From the Washington Post,

Two decades after evicting U.S. forces from their biggest base in the Pacific, the Philippines is in talks with the Obama administration about expanding the American military presence in the island nation, the latest in a series of strategic moves aimed at China.

Although negotiations are in the early stages, officials from both governments said they are favorably inclined toward a deal. They are scheduled to intensify the discussions Thursday and Friday in Washington before higher-level meetings in March. If an arrangement is reached, it would follow other recent agreements to base thousands of U.S. Marines in northern Australia and to station Navy warships in Singapore.

Among the options under consideration are operating Navy ships from the Philippines, deploying troops on a rotational basis and staging more frequent joint exercises. Under each scenario, U.S. forces would effectively be guests at existing foreign bases.

The sudden rush by many in the Asia-Pacific region to embrace Washington is a direct reaction to China’s rise as a military power and its assertiveness in staking claims to disputed territories, such as the energy-rich South China Sea.

“We can point to other countries: Australia, Japan, Singapore,” said a senior Philippine official involved in the talks, speaking on the condition of anonymity because of the confidentiality of the deliberations. “We’re not the only one doing this, and for good reason. We all want to see a peaceful and stable region. Nobody wants to have to face China or confront China.”

The strategic talks with the Philippines are in addition to feelers that the Obama administration has put out to other Southeast Asian countries, including Vietnam and Thailand, about possibly bolstering military partnerships.

What seems to be the common denominator between now and two decades ago when the Bases Extension Treaty was rejected by the Philippine Senate?

Well both has the Aquino administration (mother and son) taking on the side of—or has fought for an extension of—US foreign policy in the country.

Not that this about the Aquino administration being an American stooge, although they may well be, but about the developing trend in US foreign policy and the possible implications here.

Obama’s foreign policy has increasingly been militant just as the Presidential election approaches.

Last night at the State of the Union address President Obama threatened Iran with ‘no options off the table’ rhetoric. In addition, President Obama seems to having an on-off or love-hate affair with China with the latter being painted as a potential adversary.

Military aggression as China’s foreign policy path is unlikely, despite some caustic international incidences at the Spratlys Island.

As pointed out before, such incidences could be indicative of China’s reaction to what seems to be an encirclement strategy being applied by the US and or the heated rhetoric by President Obama of charging China as a currency manipulator.

Also China could testing the responses of her neighbors to see where their loyalty lies and to what degree they have been, which could be part of 37 war strategies of “beating the grass to startle the snake strategy”, or that China could be flaunting her new weapons to signal her newfound geopolitical muscle.

But most importantly, I think China could be using the Spratlys to gain negotiation leverage.

In politics, what you see is hardly what you get.

Nevertheless, actions serve as best indicators of intent or what Austrian economists calls as the demonstrated preference.

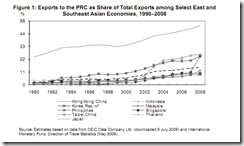

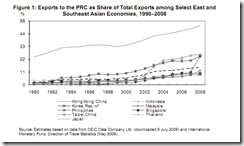

China won’t likely kill the proverbial goose that lays the golden eggs for the simple reason that China’s trade with the region has been burgeoning substantially. (charts above from ADB)

To add, China has even taken further steps to increase the usage of her country’s currency as the region’s medium of exchange in the path towards regional integration.

China will surely not attain integration by invading her neighbors. Two major World Wars of the 20th century should serve as painful lessons.

Integration can only be achieved through social cooperation via the division of labor or free trade.

And unless China’s leaders have lost their senses, perhaps out of desperation or becomes mentally deranged, a bellicose foreign policy would translate to their political suicide considering that today’s state of warfare. So this isn’t a rational or even a viable option.

In addition, the thought of foreign bases as functional deterrent to military aggression is essentially obsolete in a nuclear war.

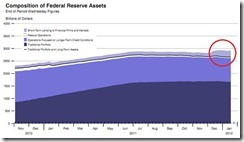

In reality, military bases have mostly been used as a staging point for political interventions in local affairs and for justifying the maintenance and or growth of the defense budget for the US federal government.

And importantly, encirclement strategies to contain China’s so-called growing military capability are not helpful, they signify signs of (US) insecurity that only promotes antagonism that could lead to genuine confrontation.

The point is, any military base agreements will serve as a magnet for any prospective war or military hostility, incentivize more foreign interventions in local (Philippine) affairs and would create social friction between the average Filipinos and US military.

Military bases for whose benefit?

Again as stated earlier, wars benefit the military industrial complex who as rent seekers, needs politics induced wars to sell their products and services to generate profit. Peace is an anathema to them.

War and imperialist policies also benefit the (local and foreign) political class who use wars (or the threat of wars) to expand to control over society through various interventions and taxation, to curb civil liberties, and to justify the budgets extracted from society for their personal benefits.

As Murray N. Rothbard once wrote,

Imperialism will ensure for the United States the existence of perpetual "enemies," of waging what Charles A. Beard was later to call "perpetual war for perpetual peace." For, Flynn pointed out, "we have managed to acquire bases all over the world…. There is no part of the world where trouble can break out where… we cannot claim that our interests are menaced. Thus menaced there must remain when the war is over a continuing argument in the hands of the imperialists for a vast naval establishment and a huge army ready to attack anywhere or to resist an attack from all the enemies we shall be obliged to have