Much of the global financial markets have been complacent about what has been going on in Japan.

Kuroda’s Policies Incites Bond Market Volatility

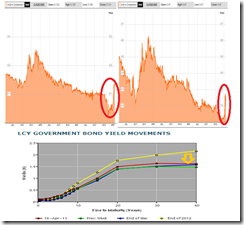

Yet part of the collapse in gold-commodity prices has been attributed[1] to the recent spike in coupon yields of Japanese Government Bonds (JGBs) across the yield curve, which may have forced cross asset liquidations on investors to pay for margin calls.

The two week upsurge in 2-year and 5-year JGB yields (chart from the Bloomberg) has essentially brought interest rates to early 2012 levels with year-to-date changes exhibiting an of increase 3.7 and 6 basis points (bps), respectively. Such increase in the short end spectrum of the yield curve comes in the light of the decline in 10 year yield at 20.4 bps, according to Asianbondsonline.org[2] data at the close of April 18, 2013.

The steep climb in short term yields relative to the long term has also materially flattened the JGB yield curve.

While yield curves usually serve as reliable indicators for recession[3], where an inverted yield curve would usually translate to symptoms of growing liquidity shortages from resource misallocations via rising short term rates relative to long end of the curve, central bank manipulation may have muddled up its effectiveness.

Japan’s rising short term rates are likely manifestations of the growing risks of price inflation from Bank of Japan’s (BoJ) Haruhiko Kuroda’s adaption of ECB chief Mario Draghi’s “do whatever is takes”, in the case of Japan “to end deflation”, or aggressive inflationism channeled through the doubling of Japan’s monetary base.

Kuroda’s “Abenomics”, which is the grandest experiment with monetary policies by yet any central bank, will bring about Japan’s monetary base to over 50% of the GDP by 2014[4], compared to the FED’s QEternity at 19% of the GDP.

Kuroda may have already attained the goal of defeating the strawman-bogeyman called “deflation”[5], that’s if McDonald’s will act as the trendsetter for Japanese companies. Japan’s McDonald’s franchise has announced price increases for as much as 25% for some of her products[6].

But the marketplace hasn’t seen what a continuous rise of interest rates will mean for Japan and for the global financial markets.

Around ¥103.76 trillion (US$1.04 trillion) of JGBs will mature or will get rolled over this 2013.

Of the total, I estimate around 76% of these to be short term papers. They consist of Treasury Bills, 2-year bonds, JGBs for retail investors consisting of 3 and 5 years fixed rate aside from floating rates) and 5 year bonds, based on Japan’s Ministry of Finance latest update[7].

In 2014, ¥72.98 trillion (US$ 733 billion) will mature. 2-5 year bonds will makeup over 60% of such debts.

Consider these figures. According to James Gruber at the Forbes.com[8]

Government debt to GDP in Japan is now 245%, far higher than any other country. Total debt to GDP is 500%. Government expenditure to government revenue is a staggering 2000%. Meanwhile interest costs on government debt equal 25% of government revenue.

Add to this Shinzo Abe’s fiscal stimulus package announced last January amounting of ¥10.3 trillion[9] US $116 billion (January), US $103.5 billion (current) and the Liberal Democratic Party LDP’s proposed US$ 2.4 trillion of public work spending programs[10] spread over 10 years which should expand on the current levels of debt.

In other words, Japan’s unsustainable debt structure has been founded on the continuance of zero bound rates. Thus a further spike in yields from the prospects of “crushing deflation” via monetary inflation will bring to the fore, Japan’s credit and rollover risks. For instance a doubling of interest rate levels will translate to a doubling of interest costs on government debt and so on. Remember, BoJ’s Kuroda set a supposed “flexible” inflation target of 2% in two years[11], while paradoxically expecting bond markets to remain nonchalant or placid.

Thus any signs of the emergence of a loss of confidence that may resonate to a debt or currency crisis may unsettle global markets.

The Japanese government via Abenomics has essentially been underwriting their economic “death warrant”.

It would be a mistake to infer “decoupling” or “immunity” from a debt or currency crisis in Japan.

A Japan crisis will hardly be an isolated event but could be the flashpoint to a global finance-banking-economic crisis given the increasingly fragile state from debt financed economic growth and debt financed political system

Yet we appear to be witnessing emergent signs of instability or a backlash from “Abenomics” based on Japan’s credit default swaps (CDS) last Thursday.

From Bloomberg[12]:

Two-year overnight-index swap rates that reflect investor expectations for the Bank of Japan’s benchmark rate are set for the biggest monthly jump since November 2010 and reached 0.095 percent this week, according to data compiled by Bloomberg. The contract has climbed from a low of 0.039 percent in January to the highest since July 2011, approaching the 0.1 percent upper range of the Bank of Japan’s benchmark rate target. The comparative swap rate in the U.S. was at 0.163 percent.

While I expect Abenomics to incite a capital flight yen based selloff from Japanese residents and companies that should benefit the Philippines or ASEAN overtime[13], it would be a different scenario if the financial markets precipitately smells the imminence of a crisis.

So the coming week/s will be crucial.

The Crux of Abenomics

It’s also important to analyze why Abenomics has been initiated.

Looking at the composition of the Japan’s public debt, since September 2008[14] or over a period of 4 years, the banking industry [42.4% September 2012; 39.6% September 2008], the Bank of Japan [11.1% September 2012; 8.7% September 2008], foreign investors [9.1% September 2012; 7.9% September 2008] general government [2.6% September 2012; 1.5% September 2008], and others [2.7% September 2012; 2.4% September 2008], posted increases in JGB holdings. The banks, the BoJ and foreigners essentially absorbed the largest share of the growing pie of JGBs.

