“However, hanging onto money is highly risky in a time of monetary inflation. The security-seeker does not understand this. Keynesian economists do not understand this. Politicians do not understand this. The result of inflationary central bank policies is the production of uncertainty in excess of what the public wants to accept. But the public does not understand Mises' theory of the business cycle. Voters do not demand a halt to the increase in money. It would not matter if they did. Central bankers do not answer to voters. They also do not answer to politicians. "Monetary policy is too important to be left to politicians," the paid propagandists called economists assure us. The politicians believe this. Until the crisis of 2008, so did voters.” Professor Gary North

Local headlines blare “Global stocks gyrate wildly; sell-off resumes in markets”[1]

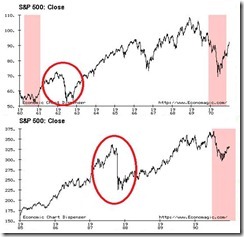

To chronicle this week’s action through the lens of the US Dow Jones Industrial Average (INDU), we see that on Monday August 8th, the major US bellwether fell 635 points or 5.5%. On Tuesday, the INDU rose 430 points or 4%. On Wednesday, it fell 520 points 4.6%. On Thursday, it rose 423 points or 3.9%. The week closed with the Dow Jones Industrials up by 126.71 points or 1.13% on Friday.

All these wild swings accrued to a weekly modest loss of 1.53% by the Dow Jones Industrials.

Some ideologically blinded commentators argue that these had been about aggregate demand. So logic tell us that aggregate demand collapsed on Monday, jumps higher on Tuesday, tanked again on Wednesday, then gets reinvigorated on Thursday and Friday? Makes sense no?

How about fear? Fear on Monday, greed on Tuesday, fear on Wednesday, and greed on Thursday and Friday? Do you find this train of logic convincing? I find this patently absurd.

Confidence doesn’t emerge out of random. Instead, people react to changes in the environment and the marketplace. Their actions are purposeful and seen in the context of incentives (beneficial for them).

And that’s why many who belong to the camp of econometrics based reality gets wildly confused about the current developments where they try in futility to fit only parts of reality into their rigid theories.

And part of the realities that go against their beliefs are jettisoned as unreal.

So by the close of the week, these people end up scratching their heads, to quip “weird markets”.

Weird for them, but definitely not for me.

Political Actions to Save the Global Banking System

Yet if there has been any one dynamic that has been proven to be the MAJOR driving force in the financial markets over the week, this has been about POLITICS, as I have been pointing out repeatedly since 2008[2].

I am sorry to say that this has not been about aggregate demand, fear premium, corporate profits, conventional economics or mechanical chart reading, but about human action in the context of global policymakers intending to save the cartelized system of the ‘too big to fail’ banks, central banks and the welfare state.

As I pointed out last week[3],

Important: The US has been downgraded by the major credit rating agency S&P after the market closed last Friday, so there could be an extended volatility on the global marketplace at the start of the week. This largely depends if such actions has already been discounted. The first thing on Monday is to watch Japan’s response.

The S&P’s downgrade tsunami reached the shores of global markets on Monday, where the US markets crashed by 5.5%.

It is very important to point out that the market backlash from the downgrade did NOT reflect on real downgrade fears, where US interest rates across the yield curve should have spiked, but to the contrary, interest rates fell to record lows[4]!

And as also correctly pointed out last week, the US Federal Reserve’s FOMC meeting, which was held last Tuesday, introduced new measures aimed at containing prevailing market distresses.

The FOMC pledged to:

-extend zero bound rates until mid-2013, amidst growing dissension among the governors,

-maintain balance sheets by reinvesting principal payments of maturing securities,

and importantly, keep an open option to reengage in asset purchases[5].

Some have argued that the Fed’s policies has essentially been a stealth QE, as the steep yield curve from these will incentivize mortgage holders to refinance. And this would spur the Fed to reinvest the proceeds.

