Thus the remedy for the boom is not a higher rate of interest but a lower rate of interest! For that may enable the so-called boom to last. The right remedy for the trade cycle is not to be found in abolishing booms and thus keeping us permanently in a semi-slump; but in abolishing slumps and thus keeping us permanently in a quasi-boom. John Maynard Keynes, The General Theory of Employment, Interest and Money[1]

Quasi Boom Policies Drives Risk ON Today

Today’s bubble dynamics has essentially been drawn from Keynesian policy paradigm of establishing permanently quasi booms.

This has become the global central banker’s creed in managing the monetary state of affairs of their respective economies channeled through zero bound interest rates (ZIRP) and quantitative easing (balance sheet expansions)

The Philippine counterpart, particularly the Bangko Sentral ng Pilipinas (BSP), particularly has acted along in conformity with the de facto global central banking standard.

Debt financed consumption activities have been anchored on permanent quasi boom policies.

Policies promoting quasi booms effectively prioritizes the short term.

Whether through democratic politics, economics or in the markets, narrowing people’s time orientation and value scales has adverse impact on the society, as Austrian economist Hans Hermann Hoppe writes[2],

Democracy has achieved what Keynes only dreamt of: the "euthanasia of the rentier class." Keynes's statement that "in the long run we are all dead" accurately expresses the democratic spirit of our times: present-oriented hedonism. Although it is perverse not to think beyond one's own life, such thinking has become typical. Instead of ennobling the proletarians, democracy has proletarianized the elites and has systematically perverted the thinking and judgment of the masses.

And booming stock market and property sectors have likewise been expressions of policy induced changes that gives a premium to the short term.

The consumption/investment ratio or consumer/savings preferences by the marketplace have been altered to reflect on the preference for price titles of capital goods caused by expansion of bank credit. In other words, investments have focused on capital and producer’s goods at the expense of the consumer industry. People have been made to believe that rising prices extrapolates to real growth, when this has been a mirage prompted for by Potemkin effect from credit expansion.

These rush to capital intensive sectors mostly via the property boom has become evident worldwide and especially pronounced in countries least affected by the previous crisis.

For instance, Canada[3] and Australia[4], now reckoned as alternative foreign reserve currencies[5] even prior to the anointment of the IMF, has been nurturing their own domestic bubbles.

Asia has likewise been manifesting symptoms of bubbles. Hong Kong even has a bizarre parking lot bubble[6]. Add to this the mushrooming of grandiose signature buildings in China and major ASEAN nations which have usually highlighted the Skyscraper curse[7].

Even the US has been currently experiencing a seeming renascence or reflation of the property sector[8]

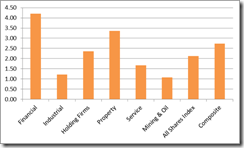

Going to the stock markets, among the ASEAN majors, the Philippine benchmark the Phisix has essentially surpassed Thailand’s SET with three consecutive weekly gains totaling 6.39% since November 16th.

Such succession of weekly gains means that the Phisix has carved out back-to-back record highs. Year-to-date returns on the Phisix commanded a lofty 32.53% as of Friday’s close.

Despite the huge gains, in Asia, the Phisix trails Pakistan’s Karachi 100 which has skyrocketed to an incredible return of 48.12% and Laos (Laos Securities) with an impressive 33.24% advance.

One would also note that global equity markets have generally been surfing on a bullish wave over the same period.

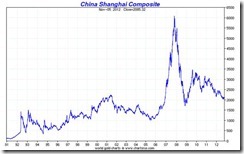

And among the majors, only the China’s Shanghai index has remained as the odd man out. Nevertheless, this week’s spectacular 4.12% gains have pruned down a big segment of this year’s losses.

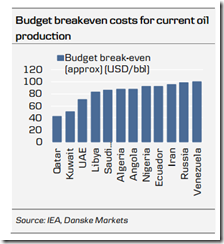

Given the recent record liquidity injections by the People’s Bank of China (PBoC) which coincided with the latest leadership changes[9], and improving signs of credit growth, perhaps from stealth stimulus[10] coursed through State Owned Enterprises (SoE), accelerating signs of improvements on infrastructure investments[11] (see above), and with retail investors almost abandoning the stock market[12] out of depression, China’s reflationary policies may yet spark new bubbles in both the stock market and the property sectors.

