s reach for yields or might we call as carry trades.

In bonds, the Ecuadorian government, who defaulted in 2008, successfully raised $2 billion this June. This comes at the heels of the largest ever debt deal by an African nation, terrorism stricken Kenya which came a day ahead and raised $2 billion that came with an incredible $8 billion in orders or whose bonds was 4x oversubscribed[17]!!

And would you believe civil War torn Ukraine’s stock market, the PFTS Index, has been up 48% year to date!!!

As a side note, Philippine stock shills should find comfort in neighboring Asia whose Price earnings ratio appear to also be at deranged levels. A Bloomberg story pegs Singapore’s SGX at a multiple of 22.4 while Hong Kong’s HKEX at 39[18]!!! This doesn’t entail that the Philippines is a buy, which would mean two wrongs don’t make a right fallacy. Rather this reveals why almost everyone has been transmogrified by Greenspan-Bernanke-Yellen and their international surrogates into a Keynesian global ‘sound’ banker: “A 'sound' banker, alas! is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional and orthodox way along with his fellows, so that no one can really blame him. (except this author)

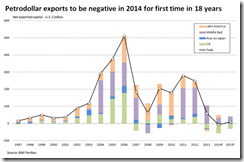

Yet what has inspired, stirred and allowed the various amassing of debt to reach such stratospheric levels that has financed a speculative orgy in various asset classes (including arts, collectibles and etc…)? The main simple answer is central bank PUT. Central bank policies (ZIRP, QEs) supposedly designed to bolster aggregate demand ended up as serially blowing asset bubbles.

Zero bound rates have really been about invisible subsidies or redistribution of resources in support of expansions or the maintenance of government liabilities and of banking system’s balance sheets, except that this has been festooned as an economic program with alleged economic benefits.

Zero bound rates have also been engineered to crash the “shorts” or to vanquish risk from existence in order to promote a one way trade or the Keynesian “quasi permanent boom” doctrine. This in reality has only has existed in terms of asset prices. Thus today’s extreme complacency seems to signify a successful but a temporary Risk ON outcome from such policies

Paradoxically the same low volatility has prompted central bankers such as Ms Yellen or the BIS to warn about. The difference is that Ms Yellen and her predecessors deny the adverse effects from debt financed spending (as they can only see the positives from “wealth effects”), while the BIS recognizes the actualization of financial stability risks from the transmission artificially low rates through the credit channel.

In short, central bankers seem to personally understand that their policies have been unsustainable. Yet since what they only know is to inflate the system, so their actions have been part of the political process, not only to enhance their image of authorities “doing something”, but to support the political agenda of corralling resources of public to be rechanneled to the government and their cronies via financial repression policies.

Yet Ms. Yellen’s eyebrow raising remarks manifest a “straddle the fence” communications (signaling channel) approach.

By impliedly warning on substantially stretched valuations on select industries, should a meltdown occur, the FED thinks that this would hedge their position from accountability. They’d probably say “We partly saw this coming, so it hasn’t been our fault. The culpability belongs to the unbridled investor’s animal spirits”.

But that wouldn’t be exactly true. The downplaying of risks highlights that the US financial and economic system has been acutely hooked onto such subsidies from which the FED has been reluctant to wean away from. They realize that a real exit or a pullback would mean asset deflation, something which they have dreaded about. Another, the FED has been clueless. The best is a combo of both.

Nonetheless Ms Yellen has been joined by IMF’s head, Christine Lagarde, who trivially just warned of financial markets being “too upbeat”

From the BBC[19]: IMF head Christine Lagarde has warned that financial markets maybe a little too upbeat given the persistently high levels of unemployment and debt in European economies. She also warned that continuing low inflation could undermine growth prospects in the region…"Confidence is improving and financial markets are upbeat, perhaps a little too upbeat," she said. "There is a danger of a vicious cycle - persistently high unemployment and high debt-to-GDP ratios jeopardize investment and lower future growth," she added.

As a side note, the IMF recently gave a clean bill of health to Bulgaria’s banking system. Two weeks after, a bank run occurred in two of the nation’s top banks[20]. Two insights from this, (one) the IMF with all its highly touted statistical models failed to see how the owner of one of the affected banks, compromised his bank’s financial health by engaging in shady deals that has been initially ensconced by accounting artifice. Second, Bulgaria’s bank run is yet another symptom of the unresolved and lingering legacy from the last banking crisis.

Bulgaria government has been fortunate that the bank run didn’t emerge during a regionwide or a worldwide crisis, otherwise, she won’t have been privileged to receive a bailout via an emergency loan worth €1.7 billion from the EU.

