Since I’ve already lain out my expectations and projections[1], and with little changes in the global political and economic landscape; all that is required is to simply monitor how my stated themes have been playing out.

Global Markets Still on a Bullish Juggernaut, Expect Profit Taking Anytime

The blazing start for the year 2012 for global equity markets continues.

So far, this has been a “free-for-all” environment for global equity markets as stock markets from developed to emerging to frontier markets seem to be furiously galloping for the top spot.

Argentina and the Philippines, whom were the early leaders[2] have fallen back and have been surpassed by newcomers Turkey, Vietnam, Greece and Venezuela. The latter have joined the recent leaders of the pack, particularly Egypt, Germany, Russia, India, Austria and Peru.

And six weeks into the year, based on nominal local currency returns, the gains have been an eye-popping 15% and more for the frontrunners!

While the local bellwether the Phisix racked up a fantastic 9.41% such advances has not been enough to keep in pace with the current pack of leaders. But this is understandable, the Phisix and ASEAN markets are trading at record highs or near record highs, whereas most of the leaders are coming off from the recent lows.

And another noteworthy observation is that the credit easing operations by the European Central Bank (ECB) at the Eurozone has led Greece and Germany and other European bellwether to outperform. But again, while the region has posted gains in general, the scale of advances has been variable. Again this seems to underscore the relative effects of monetary inflation.

For instance, Greece’s outperformance may be due to the market’s factoring in of the bailout deal[3]. For Germany, in spite of the ephemeral stabilizing effect brought by the ECB’s Long Term Refinancing Operations (LTRO) to the financial markets, investors have reportedly been stuck with placements to German bunds[4] due to lingering uncertainty over the success of the current bailout measures. My guess is that aside from the bund, part of the money from LTRO operations have percolated into Germany’s equities.

Local currency gains can be misleading too. While Venezuela posted 13.73% returns y-t-d, statistical inflation rate has been about or nearly double the returns (see chart[5]) which implies of negative real returns on equity investments.

This also infers that Venezuela’s stock market has mostly been reflecting on the state of their currency’s (Bolivar) chronic disorder, an outgrowth of socialist policies gone haywire, which of course can hardly be explained by either earnings or economic growth.

Going back to the global equity market backdrop, of the 71 bourses I track only 14% are in the red. Most of the issues that are NOT on my screen are from Middle East and North Africa (MENA) and from Central Asia, if time permits I will eventually include these benchmarks.

In Asia, aside from Vietnam, India and the Philippines, the other top gainers have been Hong Kong, Taiwan, Korea and Thailand where gains have ranged from 8-13% over the same period.

Among major ASEAN bourses, there has been a widening gap between the outperformers Philippines-Thailand and this year’s laggards Indonesia-Malaysia. The latter pair has registered measly gains of just over 2%. Such divergence would seem anomalous considering their previous tight correlations of the four bourses.

Yet if such tight correlations should continue, then we should expect either the latter pair to do some sizable catching up or for the former pair to retrace. Otherwise, current actions may signal a departure from the previous relationship.

Meanwhile, Vietnam’s recent surge can be traced to central bank policies too. Interest rates on local currency loans had been cut by 2%[6] which constitutes part of the series of cuts recently made by the Vietcombank. This is aside from recently granted subsidized rates for politically preferred industries made by state owned Bank for Investment and Development of Viet Nam (BIDV)

The big picture matters.

Looking at chart actions should give us a better handle on the current situation.

One does NOT need to rely on technical indicators to see how overbought global markets have been, given that price actions for the FTSE World (FAW), the US S&P 500 (SPX), Europe’s Stoxx 50 (Stox50) and Asia’s Dow Jones Asia Pacific Index (P1DOW) have risen nearly at an angle of 45 degrees with hardly any breathing spell.

The US equity markets, represented by the S&P, appears to have assumed the role of the du jour leader for global equity markets and now trades at the resistance levels (blue horizontal line).

On the other hand, the contemporary benchmarks of the Europe and of Asia remains way below their respective resistance levels.

Notice too how tightly correlated the major global markets have been when based on the seeming symmetry in the undulations of each of the chart actions above.