The “success” of Chinese government thrust to reflate its bubble will depend on the availability of real savings derived from the productive agents or the wealth generators (business and commercial enterprises). For as long as productive activities thrives in spite of the redistributive and wealth consuming activities by her government, or for as long as there will be resources that can be reallocated, such bubbles may last.

Recovering prices of industrial metals also seem to underpin and or portend for China’s stock market recovery.

A reflation of China’s asset bubbles will likely be supportive of the recent gains attained by ASEAN bourses.

Moreover for the moment, the inflationary boom, as revealed by the rising tide phenomenon, which has become the dominant force, with China likely being part of the cast simply reinforces the RISK ON environment.

As I have repeatedly been pounding on the table, the direction of global asset prices, including the Philippines are in the palm of the hands of central bankers.

The same dynamic be seen within the Philippine market. The rising tide seems to be lifting all boats. Even the politically persecuted sectors[13], whom have been this year’s laggards, specifically the mining-oil and the service industries, have likewise posted (less than impressive) advances this week.

The fresh milestone highs of the Phisix have emerged in the backdrop of immensely improving confidence levels.

Of the 287 issues listed[14] on the Philippine Stock Exchange, about 71% are now being traded. Average number of issues traded daily (left) have been nearing the highest level since the 1st quarter of 2012.

The same applies to the average daily trades (right) which could signal new participants and or more churning of trades by existing ones.

Increasing peso volume backed by the average number of daily trades and the average number of issues traded daily have been suggestive growing and broadening of risk appetite.

Yield chasing dynamic continues to fuel today’s advances.

I believe that should an interim correction emerge from an overheated Phisix occur, then rotation dynamic will reinforce the current inflationary boom.

The Transmission Mechanism of Quasi Booms; the Bangladesh Episode

I have been pointing out[15] that the reason for the outperformance of the Phisix has been due to the easing policies embraced by the BSP, which has been the most aggressive in Asia.

This aggressive policy easing comes in the face of the steep Philippine yield curve, which still has been the steepest in Asia (chart from ADB[16]).

And with the BSP manipulating the short end of the curve, banks have been motivated to profit from the curve through fractional reserve banking based maturity mismatches or the maturity transformation[17] or simply “borrow short term, lend long term”

Manipulation of the yield curve represents an effective subsidy to highly protected banking industry. Banks have been the main financiers of the ongoing boom in the property sector. This effectively chimes with the Austrian business cycle. Investors mistakenly sees the abundance of savings in driving down interest rates which allows them to undertake formerly unfeasible projects. Hardly do they realize that there has not been sufficient savings and resources to back this up. And artificially suppressed interest rates, which have been products of central banking manipulations, are unsustainable.

Think of it. If a local currency domestic time deposit today yields about 2% or less depending on the size of the deposits per year, and if loan rates are about 15% per annum where the stock market returns 30% over the same period today, would the public not be tempted to plough into stock market by shifting their time deposits, and or if not, even borrow from the banks to reach for yields?

That’s exactly the temptation brought about by quasi boom-negative real rates policies. People will be seduced to the yield aspects, while ignoring the risk accompanying participation in the stock market (basically the same mechanics for those who fall for Ponzi schemes[18]).

And most likely as the yield curve flattens, banks will compete feverishly to serve consumer financing demand by lowering the quality of lending standards and or by issuing new products that arbitrages on existing regulation (I am thinking the shadow banking system). That’s how current monetary policies subliminally influence people’s incentives and economic calculation

The country’s banking industry recently reported a double digit rise in income growth rate during the first three quarters of the year[19]. While much of this has been attributed to increased demand for financial non-interest services, such could be seen as testament to the blossoming credit bubble.

The outperformance of the banking and property sector has been reflected on the year to date gains in the domestic stock market.

As I predicted 2 years back[20]

Thus the environment of low leverage and prolonged stagnation in property values is likely to get a structural facelift from policy inducements, such as suppressed interest rates which are likely to trigger an inflation fuelled boom by generating massive misdirection of resources-or malinvestments.Of course many would argue on a myriad of tangential or superficial reasons: economic growth, rising middle class, urbanization and etc... But these would mainly signify as mainstream drivels, as media and the experts will seek to rationalize market action on anything that would seem fashionable.And the business cycle will be left unheard of until perhaps the realization of a bust.

