Analysts have been quick to point out that markets often wobble in the run-up to military interventions but then recover quickly as soon as they start; this was the case in the two Iraq wars. It may well be that a much more limited intervention in Syria (if, as is by no means certain, Congress approves it) will follow a similar pattern. What worried investors in the past, of course, was the wider ramifications of military action; whether the region would be set ablaze and oil supplies disrupted.That remains the concern today. The Arab spring seems to have turned into an Islamic version of the Cold War, with proxy battles taking place between Sunni nations, led by Saudi Arabia and the Shia camp, led by Iran. (Syria is a predominantly Sunni nation but Assad draws his support from the Alawites, a branch of Shia). An attempt to dislodge Assad by the West could intensify this conflict, leading to an upsurge in terrorist incidents, attacks on Israel and so on; on the other hand, advocates of intervention argue that the long-running nature of the Syrian conflict has already destabilised the region.Just because previous interventions did not lead to a wider war, does not mean the same will apply in Syria; if you juggle with a grenade long enough, it may go off. This is one of those scenarios where there are no clean outcomes, and it is foolish to predict which way events will turn out. But investors are well aware of this problem, which makes them uncertain at the prospect of western involvement.

Indeed, the tragedy of this vast string of misbegotten interventions—from the 1953 coup against Mossedegh in Iran through the recent bombing campaign in Libya —-is that virtually none of them involved defending the homeland or any tangible, steely-eyed linkages to national security. They were all rooted in ideology—that is, anti-communism, anti-terrorism, humanitarianism, R2Pism, nation-building, American exceptionalism. These were the historic building blocks of a failed Pax Americana. Now the White House wants authorization for the last straw: Namely, to deliver from the firing tubes of U.S. naval destroyers a dose of righteous “punishment” that has no plausible military or strategic purpose. By the President’s own statements the proposed attack is merely designed to censure the Syrian regime for allegedly visiting one particularly horrific form of violence on its own citizens.Well, really? After having rained napalm, white phosphorous, bunker-busters, drone missiles and the most violent machinery of conventional warfare ever assembled upon millions of innocent Vietnamese, Cambodians, Serbs, Somalis, Iraqis, Afghans, Pakistanis, Yemeni, Libyans and countless more, Washington now presupposes to be in the moral sanctions business? That’s downright farcical. Nevertheless, by declaring himself the world’s spanker-in-chief, President Obama has unwittingly precipitated the mother of all clarifying moments.

Something people don't realize about fat-tailed probabilities: We may accept to take risks with .00001 pct chance of blowing up the planet. May be OK for some. But the inconsistency is that we do serially and collectively take A LOT of "one-off" risk. If nothing happens, we may do it again. And again. Or we may take many of these at the same time. Merely allowing such action will eventually mean that we will have 100% chance of blowing up the planet.

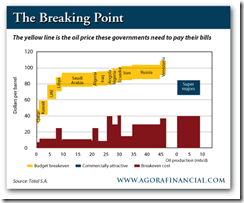

But welfare states of the Gulf States and other oil producing nations will be comforted by rising oil prices since their welfare based political economies has been tied to oil prices (see above graphs).

Risks to oil prices remain strongly skewed to the upside for the rest of 2013. Middle East tensions have removed significant spare capacity, at a time when the market is seasonally tight. Hence, any further supply disruption would be damaging.Another upside risk is the potential “product-pull” on crude prices. Strong diesel demand may already be challenging U.S. refinery capacity. U.S. distillate production is at its highest level in absolute terms and relative to gasoline. High distillate crack spreads motivate refiners to bid up oil grades with the highest distillate output. As a result, crude prices get pulled up.The U.S. consumer will not feel the pinch until oil prices are much higher, because gasoline cracks are likely to absorb most of the increase in crude. This would support oil demand despite higher prices.