No, I am not saying this, the Australian banks are.

From the Bloomberg:

Australia’s biggest banks, whose lending standards helped the nation avoid a property crash during the global credit crisis, are raising concern with home loans helping to fuel record house prices.The proportion of mortgages that represented more than 80 percent of a home’s value -- the loan-to-value ratio -- rose in the third quarter to the highest since the second quarter of 2009,data from the banking regulator show. Mortgages in which borrowers pay only interest also increased to the highest in at least five years, according to the figures.The Reserve Bank of Australia’s 2.25 percentage points rate reduction in the past two years is luring buyers counting on home prices, which jumped the most in three years in the 12 months through Oct. 31, to extend gains. As the proportion of risky loans climbs -- allowing some people to purchase homes who otherwise couldn’t -- lenders, home-buyers and mortgage insurers are more exposed to any decline in prices.

To give a perspective on what the article have been saying; when Australia’s interest rates had been 'pushed to the floor' in 2008, domestic credit provided by the banking sector markedly jumped.

Bank credit stands at 145.76% of GDP as of 2011 according to Trading Economics, this must be much higher today (update: 154.4% as per World Bank data 2012)

More signs of bubbles; Australian properties have have been transformed into objects of rampant speculation

From the same article. (bold mine)

Mortgages with loan-to-value ratios higher than 80 percent rose to 35 percent as of Sept. 30 at Australia’s four big banks -- Commonwealth Bank of Australia, Australia & New Zealand Banking Group (ANZ) Ltd., Westpac Banking Corp. (WBC) and National Australia Bank Ltd. (NAB) -- the highest since June 2009, according to the Australian Prudential Regulation Authority.The average ratio at the major banks rose to 67 percent in the third quarter from 65 percent a year earlier and a low of 63 percent in the second quarter of 2009, according to Digital Finance Analytics, the data company.“It’s not that we’ve changed any of our policies, but the mix of demand is changing,” Phil Chronican, chief executive officer of ANZ’s Australian business, said in an interview in Sydney on Nov. 27. “More people are trading up and people who trade up tend to go for higher loan-to-value ratios.”ANZ’s average ratio increased to 70 percent in the six months to Sept. 30, from 64 percent a year earlier, according to regulatory filings.The big four banks held 85 percent of the country’s A$1.2 trillion ($1.1 trillion) of outstanding mortgages in September, according to the banking regulator…Aside from existing home owners trading up, investors are also piling in. In New South Wales, the country’s most populous state, investor mortgage approvals accounted for about 40 percent of all home loans by value, the highest since 2004, the RBA said in its semi-annual Financial Stability Review on Sept. 25. The average LVR on loans to this group has risen to about 80 percent from about 60 percent in 2009, according to Digital Finance.Investors are betting on further capital gains after house prices started to rise in early 2013.

Australia’s property bubble (as measured by the NSW Sydney index as of March 2013) has coincided with a firming of the Aussie dollar…

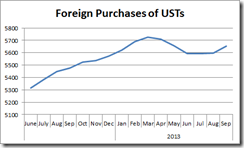

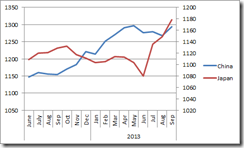

This has partly been due to foreign funds chasing the property bubble…

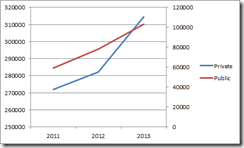

The latter two charts represents the survey of foreign flows and the distribution of foreign flows in Australia based on a report conducted by the Financial Services Council and The Trust Company (2011)

And the property boom has been overvaluing the domestic factors of production. This has partly been manifested by the soaring of producer’s prices. The growth in Australia’s producer prices have been magnified since 2008

Australian productivity has grown by only 24% since 1998…

however, Australian wages has nearly doubled over the same period.

The differentials can be construed as the bloating of wage rates engendered by Australia’s bubble policies.

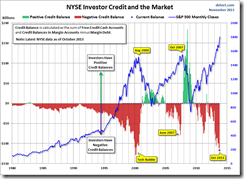

It’s not just a property bubble but could be a stock market bubble as well. The Aussie S&P ASX 200 now drifts at near recent highs post 2007. If measured by the ASX Ltd. or the Australian stock exchange, the firm's PE ratio stands at a dear 18.84 in the backdrop of zero bound rates

Properties and stocks which are titles to capital goods have been the main beneficiaries of credit inflation.

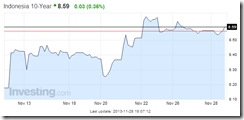

Bubbles can last until it collapses on its own weight or when the inadequacy of resources will get reflected on interest rates.

Yields of Australia’s 10 year bonds have been on an uptrend since Bernanke’s QE 3.0 in September of 2013

So Australia's banks have been right to worry, a sustained insurrection by global bond vigilantes threatens to expose on Australia’s massive malinvestments.