The point that requires emphasis is that while nominal gains accrued have been relatively diverse, price movements seems have been synchronized. These actions essentially serves as manifestations of the relative effects of inflation which magnifies on the inflationary boom being experienced by global equity markets and the ‘globalization’ of stock market price actions.

Divergent returns on convergent actions primed by a highly inflationary backdrop.

The supercharged and largely overbought global markets have yet to encounter a cyclical countertrend or a natural profit taking cycle.

So while the inflationary push on financial assets may continue over the interim, we should expect profit taking to take place anytime. And global markets will likely embrace any negative developments as an excuse to justify such actions.

However, any profit taking will likely be characterized by short term impact at a modest scale.

More Confirmation Signs of Phisix’s Inflationary Boom

Manifestations of the inflationary boom in global markets seem to be equally evident in the local Philippine Stock Exchange.

My hunch for a boom on capital intensive or capital goods industries (as seen in the property sector and energy sector, aside from the mining sector), as well as, in the banking and financial sector, as funding intermediaries, seem to come to fruition.

As I previously wrote[7],

I am predisposed towards what Austrian economics calls as the higher order stages of production or the capital goods industries, which are likely the beneficiaries of the business cycle, specifically, mining, property-construction and energy, as well as financials whom are likely to serve as funding intermediaries for these projects.

Also, market leadership seem to be rotating away from the former leader the mining sector. The levelling of gains through the broader market appears to be reinforcing the bi-annual outperformance of the mines as I previously noted[8].

Yet index watching may not tell of the entire story too.

The gains of the holding index, which placed third, have likely been due to exposure by the mother companies of Ayala Corporation and SM Investments to their sizzling hot subsidiaries in the property and or the financial sector, while the rest of the holding sector has lagged.

Also while price actions of the mining titans seem to have faltered which has led to the retracement of the mining index, the market’s attention has palpably shifted to the peripheral issues.

To cite some examples of mining component issues on a year-to-date basis, Manila Mining has been up 26.67%, Nickel Asia 17.6%, NiHao Mineral Resources 136% (!!!), Geograce Philippines 67.9% (!!), Apex Mining 37.5% (!), Omico Corporation 15.2%, Oriental Peninsula Resources 48.6% (!!) and oil issues Oriental Petroleum A 31.25% (!) and The Philodrill Corporation 45.45% (!!).

In short, the market’s attention for the mining issues remains intact except that the focus has shifted from the core to the periphery.

Going back to the internal market activities of the PSE, for 2012, through the week ending February 10th, the Phisix has corrected only once in 6 weeks.

Since the last correction, which was about two weeks ago, the local benchmark has been in consolidation.

So even as the bulls appear to be in a temporary lull, the daily Peso volume traded (averaged on a weekly basis) which has meaningfully improved, appears to have peaked.

In the meantime, advance-decline spread (averaged weekly) seems to be narrowing, following a lopsided surge which has favored the bulls.

Also for the first time this year, foreign trade posted a net selling last week.

I would see these as potential signs of a coming profit taking mode.

But there is an important caveat. In a bullmarket, overbought conditions can remain extended for a certain period of time. Therefore predicting short term moves can be tricky.

Although we can’t discount and should expect a normal countercyclical trend or a correction anytime, any profit-taking shouldn’t be seen as an end to the current momentum, as these would again, likely signify a short-term event with a modest impact (unless external factors will sharply deteriorate)

Besides, as recently exhibited by the market’s internal dynamics, corrections may imply a decline of the benchmark heavyweights but not necessarily reflecting the motions of the overall markets.

To the contrary, the rotational dynamic may likely continue; whether the market’s attention will shift in distributing gains among sectors or among issues within a particular sector.

At the end of the day, easy money policies in the Philippines and abroad will likely lend support to the cause of the bulls.

Inflationary Boom in the Real Economy

I’d further add that the inflationary boom can be seen in in the real economy as systemic credit growth has surged remarkably where the rate of growth of commercial bank lending in the Philippines has doubled in 2011 from 2010.

According to the Manila Bulletin[9]

The total outstanding loans of commercial banks went up by 19.3 percent at the end of 2011, higher than 2010 growth of 8.9 percent and reflecting a robust growth in the real sector.

