Lately I have encountered several commentaries suggesting that the “demographic time bomb” (falling population) will pose a risk to globalization by creating imbalances that would lead to political upheavals.

Here are two:

From Neil Howe and Richard Jackson in Global Aging And The Crisis Of The 2020's (bold emphasis mine)

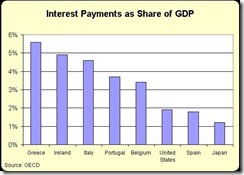

“Rising pension and health care costs will place intense pressure on government budgets, potentially crowding out spending on other priorities, including national defense and foreign assistance. Economic performance may suffer as workforces gray and rates of savings and investment decline. As societies and electorates age, growing risk aversion and shorter time horizons may weaken not just the ability of the developed countries to play a major geopolitical role, but also their will.”

From Morgan Stanley’s Spyros Andreopoulos and Manoj Pradhan in ‘Ten for the Teens’(bold emphasis mine)

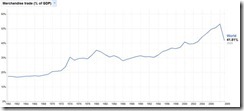

“The increase in macro instability comes at a time of major demographic transition in most DM and many EM economies. As populations become older, the demand for economic security - stable jobs, pensions - increases. This tension between higher instability and increased demand for security is likely to find its political expression in a backlash against globalisation. So far, the benefits of globalisation - higher income levels for most, i.e., the large middle class - have outweighed its drawbacks - increased competition and job instability. This has kept the globalisation show on the road until now. As this balance tips because the preferences of the middle class shift towards more security/stability, globalisation is likely to stall or reverse.”

There seems to be two separate issues here: unsustainable welfare states and globalization.

However the comments above attempt to make a connection which, for me, looks tenuous and confusingly premised on the fallacious ‘aggregate demand’.

Protectionism Equals Security?

Here is how I understand this: stripped out of the spending capacity due to old age, and with a government hobbled by fiscal straitjacket, the lack of demand (from both the private and the public) means slower economic growth which likewise would extrapolate to a political milieu that shifts from risk appetite (globalization) towards demand for ‘security and stability’ (protectionism), or in short, political stress.

For instance the Morgan Stanley tandem does an incredible turnaround, ``So far, the benefits of globalisation - higher income levels for most, i.e., the large middle class - have outweighed its drawbacks - increased competition and job instability. This has kept the globalisation show on the road until now.”

Are they suggesting that people who benefited from globalization will eventually bite the proverbial hand that feeds them? Are they suggesting too that people will see “security and stability” from lower incomes?

Will protectionism or restricting market activities make goods and services needed by the ageing society abundant and affordable? To the contrary, protectionism will only highlight on the shortages and the exorbitance of these economic goods that should lead to even more instability.

Murray N. Rothbard refuted this age old fallacy, he explained, (bold highlights mine)

It is difficult to see how a decline in population growth can adversely affect investment. Population growth does not provide an independent source of investment opportunity. A fall in the rate of population growth can only affect investment adversely if

-All the wants of existing consumers are completely satisfied. In that case, population growth would be the only additional source of consumer demand. This situation clearly does not exist; there are an infinite number of unsatisfied wants.

-The decline would lead to reduced consumer demand. There is no reason why this should be the case. Will not families use the money that they otherwise would have spent on their children for other types of expenditures?

Thus the problem of declining population can be helped by accepting immigrants or adopting to greater social mobility or the globalization of labor and by even more free trade.

We shouldn’t underestimate how people adjust to the new realities from the current underlying conditions. Importantly, we shouldn’t write off productivity of the senior citizens too (why? see below).

Illusion Or Reality?

Next would be the issue of welfare states. Once society realizes that the welfare state has been unsustainable, will people fight violently to retain the status quo (even if this is recognized as not possible) or will they cope up with the new reality?

The former would fall as part of the entitlement mentality engendered by excessive dependency or the moral hazard from political distribution while the latter will likely result from the realization that there’s no free lunch.

And perhaps in the realization that bellicosity won’t further society’s interests, they may opt for the latter (accepting harsh reality) than the former (live in a charade). And any political tensions from the succeeding reforms would signify as symptoms of ‘resistance to change’ than from a key reversal of political sentiment.

In the context of abrupt political-economic transitions from a crisis, Iceland’s violent riots from her financial crash of 2008 didn’t mechanically translate to close door ‘security’ based policies, as Iceland remains “moderately” economic free (44th), according to Heritage Foundation, even as the crisis did have some negative impact on her economic freedom ratings (due to higher taxes and government spending).

From Heritage Foundation

The point is that the notion that crisis will instigate a radical reversal of people’s sentiment from openness to protectionism seems likely misguided.

Today, Iceland has shown signs economic recovery and has even applied to join the European Union (aimed at achieving more financial and trade openness, aside from social mobility)!

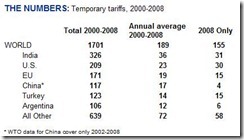

Protectionism likewise did not spread like wildfire in 2008, as earlier discussed.

Ignoring Technology

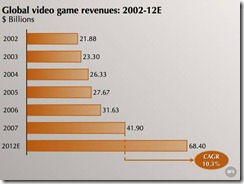

Another factor would be technology.

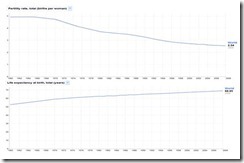

While it may true that fertility rates may be going down (upper window), it is often ignored how the advances in technology has continually enhanced people’s living conditions.

From Google Public Data

Global Life expectancy (lower window) has lengthened from 50 years to 68.95 years over the past 50 years. Japan reportedly has some 41,000 centenarians (over 100 years old)! [But I won’t be lucky to live this long, because of my love affair with beer]

And if futurist Ray Kurzweil is correct, people’s life span may extend to 120 years (by 2030) or even more (180 years) as rate of technology advances accelerates.

Again Murray Rothbard on the importance of technological advancement

“technological progress, is certainly an important one; it is one of the main dynamic features of a free economy. Technological progress, however, is a decidedly favorable factor. It is proceeding now at a faster rate than ever before, with industries spending unprecedented sums on research and development of new techniques. New industries loom on the horizon. Certainly there is every reason to be exuberant rather than gloomy about the possibilities of technological progress.”

In short, should these advances occur then all demographic projections should be thrown to the garbage bin, as they are falsely premised and would be rendered irrelevant.

The basic problem with mainstream insights is that people are treated like unthinking automatons. And because of this they’re most likely wrong.

The ultimate threat to globalization is inflationism and not demographic trends.