According to David Schawel[6],

A surge of refinancing will reduce the size of the Fed’s MBS holdings and allow them to re-invest the proceeds further out the curve

The Fed’s announcement on Tuesday, basically coincided or may have been coordinated with the European Central Bank’s purchases of Italian and Spanish bonds or ECB’s version of Quantitative Easing. The combined actions resulted to an equally sharp 4% bounce by the Dow Jones Industrials.

Mr. Bernanke has essentially implemented the first, “explicit guidance” on Fed’s policy rates, among the 3 measures he indicated last July 12th[7].

The resumption of QE and a possible reduction of the quarter percentage of interest rates paid to bank reserves by the US Federal Reserve signify as the two options on the table.

My guess is that the gradualist pace of implementation has been highly dependent on the actions of the financial markets.

I would further suspect that given the huge ECB’s equivalent of Quantitative Easing or buying of distressed bonds of Italy and Spain, aside Ireland and Portugal, estimated at US $ 1.2 trillion[8], team Bernanke perhaps desires that financial markets digest on these before sinking in another set of QEs.

And to consider that US M2 money supply[9] has been exploding, which already represents a deluge of money circulating in the US economy, thus, the seeming tentativeness to proceed with more aggressive actions.

Wednesday saw market jitters rear its ugly head, as rumors circulated that France would follow the US as the next nation to be downgraded[10]. The US markets cratered by 4.6% anew.

On Thursday, following an earlier probe launched by the US Senate on the S&P for its downgrade on the US[11], the US SEC likewise opened an investigation to a possible insider trading charge against the S&P[12].

Obviously both actions had been meant to harass the politically embattled credit rating agency. The possible result of which was that the S&P joined Fitch and Moody’s to affirm France’s credit ratings[13].

To add, 4 Euro nations[14], namely Italy, Belgium, France and Spain has joined South Korea, Turkey and Greece[15] to ban short sales. A ban forces short sellers to cover their positions whose buying temporarily drives the markets higher.

These accrued interventions once again boosted global markets anew which saw the INDU or the Dow Industrials soar by 3.9%.

Friday’s gains in global markets may have been a continuation or the carryover effects of these measures.

Unless one has been totally blind to all these evidences, these amalgamated measures can be seen as putting a floor on global stock markets, which essentially upholds the Bernanke doctrine[16], which likewise underpins part of the assets held by the cartelized banking system and sector’s publicly listed equities exposed to the market’s jurisdiction.

Thus, like 2008, we are witnessing a second round of massive redistribution of resources from taxpayers to the politically endowed banking class.

Gold as the Main Refuge

AS financial markets experienced these temblors, gold prices skyrocketed to fresh record levels at over $1,800, but eventually fell back to close at $1,747 on Friday, for a gain of $83 over the week or nearly 5%.

From the astronomical highs, gold fell dramatically as implied interventions had been also extended to the gold futures markets. Similar to the recent wave of commodity interventions, the CME steeply raised the credit margins of gold futures[17].

We have to understand that gold (coins or bullions) have NOT been used for payments and settlements in everyday transactions. So gold cannot be seen as fungible to legal tender imposed fiat cash (for now), even if some banks now accept gold as collateral.[18]

In an environment of recession or deleveraging—where loans are called in and where there will be a surge of defaults and an onrush of asset liquidations to pay off liabilities or margin calls, fiduciary media (circulating credit) will contract, prices will adjust downwards to reflect on the new capital structure and people will seek to increase cash balances in the face of uncertainty—CASH and not gold is king. Such dynamic was highly evident in 2008 (before the preliminary QEs).

Thus, it would signify a ridiculous self-contradictory argument to suggest that record gold prices has been manifesting risks of ‘deflation’.

Instead, what has been happening, as shown by the recent spate of interventions, is that for every banking problem that surfaces, global central bankers apply bailouts by massive inflationism accompanied by sporadic price controls on specific markets.

Alternatively, this means that record gold prices do not suggest of a fear premium of a deflationary environment, but instead, a possible fear premium from the prospects of a highly inflationary, one given the current actions of central banks.