Growth in commercial loans was across the board. All posted double digit growth led by mining/quarrying loans (60.1%), wholesale and retail trade (57.8%), electricity/gas/water (54.2%), real estate/rending/business services loans (25.2%), construction (22.3%) and financial intermediation (16.8%).

Statistical categorization can’t be relied on though. As in the latest Bangladesh experience[10], many loans labeled as ‘industrial’ were rechanneled to other undertaking, particularly to the stock market. The monetary tightening by the government put an end to yield chasing activities which prompted for last year’s crash that even spawned a political turmoil.

The next very crucial point is policy induced negative real rates seem to be driving the public to take on more credit driven activities. What the mainstream and the media sees as ‘healthy developments’ are in reality nascent indications of malinvestments and the implicit promotion of consumption activities.

As German economist and honorary professor Thorsten Polleit[11] explains (italics original)

The artificial lowering of the market interest rate induces additional investment. At the same time, savings decline and consumption increases. As a result, the economy starts living beyond its means. The boom is inflationary: all that has increased is the amount of money, not the supply of the means of production, such as labor and land.

The boom is economically unsustainable, because the policy-induced deviation of the market interest rate from the neutral interest rate causes malinvestment. Firms embark upon capital-intensive investment projects, and production becomes more time consuming, or roundabout.

The lengthening of the production structure implies a rise in the production of capital goods at the expense of consumer goods. The artificially suppressed market interest rate thus induces firms to engage in a kind of production that does not correspond to actual demand. As soon as this is revealed, the money-driven boom turns into bust.

Again piecing up the pieces together, we are seeing more evidence of an inflationary boom or the Austrian business cycle or the boom bust cycle at work which has been influencing the actions in the financial markets, as well as, in real economic activities.

Expect More Monetary Inflation Ahead

Central banks of developed economies have continued to telegraph aggressive expansions of their balance sheets directly or indirectly.

The Bank of England (BoE) announced a £50 billion increase[12] of their bond purchases over the next 3 months.

The European Central Banks will be offering the second tranche of their Long Term Refinancing Operation (LTRO) by the end of February[13] where ECB President Mario Draghi urged banks to avail of this facility.

The ECB may be adapting more eligible form of collateral to accommodate more banks in the upcoming LTRO.

According to the Danske Research[14],

The ECB has approved proposals relevant for acceptance of additional credit claims as collateral in the credit operations put forward by seven central banks, namely Central Bank of Ireland, Banco de España, Banque de France, Banca d’Italia, Central Bank of Cyprus, Oesterreichische Nationalbank and Banco de Portugal (see national central banks for further details). The other national central banks are working on preparing similar proposals for temporary approval of credit claims as collateral. The broadening of the collateral base can potentially increase the usage of the second LTRO substantially compared with the first one.

Draghi refrained from giving any estimate on the expected usage of the upcoming threeyear LTRO. It was clear that Draghi was comfortable about the substantial market relief following the introduction of the three-year LTRO. We expect banks to take around EUR300-600bn at the 3Y LTRO. According to Reuters, forecasts now range from EUR75bn to EUR800bn and there is still talk of EUR1tr. We expect banks to take around EUR300-600bn

LTRO’s serve not only as free money, but as opportunities for the banking system to offload toxic assets to the ECB. The banking system will oblige on Draghi’s call.

Next politicians have been pressuring the Bank of Japan (BoJ) to ease further or face a revision of the BoJ law[15] in order to “give the government more room to intervene in monetary policy”. This is an example of the sham in the so-called central banking independence.

Central banks are politically influenced directly or indirectly. The BoJ will be stepping on the QE gas pedal. Yet, if Japan’s government manages to remold on the BoJ law which gives Japanese politicians the space to intervene directly, then the yen will be faced with greater risk of hyperinflation.

Acting chairman of the Swiss National Bank, Thomas Jordan, also vowed to continue with currency intervention[16] through quantitative easing if deemed required by the technocracy.

Moreover, a purported $26 billion foreclosure deal[17] by the US government with various states and the 5 biggest banks appear to be parcel to US Federal Reserve chairman Ben Bernanke’s repeated pronouncements of QE 3.0 targeting mortgages[18] which could serve as a backdoor bailout of the privileged “too big to fail” banks[19].

Around the world this week, three central banks slashed rates (Belarus and Indonesia[20] as well as Vietnam). This further adds to the negative real rates environment that should be supportive of the asset markets.