Remember just recently the incumbent administration bragged about the huge jump in construction industry as the “best property boom in two decades”[21] which incidentally cushioned the decline of the export sector to deliver a surprise third quarter 7.1% economic growth.

The administration even had the audacity to label such statistical outperformance as “Aquinomics”, when all these have accounted no more than the frontloading of consumption via the Keynesian permanent quasi boom formula of debt based spending.

But media has kept reticent in saying that the surge in construction activities has been financed by a credit boom or “lending to the real estate sector hit an all-time high” last June[22].

Domestic credit provided by the banking sector as of 2011 according to the World Bank via tradingeconomics.com[23] has steadily been rising since 2003. In 2011, bank credit as a share of GDP has accounted for 51.84% of the GDP. This must be a lot higher today.

Current growth trends have popped above the long term average. The implication is that growth credit has begun to surpass the growth in the real GDP. Credit expansion now drives the statistical economy.

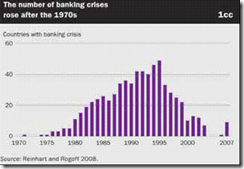

One would notice that growth in bank credit can leapfrog, similar to the 1992-1998 window which culminated with the Asian crisis[24]. In 1997 or at the precipice of the boom, bank credit accounted for 84.47% of the GDP.

The economic crisis during the terminal phase of the Marcos regime[25] led to a contraction of bank credit which had been reversed during pre-Asian crisis Japanese money driven boom.

By the way, a déjà vu of a Japan driven Phisix-ASEAN bubble in response to the Japan’s government’s policies must not be discounted[26]

Unfortunately, despite announcements of domestic regulators of the supposed potency of their ability to control credit flow, unless they possess the supernatural privilege of omniscience, such money flows emanating from credit expansion can hardly be determined with technocratic precision.

The great Austrian professor Ludwig von Mises admonished[27],

Discrimination in lending is no substitute for checks placed on credit expansion, the only means that could really prevent a rise in stock exchange quotations and an expansion of investment in fixed capital. The mode in which the additional amount of credit finds its way into the loan market is only of secondary importance. What matters is that there is an inflow of newly created credit. If the banks grand more credits to the farmers, the farmers are in a position to repay loans received from other sources and to pay cash for their purchases. If they grant more credits to business as circulating capital, they free funds which were previously tied up for this use. In any case they create an abundance of disposable money for which its owners try to find the most profitable investment. Very promptly these funds find outlets in the stock exchange or in fixed investment. The notion that it is possible to pursue a credit expansion without making stock prices rise and fixed investment expand is absurd.

This means quasi boom policies may incite money flows into the stock market and or to the property sector and or both and or other capital intensive industries.

No one knows exactly where these monies will flow into.

This has been the case of Bangladesh in 2011.

Prior to the politically tumultuous stock market crash[28], the stock market absorbed much of the credit expansion from the banking system. Loans had been diverted away from intended uses, which fueled to the antecedent stock market boom. Bangladesh’s Dhaka became one of the best performing bourses in the world in 2010[29].

However, Bangladesh officials apparently realized of the danger from pursuing easy money policies and decided to sacrifice the boom by tightening credit. This impelled for the crash.

Since the peak in November 2010, Bangladesh’s Dhaka 100 has been about 50% lower. (see above chart from Bloomberg)

Fortunately, the underdeveloped Bangladesh’s stock market’s capitalization represents only 21.6% of the GDP as of 2011 (this should be lower today) as the crash hardly made a dent to her economy.

It’s a different story for the ASEAN majors whose market capitalization plays a big role in the economy: as of 2011 Indonesia accounted for 46.11% of GDP, Malaysia 141.8%, the Philippines 73.6% and Thailand 77.7% according to World Bank[30]. And the aforementioned ratios should be much larger today, given the huge gains

The point is once consumption-savings preferences will revert to their former proportions, and where the shortages of savings and real resources would have been revealed and that prices of goods and labor would have been bided up too high, all of these will be ventilated through higher interest rates, where the ensuing bust will account for the necessary adjustments for the massive build-up of malinvestments during the preceding boom.

A bursting credit bubble for ASEAN, whom has begun to interlock equity markets via cross listings, will have far more catastrophic effect than one experienced by Bangladesh. Moreover, Asia’s intra-region trade links has been growing overtime now accounting for more than 50%[31]. This amplifies the contagion risks.

