Recent developments in the gold markets seem to have exposed, which partly validates my view (if the below report is accurate), that the flash crash in Wall Street-Government Paper gold had been contrived.

From CNBC:

J.P. Morgan accounts for nearly all of the physical gold sales that Comex in the last three months, blogger Mark McHugh wrote in a blog on Friday, which was reposted on ZeroHedge.McHugh, who writes the “Across the Street” blog, cited a report on the CME Group web site that details metals issues and stops year to date for his findings.In the report, “I” stands for issues, the number of contracts it sold, “S” stands for stops, meaning the firm took delivery of the gold, McHugh said. It shows that just one firm accounts for 99.3% of the physical gold sales at the Comex in the last three months, he said.Doing the math on J.P. Morgan, McHugh says the brokerage “fumbled ownership” of 1,966,000 troy ounces of gold since Feb. 1 through the reporting date of April 25. (One gold futures contract is 100 troy ounces.)That nearly 2 million ounces of gold is 74% more gold than the U.S. Mint delivered through the U.S. Mint’s American Eagle program in all of 2012, said McHugh.“One thing’s very clear: When it comes to selling physical gold, J.P. Morgan is acting alone,” he said.

Gosh. 99.3% of gold sales contracts.

Two days ago, Zero Hedge questioned the steep fall on JP Morgan’s eligible inventories (bold and italics original)

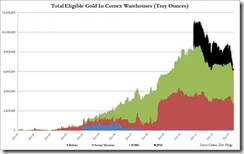

What many may not know, is that while registered Comex gold has been flat, the amount of eligible gold in Comex warehouses (the distinction between eligible and registered gold can be found here) in the past several weeks has plunged from nearly 9 million ounces, to just 6.1 million ounces as of today- the lowest since mid-2009.What nobody knows, is why virtually the entire move in warehoused eligible gold is driven exclusively by one firm: JPMorgan, whose eligible gold has collapse from just under 2 million ounces as of the end of 2012 to a nearly record low 402,374 ounces as of today, a drop of 20% in one day, though slightly higher compared to the recent record low hit on April 5 when JPM warehoused commercial gold touched a post-vault reopening low of just over 4 tons, or 142,700 ounces.This happened just days ahead of the biggest ever one-day gold slam down in history.Some questions we would like answers to:

Adding up the pieces of the jigsaw puzzle.

Falling comex gold warehouse inventories—both from the registered (top) and eligible (bottom) categories—appears to be consistent with the record sales exhibited by retail physical “real” gold markets worldwide. Both charts are from 24gold.com.

A drawdown in the Comex inventories may have been channeled to the physical markets, which also means that Wall Street-Central banks may have lesser leeway to continue with their stealth suppression attempt.

But marked distinction between the withdrawal in “registered” gold which is reportedly the “physical” inventory relative to the eligible “gold” which is “some else’s inventories” seems like another puzzle. Add to this JP Morgan’s collapsing ‘someone else’s’ gold holdings, which partially matches the reported dominance 99.3% of selling contracts over the last 3 months. Has JP Morgan shorted gold deposits of their clients? Could the client/s be the New York Federal Reserve? Or the US Federal Reserve?

Such mysteries will likely be made public soon.

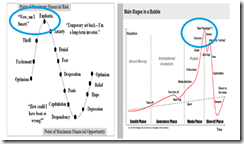

I share the conclusions of Alasdair Macleod from GoldMoney.com:

A blowback may be in the process.For the last 40 years gold bullion ownership has been migrating from West to elsewhere, mostly the Middle East and Asia, where it is more valued. The buyers are not investors, but hoarders less complacent about the future for paper currencies than the West’s banking and investment community. There was a shortage of physical metal in the major centres before the recent price fall, which has only become more acute, fully absorbing ETF and other liquidation, which is small in comparison to the demand created by lower prices. If the fall was engineered with the collusion of central banks it has backfired spectacularly.The time when central banks will be unable to continue to manage bullion markets by intervention has probably been brought closer. They will face having to rescue the bullion banks from the crisis of rising gold and silver prices by other means, if only to maintain confidence in paper currencies.