On the other hand, Public Pensions [7.0% September 2012; 11.7% September 2008], Pension Funds [3.0% September 2012; 3.8% September 2008] and Households [2.7% September 2012; 5.2% September 2008] holdings of JGBs shriveled given the same time frame.

The share of Life and non-life insurance industry has remained largely little changed.

Despite the much ballyhooed battle against “deflation”, the changing debt structure reveals of the crux of Abenomics.

Financials (banks and insurance) accounted for 61.7% of JGBs holdings in 2012. Considering that the largest holders of equities in Japan have reportedly been the banking and insurance industry[15] as households account for only 6.8%, Abenomics has functioned as redistributive mechanism or a subsidy in support of these highly privileged sectors.

Thus, Abenomics has partly been engineered to forestall stresses and frictions that may increase the risks the collapse of these sectors. This also exhibits how this hasn’t been about the economy but about preserving the privileged status of political connected industries which politicians also depend on for financing.

Further Abenomics operates in a logical self-contradiction. While the politically and publicly stated desire has been to ignite some price inflation, Abenomics or aggressive credit and monetary expansion works in the principle that past performance will produce the same outcome or the that inflationism will unlikely have an adverse impact on interest rates, or that zero bound rates will always prevail.

The idea that unlimited money printing will hardly impact the bond markets is a sign of pretentiousness.

But there seems to be a more important reason behind Abenomics; specifically, the Bank of Japan’s increasing role as buyer of last resort through debt monetization in order to finance the increasingly insatiable and desperate government.

Note in particular, savers via Japanese household have reduced stock of JGBs by a whopping 48% since 2008, while pensions by both the public and private sectors contracted by 40% and 21% respectively.

Such a slack has been taken over by the banking system and the BoJ. While foreign holdings have manifested growth, they are considered as fickle and may reverse anytime.

Reduction of JGBs by savers could partly manifest Japan’s demographics or her negative population growth[16]. But such explanation hasn’t been sufficient.

The distribution of Japan’s household assets has mainly been channeled towards cash and deposits (55.2%) and insurance and pension reserves (27.7%). This is according to the latest flow of funds reported by the Bank of Japan[17]

According to the following charts from Danske Bank[18], Japanese investors with parsimonious exposure on foreign assets have been net sellers of foreign stocks (right window).

But more important aspect is that Japan’s insurance and pension companies, which accounts for the second largest bulk of household assets, have increasingly been deploying their resources overseas (left window). The rate of growth has been accelerating in tandem with BoJ’s policies.

In addition, gold priced in the yen[19], in spite of last week’s quasi-crash, which is likely an anomaly, has been ramping up higher since 2008.

Japan’s pension and insurance fund’s accelerating exposure on foreign securities, combined by the bull market in gold priced in the yen and the increasing preference by Japanese companies to tap foreign capital[20] can be seen as seminal signs of capital flight.

Thus, Abenomics provides the insurance cover or a backstop against capital flight. With this we can expect Abenomics to eventually include price controls and importantly capital-currency controls.

Japan’s major bellwether the Nikkei 225 fell by 1.25% this week, which really is a speck relative to the astounding 28% year-to-date gains. The other major benchmark, the Topix, lost 1.91% but remains 31.04% from the start of the year.

But there appears to be increasing signs of divergences even in Japan, which may be seen as parallel to the ongoing distribution in the global marketplace. The leaders of the recent rally Topix banks (left) and the Insurance (right) sectors seems as exhibiting signs of exhaustion[21]

Finally the coming weeks will be very critical for global financial markets. If Japan’s short term rates continues to spiral higher then this may provoke amplified volatility on the global financial markets.

Another very important factor will be how Japanese authorities will react to them.

Otherwise, if the volatility in yields will be suppressed then we can expect the boom bust cycles to remain in play.

It pays to keep vigilant

[1] See Tanking Gold and Commodities Prices and the Theology of Deflation, April 15, 2013

[3] See Influences Of The Yield Curve On The Equity And Commodity Markets, March 22, 2010

[4] Zero Hedge CLSA Breaks The Wall Street Mold: Sells Japanese Equities To Buy Gold, April 18, 2013

[5] See Japan’s Lost Decade Wasn’t Due To Deflation But Stagnation From Massive Interventionism July 6, 2010

[6] See Abenomics: Japan’s McDonald’s to Raise Prices by 25% April 19, 2013

[7] Quarterly Newsletter of the Ministry of Finance Japan, What’s New, January 2013

[8] James Gruber Forget Cyprus, Japan Is The Real Crisis, Forbes.com March 23, 2013

[9] See More Magic from Abenomics: 10.3 Trillion Yen in Fiscal Stimulus January 11, 2013

[10] Quartz Abe is planning a massive fiscal stimulus—but what’s left to stimulate? Yahoo Finance December 20, 2012

[11] Wall Street Journal BOJ's Kuroda Says 2% Inflation Target "Flexible" April 11, 2013

[12] Bloomberg.com Kuroda Endgame Seen as Swaps Climb Most Since ’10: Japan Credit April 18, 2013

[13] See Will Japan’s Investments Drive the Phisix to the 10,000 levels? March 19, 2012

[14] Quarterly Newsletter of the Ministry of Finance Japan, What’s New, January 2009

[15] See Japan’s Economic Minister: We Will Print Money to Boost the Stock Market February 12, 2013

[16] The Statistics Bureau and the Director-General for Policy Planning Chapter 2 Population Ministry of Internal Affairs

[17] Bank of Japan Flow of Funds - Overview of Japan, US, and the Euro area – March 25, 2013

[18] Danske Research Monitor Japanese investor flows, April 19, 2013

[19] Gold.org Spot gold price in JPY in oz

[20] See Abenomics: More Signs of Backfire April 16, 2013

[21] Tokyo Stock Exchange Stock Price Index - Real Time