Real Bubble Bust: The Path to E-VAT 15%

In the Philippines, today’s quasi boom policies which are being manifested through the property and the stock market boom and which has been spurred by credit expansion will likely be compounded by consumer debt and aggressive government spending programs.

Consumers will be tempted to live beyond their means. They are likely to expand consumption activities through consumer credit facilities through credit cards, housing loans, car loans and etc…

All these imply that debt based activities from the private sector—via speculation on capital intensive misdirected investment projects and via consumer credit—along with government spending will translate to stiff competition for resources which will put pressure on interest rates.

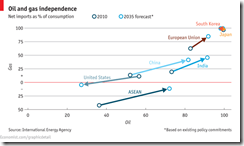

The likelihood is that given the low savings rate about 19-23% of GDP, where the Philippines has the lowest savings in the region[32] (partly due to limited access to the formal banking system), trade balance could turn into deficit as OFW remittances and export receipts would fail to cover for the debt based consumption activities.

It would seem as déjà vu of the Asian crisis as trade deficits continue to widen but so far thanks to record remittances[33] and globalization such deficits has been amply covered.

Record forex currency reserves would begin to deplete as these would likely be used to bridge finance on such gaps.

And if the BSP makes good of the threat to impose more reverse capital controls[34], to control influx of foreign money, interest rates will zoom higher to reflect on the scarcity of savings and of real resources. This would prick the credit bubble and send the Phisix and the Peso on a tailspin.

Let me add that the IMF’s recent endorsement of reverse capital controls[35] could be seen as partly advocating selective protectionism, and partly could be part of the central bank cabal to place an international dragnet to keep capital flows from nations imposing intense financial repression from fleeing.

The New York Times[36] recently gave a clue noting that “the Internal Revenue Service is asking foreign financial institutions and tax agencies to join the cause”. I just cannot help but think that this has been part of the encirclement strategy or pincer movement[37] employed by increasingly desperate politicians to thwart capital mobility with the help and collaboration of other central banks in order to seize private sector resources to finance the unsustainable profligacy of politicians and bureaucrats.

And since the prolonging of the domestic boom requires foreign capital or that trade deficits would need to be offset by capital accounts[38] or increasing foreign claims on local assets, either the BSP loosens up or keeps an eye closed on foreign money flows. Most of which will likely come from hot money inflows seeking refuge from inflationism and financial repression.

Nonetheless if political conditions overseas become intolerable, where international savings will seek shelter from overseas, no amount of capital controls can really stop this.

In the case of China, which has stringent capital controls, hot money continues to play a significant role in driving up the boom-bust cycles.

All these suggest once the domestic and regional bubble has been popped, governments will do the same things as they are doing today in crisis afflicted developed nations. They are likely to engage in bailouts of the banking and finance sectors.

And of course, financial repression via forcible transfer of resources which are meant to safeguard the politically privileged enterprises would mean higher taxes for everyone. Haven’t you noticed? We always pay for the mistakes of the political leaders.

That’s why I believe that the consequence from today’s boom will be a 15% E-VAT in the fullness of time.

Currently E-VAT is at 12% which was implemented on September 1, 2005[39]. The Value added Tax was introduced in the Philippines by President Cory Aquino’s Executive Order 273 in July 25, 1987[40]

My impression is that domestic politicians would see the Value Added Taxes as the easiest way to capture taxes on a broader scale. Yet perhaps it may be more than just about collections

As the great libertarian Frank Chodorov pointed out (quoted by Murray Rothbard[41])

It is not the size of the yield, nor the certainty of collection, which gives indirect taxation [read: VAT] preeminence in the state's scheme of appropriation. Its most commendable quality is that of being surreptitious. It is taking, so to speak, while the victim is not looking.Those who strain themselves to give taxation a moral character are under obligation to explain the state's preoccupation with hiding taxes in the price of goods. (Frank Chodorov, Out of Step, Devin-Adair, 1962, p. 220)

Bottom line: Policies which promotes permanent Quasi booms have real effects of damaging and consuming wealth through perpetual bubble cycles

[1] John Maynard Keynes Book VI Short Notes Suggested by the General Theory Chapter 22. Notes on the Trade Cycle John Maynard Keynes The General Theory of Employment, Interest and Money Marxist.org