Add to Bulgaria’s woes has been the recent hubbub over Portugal’s largest listed lender the Banco Espiritu Santo (BES) which just filed for creditor protection following the company’s newly discovered financial irregularities and the failure to make payments to creditors[21]. Following March highs, Portugal’s stock market (PSI-20) plummeted into the bear market as the BES saga unraveled.

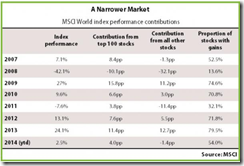

As one would notice despite record US stocks, there have been pockets of volatility happening elsewhere.

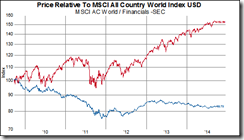

US Financial Markets as Core of the Mother of all Bubbles

US financial markets have played the most critical role of buttressing of the global financial system. This means that if the US financial markets unwind, then global markets will most likely tumble along with her.

Unlike in 2007-2008 where the US meltdown was transmitted to the world as a contagion, a bubble bust in the US will likewise prick national bubbles across the globe.

Today’s problem hasn’t just been private sector debt but public debt as well. This is especially pronounced in developed economies.

This is why despite internal bubbles, emerging markets seem as relatively in a better position than the extreme leverage conditions of advanced economies already hobbled by a baggage of debt.

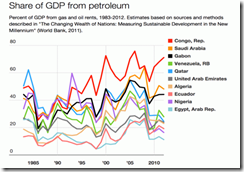

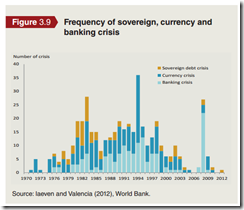

Of course the reason why epic bubbles have become a norm has been due to free willing money and credit expansion from a politicized centrally planned global unanchored monetary system. Since the Nixon shock, sovereign debt, currency and banking crisis has become a common fare (chart from the World Bank). The difference before was of the isolated incidences of crisis. Today we have bubbles in synchronicity.

Unlike in the post-Lehman era where emerging markets like the Philippines has little debt and malinvestments, when the MOTHER of all bubbles burst, monetary and fiscal policies will likely be of little help because lots of resources have already been sunk or committed to unproductive ventures. This will require an intensive market clearing process which most governments will unlikely embrace

Second, since many nations have indulged in capital consumption activities there will be widespread shortages of funding and resources. Since the crisis will be global, multilateral institutions will have limited funds. And extra funds from the IMF, World Bank, ADB and etc., will likely be extended to the select allies of multilateral agency’s largest shareholders. In the case of the IMF, the US is the largest shareholder (17.69%).

We will see how forex reserves will play out in the crisis. Contra the mainstream, I don’t expect any miracles from having substantial forex reserves which are for me represents the obverse side of bubbles.

Although monetary and fiscal policies will be ineffective, given the path dependency of political leaders, I expect many governments to experiment with these. And along with these will most likely be DEPOSIT LEVIES (or bank deposit haircuts).

I don’t think it wouldn’t be farfetched where some political economies may radically undertake real reforms by allowing for bankruptcies, slashing taxes and by easing economic regulations or political obstacles. Should such actions be undertaken then these economies would then signify a BUY.

It would be a grave mistake to believe that central banks can just “reflate” a crisis stricken economy amidst balance sheet disorders. Considering the shortages of resources such reckless policies would amplify hyperinflation risks especially for emerging and frontier markets.

US Government Sows the Seeds of the Loss of US Dollar’s Currency Reserve Status

While I am temporarily bearish the peso due to internal bubbles, I am also bearish the US dollar.

I believe that the US dollar is bound to lose her de facto currency reserve leadership in the fullness of time due to various reasons.

One is FACTA. This repressive financial regulation is tantamount to imperialism applied on a financial dimension. The US government effectively forces other governments to surrender their sovereignty by requiring domestic banks to share information on American taxpayers with foreign accounts in order to supposedly stem tax evasion, least be steeply penalized on transactions with US banks. The FACTA became effective July 1, 2014

While foreign countries may abide by the US government regulation, the likely response will be for domestic banking system to gradually ease out US clients. This may result to Americans having diminished transactions with host countries[22]

So lesser transactions with US citizens and with US entities means lesser demand for the US dollar.

There could be other repressive financial regulations.

For instance the domestic central bank, the Bangko Sentral ng Pilipinas (BSP) appears to be recently concerned over the abandonment of several major US banks to provide remittance services.

From the Inquirer[23]: Over the past year, some of the US’ biggest banks have scrapped remittance services to emerging markets. Among these banks are JPMorgan Chase, Bank of America and Citigroup. This follows a recent crackdown by American regulators on the flow of remittances from the US, which has forced banks to spend more on surveillance.