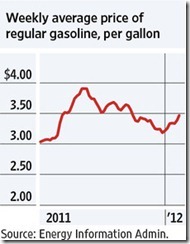

Commodity prices have risen but returns have varied. Gold has led the recovery followed by the industrial metals (DJAIN) and the energy index (GJX). Agriculture prices have trailed (GKX). Nonetheless, world food prices have reportedly reached the highest level in 11 months[21].

With commodity prices not as responsive relative to gains of financial asset markets, this will be seen by central bankers as windows of opportunities for the deployment of more credit easing programs.

So any correction must be seen as an opportunity to accumulate as all these money printing will have to flow somewhere.

Finally while I have been emphasizing that interest rates will serve as a major gauge on monetary conditions, interest rates won’t be a one-size-fits all solution in predicting cyclical inflection points.

As I have pointed out in the past[22],

interest rates will most likely determine the popping of this bubble where interest rates may be driven by any of the following dynamics, changes in: 1) inflation expectations 2) state of demand for credit relative to supply 3) perception of credit quality and or 4) of the scarcity/availability of capital.

Plainly put, different circumstances will influence interest rate prices distinctly. This also means varying impacts on the financial markets. Thus identifying the cause of interest rate conditions will matter. The yield curve will matter. Actions in several credit markets (CDS, TED Spread, Libor-OIS) will matter. The correlations with other interconnected markets will also serve as other pivotal factors.

Since markets represent human actions, they are a complex dynamic. Thus aggregate based analysis or heuristics paraded as economic reasoning can be fatal.

[1] See What To Expect in 2012, January 9, 2012

[2] See Global Equity Markets: Philippine Phisix Grabs Second Spot, January 14, 2012

[3] Reuters.com Greece set to agree bailout as Germany demands action, February 12, 2012

[4] Bloomberg.com ECB Cash Fails to Wean Investors Off German Debt: Euro Credit, February 10, 2012

[5] Tradingeconomics.com Venezuela Inflation Rate

[6] Vietnamnews.com Banks flirt with low interest rates February 11, 2011

[7] See Phisix-ASEAN Equities: Awaiting for the Confirmation of the Bullmarket, November 13, 2012

[8] See Graphic of the PSE’s Sectoral Performance: Mining Sector and the Rotational Process, July 10, 2011

[9] Manila Bulletin Loans Grow 19.3% In 2011 February 9, 2011 mb.com.ph

[10] See Bangladesh Stock Market Crash: Evidence of Inflation Driven Market, January 11, 2011

[11] Polleit, Thorsten The Cure (Low Interest Rates) Is the Disease, April 5, 2011, Mises.org

[12] See Bank of England Adds 50 billion Pounds to Asset Buying Program (QE), February 9, 2012

[13] Reuters.co Euribor rates fall after ECB urges banks to tap LTRO, February 10, 2012

[14] Danske Research Flash Comment ECB meeting: looking intensively at credit tightening risk, February 9, 2012

[15] Reuters.com BOJ may consider action next week as political pressure mounts, February 10, 2012

[16] Financial Times Jordan vow to continue SNB intervention, February 2, 2012

[17] New York Times, States Negotiate $26 Billion Agreement for Homeowners, February 8, 2012

[18] Bloomberg.com Bernanke Doubles Down on Fed Bet Defied by Recession: Mortgages, January 20, 2012 Businessweek.com

[19] Newsmax.com David Stockman: Obama Mortgage Refinance Plan is 'Crony Socialism' February 8, 2012

[20] Centralbanknews.info Monetary Policy Week in Review - 11 February 2012, February 10, 2012

[21] See Inflation Watch: World Food Prices Jump Most in 11 Months February 9, 2011

[22] See I Told You Moment: Philippine Phisix At Historic Highs! January 15, 2012

![clip_image001[1] clip_image001[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhBnBjrusg-vbviYhP7CyjArdlijM_2B1a65Te9lLCZ02xFmGvyBR0ko6V5W7ziHYnpZgfulBiF0duMnjN8u1UHUzMNn55rowlXj5lGK2EUc-LpCqx7mAMCTIeVaUpq9hj4lMtr/?imgmax=800)