This panic-manic feedback loop or in the analogy of Dr. Jeckll and Mr. Hyde’s “split personality” which characterizes the global markets of last week has been materially different from the 2007-2008 US mortgage crises.

Not only has there been a divergence in market response across different financial markets geographically (e.g. like ASEAN-Phisix), the flight to safety mode has been starkly different.

The US dollar (USD) has failed to live up to its “safehaven” status, which apparently has shifted to not only gold but the Japanese Yen (XJY) and the gold backed Swiss Franc (XSF).

It’s important to point out that the franc’s most recent decline has been due to second wave of massive $55 billion of interventions by the SNB during the week. The SNB has exposed a total of SFr120 billion ($165 billion!) over the past two weeks[19]. The pivotal question is where will $165 billion dollars go to?

Bottom line:

This time is certainly different when compared to 2008 (but not to history where authorities had been predisposed to resort to inflation as a political solution). While there has been a significant revival of global market distress, market actions have varied in many aspects, as well as in the flight to safety assets.

This implies that in learning from the 2008 episode, global policymakers have assimilated a more activist stance which ultimately leads to different market outcomes. Past performance does not guarantee future results.

The current market environment can’t be explained by conventional thinking for the simple reason that markets are being weighed and propped up by the actions of political players for a political purpose, i.e. saving the Global Banks and the preservation of the status quo of the incumbent political system.

[1] Inquirer.net Global stocks gyrate wildly; sell-off resumes in markets, August 12, 2011

[2] See Stock Market Investing: Will Reading Political Tea Leaves Be A Better Gauge?, November 30, 2008

[3] See Global Market Crash Points to QE 3.0, August 7, 2011

[4] See Has the S&P’s Downgrade been the cause of the US Stock Market’s Crash?, August 9, 2011

[5] See US Federal Reserve Goes For Subtle QE August 10,2011

[6] Schawel, David Stealth QE3 Is Upon Us, How Ben Did It, And What It Means Business Insider, August 9, 2011

[7] See Ben Bernanke Hints at QE 3.0, July 13, 2011

[8] Bloomberg, ECB Bond Buying May Reach $1.2 Trillion in Creeping Union Germany Opposes, August 8, 2011

[9] FRED, St. Louis Federal Reserve, M2 Money Stock (M2) M2 includes a broader set of financial assets held principally by households. M2 consists of M1 plus: (1) savings deposits (which include money market deposit accounts, or MMDAs); (2) small-denomination time deposits (time deposits in amounts of less than $100,000); and (3) balances in retail money market mutual funds (MMMFs). Seasonally adjusted M2 is computed by summing savings deposits, small-denomination time deposits, and retail MMMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1.

[10] The Hindu, Fears of France downgrade trigger massive sell-off in Europe, August 11, 2011

[11] Bloomberg.com U.S. Senate Panel Collecting Information for Possible S&P Probe, August 9, 2011

[12] Wall Street Journal Blog SEC Asking About Insider Trading at S&P: Report, August 12, 2011

[13] Bloomberg.com French AAA Rating Affirmed by Standard & Poor’s, Moody’s Amid Market Rout, August 11, 2011

[14] USA Today 4 European nations ban short-selling of stocks, August 11, 2011, see War against Short Selling: France, Spain, Italy, Belgium Ban Short Sales, August 12, 2011

[15] Business insider 2008 REPLAY: Europe Moves To Ban Short Selling As Crisis Spreads, August 11, 2011, also see War Against Market Prices: South Korea Imposes Ban on Short Sales, August 12, 2011

[16] See US Stock Markets and Animal Spirits Targeted Policies, July 10, 2010

[17] See War on Gold: CME Raises Credit Margins on Gold Futures, August 11, 2011

[18] See Two Ways to Interpret Gold’s Acceptance as Collateral to the Global Financial Community, May 27, 2011

[19] Swissinfo.ch Last ditch defence of franc intensifies, August 10, 2011