In short, US banks are required to produce mountains of documents just to facilitate remittance services. So the tedious and costly regulatory compliance effectively renders the remittance services, especially by small individual retail accounts, to become cost prohibitive and therefore unviable. So the most likely response by banks has been to discontinue or terminate on providing such services.

Also it is not clear if such an outcome represents the US government’s intention. Whether intended or not what is clear is that this would serve as deterrent to immigrants to the US. To cut funding flows means to diminish incentives by foreigners to work in the US. This can be construed as a tacit anti-immigration policy.

And the most likely response by non-US OFWs and money senders whose remittances are serviced through US banks (as intermediary) would be a bypass on the US banking system. This implies that remittance services may now be channeled through non-US dollar denominated transactions. Again diminish use of the US dollar means reduced demand for it.

It is unclear if this applies to non-US banks operating in the US who might be able to provide the alternative. But if this covers non-American banks too then as for US based remittors, the likely recourse for the meantime will be the underground or black market option.

Notice that it hasn’t been crisis time for the US, but FACTA and perhaps the Dodd Frank 1073 remittance transfer rule seem as already manifestations of regimented imposition of capital controls against efflux of money from American taxpayers, as well as, foreigners based on the US or on non-US based foreigners whose banks transactions are facilitated through US banks.

Yet the FACTA and the Dodd Frank remittance transfer rule, under the current regulatory framework, may have already underwritten the death warrant of the US dollar as the world’s reserve currency standard.

And as an example of financial imperialism, the US recently punished one of the leading French bank, the BNP Paribas, for allegedly violating US sanctions against Cuba, Sudan and Iran with a whopping record $9 billion fine[25]. The French response—a Memorandum of Understanding (MoU) with China that paves way for the creation of a renminbi based payment and clearing system[26] in France.

Second, US imperial foreign policies which advances the neo-conservative and military industrial complex political agenda of engendering wars by meddling in affairs of other countries has begun to polarize the world into US faction and non-US faction led by the Russia and China. Whether territorial disputes at the Southeast Asia, the Middle East or in Europe or elsewhere, what has been seen have been the conflicts as the current developments reveal. What have not been seen by the public have been behind the scenes interventions that have led to the current conflicts which has fingerprints of US imperial policies have been all over.

Going back to the US-BNP fine and the French response, what has not been seen is that US fine of BNP Paribas has had a hand in the shaping of allegiances in the contest between US and Russia over Ukraine.

As the Zero Hedge observed[27]: Putting this whole episode in context: in an attempt to punish France for proceeding with the delivery of the Mistral amphibious warship to Russia, the US "punishes" BNP with a failed attempt at blackmail (recall that as Putin revealed, the BNP penalty was a used as a carrot to disincenticize France from concluding the Mistral transaction: had Hollande scrapped the deal, BNP would likely be slammed with a far lower fine, if any). Said blackmail attempt backfires horribly when as a result, the head of the French central bank makes it clear that not only is the US Dollar's reserve currency status not sacrosanct, but "the world" will now actively seek to avoid USD-transactions in order to escape the tentacle of global "pax Americana."

This leads us to the third interrelated factor.

Whether in reaction to imperialism on the financial spectrum or military interventions or domestic political interference, the non-US faction has already formed an alternative to the US hegemony.

The BRICs (Brazil, Russia, India and China) with South Africa has introduced a $100 billion multilateral bank which assumes the role of both development bank and a currency reserve pool[28]. This bank will most likely facilitate transactions outside the US dollar system.

This hasn’t been the first area of assemblage of the rival non-US faction.

As the primary target of US military encirclement strategy, both China-Russia has spearheaded the formation of Shanghai Cooperation Organization (SCO) which includes former Soviet Union Central Asian satellite states of Kazakhstan, Kyrgyzstan, Tajikistan, and Uzbekistan and has recently enlisted in her observer status Mongolia, Iran, Pakistan and India. Belarus, Turkey and Sri Lanka have also been added as dialogue partners.

The SCO, according to the Council of Foreign Relations[29], serves more as a forum to discuss trade and security issues, including counterterrorism and drug trafficking.

It is my guess that the SCO and the BRIC banks may eventually merge or link up to incorporate political, economic and financial competition to the US dominion. Such ties will undermine the US dollar as the currency reserve and expose the underbelly of the US government to her addiction to seignorage privileges.

The weakening of the US as the global hegemon will likewise increase the risk of a military conflict between the competing factions.

One thing may lead to another. If the brinkmanship escalation worsens, then sanctions are likely to expand to eventually cover trade and finance and more. This paves way for more heated confrontation which may open the door to a military conflict in today’s nuclear age. We just pray that cooler heads will prevail.

Have a nice day.

