After all the portrayal of invincibility and of “this time is different”, the Philippine Phisix is shown to be mortal after all!

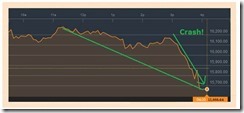

With today’s 6.7% carnage which totals 16.44% from the April 10 record high of 8,127.48, suddenly the Philippine benchmark finds itself staring at the eyes of the bear market.

I expect the self attribution bias to dominate tomorrow’s headlines: Today’s crash hasn’t due to internal factors but to external forces [insert explanation here. Choose: Fed hike, US, China, global meltdown, blah blah blah]

What you won’t hear is that panics and crashes are symptoms of excesses.

What you won’t also hear is that Philippine stocks have become vulnerable to external influences because of internal maladjustments.

Just to give some basic examples: Are 20-35 PERs ‘normal’? Especially for mature firms whose growth should in the long run equal the rate of growth the economy? (the above are based on Friday’s close)

Second, just look at the distribution of market cap weight as % share of total index. The top 5 issues carry a weight of 39.5% which is almost DOUBLE the aggregate share of the last 15 issues at 19.82%! (again numbers are from last Friday). The next 5-10 accounts for 25.33% which is still 27% more than the last 15!

The mispricing based on PERs has been reflected on the market cap distribution. That’s because the object of the previous pumping has been centered on the biggest markets caps. And such daily serial pumps on these big cap issues has vastly inflated their PERs

Again, the disproportion in the distribution in market cap and the PERs has been a function of the index pumping which is basically has been a result of the scheme by manipulators to push the index to record highs even when the general market has been diverging from the performance of the top 10 issues.

So manipulations led to the deformation of the index weighting and to the overvaluations.

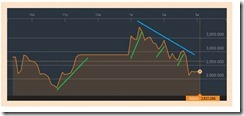

And remember, the Phisix has already been weakening even prior to the last week’s global meltdown. Just look at the chart above from Bloomberg.

I spilled a lot of ink here showing how shrinking volume, and other trade data, aside from deteriorating market internals, have been indicative of diminishing liquidity. Just yesterday I wrote,

This week’s average daily peso volume has skidded to the lowest level for the year. This extrapolates to the fast evaporating firepower from the bulls and from manipulators in support of the bids. When the support for the bids at current levels weakens, the probability of pronounced downside volatility will be amplified.

Just look at the PSE data above, the bids appeared (as shown by the Php 13.03 billion) only after the Phisix came down to the 6,800 levels. Yet to sustain this level, volume has to be retained. Otherwise there will be more downside pressures.

Moreover, the internal market selloffs have been a continuing trend since the start of the year. But the deterioration of which became evident during the past four weeks.

Thus, today’s 13 advancers as against 212 decliners or 1 advancing issue for 16 declining issues represents the venting of the buildup of internal pressures.

So what happened was that external factors became the justification to unleash the pressures from imbalances that has accrued WITHIN the index proper.

You can see this before and after the crash.

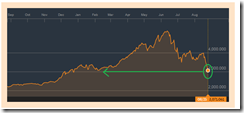

As of Friday, 15 index issues have been in bear markets. Four came from the top 15. But the Phisix was just slightly off the record highs.

Here is how it looks today at 6,790.

21 issues are now in bear markets! Four have now infected the top 10, and 9 on the top 15. So bears spread to contaminate more of the biggest heavyweights.

Media and their talking heads will blame everyone else. But here is the most important factor which they will deny or ignore:

The obverse side of every mania is a crash.