[2] Hans Hermann Hoppe, Natural Elites, Intellectuals, and the State Mises.org

[3] The Globe and Mail, Canada’s credit bubble a central banker’s dilemma October 21, 2012

[4] The Sydney Herald Is the RBA trying to re-inflate the housing bubble? October 3, 2012

[5] See New Currency Reserves: Australian Dollar, Canadian Dollar and Gold, November 28, 2012

[6] See Hong Kong’s Parking Lot Bubble November 28, 2012

[7] See Does the Skyscrapers Curse Signal a coming Asian Crisis? July 6, 2012

[8] see US Federal Reserve Policies Re-Inflate US Property Bubble October 20, 2012

[9] see On China’s New Leaders November 19, 2012

[10] See Possible Reasons Behind the 2.9% Surge by China’s Shanghai Index December 5, 2012

[11] Danske Bank The Tide is Turning Global Scenarios December 2012

[12] see Lessons from the Sad Experience of China’s Retail Stock Market Investors December 6, 2012

[13] See Inflationary Boom Powers Phisix to Milestone Highs November 26, 2012

[14] Credit Risk Monitor Directory of Public Companies in Philippines crmz.com

[15] See Phisix at 5,600: Emergent Signs of Euphoria? December 3, 2012

[16] Asianbondsonline.org ASIA BOND MONITOR NOVEMBER 2012

[17] Wikipedia.org Maturity transformation, Wikipedia.org Banks Economic Function

[18] See The Symmetry Between Ponzi Scams and Ponzi Financed Global Financial Markets November 19, 2012

[19] Inquirer.net PH banks post double-digit income rise as of Q3 December 7, 2012

[20] see The Upcoming Boom In The Philippine Property Sector September 12, 2010

[21] See The Secret of Aquinomics: Bubble Economic Policies November 29,2012

[22] Oxford Business Group Philippines: Real estate loans rising November 2, 2012

[23] Tradingeconomics.com DOMESTIC CREDIT PROVIDED BY BANKING SECTOR (% OF GDP) IN PHILIPPINES The Domestic credit provided by banking sector (% of GDP) in Philippines was last reported at 51.84 in 2011, according to a World Bank report published in 2012. Domestic credit provided by the banking sector includes all credit to various sectors on a gross basis, with the exception of credit to the central government, which is net. The banking sector includes monetary authorities and deposit money banks, as well as other banking institutions where data are available (including institutions that do not accept transferable deposits but do incur such liabilities as time and savings deposits). Examples of other banking institutions are savings and mortgage loan institutions and building and loan associations.

[24] Wikipedia.org 1997 Asian financial crisis

[25] Country-data.com Philippines External Debt

[26] See Will Japan’s Investments Drive the Phisix to the 10,000 levels? March 19, 2012

[27] Ludwig von Mises, 5. Credit Expansion XXXI. CURRENCY AND CREDIT MANIPULATION Human Action Mises.org

[28] See Bangladesh Stock Market Crash: Evidence of Inflation Driven Markets January 11, 2011

[29] Wikipedia.org Investment 2010-11 market crash Economy of Bangladesh

[30] World Bank Data Market capitalization of listed companies (% of GDP)

[31] Asianbondsonline.org Asian Economic Integration Monitor JULY 2012

[32] Asian Investment Managers Guide Philippines Market Profile

[33] Inquirer.net BSP expects forex reserves to hit new highs December 4, 2012

[34] Philstar.com Capital controls should serve only as measure of last resort – BSP December 5, 2012

[35] See IMF Supports Capital Controls December 5, 2012

[36] New York Times Few Places to Hide as Taxes Trend Higher Worldwide, December 2, 2012

[37] Wikipedia.org Pincer movement

[38] Wikipedia.org Capital account

[39] Wikipedia.org Republic Act 9337

[40] Lawphil.net EXECUTIVE ORDER NO. 273 July 25, 1987 ADOPTING A VALUE-ADDED TAX, AMENDING FOR THIS PURPOSE CERTAIN PROVISIONS OF THE NATIONAL INTERNAL REVENUE CODE, AND FOR OTHER PURPOSES

[41] Murray Rothbard The Value-Added Tax Is Not the Answer Mises.org April 23, 2010