Last late June 2014, I noted of tremors in the some of the stock markets of major Arab oil producers, the Gulf Cooperation Council (GCC). The GCC is composed of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

The key concern then has been on the region’s escalating wars or increase in social instability, compounded by some worries over property bubbles. Apparently the global risk ON environment has been strong enough for speculators to gloss over or ignore these concerns from which their respective stock markets have partially recovered.

But now a new dynamic compounds on the existing predicaments: Collapsing oil prices in the face of the rallying US dollar.

Pardon me but I will have to compress these charts so as not to make my blog size too big.

The strong US dollar which has been become a broad based phenomenon has usually underscored a risk OFF environment. As I noted back in mid-September:

As a final note on markets, the US dollar index has been firming of late. Since July 1, the US dollar index has been up by 5%!

Their individual charts reveal that the US dollar has been rising broadly and sharply against every single currency in the basket during the past 3 months.

Yet a rising US dollar has usually been associated with de-risking or a risk OFF environment. Last June 2013’s taper tantrum incident should serve an example.

So the strong US dollar contributed to last night’s hammering of the US West Intermediate Crude (WTI-lower left) which dived by 3.18% and Europe’s Brent (lower right) which crashed by 4.33%. Yesterday's sharp cascade has been part of the recent downhill trend of oil prices.

The Zero Hedge notes that “WTI has just hit the most oversold levels since Lehman” and “what is gong on with Brent turned out to be far worse, and as the weekly RSI indicator shows the selloff in Brent is now the worst, well, ever!” (bold original)

Some will argue that this should help consumption which subsequently implies a boost on “growth”, but I wouldn’t bet on it.

Current events don’t seem to manifest a problem of oversupply. To the contrary current developments in the oil markets seem to signify a problem of shrinking global liquidity and slowing economic demand whose deadly cocktail mix has been to spur the incipient phase of asset deflation (bubble bust)

Others argue that this could part of an alleged “predatory pricing” scheme designed as foreign policy tool engaged by some of major oil producers to strike at Russia, Iran or even against Shale gas producers in the US.

This would hardly be a convincing case since doing so would mean to inflict harm on the oil producers themselves in order to promote a flimsy case of “market share” or to “punish” other governments.

Say Shale oil. There are LOTS more at stake for welfare states of OPEC-GCC nations than are from the private sector shale operators (mostly US). Shale operators may close operations or defer investments until prices rise again. There could also be new operators who could pick up the slack from existing “troubled” Shale oil and gas operators. Such aren’t choices available for oil dependent welfare governments of oil producing nations. As one would note from the above table from Wall Street Journal, at current prices only Kuwait, the UAE and Qatar remains as oil producers with marginal surpluses.

And a shortfall from oil revenues means to dip on reserves to finance public spending. And once these resources drain out from a prolonged oil price slump, the risks of a regional Arab Spring looms.

And the heightened risk of Arab Springs would further complicate the region’s social climate tinderbox. Add to this the economic impact from a weak oil prices-strong dollar, regional malinvestments would compound on the region’s fragility.

Thus, the adaption of "predatory pricing" supposedly aimed at punishing other governments would only aggravate the region’s already dire conditions that risks a widespread unraveling towards total regional chaos.

Two wrongs don’t make a right.

While I don’t expect politicians to be “smart”, their self-interests in maintaining power would hardly let them be dismissive of the welfare state which has been the source of their current political privilege.

And as one can see, the GCC has long depended on a weak dollar (easy money) environment. This appears to have now reversed, thus exposing their internal structural fragilities from unsustainable economic bubbles and the welfare state as well as tenuous regional and geopolitical relationships.

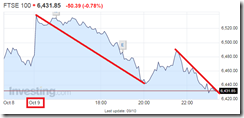

This brings us back to the stock markets. There has been renewed signs of stock market tremors among GCC states.

Meanwhile like Kuwait, the seeming recovery of UAE’s Dubai Financial General from the collapse a quarter back seems to have faded.

Unlike the April-June episode, GCCs stock markets appear to be in unison in signaling a downturn.

I’d say that this serves as reinforcing signs of the periphery to the core dynamics in motion.

Will the current weakness deepen? Or will this just be another cyclical dip? We’ll see.

.bmp)