The test of a first-rate intelligence is the ability to hold two opposed ideas in the mind at the same time, and still retain the ability to function. — F. Scott Fitzgerald

The landmark breakout by the Philippine composite benchmark, the Phisix, has been confirmed!

It’s certainly not just that the local benchmark has treaded on fresh nominal record highs, importantly, we should expect momentum to continue if not accelerate.

Attempting to time the markets under these conditions will likely leave market participants with opportunity losses and remorse (regret theory), as broad market actions will likely be defined by sharp upside swings.

Again this phenomenon has not been isolated to the Phisix but can be seen as a regional dynamic.

While major ASEAN equity markets crawled away from the losses at the start of the year, the high octane rebound appears have been a recent phenomenon which only commenced last June.

Ironically, these has been happening on a post QE 2.0 environment (but with QE 3.0 officially on the table[1]), and despite various global market interventions, that initially had jolted global financial markets.

Malaysia [KLCI: red line], whom earlier took a temporary lead has, over the interim, deviated from the group and appears to be weakening. This divergence could be a temporary phenomenon.

Nonetheless, all four ASEAN bellwethers have posted advances on a year-to-date basis. And notably, the gains by ASEAN ex-Malaysia appear to be progressing swiftly.

Breakout Confirms the Long Term Direction

The most important message from such this monumental breakout is the apparent continuing confirmation of my long held view of the evolving boom-bust cycle of the Phisix[2].

Patterns don’t play out because of fate or destiny, as some mechanical chartists seem to suggest, instead patterns play out because of real underlying forces that drive them. People’s choices and NOT patterns ultimately determine market actions or cycles.

We should never confuse patterns or historical experience with deterministic action in the way natural science behaves.

As the great Ludwig von Mises reminded us[3], (bold emphasis mine)

The experience with which the sciences of human action have to deal is always an experience of complex phenomena. No laboratory experiments can be performed with regard to human action. We are never in a position to observe the change in one element only, all other conditions of the event remaining unchanged. Historical experience as an experience of complex phenomena does not provide us with facts in the sense in which the natural sciences employ this term to signify isolated events tested in experiments. The information conveyed by historical experience cannot be used as building material for the construction of theories and the prediction of future events. Every historical experience is open to various interpretations, and is in fact interpreted in different ways.

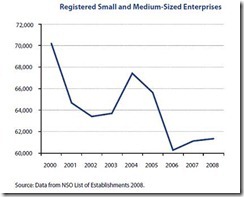

The Philippines experienced its first modern bubble cycle which progressed during 1985-2003, an 18 year cycle. This cycle surfaced after the Philippines had been liberated from a tyrannical rule which had suppressed the local market and the economy.

The first bubble cycle saw the Phisix advance from around 150 to around 3,100 for a whopping gain of 19x. The advance had not been linear, though. Two bear markets interspersed the advance phase. These bear markets (orange and green ellipses) were both triggered by failed coup d'états.

Yet the advances coincided with then President Cory Aquino’s administration’s US $12 billion worth of bailouts of several politically connected banks that caused the old central bank to fold from the strain[4].

A topping process developed in 1994-1997, as Japan’s busted bubble redirected a gush of Japanese capital into ASEAN economies[5]. The regional or ASEAN inflation boom eventually unraveled and became known as the Asian Crisis[6].

The ensuing 6 year bear market accounted for as the market clearing process for the region and for the Philippines, part of which had been aggravated by a global recession[7] triggered by the US dot.com bubble bust[8].

Today, the Phisix has been playing out a seminal cycle.

The 2007-2008 bear market in the Phisix had been due to exogenous factors—a contagion from the US mortgage crisis. Yet the latest bear market resembles the earlier or first coup bear market of 1987 (orange ellipse).

This week’s breakout only confirms my long time claim that the recent bear market served as normative countercyclical phase representative of any major trends.

And that’s why I’ve been repeatedly saying that the Phisix will, in the fullness of time, reach 10,000.