Philippine FDI Spike: More Signs of Debt Accumulation from External Sources

Since the BSP’s grand pirouette in 2009 to boost domestic demand through aggregate demand policies, I recently dwelled with the Philippine government’s decision to remain a closed economy through increases in Foreign Ownership Restrictions (FORs) with limited liberalization focused on the bubble sectors particularly large retailers and casinos[30].

The BSP last week noted that FDI’s increased fourfold.

From the BSP[31] (bold mine): Net inflows of foreign direct investments (FDI) surged to US$597 million in April 2014, four times higher than the US$149 million recorded in the same period last year. The significant rise in FDI in April was driven by the spike in investment inflows in debt instruments (or intercompany borrowings) to US$518 million from US$23 million a year ago. In addition, reinvestment of earnings increased by 26.2 percent to US$80 million compared to US$63 million in the previous year. Meanwhile, equity capital placements yielded net outflows of US$1 million. This developed as withdrawals of US$79 million more than offset the US$78 million gross equity capital placements. The bulk of these equity capital investments—which emanated largely from the United States, Japan, Singapore, the United Kingdom, and Germany—was channeled mainly to activities related to real estate; financial and insurance; accommodation and food service; and transportation and storage.

While such data would look impressive on the surface, what has been striking has been the quality of inflows or specifically investment inflows in debt instruments which comprises 86% of the overall inflow, as well as, the areas absorbing the inflow, specifically the bubble sectors.

It appears that the bubble sectors been expanding their sourcing of financing, which comes not only from the banking system, but likewise now from overseas (or supposedly interbank borrowings). Some questions: Why has this been so? Have these been part of the bond sales conducted overseas made through foreign branches? For the real estate sector as the biggest share of inflows, have this been part of measures to skirt on the banking loan cap? Yet why has liquidity growth been stagnating in spite of expanding debt accumulation (from banking and now from external sources) which should signify as fresh spending power? Where have been all the money been going?

Part of my concerns can be seen in the BSP’s latest inflation report.

Again the BSP[32]: Domestic demand remains firm. Real gross domestic product (GDP) growth decelerated to 5.7 percent in Q1 2014, reflecting largely the lingering effects of typhoon Yolanda (Haiyan), a smaller increase in capital formation, and a weaker expansion in manufacturing output. Nonetheless, strong private spending and exports recovery as well as solid gains in the services sector helped buoy output growth. Indicators of demand also continued to show positive readings. Vehicle and energy sales remained brisk, while the Purchasing Managers’ Index (PMI) continued to signal an expansion in domestic economic activity. The outlook of consumers and businesses for the following quarter also remained favorable, supporting the continued strength of aggregate demand in the coming months.

The only real link to typhoon Yolanda (Haiyan) has been the coconut industry[33].

The real issue has been the “smaller increase in capital formation” and “weaker expansion in manufacturing”

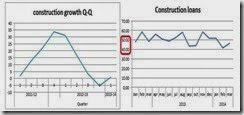

Gross Domestic Capital Formation according to the BSP’s definition[34] is composed of gross additions to fixed assets and changes in stocks. And based on the NSCB data it has been the construction industry, particularly private sector that has been the major drag to 1Q capital formation. Question is why? During the first quarter the banking system’s construction loan growth y-o-y has been hovering from 40-45%, so where has all the money gone? Will this trend be sustained? If yes, then this will be another surprising negative development for 2Q 2014.

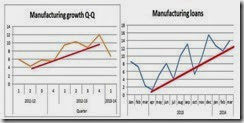

The same dynamic holds true with the “weaker expansion in manufacturing”. For 2013, manufacturing growth (Q-Q) has essentially mirrored growth in the banking sector’s loan portfolio to the manufacturing industry. This relationship appears to have been broken or has diverged in 2014. Question again is why?

Manufacturing loan growth has even picked up steam during the 2Q. Will the divergence hold? If it does then the consensus will be faced with a big nasty surprise. This week’s Typhoon Glenda won’t be a good alibi, that’s because this week’s calamity falls under the third quarter.

What all the above reveals is of the fantastic rate of debt absorption which is being translated into less statistical growth. The laws of diminishing returns on debt in motion?

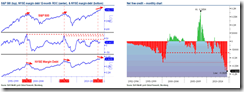

For me a major “marking the close” signifies a .5% last minute move.

While I don’t consider the two successive sessions last week as seen above to be a major “marking the close” (charts from technistock.net), what can be noticed has been the increasing frequency of (seemingly desperate) attempts to fix closing prices most likely to create the impression of bullishness. Notice too that the price fixing comes with rather muted end of the day volume.

Ironically while some worry about “pump and dump”, it seems a curiosity why the silence on last minute price fixing of the general market?