From 30th US President Calvin Coolidge (who incidentally was born on the 4th of July) (Heritage Foundation) (Emphasis added)

If all men are created equal, that is final. If they are endowed with inalienable rights, that is final. If governments derive their just powers from the consent of the governed, that is final. No advance, no progress can be made beyond these propositions.

Anthony Gregory on why popular knowledge of history about Independence Day has been a sham. (Emphasis added)

In the first five U.S. presidencies, we see the American empire, albeit in embryonic form, begin its centuries-long crusade of aggressive expansion and centralization of power in the capital. George Washington cracked down on the libertarian Whiskey Rebellion, created a national bank, and put Alexander Hamilton, a centralizing statist, in charge of the Treasury. John Adams blatantly violated the First Amendment as much as any president since with his notorious Alien and Sedition Acts. Thomas Jefferson deployed the Marines on an ultimately failed mission in the Barbary war, attempted to suspend habeas corpus and create a department of education, imposed a brutal embargo on English goods that decimated the economy and destroyed privacy rights, and conducted the Louisiana Purchase in bold defiance of the Constitution. James Madison invaded Canada in his war with England, a war in which martial law was enforced in New Orleans and a judge was jailed merely for issuing a writ of habeas corpus on behalf of a newspaper editor whose only crime was criticizing the war. Under James Monroe, the U.S. invaded Spanish Florida and adopted a doctrine whereby the U.S. would essentially claim prerogative over the whole of the Western Hemisphere, a colonial pretension whose bloody legacy continues to this day. This could all be blamed on the Constitution rather than the American Revolution itself, but it was the war that brought the "Founding Fathers" to power and allowed them to consolidate authority and take over the nation.

July Fourth celebrations did not become tacky or hypocritical only recently. The day was always a dubious cause of commemoration. The word "holiday" – holy day – clearly has a religious connotation. It is a day set aside for sacred observation. Those who regard Independence Day revisionism as profane should ask themselves which religion is sacrosanct to them. The Fourth of July is ultimately a celebration of the American nation-state’s birthday. It is a ritual in the U.S. civic religion. This is why it has been a militarist tradition since 1777, when the occasion was marked in Philadelphia with 13-gun salutes and imagery of the battle flag everywhere. The greeting card holidays might seem unworthy of mention alongside Christmas, Hanukkah and Easter. But Independence Day, even more than the politically correct and secular days celebrated every year, resembles an actual incidence of blasphemy.

There is a heroic side to the American Revolution, and surely no U.S. war since has been nearly as just in its cause. But the political shenanigans that led to war, the war itself, and its aftermath all deserve more criticism. Sadly enough, those who support the federal government’s domestic ambitions and foreign occupations while waving the flag on Independence Day are only as hypocritical as the colonists who tarred and feathered their antiwar countrymen in the name of liberty, the soldiers who invaded Canada in the name of anti-imperialism, the rebels who destroyed privately owned tea in the name of property rights, the Founders who waged a war against tyranny only to create a regime as formidable as King George’s, or the Father of our Country who started an unnecessary and tragic world war and then led a revolution in refusal to pay the bills for it.

Professor Gary North on why he doesn’t celebrate Independence Day... (Emphasis added)

The Continental Congress declared independence on July 2, 1776. Some members signed the Declaration on July 4. The public in general believed the leaders at the Continental Congress. They did not understand what they were about to give up. They could not see what price in blood and treasure and debt they would soon pay. And they did not foresee the tax burden in the new nation after 1783.

In an article on taxation in that era, Rabushka gets to the point.

“historians have written that taxes in the new American nation rose and remained considerably higher, perhaps three times higher, than they were under British rule. More money was required for national defense than previously needed to defend the frontier from Indians and the French, and the new nation faced other expenses.”

So, as a result of the American Revolution, the tax burden tripled.

The debt burden soared as soon as the Revolution began. Monetary inflation wiped out the currency system. Price controls in 1777 produced the debacle of Valley Forge...

That the largest signature on the Declaration of Independence was signed by the richest smuggler in North America was no coincidence. He was hopping mad. Parliament in 1773 had cut the tax on tea imported by the British East India Company, so the cost of British tea went lower than the smugglers' cost on non-British tea. This had cost Hancock a pretty penny. The Tea Party had stopped the unloading of the tea by throwing privately owned tea off a privately owned ship – a ship in competition with Hancock's ships. The Boston Tea Party was in fact a well-organized protest against lower prices stemming from lower taxes.

So, once again, I shall not celebrate the fourth of July.

Finally, along with the US, this week China also commemorates the 90th anniversary of the founding of the Chinese Communist Party.

However, Cato’s David Boaz sees the light on how China’s path towards economic freedom may possibly influence her political institutions.

From Prof Boaz (Emphasis added)

China of course followed a different vision. Take the speech of Mao Zedong on July 1, 1949, as his Communist armies neared victory. The speech was titled, “On the People’s Democratic Dictatorship.” Instead of life, liberty, and the pursuit of happiness, it spoke of “the extinction of classes, state power and parties,” of “a socialist and communist society,” of the nationalization of private enterprise and the socialization of agriculture, of a “great and splendid socialist state” in Russia, and especially of “a powerful state apparatus” in the hands of a “people’s democratic dictatorship.”

Tragically, unbelievably, this vision appealed not only to many Chinese but even to Americans and Europeans, some of them prominent. But from the beginning it went terribly wrong, as really should have been predicted. Communism created desperate poverty in China. The “Great Leap Forward” led to mass starvation. The Cultural Revolution unleashed “an extended paroxysm of revolutionary madness” in which “tens of millions of innocent victims were persecuted, professionally ruined, mentally deranged, physically maimed and even killed.” Estimates of the number of unnatural deaths during Mao’s tenure range from 15 million to 80 million. This is so monstrous that we can’t really comprehend it. What inspired many American and European leftists was that Mao really seemed to believe in the communist vision. And the attempt to actually implement communism leads to disaster and death.

When Mao died in 1976, China changed rapidly. His old comrade Deng Xiaoping, a victim of the Cultural Revolution, had learned something from the 30 years of calamity. He began to implement policies he called “socialism with Chinese characteristics,” which looked a lot like freer markets — decollectivization and the “responsibility system” in agriculture, privatization of enterprises, international trade, liberalization of residency requirements.

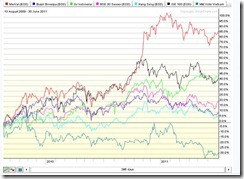

The changes in China over the past generation are the greatest story in the world—more than a billion people brought from totalitarianism to a largely capitalist economic system that is eroding the continuing authoritarianism of the political system. On its 90th birthday, the CCP still rules China with an iron fist. There is no open political opposition, and no independent judges or media...

The CCP remains in control. But it struggles to protect its people from acquiring information, routinely battling with Google, Star TV, and other media. Howard French notes that “the country now has 165,000 registered lawyers, a five-fold increase since 1990, and average people have hired them to press for enforcement of rights inscribed in the Chinese Constitution.” People get used to making their own decisions in many areas of life and wonder why they are restricted in other ways. I am hopeful that the 100th anniversary of the CCP in 2021 will be of interest mainly to historians of China’s past and that the Chinese people will by then enjoy life, liberty, and the pursuit of happiness under a government that derives its powers from the consent of the governed.

I may be late, as I am writing from sickbed but nonetheless...

“Happy Freedom Day!”