It’s a long term trend that seems underway even for our neighbors.

With the conspicuous breakout for the Indonesia, Malaysia and the Philippines (as shown by the charts from chartrus.com), only Thailand, the hub of the Asian Crisis, has yet to reach all time highs.

My crystal ball does not have the surreal or metaphysical sophistication that would allow me to predict the exactitudes, or simply stated, “I can’t say when”. I am no Madame Auring.

All I know is that for as long as the primary forces which drives the Phisix or ASEAN markets—particularly the internal or domestic monetary policies and transmission mechanism from external monetary policies—both of which signify as bubble policies, globalization (which implies further development of the capital markets of ASEAN or of most of Asia) and the global wealth transfer (West-East) or convergence dynamics—remains intact, this advance phase should continue.

In my view, it would take an endogenous or a regional bust similar to 1997, or a reversal of one of these primary factors—through the materialization any of these ‘fat tail’ events: outbreak of global protectionism or a US dollar collapse that risks global hyperinflation or a war that involves the region or a deflationary banking collapse where central banks would not intervene or the adaption of a gold standard—that risks terminating this inflationary boom cycle.

In short, patterns are hardly ever conclusive or that they don’t play out because they have or need to. Since market actions are not historically determined, the realization of patterns would be conditional to the material similarities in the feedback mechanisms or stimulus response dynamics which operated then and which operates today.

If there is a single major nexus between then and today that could influence the fulfillment of said patterns, it is the path dependent nature of governments to inflate the system designed to safeguard the banking system and to preserve the cartelized tripartite patron-client relationship of the welfare state, banking political class and central bankers. The consequences of their actions have perennially led to business (bubble) cycles.

As to whether there will be another countercyclical trend [another provisional bear market] or that the Phisix might advance unobstructed is beyond my ken. Albeit if there will be a clear and present danger that risks another major crisis, I think this could emanate from China[9], instead of the the Eurozone or the US in contrast to mainstream’s expectation.

So far while there have been signs of strains[10] in China, they have not reached a point where I would need to increase demand for cash balances for myself and for my clients.

As far as the current signals from which price trends seem to have been telling us, the upside leg of this advance phase may not only continue, but would likely strengthen.

Breakout Confirmed by the Peso and Market Internals

The Philippine Peso has conjointly broken out of their resistance levels along with Phisix. I told you so.

The tandem’s working relationship has been pretty much solid and dependable. The correlation may not be perfect since the Peso’s action has been distorted by the sporadic interventions by the Bangko Sentral ng Pilipinas (BSP) nonetheless the causation has been strong. Both have been reacting to the relative demand for the Peso assets. The Peso has been driven more by the state of capital flux[11].

Also the Peso can be seen as pursuing less inflationary policies than the US dollar, but a lot more inflationary than the Swiss franc[12].

The simultaneous breakouts can be viewed positively.

Yet the pendulum of the market internals has swung decidedly in favor of the bulls.

This historic breakout has been backed by a hefty surge in volume (weekly volume; left window) which translates to more participation by the public and the pronounced aggressiveness by the buyers.

Foreign inflows, for the week, remained substantial but constituted only about 35% of total trades. This implies positive sentiment for both local and foreign participants.

Based on the average daily traded issues (computed on a weekly basis), the public’s trading interest reached nearly 80% of the 244 issues listed. This means that third tier formerly illiquid and dormant securities have been getting some attention and liquidity. Such spillover dynamics signals broad market bullishness.

It is rare to ever see such strongly linked or convergence of signals as this.

Except for the holding sector, every sector in the Philippine Stock Exchange posted gains.

This time the financial and the property sector tailed the overheated Mining sector both of which has contributed substantially to the advances of the Phisix.

Yet given the sharp pullback by the mining sector over the past two sessions (about 6% from the 2-day high), despite the weekly reported gains, the overstretched mining sector could enter a temporary corrective-consolidation phase.

The mining sector has been up by a remarkable 15 of the last 17 weeks. This week’s advances marked the 5th consecutive week which has elevated the sizzling hot year-to-date returns to an eye-popping 61.45% as of Friday’s close.

While the strong breakout and the bullish tailwind could mean that the Phisix could rise further, we can’t discount profit taking sessions.

And part of this phenomenon could highlight a rotation away from the mining sector and into the other laggards, perhaps to the finance[13] and the property[14] sector as the next major beneficiaries of the percolating inflation driven boom as previously discussed.

A Journey of a Thousand Miles by Single Steps

Greece received second round bailout package 159 billion euros ($229 billion) which has been larger “shock and awe” than expected by the public.

As the Danske Bank reports[15], (bold emphasis mine)

In particular, the elements of the second rescue package for Greece: EUR109bn in official funds, a EUR12.6bn debt buy-back programme, a lowering of interest rates to 3.5%, a lengthening of the maturity on future loans to Greece to a minimum of 15 years and up to 30 years with a 10 year grace period, as well as a lengthening of the maturity on existing loans.

Burden sharing with the IMF will proceed in line with standard practice (1/3 from the IMF).

The increased flexibility of the EFSF could result in more active intervention in the secondary market. The EFSF now takes on this role, which was previously played by the ECB, but will still be supported by ECB analysis.

Such announcement appears to have lifted the global equity market’s sentiment. That’s because we have another QE in place, but this time based on the Eurozone’s rescue, which has been hardly about Greece, but of the Euro (and US) banking system.

And if global equity markets continue to recover from the recent PIIGS crisis shakeout, where the direction of global equity markets may converge, then this should further intensify the bullish proclivities at the Philippine Stock Exchange or ASEAN bourses as foreign capital seek for higher returns or as safehaven on assets of currencies that have been less tainted by inflationists policies.

Under current circumstances it would be best to use pullbacks as buying windows and to refrain from “timing the markets”.

The gist of any relative outperformance portfolio gains or Alpha[16]--return in excess of the compensation for the risk borne—frequently comes from the magnitude of returns[17] and not from frequency of marginal returns which contemporary sell side analysts design their literatures for their clients or how we are traditionally taught even by academia. (I had to challenge my son’s professor on this)

Yet before we think of the Phisix at 10,000, we will need to see the local bellwether transcend the psychological threshold at 5,000, perhaps by the end of the year.

This journey of a thousand steps, to paraphrase Confucius, will be attained through a series of single steps.

Again, profit from political folly.

[1] See Ben Bernanke on QE 3.0: Not Now, But An Open Option, July 15, 2011

[2] See The Phisix And The Boom Bust Cycle, January 10, 2011

[3] Mises, Ludwig von Praxeology and History Chapter II. The Epistemological Problems of the Sciences of Human Action Chapter 2, Section 1 Human Action, Mises.org

[4] See Philippine Banking System: “Most Heavily Fortified Bastion of Privilege and Profit”, June 20, 2011

[5] See Capital Flows, Financial Liberalization and Bubble Cycles, July 22, 2011

[6] Wikipedia.org 1997 Asian financial crisis

[7] Wikipedia.org Early 2000s recession

[8] Wikipedia.org Dot-com bubble

[9]See Mark Twain and China’s Yuan, June 25, 2011

[10] See China’s Bubble Cycle: Shadow Financing at $1.7 Trillion June 28, 2011

[11] See I Told You So Moment: The Phisix At Milestone Highs, July 17, 2011

[12] See Is the Swiss Franc Better than Gold?, July 21, 2011

[13] See A Bullish Financial Sector Equals A Bullish Phisix? May 22, 2011

[14] See Expect a Rebound from the Lagging Philippine Property Sector, July 17, 2011

[15] Danske Bank EU summit delivers bold measures, July 22, 2011

[16] Wikipedia Alpha (investment)

[17] See Investing Guru Joel Greenblatt: Focus on the Long Term, July 9, 2011